HighPeak Energy (HPK), led by CEO Jack Hightower, has garnered attention due to significant insider buying, with the CEO purchasing over $2.8 million worth of stock recently. This move coincides with the company’s impressive financial performance and growth, especially in the Permian Basin, where it focuses on oil, natural gas, and natural gas liquid production. HighPeak Energy has reported robust operational results, including a 15% year-over-year production increase and sustained positive cash flowThe cash flow statement provides a detailed overview of the cash inflows and outflows of a company over a specified period of time. It includes cash received from operations, inves... More. The company also raised its quarterly dividend by 60% and initiated a $75 million share buyback plan. With a moderate buy rating from analysts and a valuation lower than the industry average, HighPeak is positioned as a potentially attractive investment opportunity in the energy sector.

Strong Financial Performance and Growth Prospects

HighPeak Energy has been demonstrating impressive operational performance, marked by increased sales volumes and reduced operating expenses. The company reported solid results in its second-quarter earnings for 2024, with a 15% year-over-year boost in production to 48,531 barrels of oil equivalent per day. This strong performance of HighPeak Energy stock has been very encouraging for investors. HighPeak also achieved an adjusted net income of $39.4 million, or $0.28 per share, and maintained positive free cash flow for the fourth consecutive quarter.

The company’s robust performance reflects its strategic focus on the Permian Basin in West Texas, a prime location for oil, natural gas, and natural gas liquid reserves. HighPeak Energy’s use of advanced technology and cost optimization strategies has set it apart from competitors in this region. As a result, HighPeak Energy stock has drawn interest from both analysts and investors alike.

Dividend Increase and Share Buyback Highlight Financial Discipline

HighPeak Energy recently increased its quarterly dividend by 60%, offering $0.04 per share and bringing the annual dividend to $0.16, resulting in a forward yield of 1.10%. While the yield might seem modest, the increase is a strong indication of the company’s commitment to returning value to shareholders. Additionally, the announcement of a $75 million share buyback plan reinforces the company’s confidence in its financial stability and future growth prospects. These actions have made HighPeak Energy stock more attractive to potential investors.

These actions, along with the company’s attractive valuation of 3.15x enterprise value (EV)-to-EBITDA, well below the energy sector average of 5.78x, suggest that HighPeak Energy is undervalued and presents an appealing investment opportunity.

Insights

- Insider buying by the CEO reflects strong confidence in the company’s prospects.

- HighPeak’s financial performance indicates robust growth and operational efficiency.

- The valuation metrics suggest the stock is relatively undervalued compared to its peers.

The Essence (80/20)

HighPeak Energy is a small-cap energy company focusing on the Permian Basin, showing strong growth in production and cost efficiency. The CEO’s substantial insider buying, increased dividends, and a share buyback plan highlight management’s confidence and the company’s financial health. HighPeak’s valuation suggests it could be a bargain compared to the broader energy sector, making it an appealing opportunity for investors looking for growth in the energy market.

The Guerilla Stock Trading Action Plan

- Research HighPeak Energy’s financial reports to understand recent performance and future projections.

- Monitor insider buying activity and analyst ratings for ongoing signs of confidence in the stock.

- Evaluate the stock’s valuation against the broader energy sector to assess its investment potential.

- Consider diversifying within the energy sector if adding HighPeak to a portfolio, to balance potential risks.

Blind Spots

Dependence on Permian Basin Production:

- Blind Spot: HighPeak Energy’s heavy focus on the Permian Basin makes it vulnerable to regional issues such as regulatory changes, local infrastructure challenges, or natural disasters.

- Remedy: Diversify assets by exploring or acquiring interests in other productive basins to reduce geographical risk and dependence on a single region.

Exposure to Commodity Price Volatility:

- Blind Spot: Fluctuations in oil and natural gas prices can significantly impact revenue and profitability, given the company’s reliance on these commodities.

- Remedy: Implement hedgingFinancial hedging is a strategy used to reduce or eliminate the risk of financial losses that may arise from unfavorable price movements. More strategies to mitigate price risks, such as using futures and options contracts to lock in prices for a portion of production.

