When analyzing the stock market’s future, relying solely on past earnings reports can be misleading. While mainstream media often uses these reports to predict future market movements, this approach overlooks the critical factor of earnings forecasts. Recent trends show that earnings forecasts for the remainder of the year have been declining over the past few months. This is an indication that the recent growth in stock prices has primarily been due to multiple expansion.

Understanding Multiple Expansion

Multiple expansion occurs when a stock’s valuation grows faster than its fundamental value. This trend has been a significant driver of stock returns in recent years. Investors must recognize that while past earnings provide insight into a company’s performance, they do not necessarily predict future stock movements. Instead, it is essential to focus on forward-looking earnings forecasts and underlying economic conditions.

The Current Consumer Landscape: A Temporary Boom?

Despite the Federal Reserve’s ongoing rate hikes, consumer spending has surpassed expectations. This paradox presents a complex picture of the economy. Real personal disposable income has grown by only 1% over the past year, while consumer spending has increased by nearly 3%. This discrepancy has led to a steady decline in the personal savings rate, now at 2.9%, a figure seen in only 5% of historical data. This rare event suggests that consumer spending is being driven not by income growth but by depleting savings. This trend is unsustainable.

As savings dwindle and consumers reach their credit limits, a sudden drop in consumer spending could occur. Additionally, various sectors, including capital spending, the industrial sector, and housing, have already shown signs of recession. The consumer sector, the most significant component of GDP, has so far remained resilient, but this will not last.

The Uncertain Job Market and Federal Reserve Policies

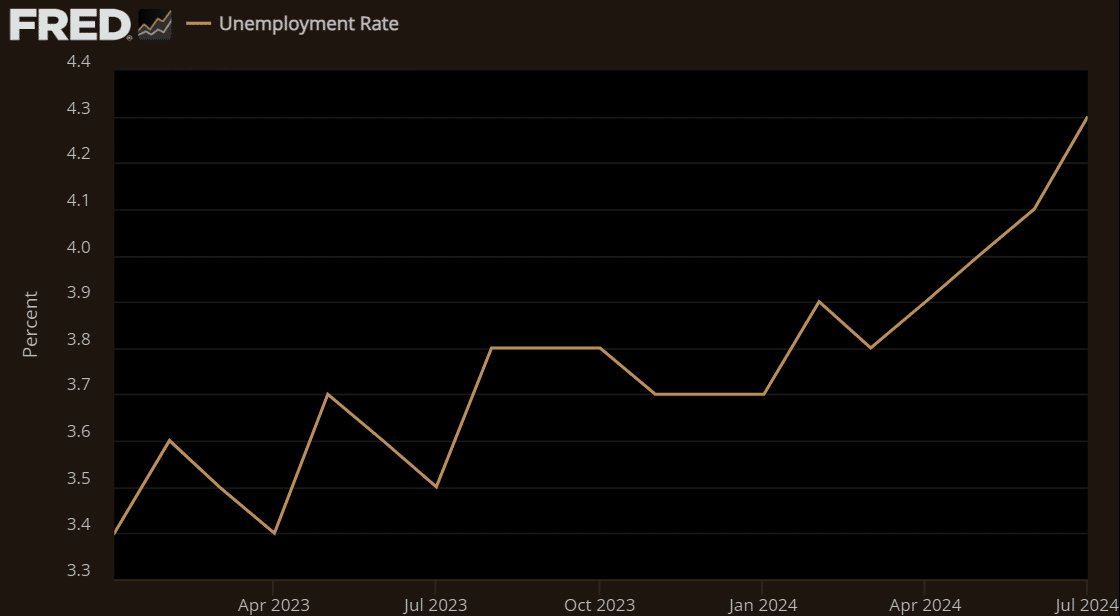

The unemployment rate currently stands at 4.3%, but it has risen by 90 basis points since April 2023, capturing the attention of Federal Reserve Chair Jay Powell.

This increase suggests that there may be too much slack in the labor market, prompting concerns about economic stability. Powell has indicated that unemployment is a key statistic for the Federal Reserve, influencing its decision to cut interest rates.

The Fed is behind the curve, particularly concerning the yield curve. At a recent press conference, Powell suggested that while the economy and inflation have largely normalized, there is more slack in the labor market now than before the COVID-19 pandemic. Despite these observations, the current Fed funds rateThe Fed Funds Rate is the rate at which member banks of the Federal Reserve (the Fed) lend each other money, usually for overnight loans. More is at 5.38%, significantly higher than the Fed’s neutral rate estimate of 2.75%. This disparity indicates that the Federal Reserve’s policies do not align with the current economic environment.

Defensive Moves by Investors: A Shift in Strategy

Amid economic uncertainty, many investors are turning to defensive sectors. Investments in gold, healthcare, and utilities have increased, reflecting a strategic shift to safeguard against potential downturns. These sectors tend to be re-rated by investors when there is an expectation that the economy is cooling off, as seems to be the current trend.

Mainstream media, which often shapes public perception of economic conditions, currently maintains that the U.S. is not in a recession, promoting a narrative of a potential “soft landing.” However, there are signs that disinflationary slack is building within the economy. For example, while the supply side of the economy is expanding at over 4%, GDP growth is estimated to be around 2.5% to 3%, suggesting an imbalance that could lead to cooling in the broader economic environment.

The Relevance of Defensive Sectors for Investors

In light of these economic dynamics, defensive sectors like bondsUnited States Treasury securities are debt instruments issued by the United States government to finance its spending. Treasury securities come in a variety of forms, including bil... More, utilities, certain real estate investment trusts (REITs), and gold are becoming increasingly attractive to investors. Here is why each sector holds importance:

Gold: A Safe Haven Amid Uncertainty

Gold remains a traditional safe-haven asset, especially during periods of economic instability or anticipated market downturns. Its value tends to increase when investors are concerned about inflation or geopolitical risks. As concerns about economic cooling and disinflation grow, gold’s role as a defensive investment is more pronounced. For investors looking to mitigate risks, gold offers a tangible store of value.

