The Current Challenges Facing Airline Stocks

The S&P 500 Passenger Airlines Index has experienced a sharp decline of over 42% in the past five years, primarily due to the significant impact of the COVID-19 pandemic, which severely reduced passenger traffic. As a result, many airline stocks have ended up in bargain territory, trading at low multiples to sales and earnings. However, there are signs that some of the best airlines stock could be poised for a recovery in the near future.

Optimism for a Turnaround in Airlines Stock

United Airlines CEO Scott Kirby has expressed optimism about a potential turnaround for the industry, suggesting that an inflection point may be just 30 days away. This perspective is further supported by the International Air Transport Association (IATA), which has recently strengthened its projections for the profitability of airline stocks.

According to the IATA, the airline industry is expected to achieve net profits of $30.5 billion in 2024, up from a forecast of $25.7 billion in December 2023. The expected return on invested capitalReturn on Invested Capital (ROIC) is a vital financial metric that assesses a company's efficiency in allocating capital to profitable investments. It provides valuable insights in... is 5.7% in 2024, while operating profits are projected to increase from $52.2 billion in 2023 to $59.9 billion in 2024. Total revenues are anticipated to reach a record $996 billion, representing a 9.7% increase, with a corresponding rise in expenses to $936 billion and a record 4.96 billion total travelers in 2024.

Buy Spirit Airlines Stock?

it does not appear to be a good time to buy Spirit Airlines (SAVE) stock. Here are the key reasons:

- Poor Financial Performance: Spirit Airlines reported a net loss of $158 million in the second quarter of 2024 and expects weak revenue for the third quarter.

- Declining Stock Price: Spirit Airlines stock has plummeted to a 52-week low of $2.48, representing a staggering 83.97% drop over the past year.

- Negative Analyst Sentiment: The stock has received a consensus rating of “Strong Sell” from analysts, with 7 sell ratings, 2 hold ratings, and no buy ratings.

- High Short Interest: 32.09% of the float has been sold short, indicating significant bearish sentiment among investors.

- Debt Burden: Spirit Airlines operates with a significant debt burden, which could further strain its financial stability.

- Weak Industry Outlook: The airline industry continues to face challenges, including competition, fluctuating fuel prices, and changing consumer travel patterns.

- Technical Indicators: The stock is trading below both its 50-day and 200-day moving averages, suggesting a strong downtrend.

- Negative Earnings Growth: The company’s earnings per shareEarnings per share (EPS) is a fundamental financial metric that provides valuable insights into a company's profitability. This widely used indicator helps investors and analysts g... are projected to remain negative, moving from -$6.94 to -$4.28.

While Spirit Airlines stock’s low price and high dividend yield might seem attractive, these factors are overshadowed by the company’s financial struggles and negative market sentiment. The majority of analysts and market indicators suggest that Spirit Airlines stock is likely to continue underperforming in the near future.

