September has historically been a challenging month for traders, and 2024 could be even more volatile due to uncertainties surrounding the Federal Reserve’s anticipated interest-rate cuts. Traditionally, September has been a month of losses for bondsUnited States Treasury securities are debt instruments issued by the United States government to finance its spending. Treasury securities come in a variety of forms, including bil... More, stocks, and gold, as traders reassess portfolios after summer. Both the S&P 500 and Dow Jones Industrial Average have experienced significant losses in September since 1950. The upcoming US jobs report is crucial, influencing the Fed’s rate cut decisions, which could result in increased market volatility. Markets are currently vulnerable, driven by few mega-cap tech stocks and sensitive to surprises, including economic data and political events like the upcoming debate between Vice President Kamala Harris and former President Donald Trump. Investors are bracing for heightened volatility, especially if the Fed’s stance appears less dovish than expected.

The Historical Trend of September Losses

Since 1950, both the S&P 500 Index and the Dow Jones Industrial Average have seen their largest percentage losses during September. Bonds have also declined in eight of the past ten Septembers, while gold prices have dropped every September since 2017. This seasonal pattern often reflects a reassessment of market conditions as traders return from summer vacations and start preparing for the final quarter of the year.

Investors are accustomed to September’s turbulent markets, but 2024 might prove even more challenging. Several uncertainties loom, including the upcoming U.S. jobs report, which is seen as crucial in determining the scale and timing of future interest-rate cuts by the Federal Reserve. With stock indices trading near record highs and Treasury bonds enjoying their longest monthly winning streak in three years, the markets appear vulnerable to data shocks or unexpected developments from a closely contested U.S. presidential race.

Uncertainties Surrounding the Federal Reserve

The Federal Reserve’s approach to monetary policy is a critical factor influencing September’s market performance. Currently, markets have priced in four quarter-point rate cuts by the end of 2024. However, the possibility of “wild market swings” remains if the Federal Reserve appears less inclined to ease monetary policy than expected at its upcoming meeting on September 18, 2024.

Investors are particularly focused on the upcoming U.S. employment data, which could provide valuable insights into the health of the U.S. economy and shape the Federal Reserve’s rate-cutting strategy. A stronger-than-expected jobs report may suggest that the U.S. economy is resilient enough to handle fewer rate cuts, leading to a sharp correction in both stocks and bonds. Conversely, a weaker report could reinforce the case for more aggressive easing, but it could also signal deeper economic concerns that might weigh on investor sentiment.

The Impact of U.S. Presidential Election Uncertainties

Adding another layer of complexity to September’s market dynamics is the political uncertainty surrounding the U.S. presidential election. Next week, Vice President Kamala Harris and former President Donald Trump will participate in their first televised debate, a crucial event that could significantly impact their respective campaigns as the election enters its final stretch.

The debate is expected to be a pivotal moment, and any perceived misstep or strong performance could shift market expectations regarding policy directions. Additionally, there is a risk of heightened volatility due to concerns about a contested election, reminiscent of the 2000 presidential election, which saw significant market turbulence and public unrest. Any signs of potential election disputes could further unsettle markets already bracing for economic uncertainty.