Limited Dividend History and Low Yield:

- Blind Spot: With only a two-year dividend history and a relatively low yield, the company may not attract income-focused investors who seek consistent and higher payouts.

- Remedy: Increase dividend payouts gradually and maintain a stable or growing dividend policy to build a track record that attracts long-term, income-focused investors.

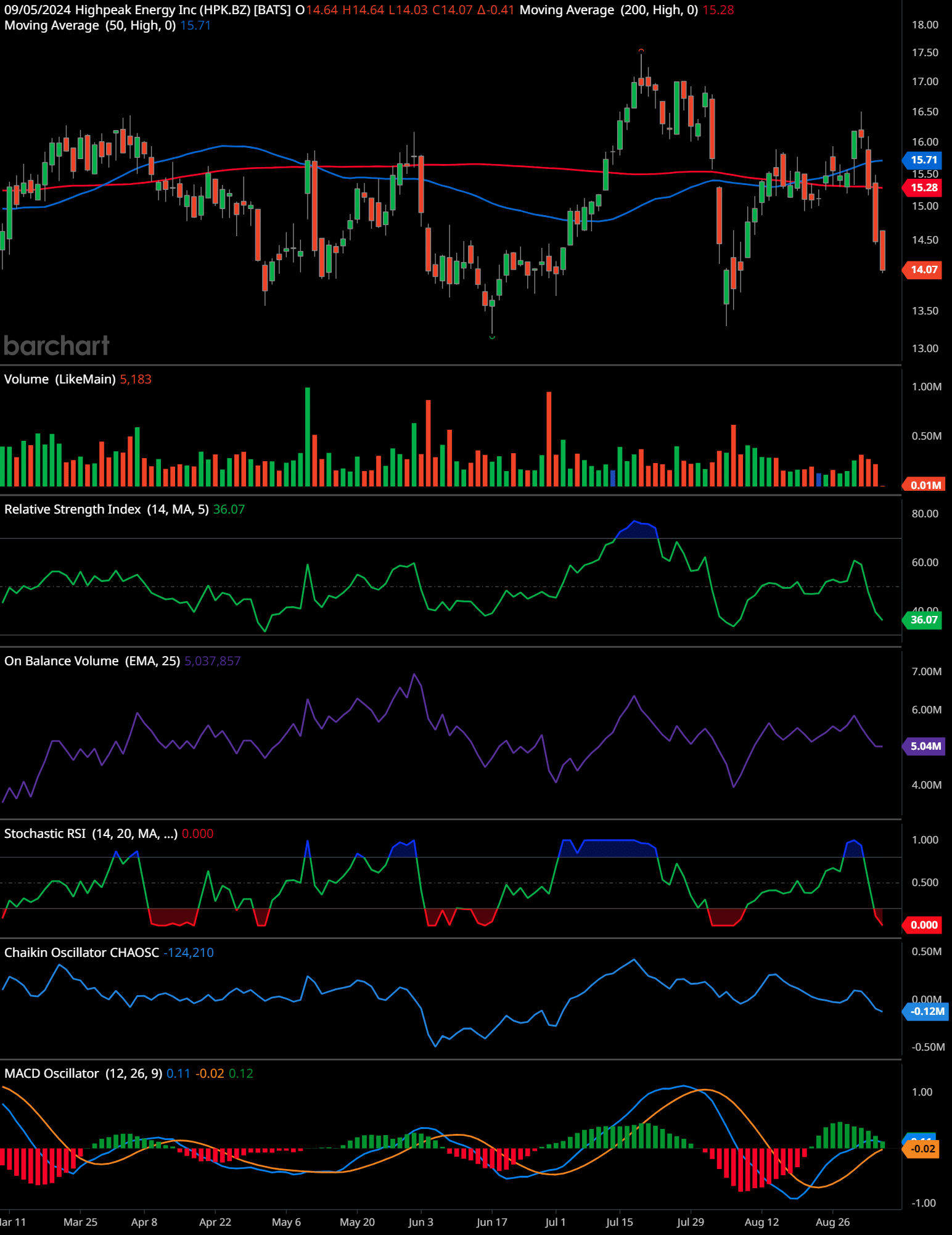

HPK Stock Technical Analysis (daily)

