The oil and gas sector, a cornerstone of the U.S. economy, is poised for significant volatility as the November Presidential election approaches. The industry’s future largely depends on the outcome of this election, with the two leading candidates, Kamala Harris and Donald Trump, holding vastly different views on energy policies, particularly regarding oil, gas, and renewable energy.

Contrasting Energy Policies: Harris vs. Trump

Kamala Harris and Donald Trump represent two distinct visions for America’s energy future. Harris, known for her past advocacy against fracking and her strong stance on environmental protection, has yet to fully clarify her current energy policies. In contrast, Trump’s energy agenda is unambiguous, championing increased domestic oil and gas production while dismissing climate change initiatives as misguided.

Kamala Harris: A History of Environmental Advocacy

Before becoming a part of the Biden-Harris administration, Harris had a record of supporting environmental protection measures. In 2019, she was a vocal proponent of a fracking ban and was one of the original sponsors of the Green New Deal resolution. As California’s Attorney General, Harris took legal action against major fossil fuel companies, including prosecuting a pipeline company for an oil spill and investigating Exxon Mobil for allegedly misleading the public about climate change.

However, Harris’s stance on fracking has evolved since joining the Biden-Harris ticket. Despite her previous opposition, she now insists that she will not support a fracking ban, a position likely influenced by the political landscape in battleground states like Pennsylvania, where natural gas production plays a critical role in the local economy.

Donald Trump: Drill, Baby, Drill

Donald Trump, on the other hand, has consistently advocated for expanding domestic oil and gas production. His administration has rolled back numerous environmental regulations in favor of boosting the fossil fuel industry. Trump’s energy policy can be summed up by the phrase “Drill, baby, drill!” He has frequently criticized the Biden administration’s climate change initiatives, dismissing them as part of a “Green New Scam.”

Trump’s clear support for the oil and gas industry is seen as a potential driver for increased production, which could lead to lower oil prices. However, this stance may also introduce uncertainty into the market, as the industry grapples with the potential for increased volatility depending on the election’s outcome.

Market Implications: Uncertainty and Volatility

The looming Presidential election has injected a significant degree of uncertainty into the oil and gas market. Industry experts like Phil Flynn of Price Futures Group suggest that the market is currently in a state of flux, awaiting clearer signals from the election. Flynn notes that while the global market is tightening, the potential for a Trump presidency, which would likely lead to increased oil and gas production, is viewed by some as a possible negative factor for oil prices.

This uncertainty is compounded by the fact that Harris has not yet outlined a comprehensive energy policy, leaving the industry to speculate on the potential impacts of her leadership. On the other hand, Trump’s well-documented support for fossil fuels suggests that his re-election could lead to a continuation of current policies favoring the oil and gas sector.