Focus on Key Economic Data

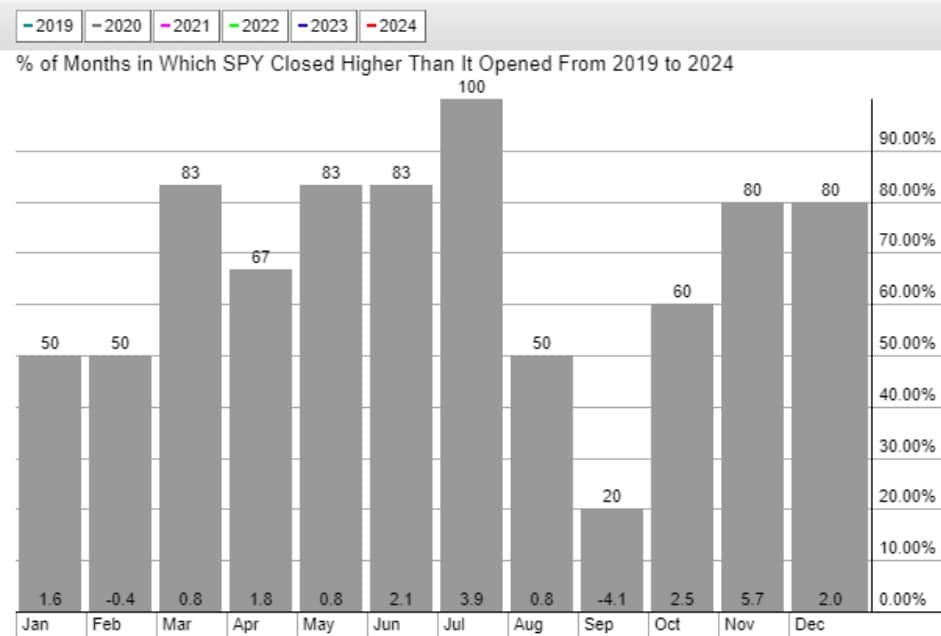

September’s market performance will largely hinge on the U.S. non-farm payrolls data, which is due to be released soon. This data is of particular importance this year as it may dictate the market’s direction for the remainder of 2024. Given that the S&P 500 has declined in each of the last four Septembers, the employment report’s impact on U.S. stocks could be more pronounced than usual.

The current market is heavily influenced by a few mega-cap technology stocks. As these stocks continue to drive the broader indices, any unexpected economic data could lead to significant drawdowns. A surprise in the jobs data or any sign of hesitation from the Federal Reserve could prompt a rapid unwinding of leveraged positions, leading to sharp market corrections.

What Investors Should Watch in September

For investors, September presents a range of challenges and opportunities. The primary areas to watch include:

1. Federal Reserve Decisions

The Federal Reserve’s meeting on September 18, 2024, will be a critical event. Investors should pay close attention to the language used by Fed Chair Jerome Powell and other policymakers to gauge the central bank’s stance on future rate cuts. Any deviation from the expected path of easing could trigger significant market reactions across asset classes.

2. U.S. Jobs Report

The upcoming non-farm payrolls data to be released on September 6, 2024, will be pivotal in setting the market tone for the rest of the year. A stronger-than-expected report could diminish expectations for aggressive rate cuts, while a weaker report could have the opposite effect. Either outcome is likely to generate market volatility, particularly given the elevated valuations in the equity and bond markets.

3. U.S. Presidential Election Developments

The first TV debate between Vice President Kamala Harris and former President Donald Trump is another key event scheduled for September 10, 2024. Investors should be prepared for potential market movements driven by political headlines, especially if the debate results in a shift in polling or market expectations regarding policy outlooks. The possibility of a contested election or concerns about election integrity could add further uncertainty to the mix.

4. Market Reactions to Mega-Cap Stocks

With the market heavily reliant on a few mega-cap technology stocks, any significant moves in these stocks could have outsized effects on the broader indices. Investors should monitor these stocks closely for signs of weakness or shifts in sentiment that could lead to broader market corrections.

Why These Developments Matter for Investors

For investors, understanding the factors driving September’s market dynamics is crucial for navigating potential volatility. Each of these developments — Federal Reserve policy, key economic data, and political uncertainties — plays a significant role in shaping market expectations and investor sentiment.

Importance of Following Key Players

- Federal Reserve: The central bank’s policies directly impact interest rates, bond yields, and the broader economic outlook. Investors should closely follow Fed communications to anticipate shifts in monetary policy that could affect their portfolios.

- U.S. Jobs Report: As a key indicator of economic health, the non-farm payrolls report influences market expectations around growth, inflation, and monetary policy. Investors should be prepared for potential market reactions to this data.

- Mega-Cap Tech Stocks: These stocks often serve as bellwethers for market sentiment. Significant movements in mega-cap stocks can trigger broader market moves, making it essential for investors to stay informed about developments affecting these companies.

- U.S. Presidential Election: Political outcomes can have far-reaching implications for fiscal policy, regulation, and international relations. Investors should be aware of how election dynamics might affect market sentiment and investment strategies.

The Guerilla Stock Trading Action Plan

- Monitor Economic Indicators: Closely track the US jobs report and other key economic data releases.

- Prepare for Volatility: Consider risk management strategies to handle potential market swings.

- Stay Informed on Political Developments: Be aware of political events, such as debates, that could impact market sentiment.

Blind Spot

Overlooking the impact of geopolitical tensions and other macroeconomic factors beyond the US that might influence global markets.

Preparing for a Stormy September

As September unfolds, investors face a range of uncertainties that could drive significant market volatility. By staying informed about key economic data, Federal Reserve decisions, and political developments, investors can better position themselves to navigate the challenges ahead. Understanding these dynamics is essential for managing risk and seizing opportunities in a month that has historically proven difficult for markets.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.