Time-Frame Signals

3-Month Signal: Sell

The stock price is currently at $14.07, showing a clear downward trend in the short term. The recent candlesticks indicate strong selling pressure, particularly with the last two red candles breaking below the 50-day (15.71) and 200-day (15.28) moving averages. The Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI) is at 36.07, which is approaching oversold territory, but not low enough to suggest an immediate reversal. The On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV) is flattening, indicating waning buying interest. The MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More histogram has recently crossed into negative territory, and both the MACD line and the signal line are trending downward, indicating a bearish momentum. The Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... is also in negative territory (-124,210), further suggesting distribution. Overall, there is a strong downward bias over the next three months.

6-Month Signal: Hold

For the 6-month outlook, a “Hold” recommendation is appropriate due to mixed signals. Although the short-term indicators are bearish, the 200-day moving average is relatively flat, indicating a lack of a decisive long-term trend. The stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... is currently at 0.000, which suggests that the stock is oversold in the short term and might experience a rebound or a consolidation phase. Additionally, if the price finds support around $14.00, this could lead to a sideways movement rather than a continued drop. The Chaikin Oscillator suggests negative money flow, but it is not yet at extreme levels. A hold position would be prudent until more clarity is observed in the longer-term trend direction.

12-Month Signal: Hold

The 12-month outlook also suggests a “Hold.” While there is downward pressure in the short term, longer-term technical indicators do not provide a clear direction. The moving averages are converging, which often precedes a significant move but doesn’t indicate the direction. If the stock finds support near the current price level, it could start forming a base for a potential future upward trend. However, a significant resistance level around $16.50 needs to be broken to confirm a bullish reversal. If the stock cannot hold above $14.00, the trend could continue downward, possibly testing the next support around $13.00.

Support and Resistance Levels

Support levels:

- $14.00 – The recent low and the current price level, where the stock might find some buying interest.

- $13.00 – A historical support level from earlier in the year.

Resistance levels:

- $15.50 – Near the 50-day moving average, which the stock recently broke below.

- $16.50 – A significant resistance level from previous highs in August.

Future Trend Indications

The chart suggests that HighPeak Energy Inc. is currently in a short-term downtrend, confirmed by the recent break below both the 50-day and 200-day moving averages. The bearish momentum is supported by the declining MACD and negative Chaikin Oscillator, indicating that selling pressure is dominant. However, the RSI is nearing oversold levels, which could lead to a short-term rebound or consolidation. For a potential bullish trend to develop, the stock must break above the 50-day moving average and sustain a move above the $16.50 resistance level. In the absence of such a move, the current bearish trend may persist, with a potential test of the support at $14.00 or lower.