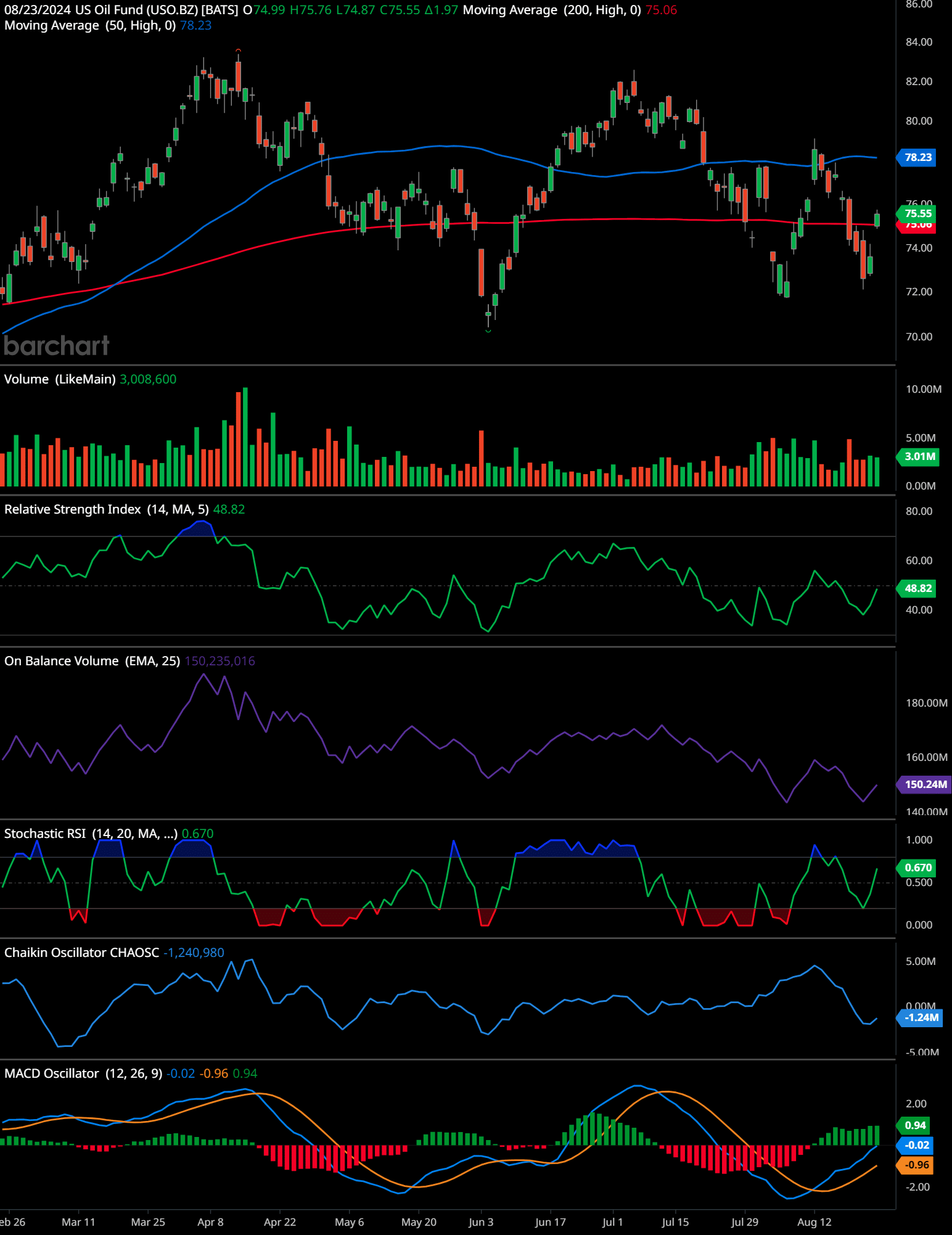

USO Technical Analysis (daily)

This chart represents the daily price movements of the US Oil Fund (USO). Here’s a detailed analysis:

Price Action and Moving Averages: The price has been oscillating between the 50-day moving average (currently around 78.23) and the 200-day moving average (currently around 75.06). Recently, the price dipped below the 200-day moving average, which is often considered a bearish signal, but it is now attempting to rise back above this level. The 50-day moving average is still above the 200-day moving average, suggesting that the overall trend has been bullish, but the recent price action indicates potential weakness.

Support and Resistance Levels: Key support is around the $74 level, where the price has recently bounced. Resistance appears near the $78.50 to $79 level, where the price has previously struggled to move higher.

Volume: The volume is moderate with no significant spikes, indicating a lack of strong conviction either way. The recent green volume bars suggest some buying interest at the lower levels.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is currently at 48.82, which is in the neutral zone. This suggests neither overbought nor oversold conditions, and the RSI has been moving sideways, reflecting the indecision in the market.

On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV is showing a gradual decline, indicating that on days when the price moves up, the volume is not as strong as on days when the price moves down. This suggests that the broader market sentiment might be leaning bearish.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: The Stochastic RSI is at 0.670, moving from the oversold region towards the overbought territory. This could indicate a short-term bullish momentum if it continues to rise.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: The Chaikin Oscillator is at -1.24M, which is negative, indicating that the selling pressure outweighs buying pressure. However, it has shown some signs of stabilizing, suggesting a possible bottoming out.

MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More: The MACD line is slightly below the signal line, with the histogram also showing a small positive divergence. This indicates that the bearish momentum might be weakening, and there could be a potential for a bullish crossover soon.

Time-Frame Signals:

- 3-Month: The recent struggle to maintain above the 200-day moving average suggests a cautious outlook. Potential for a further test of support around $74, with resistance near $78.50. Signal: Hold.

- 6-Month: Given the mixed indicators, with OBV declining and MACD showing potential for a bullish crossover, the market could consolidate within the current range before a decisive move. Signal: Hold.

- 12-Month: The longer-term uptrend is still intact, but weakening momentum could lead to a deeper pullback if the price fails to reclaim the 50-day moving average convincingly. Signal: Hold/Sell if breakdown continues below $74.

Future Trends: The chart indicates a period of consolidation with a possible slight bearish bias in the short term if the price fails to hold above the 200-day moving average. However, if the price can reclaim the 50-day moving average and maintain above it, a return to bullish momentum is possible. The next few days are crucial to determining the direction.

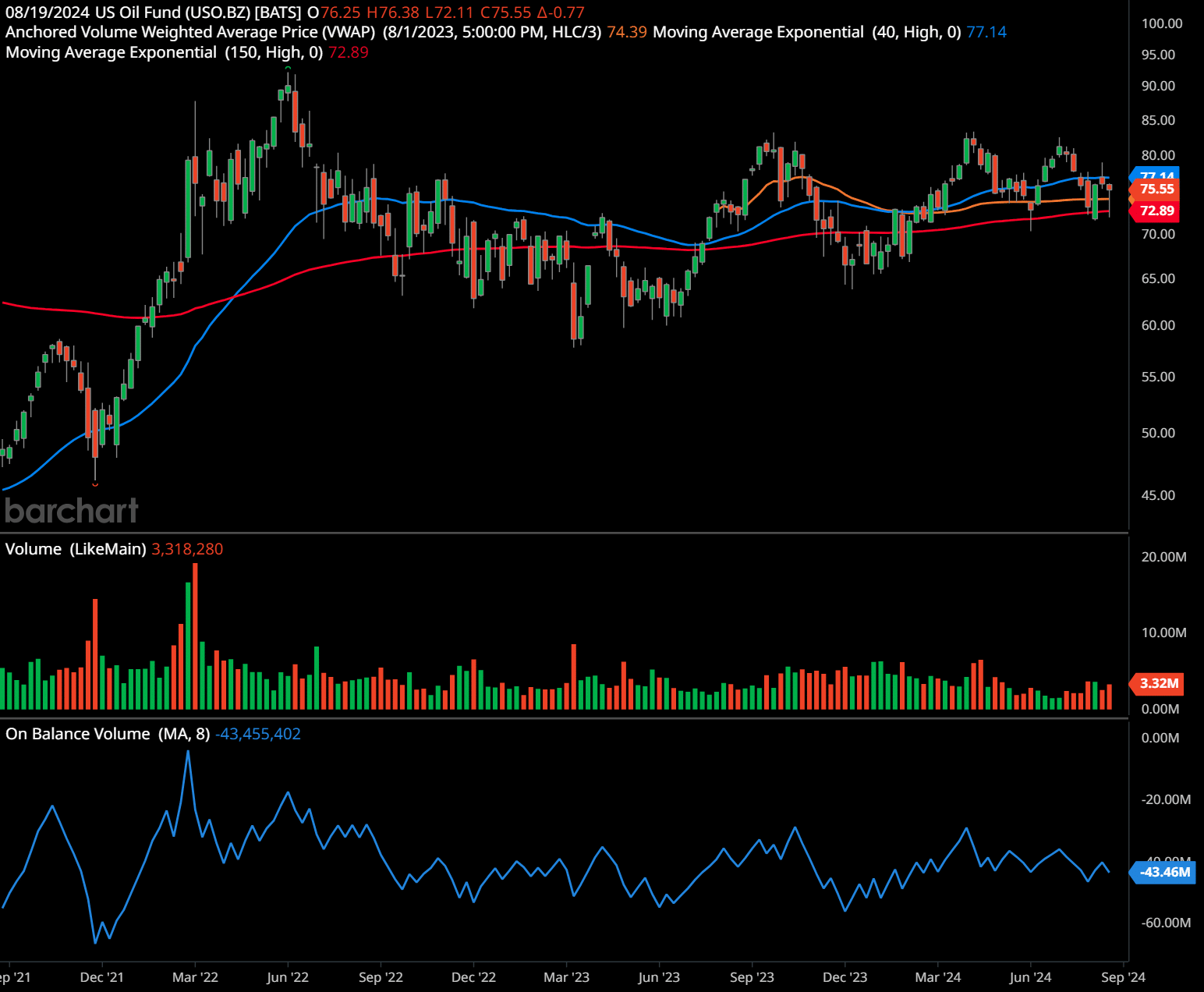

USO Technical Analysis (weekly)

This chart represents the weekly price movements of the US Oil Fund (USO) over the past few years. Here’s a detailed analysis:

Price Action and Moving Averages: The price is currently hovering around the 150-week moving average (at 72.89) and the 40-week moving average (at 77.14). The price recently crossed below the 40-week moving average, which can be seen as a bearish signal. The anchored VWAP from August 2023 is at 74.39, which also acts as a critical level. The overall price action has shown a series of lower highs and lower lows, indicating a possible shift towards a bearish trend.

Support and Resistance Levels:

- Support: The primary support is around the $70 level, where the 150-week moving average is located. If this level fails to hold, the next significant support is around the $65 level, which acted as a support in 2021.

- Resistance: The primary resistance is at the $80 level, where the price previously struggled to break above and where the 40-week moving average is positioned. A secondary resistance is around $85, where the price topped out multiple times in 2023.

