Oil prices have been on a downward trajectory recently, influenced by a myriad of factors stemming from both supply and demand dynamics, alongside broader economic conditions. This comprehensive analysis delves into the primary reasons behind the falling oil prices, categorized under demand concerns, supply factors, market sentiment, and their collective impact on the global oil market.

Demand Concerns

Weak Global Economic Growth

The global economy’s sluggish pace has significantly dampened expectations for oil demand. Major economies, including China, have exhibited slower-than-anticipated growth, exacerbating these concerns. China’s economic performance has particularly fallen short of expectations, with the absence of substantial economic stimulus measures from the Chinese government further aggravating the situation. This slowdown has created a ripple effect, contributing to the overall decline in global oil demand.

Lower Consumption in Key Regions

A notable decline in crude oil imports in Asia, particularly China, underscores the weakening demand in the region. In July 2024, Asia’s crude oil imports plummeted to their lowest level in two years. This drop reflects the broader trend of reduced consumption in key markets, which has played a crucial role in the recent slump in oil prices.

Supply Factors

Increased Supply from Non-OPEC+ Producers

The rise in oil production from non-OPEC+ countries, including the United States, Brazil, Guyana, Canada, and Norway, has significantly impacted the oil market. This surge in supply has effectively countered the production cuts implemented by OPEC+ aimed at stabilizing prices. The increased output from these countries has flooded the market with additional supply, thereby exerting downward pressure on prices.

OPEC+ Production Cuts

While OPEC+ has taken measures to cut production in an attempt to support prices, these efforts have been insufficient to counterbalance the increased supply from non-OPEC+ producers and the weak demand. The organization’s attempts to stabilize prices through production adjustments have not been able to mitigate the overall downward trend.

Market Sentiment and Speculation

Inventory Levels

Despite a recent drawdown in U.S. crude inventories, market sentiment has remained more heavily influenced by broader economic concerns and weak demand signals. The temporary impact of inventory changes has done little to alter the prevailing negative sentiment in the market.

Interest Rate Expectations

The potential for interest rate cuts by the Federal Reserve has also played a role in shaping market sentiment. While lower interest rates can stimulate economic activity and potentially boost oil demand, the overall market remains cautious due to persistently weak economic indicators. The anticipation of interest rate adjustments has not been sufficient to counter the negative outlook driven by economic growth concerns.

Impact of Weak Global Fuel Demand

Supply-Demand Imbalance

Weak global fuel demand creates a fundamental imbalance between supply and demand. Oil producers often find themselves with excess supply relative to the reduced demand, leading to downward pressure on prices. The International Energy Agency (IEA) has highlighted that weak economic growth and poor industrial activity have dampened oil demand, particularly in developed OECD countries, resulting in a contraction in demand.

Inventory Build-Up

Lower demand frequently results in higher oil inventories as the excess supply is stored rather than consumed. This build-up in inventories further depresses oil prices by signaling to the market that there is more than enough supply to meet current demand levels. The IEA has reported consecutive months of rising global oil inventories, contributing to the persistent pressure on prices.

Economic Indicators and Market Sentiment

Weak fuel demand often reflects broader economic issues. For instance, slow economic growth in major economies like China has led to reduced consumption of crude oil. This significant factor in the recent decline in oil prices underscores the impact of weak manufacturing activity and lower crude imports in China, raising concerns about future demand.

Market Sentiment

Investors and market participants closely monitor demand indicators, and signs of weak fuel demand can lead to negative market sentiment. This sentiment prompts traders to sell off oil futures and other related assets, driving prices down further. For example, multiple sources have noted a four-week decline in oil prices linked to weak global fuel demand.

Impact on Production Decisions

OPEC+ Production Adjustments

When demand is weak, major oil producers like those in OPEC+ may adjust their production levels to try to stabilize prices. However, if these production cuts are not sufficient to offset the decline in demand, prices can continue to fall. The increased supply from non-OPEC+ producers has compounded the downward pressure on prices despite OPEC+’s efforts.

Future Production Plans

Weak demand also influences future production plans and investments in the oil sector. Producers may delay or reduce investments in new oil projects if they anticipate continued weak demand, which can have long-term implications for supply and prices.