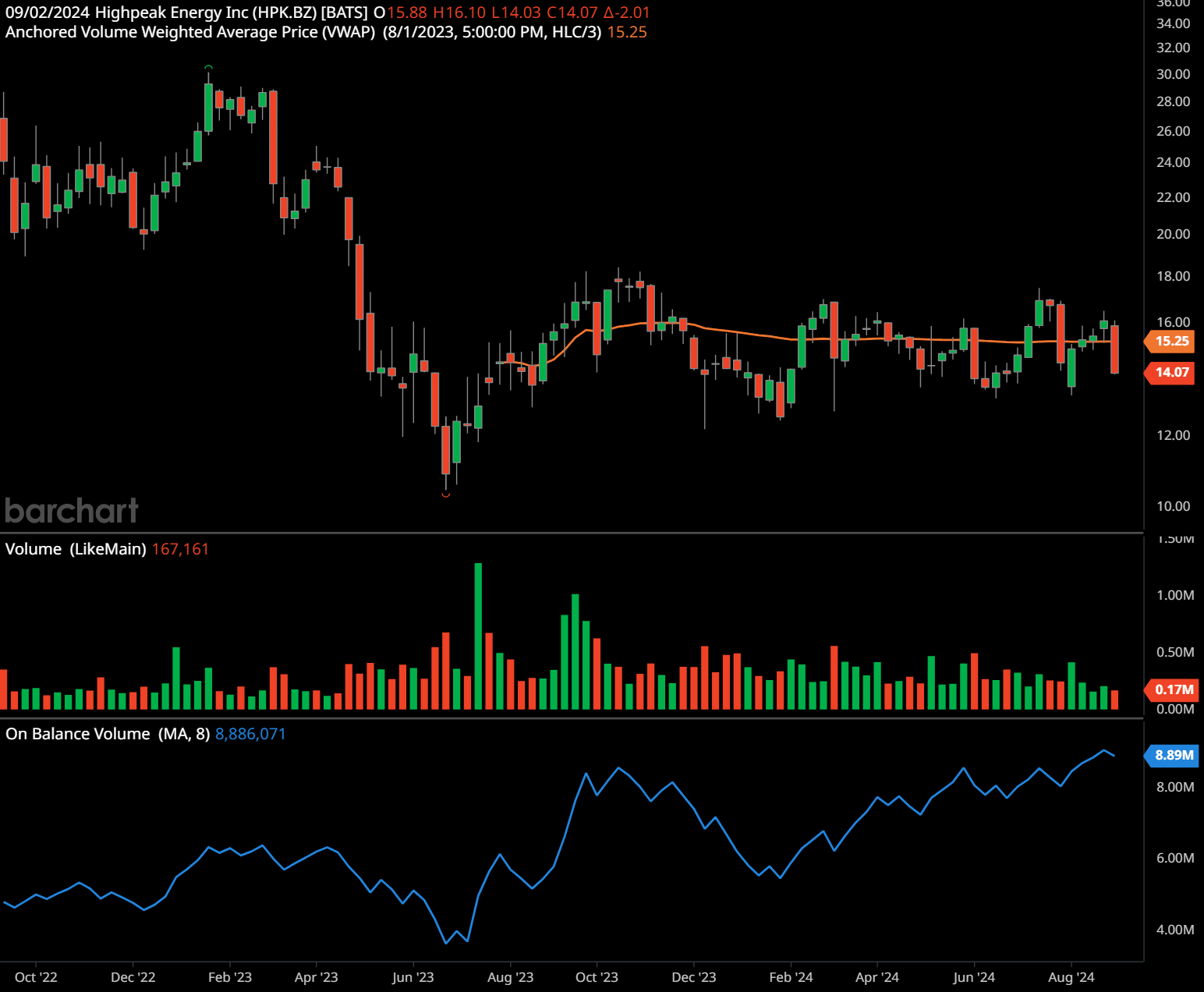

HPK Stock Technical Analysis (weekly)

Time-Frame Signals

1-Year Signal: Hold

The stock price is currently at $14.07, which is below the Anchored Volume Weighted Average Price (VWAP) of $15.25. This indicates that the stock is trading below the average price paid by investors since August 2023. The overall trend in the past year has been relatively sideways, with significant volatility between $12.00 and $18.00. The On-Balance Volume (OBV) is showing a slow upward trend, suggesting that there is a gradual accumulation despite the recent price declines. However, the low trading volume over the last few months implies a lack of strong buying interest. Given these mixed signals, a “Hold” is appropriate until the price shows a more definitive trend either above or below key support and resistance levels.

2-Year Signal: Hold

Over the past two years, the chart shows a significant decline from highs above $30 in late 2022 to current levels around $14.07. The price action is consolidating in a range between $12.00 and $18.00, which suggests that the stock could be forming a base after a large drop. The Anchored VWAP around $15.25 is acting as a dynamic resistance. The OBV shows a slow, steady accumulation pattern, which indicates some buying pressure, but not enough to signal a breakout. Given this base-building behavior, a “Hold” recommendation is advised, with caution to wait for a break above resistance or a confirmed breakdown below support to reassess the position.

3-Year Signal: Sell

Looking over a three-year period, the trend remains clearly bearish. The stock peaked at over $34 in 2021 and has been in a consistent downtrend since. The recent consolidation phase between $12.00 and $18.00 could either signify a bottoming process or a continuation of the long-term downtrend. The Anchored VWAP remains well above current prices, reinforcing the bearish outlook in the longer-term. Given the absence of a clear reversal pattern, and with the stock trading well below major moving averages, a “Sell” is advised for a three-year horizon unless significant technical improvements are seen.