Spirit Airlines Stock

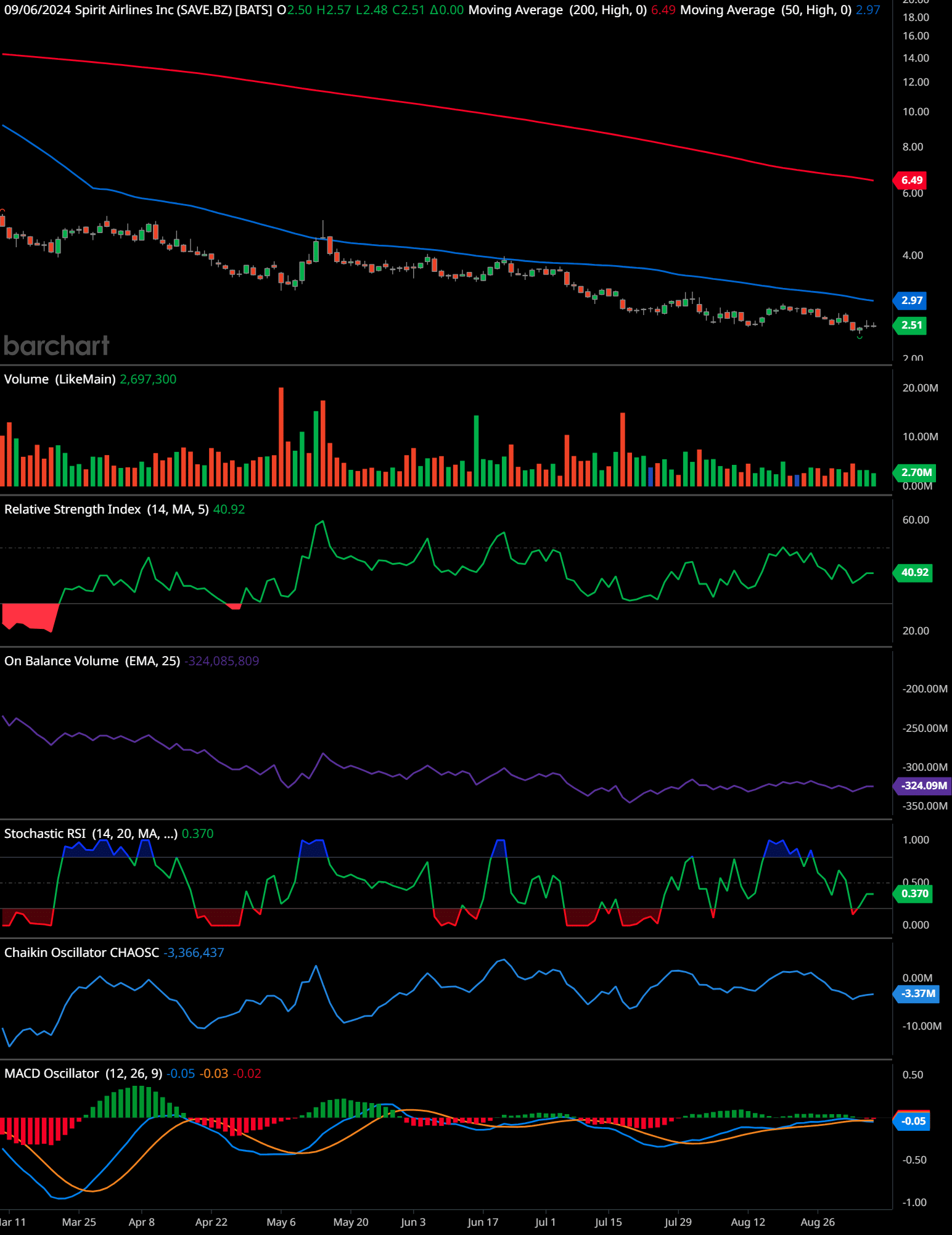

The chart shows the daily price movement of Spirit Airlines Inc. (SAVE) with several key technical indicators.

Price Action: The stock has been in a sustained downtrend since March 2023, marked by a series of lower highs and lower lows. The price is currently trading at $2.51, which is below both the 50-day (blue line at $2.97) and the 200-day (red line at $6.49) moving averages, indicating strong bearish momentum. The recent price action shows some consolidation between the $2.40 and $2.60 range, but there is no clear sign of a reversal yet.

Support and Resistance Levels: The nearest support level is around $2.40, which is where the stock has shown some stabilization in the recent past. A break below this level could lead to further downside. The next resistance level is around $2.97 (50-day moving average). If the price manages to break above this level, it could indicate a potential trend reversal. The 200-day moving average at $6.49 represents a significant long-term resistance level.

Volume: The volume has been relatively stable, with some spikes during the downward moves, indicating selling pressure. The recent low trading volumes could suggest a lack of strong buying interest at current levels.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is currently at 40.92, which is below the neutral level of 50 but above the oversold threshold of 30. This suggests that the stock is neither overbought nor oversold but is leaning towards a bearish bias.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV is trending downward, indicating that more volume is associated with downward price movements. This confirms the bearish sentiment.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: The Stochastic RSI is at 0.37, which is relatively low, suggesting that the stock may be nearing oversold conditions. However, it is not yet at extreme levels, so there could still be room for further downside.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: The Chaikin Oscillator is at -3.37M, showing negative money flow, which further supports the bearish trend.

MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More Oscillator: The MACD line is below the signal line, and both are in negative territory. The histogram is close to zero, suggesting that bearish momentum is slowing but there is no indication of a bullish crossover at this point.

Time-Frame Signals:

3-Month: Hold/Sell. The trend is strongly bearish, with no clear signs of a reversal. However, if the price holds above $2.40, it may suggest a short-term consolidation.

6-Month: Hold. The downward trend could persist unless there is a strong bullish catalystA stock catalyst is an engine that will drive your stock either up or down. A catalyst could be news of a new contract, SEC filings, earnings and revenue beats, merger and acquisit... More. A break above the 50-day moving average could change the outlook.

12-Month: Hold/Sell. The long-term trend is down, and the stock remains below the 200-day moving average. A sustained break above this level would be needed for a bullish outlook.

The chart indicates a continuation of the bearish trend unless there is a breakout above key resistance levels. Traders should watch for a break below the $2.40 support level for further downside or a break above the $2.97 resistance level for a potential reversal.

Past performance is not an indication of future results, and this article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Delta Airline Stocks’ Mixed Picture

Delta Air Lines (DAL) stock presents a mixed picture, but several factors suggest it could be a good buy for investors with a long-term outlook:

Delta Air Lines Stock, Positive Factors

Strong Analyst Consensus: Wall Street analysts overwhelmingly rate Delta Air Lines stock as a “Strong Buy”. All 11 analysts covering the stock have a buy recommendation, with an average price target of $63.07, implying a substantial 40% upside potential.

Undervalued: Following recent declines, Delta’s forward P/E ratioThe price-to-earnings ratio, often abbreviated as P/E ratio, is a fundamental metric used by investors and analysts to evaluate the relative value of a company's shares in the stoc... stands at 7.2x, nearly 30% below its 5-year average. This suggests the stock may be undervalued relative to its historical levels.

Operational Strength: Delta consistently ranks ahead of its domestic network peers in customer satisfaction surveys and independent third-party ratings. The company focuses on offering differentiated products and delivering best-in-class service and operational reliability.

Strategic Partnerships: Delta’s affiliation with American Express has significant growth potential, as less than a third of SkyMiles members currently possess a co-branded credit card.

Delta Air Lines Stock, Challenges

Capacity Issues: In Q2 2024, Delta faced challenges due to industry-wide oversupply, leading to weak unit revenue numbers. The company’s capacity growth outpaced revenue growth, impacting profitability.

Conservative Outlook: Delta provided a conservative Q3 2024 outlook, with earnings guidance below analyst expectations.

Industry Volatility: The airline industry is subject to various external factors like fuel prices and economic conditions, which can impact profitability.

While Delta faces some near-term challenges, its strong market position, analyst support, and current valuation make it an attractive option for investors willing to weather some volatility. The company’s robust balance sheetThe balance sheet is a snapshot of a company's financial position at a specific point in time. It shows the company's assets, liabilities, and equity. More and diverse business model make it one of the safer bets in the volatile airline industry.