Insights

- Weak economic growth in China is a key factor in reduced oil demand.

- Increased production from non-OPEC+ countries offsets OPEC+ cuts.

- Market sentiment remains cautious despite potential interest rate cuts.

- Higher oil inventories signal oversupply and depress prices.

- Production decisions by OPEC+ are crucial but not always sufficient.

The Essence (80/20)

Core Topics:

- Global Economic Growth: Understanding the impact of economic performance in major economies, particularly China, on oil demand.

- Supply Dynamics: Analyzing the roles of OPEC+ and non-OPEC+ producers in influencing oil supply.

- Market Sentiment: Observing how inventory levels, interest rates, and economic indicators shape market expectations and oil prices.

Detailed Descriptions:

- Slower economic growth in China and other major economies reduces oil demand.

- Non-OPEC+ producers have ramped up oil production, balancing the market despite OPEC+ cuts.

- Inventory levels and economic indicators, including potential interest rate cuts, influence market sentiment and oil prices.

The Guerilla Stock Trading Action Plan

- Monitor Economic Indicators: Regularly assess economic growth data from major economies, focusing on China.

- Track Oil Production: Keep an eye on production levels from both OPEC+ and non-OPEC+ countries.

- Analyze Market Sentiment: Observe inventory levels, interest rate trends, and broader economic indicators to gauge market sentiment.

- Strategic Adjustments: Make informed decisions on investments and production based on the balance of supply and demand dynamics.

Blind Spot

Potential Overlooked Details:

Long-term environmental policies and their influence on global oil consumption.

The role of geopolitical factors in oil supply and demand dynamics.

The impact of alternative energy sources and technological advancements on future oil demand.

