Wheeler Real Estate Investment Trust (WHLR) has recently experienced a substantial upward movement in its stock price due to several significant factors. The company’s robust financial performance in Q2 2024 has played a key role in this positive momentum. On August 6, 2024, Wheeler Real Estate Investment Trust released its financial and operating results for the second quarter of 2024. The report showed a gross profit marginWhen it comes to evaluating a company's financial well-being, one of the fundamental metrics that analysts and investors rely on is the gross profit margin. This metric provides va... of 65.8% and an operating income margin of 29.43% over the past twelve months, indicating strong operational efficiency and profitability.

Preferred Shares Hit 52-Week High

The company’s preferred shares (WHLRP) reached a new 52-week high of $2.79 on September 4, 2024, reflecting increased investor confidence in the financial stability and future prospects of Wheeler Real Estate Investment Trust. This rise in preferred shares suggests that investors are optimistic about Wheeler’s ability to continue generating solid returns and manage its financial obligations effectively.

Substantial Price Gains and Positive Technical Indicators

Wheeler’s common stock has also shown remarkable price gains, with a 486.04% increase on June 28, 2024, from $2.65 to $15.53. During the same trading day, the stock demonstrated high volatility, fluctuating 142.89% between a low of $12.31 and a high of $29.90. Additionally, the stock’s movement above its short-term rising trend indicates potential for further gains, supported by buy signals from both short and long-term moving averages. This growth highlights the investment potential of Wheeler Real Estate Investment Trust as well.

High Volatility Attracts Short-Term Traders

Wheeler’s stock has exhibited high price volatility, which can attract traders looking for short-term opportunities. However, this volatility also presents risks, especially considering a potential Nasdaq delisting notice in July 2024 due to a shortfall in publicly held shares. Investors should weigh both the positive momentum and the potential risks before making any decisions related to Wheeler Real Estate Investment Trust.

Why Investors Should Follow Wheeler Real Estate Investment Trust

Wheeler Real Estate Investment Trust offers a compelling case for investors due to its strong financial performance and potential for significant returns. However, the high volatility and recent price fluctuations also mean that investors should carefully monitor the company’s financial health and market conditions to ensure the best outcomes when investing in Wheeler Real Estate Investment Trust.

Understanding the Impact of Interest Rate Cuts on REITs

Real Estate Investment Trusts (REITs) like Wheeler generally benefit from interest rate cuts by the Federal Reserve. Lower interest rates reduce borrowing costs, improve profitability, and increase cash flowThe cash flow statement provides a detailed overview of the cash inflows and outflows of a company over a specified period of time. It includes cash received from operations, inves... More, making REITs an attractive option for income-seeking investors. Moreover, lower rates often lead to higher demand for REIT shares, as investors seek higher yields compared to bondsUnited States Treasury securities are debt instruments issued by the United States government to finance its spending. Treasury securities come in a variety of forms, including bil... More. The potential for property value appreciation also increases when lower rates make real estate investments more appealing.

Historically, REITs have outperformed the broader stock market during periods of falling interest rates, driven by increased capital flows into property markets and potentially compressed capitalization rates that boost property values. However, the impact of rate cuts can vary across different REIT sectors, depending on their business models and lease structures. Notably, Wheeler Real Estate Investment Trust might benefit from these trends.

While interest rate cuts generally support REIT performance, investors should consider other economic factors and the underlying reasons for the rate cuts. For long-term investors, interest rate-driven corrections in REIT prices could present attractive buying opportunities. However, individual REIT performance, including that of Wheeler Real Estate Investment Trust, will also depend on factors such as property type, geographic location, balance sheetThe balance sheet is a snapshot of a company's financial position at a specific point in time. It shows the company's assets, liabilities, and equity. More strength, and management quality.

Insights

- WHLR has shown strong financial performance but faces significant volatility.

- Interest rate cuts often boost REIT performance but are not universally beneficial.

- Investors should weigh both opportunities and risks in REIT investments.

The Essence (80/20)

- Strong Q2 2024 Performance: WHLR reported solid margins, indicating operational strength.

- Stock Volatility and Gains: A sharp increase in stock price and positive technical signals suggest potential growth, but with high volatility.

- Interest Rates and REITs: Lower interest rates typically benefit REITs by reducing borrowing costs and increasing investor demand, but the effects can vary based on broader economic conditions.

The Guerilla Stock Trading Action Plan

Diversify REIT Holdings: Invest in various REIT sectors to mitigate risk, considering factors like property type and geographic exposure.

Evaluate WHLR: Consider both the strong recent performance and risks such as potential delisting and high volatility.

Monitor Interest Rate Trends: Assess potential changes in Federal Reserve policy and their impact on REITs.