Delta Air Lines Stock

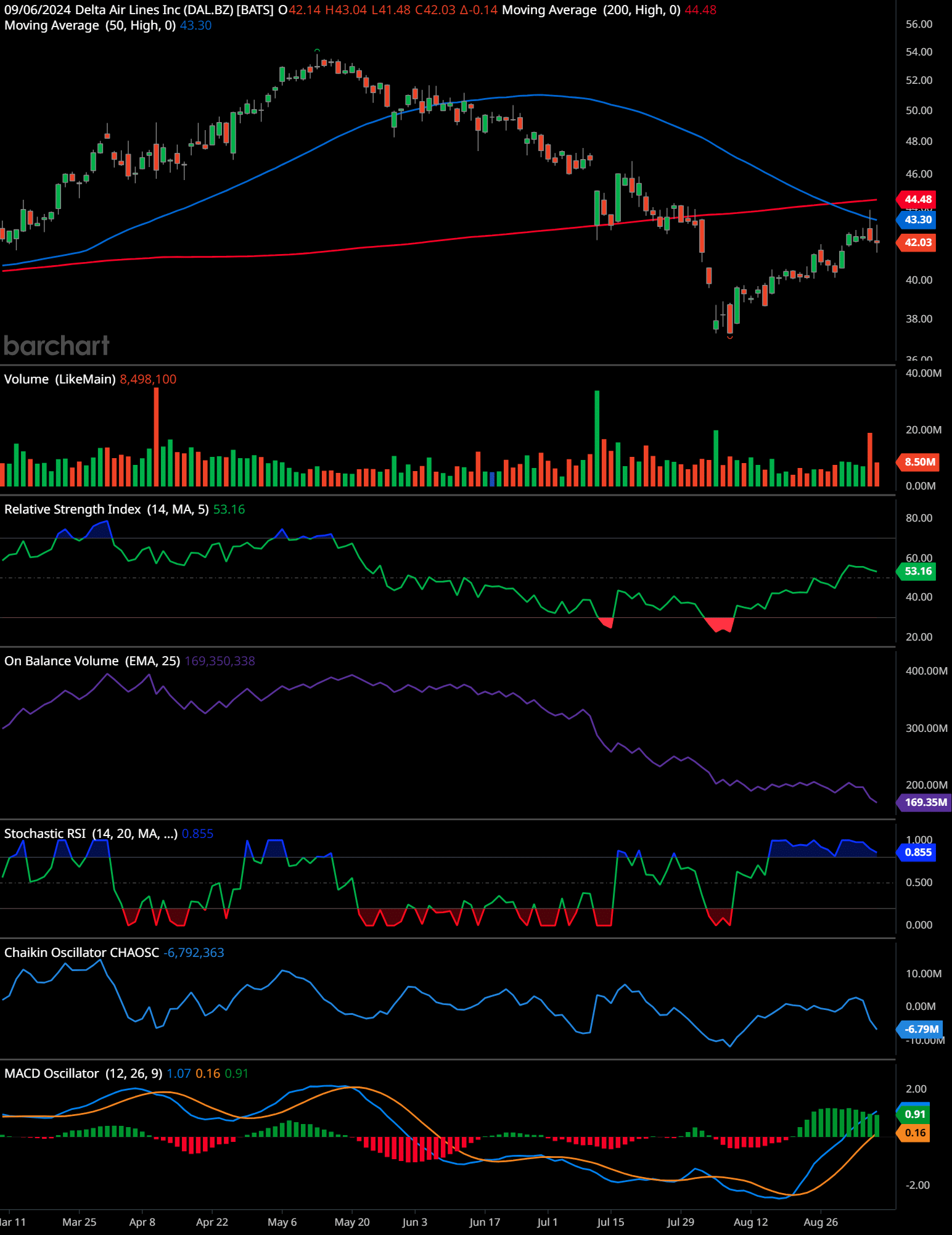

The chart shows the daily price movement of Delta Air Lines stock (DAL) with several key technical indicators.

Price Action: The stock recently experienced a significant downtrend from a high of around $52 in July to a low of approximately $38 in mid-August. However, it has since rebounded, and the price is currently trading at $42.03. The price is below the 200-day moving average (red line at $44.48) but is near the 50-day moving average (blue line at $43.30), suggesting mixed signals. The stock is in a consolidation phase after the recent rebound, but it remains below key resistance levels.

Support and Resistance Levels: The nearest support level is around $41, where the stock recently found some buying interest. A break below this level could lead to a retest of the $38 support level. Resistance is near the 50-day moving average at $43.30. A break above this level could lead to further gains toward the 200-day moving average at $44.48. A sustained move above the 200-day moving average could signal a more significant trend reversal.

Volume: Volume spiked in mid-August during the sharp decline, indicating strong selling pressure. Recently, volume has decreased, which could suggest consolidation or reduced trading interest at current levels.

Relative Strength Index (RSI): The RSI is currently at 53.16, which is above the neutral level of 50, indicating slightly bullish momentum. The RSI is not in overbought or oversold territory, suggesting the stock has room to move in either direction.