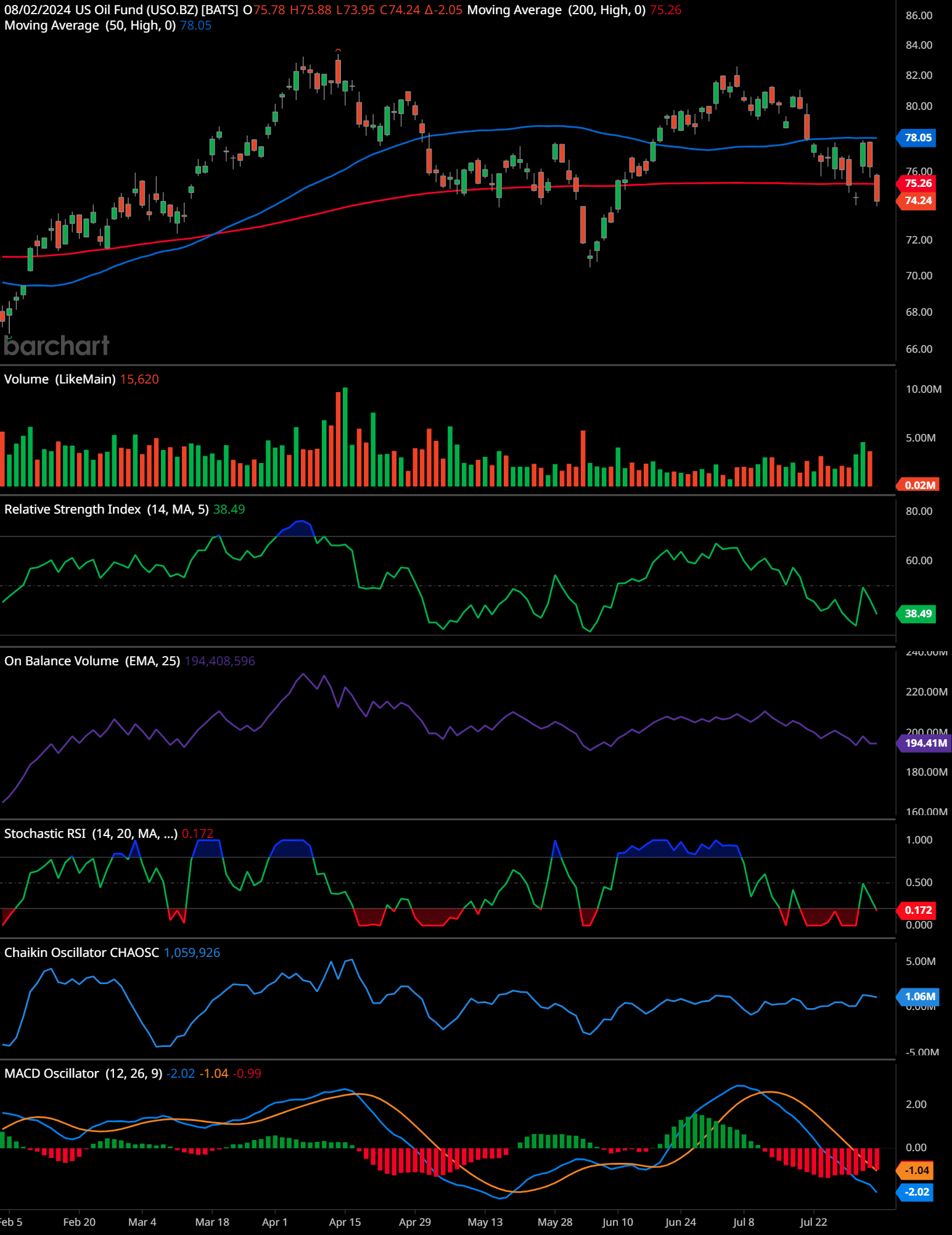

USO Technical Analysis Daily Time Frame

The chart for US Oil Fund (USO) shows a recent downward movement, with the price dropping to $74.24. The 50-day moving average is at $78.05, and the 200-day moving average is at $75.26, indicating a mixed trend with short-term bearish sentiment.

Volume analysis shows a decrease, suggesting less trading activity during the recent decline.

The Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI) is at 38.49, indicating the stock is approaching oversold conditions.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV) shows a gradual decline, reflecting decreasing buying pressure.

The Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... is at 0.172, in the oversold zone, indicating potential for a price rebound.

The Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... shows a slight positive value, suggesting some accumulation.

The MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More oscillator indicates bearish momentum, with the MACD line below the signal line and both below the zero line.

Time-Frame Signals:

12 months: Buy. Long-term indicators and historical support levels suggest growth potential.

3 months: Hold. The indicators suggest a potential rebound but confirm the short-term bearish sentiment.

6 months: Buy. Oversold conditions and potential accumulation suggest a recovery.