Healthcare: Resilience in Economic Downturns

Healthcare stocks are often considered recession-proof because people continue to require medical care regardless of economic conditions. Companies in this sector provide essential services, which can help stabilize their earnings even when other industries face declines. For investors, healthcare presents an opportunity to benefit from steady demand and an aging population, providing long-term growth potential.

Utilities: Stability Through Regulated Returns

Utilities also offer a defensive investment option due to their stable and regulated nature. Companies in this sector provide essential services, such as electricity, water, and gas, which remain in demand regardless of the broader economic climate. Additionally, many utilities pay consistent dividends, providing investors with a reliable income stream. As the economy shows signs of slowing, utilities can serve as a stable component of an investment portfolio.

Real Estate Investment Trusts (REITs): Income and Diversification

Certain REITs, particularly those focused on sectors like healthcare and residential properties, offer defensive qualities that appeal to risk-averse investors. REITs provide exposure to the real estate market without the need for direct property ownership and can offer attractive dividends. In times of economic uncertainty, REITs that operate in stable segments can provide both income and diversification benefits.

Insights

- Relying on past earnings to predict market trends ignores current economic realities.

- Consumer spending growth is unsustainable due to low savings rates and high credit use.

- Rising unemployment rates indicate potential concerns for future economic stability.

- Investors are moving to defensive sectors, anticipating economic downturns.

The Essence (80/20)

- Earnings vs. Stock Market Predictions: Media reliance on past earnings is misleading; future market performance should be based on declining earnings forecasts.

- Unsustainable Consumer Spending: Consumer spending is driven by reduced savings, not real income growth, signaling potential for a sharp downturn when savings are depleted.

- Fed’s Stance and Interest Rates: The Federal Reserve’s high-interest rates, despite signs of normalization, indicate a delay in responding to economic conditions.

- Investor Behavior: Defensive investments are rising as investors anticipate economic cooling and potential recession.

The Guerilla Stock Trading Action Plan

- Track Fed Decisions: Stay informed on Federal Reserve policies and interest rate movements to predict economic shifts.

- Monitor Earnings Forecasts: Focus on earnings forecasts rather than past earnings reports to gauge market trends.

- Prepare for Market Corrections: Anticipate potential corrections in consumer spending and market valuation due to unsustainable growth trends.

- Adjust Investment Strategy: Consider reallocating investments to defensive sectors like gold, healthcare, utilities, and certain bonds.

Looking Ahead

As the economic landscape evolves, investors must remain vigilant and adapt their strategies accordingly. The recent rise in multiple expansion, declining earnings forecasts, and mixed signals from consumer spending and the job market suggest that the stock market may face increased volatility in the near future. While some sectors, such as technology and consumer discretionary, may continue to experience growth, defensive sectors like gold, healthcare, utilities, and certain REITs provide a buffer against potential downturns.

Investors should continue to monitor key economic indicators, such as the Federal Reserve’s interest rate policies and consumer spending trends, while considering the importance of maintaining a diversified portfolio. As uncertainty persists, positioning within defensive sectors could offer a prudent approach to navigating potential challenges ahead.

Frequently Asked Questions

1. Why is using earnings reports to predict future stock market performance considered intellectually dishonest?

Using earnings reports for the last quarter is considered misleading because it looks backward instead of forward. To accurately gauge future market performance, one should consider earnings forecasts, which reflect future expectations rather than past results.

2. What does multiple expansion mean in the context of the stock market?

Multiple expansion occurs when a stock’s valuation increases faster than its fundamental value. In recent years, this has been a primary driver of stock returns.

3. How has consumer spending compared to real personal disposable income growth?

While real personal disposable income has grown by 1% over the past year, real consumer spending has increased by nearly 3%. This discrepancy has led to a decline in the personal savings rate.

4. Why is the personal savings rate currently considered low?

The personal savings rate has dropped to 2.9%, which is historically low and has only been this low 5% of the time in the past. This is considered unsustainable as it reflects spending beyond real income growth.

5. What sectors of the economy are currently in a recession?

The industrial sector, the housing market, and real capital spending are all in recession, although they are not the largest components of GDP.

6. How might consumer spending collapse, and why?

Consumer spending might collapse rapidly due to depleted savings and maxed-out credit limits, causing a sharp decline in economic activity.

7. What is the current state of unemployment and its impact on Federal Reserve policy?

Unemployment is at 4.3%, but it has risen by 80 basis points in the past year. This increase has concerned the Federal Reserve, prompting interest rate cuts.

8. What is meant by the Fed being “behind the curve”?

The Federal Reserve is said to be “behind the curve” because it has maintained a higher interest rate than what is considered normal for a stabilized economy, despite normalization in inflation and labor market conditions.

9. How are investors responding to current economic conditions?

Investors are making defensive moves, such as investing in gold, healthcare, and utilities, which tend to perform better when the economy cools off.

10. What is the mainstream media’s narrative about a recession?

The mainstream media claims that the economy is not in a recession and suggests a “soft-landing” scenario, often perceived as being politically motivated.

11. What is the expected trend for interest rates according to the provided text?

Interest rates are expected to continue declining, even though the Federal Reserve has not officially cut rates yet, creating an environment where rate-sensitive sectors may be re-rated with a higher multiple.

12. Which sectors are considered appropriate for investment given the current economic outlook?

Defensive sectors like bonds, utilities, certain REITs, and gold are considered appropriate due to the expected economic slowdown and potential re-rating of these assets.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.