On Balance Volume (OBV): The OBV is showing a downward trend, indicating that the volume associated with down moves has been higher than the volume associated with up moves. This suggests that the selling pressure may still be present.

Stochastic RSI: The Stochastic RSI is at 0.855, which is in the upper range, indicating the stock may be nearing overbought conditions. This suggests a possible pullback if buying momentum does not continue.

Chaikin Oscillator: The Chaikin Oscillator is at -6.79M, showing negative money flow, which indicates that selling pressure remains dominant despite the recent price recovery.

MACD Oscillator: The MACD line has crossed above the signal line, and both are in positive territory. The histogram is also positive, indicating a potential shift to bullish momentum. However, this signal is still in its early stages and requires confirmation.

Time-Frame Signals:

3-Month: Hold/Buy. The MACD crossover and the RSI above 50 suggest short-term bullish potential. A break above the 50-day moving average could confirm this trend.

6-Month: Hold. The stock remains below the 200-day moving average, indicating that the longer-term trend is still uncertain. Watch for a break above the $44.48 resistance level for a stronger bullish signal.

12-Month: Hold. The overall trend remains neutral to bearish until the stock breaks above the 200-day moving average. A sustained move above this level would be needed for a more bullish outlook.

The chart indicates mixed signals with potential for a short-term rebound if the stock breaks above the 50-day moving average. However, the longer-term trend remains uncertain and slightly bearish unless the stock can move above the 200-day moving average.

Past performance is not an indication of future results, and this article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Jet Blue Airlines Stock Price

As of the most recent data available, JetBlue Airways (JBLU) stock is trading at $5.30 per share. Here’s an analysis of JetBlue’s current stock situation and outlook:

Stock Price and Recent Performance

JetBlue’s stock price has seen some volatility recently:

Analyst Recommendations

The overall analyst consensus on JetBlue stock is “Hold”:

- Out of 11 analysts, the average rating is “Hold”

- The breakdown of ratings is: 2 Strong Buy, 0 Buy, 5 Hold, 3 Sell, 1 Strong Sell

Price Targets

Analysts have provided the following 12-month price targets for JetBlue:

The average target of $6.15 represents a potential upside of 16.04% from the current price.

Factors to Consider

- JetBlue recently raised its third-quarter guidance due to better-than-expected revenue trends, causing the stock to jump 8%.

- The company faces challenges, including industry competition and economic uncertainties.

- JetBlue’s proposed merger with Spirit Airlines was blocked by a federal judge, adding uncertainty to its future prospects.

- The airline industry is expected to see strong demand in 2024, which could benefit JetBlue.

Whether JetBlue is a good buy depends on your investment goals and risk tolerance. While there’s potential upside based on analyst targets, the stock is considered relatively risky. The “Hold” consensus suggests caution, and investors should carefully consider the company’s challenges and opportunities before making a decision. It’s advisable to conduct further research and possibly consult with a financial advisor before investing.