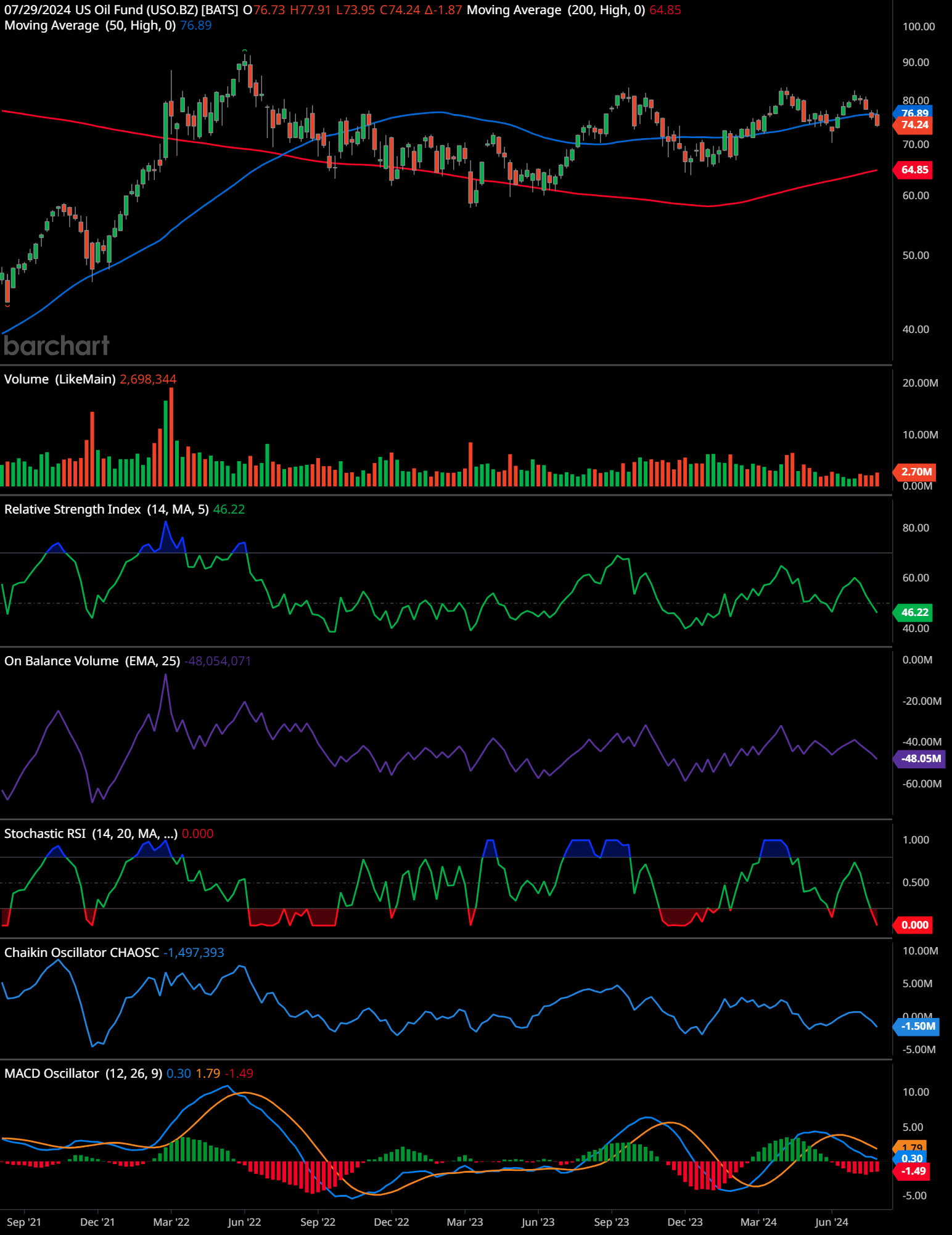

USO Technical Analysis Weekly Time Frame

This chart of the US Oil Fund (USO) depicts weekly price action with several technical indicators, providing a comprehensive view of its performance over time. Here’s the analysis:

The primary trend is generally upward, though it shows periods of consolidation and pullbacks. The price currently hovers around $74.07, slightly above the Anchored VWAP at $71.07, suggesting recent support.

Volume trends show relatively stable trading activity, with no significant spikes or drops. However, the lack of volume increase during price rises might indicate weaker bullish momentum.

The Relative Strength Index (RSI) at 45.94 is below the neutral 50 mark, indicating a moderately bearish to neutral stance. This suggests there is no strong buying pressure currently.

The On-Balance Volume (OBV) line shows a gradual decline, which indicates distribution or selling pressure over the observed period. This aligns with the RSI’s neutral to bearish reading.

The Stochastic RSI shows oversold conditions, signaling potential short-term upward correction or consolidation. However, it has been at zero, suggesting caution.

The Chaikin Oscillator indicates significant negative divergence at -1.57M, reflecting strong bearish momentum. This is another cautionary sign for bullish traders.

The MACD Oscillator is showing a bearish crossover with the MACD line at -0.29 below the signal line at 1.70. This crossover typically signals potential downward movement.

Time-Frame Signals:

1 Year: Hold. The current indicators suggest a neutral to bearish outlook. It is advisable to wait for stronger bullish signals or confirmation of a trend reversal before making any buy decisions.

2 Year: Hold. The long-term upward trend remains intact, but bearish indicators suggest potential further consolidation or correction. Monitoring for any significant change in volume or trend is recommended.

3 Year: Buy. Over a longer horizon, the primary upward trend remains robust. Despite short-term bearish signals, the overall growth trajectory supports a bullish long-term outlook.

Past performance is not an indication of future results. This article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions.🧡

Looking Ahead

In summary, the recent decline in oil prices is primarily driven by concerns over weak global economic growth, particularly in key markets like China, coupled with increased oil supply from non-OPEC+ producers. These factors have outweighed the efforts by OPEC+ to cut production and stabilize prices. The interplay of supply-demand imbalances, inventory build-ups, economic indicators, and market sentiment continues to shape the global oil market, resulting in the ongoing downward pressure on oil prices.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.