WHLR Stock Technical Analysis

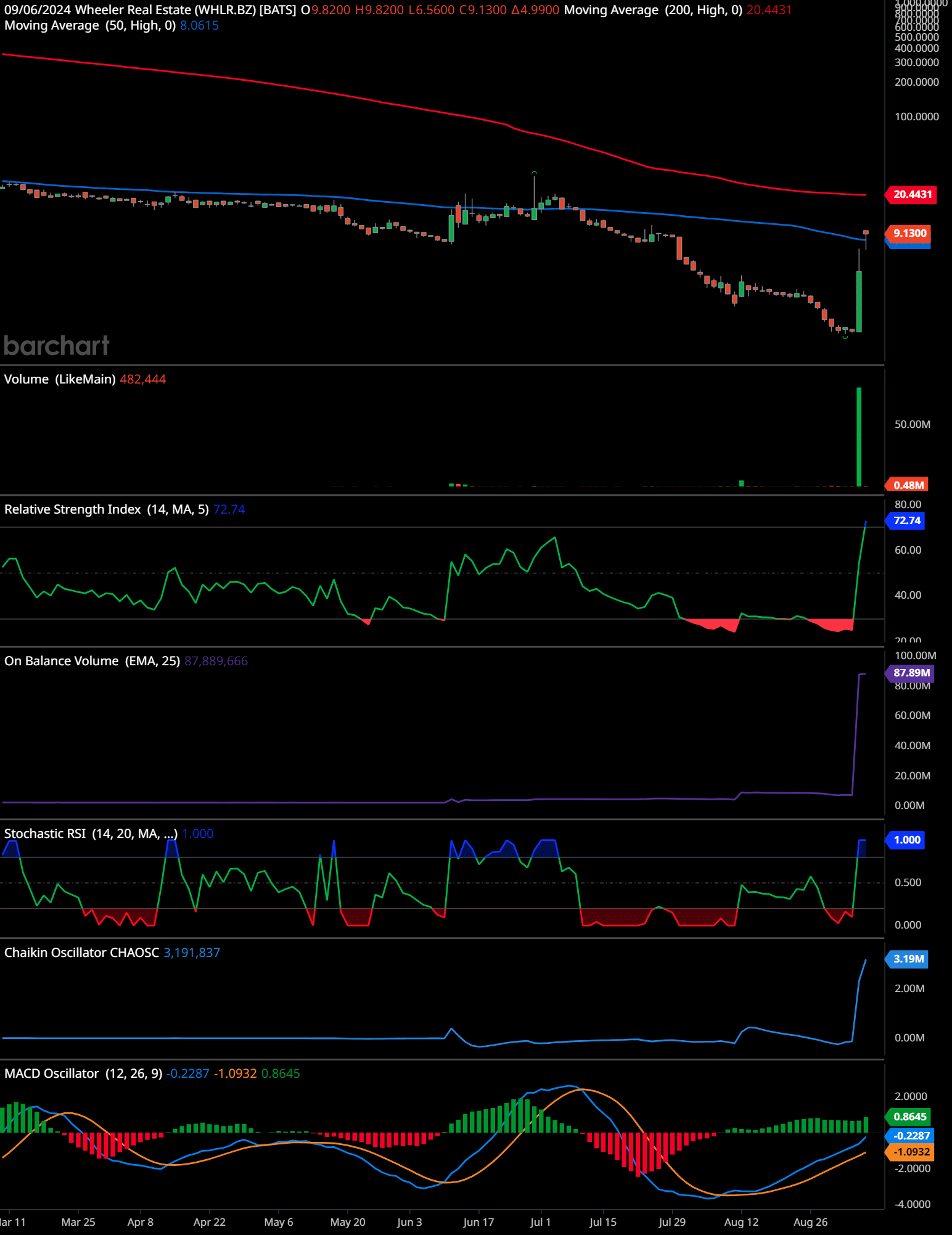

This daily chart of Wheeler Real Estate (WHLR) shows a series of technical indicators suggesting a potential change in the stock’s trend. Here is a detailed analysis based on the different elements present in the chart:

Trend Analysis:

The stock has been in a downtrend as indicated by the 200-day moving average (red line) trending downward, positioned significantly above the current price. The 50-day moving average (blue line) is also below the 200-day moving average, reinforcing the bearish trend. Recently, there has been a sharp upward move with the price closing at 9.13, up from a low of 4.99, indicating a potential reversal or at least a strong counter-trend rally.

Support and Resistance Levels:

The immediate support level is at 4.99, the recent low marked on the chart. There is another potential support level around 6.56, the recent dip before the sharp bounce. On the upside, the resistance levels to watch are around 9.82, the recent high, and 10.82, a previous swing high level. If the price breaks above these levels, the next resistance would be around 20.44, the area near the 200-day moving average.