Support and Resistance Levels

Support levels:

- $14.00 – A psychological and recent price support level.

- $12.00 – A strong support level tested multiple times over the past year.

Resistance levels:

- $15.25 – Anchored VWAP, acting as dynamic resistance.

- $18.00 – The upper bound of the current trading range, acting as a significant resistance level.

Future Trend Indications

The weekly chart indicates a mixed outlook. The recent consolidation in the range of $12.00 to $18.00 suggests that the stock is either in the process of forming a base or preparing for another move down. The Anchored VWAP at $15.25 acts as a crucial resistance, and a break above this level could signal a bullish reversal in the short to medium term. However, until the stock breaks out of the current range or shows a definitive reversal pattern, the longer-term bearish trend remains intact. The upward slope in OBV suggests accumulation, but the low volume indicates cautious trading activity. The future trend will depend on whether the stock can break out above $18.00 or fall below $12.00.

Past performance is not an indication of future results. This article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Why HighPeak Energy Is Important for Investors

For investors, HighPeak Energy stock represents a compelling opportunity in the energy sector. The company has demonstrated strong operational and financial performance, a focus on shareholder returns through dividends and share buybacks, and has the backing of significant insider buying from its CEO. With a “moderate buy” consensus rating from analysts and a projected 45% upside potential to the average price target, HighPeak Energy stock is positioned as an attractive option for those looking to capitalize on growth in the energy market.

Frequently Asked Questions (FAQs) about HighPeak Energy (HPK)

1. Who is the CEO of HighPeak Energy (HPK)?

The CEO of HighPeak Energy is Jack Hightower.

2. How much stock did CEO Jack Hightower recently buy?

CEO Jack Hightower recently purchased over $2 million worth of company stock, specifically 186,392 shares in two transactions.

3. What is the market capitalization of HighPeak Energy?

HighPeak Energy has a market capitalization of approximately $1.85 billion.

4. Where is HighPeak Energy focused geographically?

HighPeak Energy is primarily focused on the Permian Basin in West Texas.

5. What does HighPeak Energy do?

HighPeak Energy is an independent energy company engaged in the acquisition, development, and production of oil, natural gas, and natural gas liquid reserves.

6. What were HighPeak Energy’s recent production and financial results?

In the second quarter of 2024, HighPeak Energy boosted production by 15% year-over-year to 48,531 barrels of oil equivalent per day and reported adjusted net income of $39.4 million, or $0.28 per share, while maintaining positive free cash flow for the fourth consecutive quarter.

7. Has HighPeak Energy increased its dividend recently?

Yes, HighPeak Energy increased its quarterly dividend by 60% to $0.04 per share, bringing the annual dividend to $0.16, with a forward yield of 1.10%.

8. What is the consensus rating from analysts for HighPeak Energy?

HighPeak Energy has a “moderate buy” consensus rating from analysts.

9. What is the projected upside potential for HighPeak Energy?

HighPeak Energy has a projected upside potential of 45% to the average price target according to analysts.

10. Does HighPeak Energy have a share buyback plan?

Yes, HighPeak Energy has a $75 million share buyback plan in place.

11. How does HighPeak Energy’s valuation compare to the broader energy sector?

HighPeak Energy’s enterprise value (EV)-to-EBITDA valuation is 3.15x, which is considered a bargain compared to the broader energy sector’s average multiple of 5.78x.

12. Why is insider buying significant for HighPeak Energy?

The recent insider buying activity, particularly by CEO Jack Hightower, signals confidence in the company’s growth potential and financial health, making it an attractive investment opportunity.

- Nvidia just poured $160 million into Applied Digital Stock… and it skyrocketed 76% in a day! 🚀 - September 8, 2024

- Is Trump Media stock the next meme stock disaster? 📉 Find out why DJT stock is tanking! - September 8, 2024

- When was the last time a new drug humbled the world’s best? Summit Therapeutics Stock To Explode 🧬 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.