Volume: The volume has been decreasing, indicating a lack of strong buying or selling conviction. The volume spikes seen in late 2021 and early 2022 show the periods of high activity, but the recent lower volume suggests consolidation or indecision.

On-Balance Volume (OBV): The OBV shows a gradual decline, indicating that selling pressure has been more dominant over the past year. The OBV’s current position near -43.46M suggests that more volume has exited the market during price declines than entered during rallies, which is a bearish sign.

Time-Frame Signals:

- 1-Year: The price is testing critical support levels, and the downward cross of the moving averages suggests potential further downside. However, if the price can stay above the $70 level, a range-bound movement could occur. Signal: Hold/Sell.

- 2-Year: The consistent lower highs and failure to break significant resistance levels point to a bearish trend over the medium term. The price might retest lower support levels. Signal: Sell.

- 3-Year: The long-term trend is weakening, with lower highs forming a potential downward channel. However, if strong support around $65-$70 holds, there could be a potential for a reversal. Signal: Hold/Sell.

Future Trends: The chart indicates that the US Oil Fund is in a potential downtrend, with key support levels being tested. If the price breaks below the $70 level decisively, further declines could be expected. However, if the price stabilizes and volume increases, there could be a chance for a reversal or at least a consolidation phase. Given the mixed signals, cautious trading is advised.

Past performance is not an indication of future results, and this article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

As the November election draws closer, the oil and gas sector remains on edge, with its future largely tied to the outcome. The stark differences between Harris and Trump’s energy policies underscore the potential for significant shifts in the industry depending on who wins the White House. With Harris’s evolving stance on fracking and Trump’s unwavering support for fossil fuels, the election is likely to be a major determinant of the industry’s direction in the coming years. Investors and industry stakeholders will be closely watching the election results, as they brace for the potential volatility that lies ahead.

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

- Nvidia just poured $160 million into Applied Digital Stock… and it skyrocketed 76% in a day! 🚀 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.