Volume Analysis:

There is a significant spike in volume during the recent price increase, which suggests strong buying interest. The volume increase could indicate that new money is coming into the stock, potentially supporting a continued upward move.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI):

The RSI (14) is currently at 72.74, which is above the overbought threshold of 70. This suggests that the stock is in overbought territory and may be due for a pullback or consolidation.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV):

The OBV is sharply rising, which indicates that the stock is being accumulated by buyers. This is a positive sign for the potential continuation of the uptrend, especially when it aligns with the recent volume increase.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...:

The Stochastic RSI is at its maximum level of 1.000, which also suggests that the stock is overbought. This could indicate a potential reversal or consolidation in the short term before any further upward movement.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...:

The Chaikin Oscillator is sharply rising, indicating an increase in buying pressure and positive money flow into the stock. This suggests that the current bullish move may continue if there is sustained buying interest.

MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More Oscillator:

The MACD line (blue) has crossed above the signal line (orange) and the histogram is in positive territory, confirming a bullish crossover. This is often a signal of a trend reversal or continuation of the current upward move. However, the MACD is still below the zero line, indicating that the broader trend is not yet fully bullish.

Future Trend Indication:

The combination of technical indicators suggests a potential short-term bullish trend or reversal in Wheeler Real Estate. The sharp increase in price, volume spike, and positive momentum indicators like the OBV, Chaikin Oscillator, and MACD crossover all support the possibility of further upward movement. However, the overbought conditions indicated by the RSI and Stochastic RSI suggest that there could be some consolidation or a minor pullback before any continued upward trend. For a sustained uptrend, the price would need to break above the 10.82 resistance level and move toward the 200-day moving average at 20.44. Until then, caution is advised due to the overbought signals.

Time-Frame Signals:

3 Months: Hold – Wait for a confirmation of the breakout above resistance levels or signs of consolidation.

6 Months: Buy – If the stock sustains above the recent highs and shows continued accumulation.

12 Months: Hold – Monitor for a full trend reversal signaled by price breaking above the 200-day moving average.

Looking Ahead: Weighing Opportunities and Risks

Investors should closely follow Wheeler Real Estate Investment Trust for its strong operational performance and the broader context of how interest rate changes affect REITs. While the recent price gains and positive signals offer potential opportunities, understanding the associated risks is crucial for making informed investment decisions regarding Wheeler Real Estate Investment Trust.

Frequently Asked Questions (FAQs)

1. What recent performance highlights have impacted Wheeler Real Estate Investment Trust (WHLR) stock?

Wheeler Real Estate Investment Trust (WHLR) has experienced significant upward movement recently due to its strong Q2 2024 performance, a new 52-week high for its preferred shares, substantial recent price gains, and positive technical signals.

2. How did Wheeler Real Estate Investment Trust perform in Q2 2024?

The company reported a gross profitIn the world of finance and accounting, the term "gross profit" holds significant importance as it provides a fundamental snapshot of a company's financial health. Also known as gr...<profit marginIn the dynamic world of business, profitability is a fundamental metric that encapsulates a company's ability to generate earnings from its operations. Profit margins, expressed as... of 65.8% and an operating income margin of 29.43% over the last twelve months as of Q2 2024, indicating solid operational performance.

3. What is the significance of Wheeler’s preferred shares reaching a new 52-week high?

The preferred shares (WHLRP) reached a new 52-week high of $2.79 on September 4, 2024, reflecting increased investor confidence in the company.

4. What factors contributed to the substantial recent price gains of WHLR stock?

WHLR stock saw a price gain of 486.04% on June 28, 2024, due to a combination of strong quarterly performance, positive technical signals, and increased investor interest.

5. How has high volatility affected WHLR stock?

High price volatility in WHLR stock has attracted traders looking for short-term opportunities, although it also brings potential risks for investors.

6. What potential risks should investors consider with WHLR stock?

Despite recent gains, WHLR stock faces potential risks, including a possible Nasdaq delisting notice received in July 2024 due to a shortfall in publicly held shares.

7. How do REITs generally perform when interest rates are lowered?

REITs tend to perform well when interest rates are lowered by the Federal Reserve, benefiting from reduced borrowing costs, increased demand for REIT shares, and potential property value appreciation.

8. What are the benefits of lower interest rates for REITs?

Lower interest rates can improve profitability and cash flow, increase demand for REIT shares, and potentially lead to property value appreciation.

9. Do all REIT sectors respond similarly to interest rate cuts?

No, different REIT sectors may respond differently to rate cuts depending on their specific business models and lease structures.

10. What other factors besides interest rates can impact REIT performance?

Other factors that impact REIT performance include economic conditions, property types, geographic locations, balance sheet strength, and management quality.

- Nvidia just poured $160 million into Applied Digital Stock… and it skyrocketed 76% in a day! 🚀 - September 8, 2024

- Is Trump Media stock the next meme stock disaster? 📉 Find out why DJT stock is tanking! - September 8, 2024

- When was the last time a new drug humbled the world’s best? Summit Therapeutics Stock To Explode 🧬 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.