Jet Blue Airlines Stock

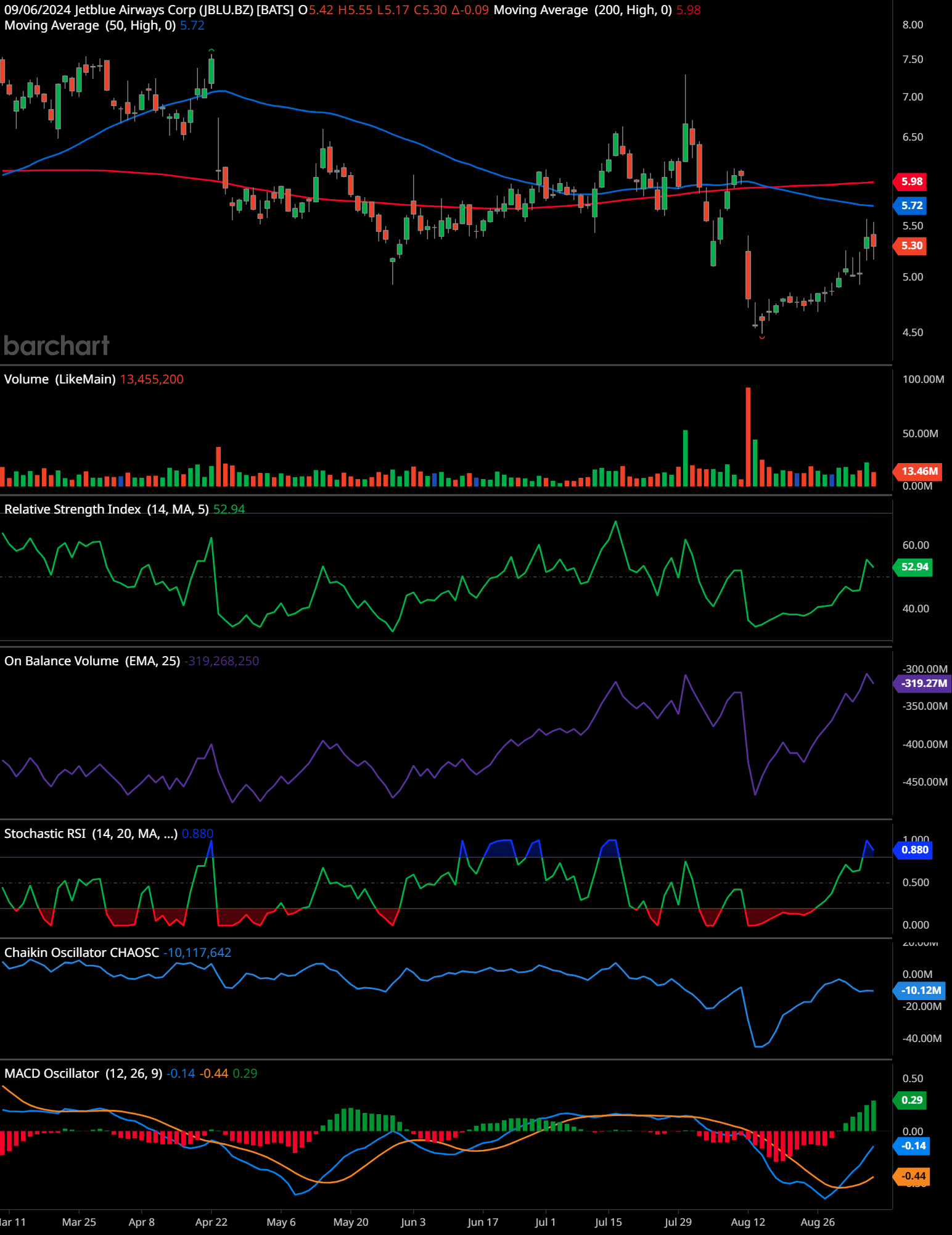

The chart shows the daily price movement of JetBlue Airways Corp (JBLU) with several key technical indicators.

Price Action: The stock recently experienced a sharp decline from around $6.80 in late July to a low of approximately $4.90 in mid-August. Since then, the price has rebounded and is currently trading at $5.30. The price remains below both the 50-day (blue line at $5.72) and the 200-day (red line at $5.98) moving averages, indicating the overall trend is still bearish. However, the recent rebound suggests a possible short-term recovery.

Support and Resistance Levels: The nearest support level is around $5.00, where the stock found some buying interest in mid-August. A break below this level could lead to a retest of the $4.90 area. Resistance is near the 50-day moving average at $5.72. A break above this level could lead to further gains toward the 200-day moving average at $5.98. A sustained move above the 200-day moving average could signal a more significant trend reversal.

Volume: The volume spiked significantly during the mid-August decline, indicating strong selling pressure. Since then, the volume has moderated but remains relatively high, suggesting continued interest in the stock’s recent price action.

Relative Strength Index (RSI): The RSI is currently at 52.94, slightly above the neutral level of 50, indicating a mild bullish momentum. The RSI suggests the stock has some room to move higher but is not yet in overbought or oversold territory.

On Balance Volume (OBV): The OBV is showing a gradual upward trend, indicating that the volume associated with up moves has been increasing. This suggests that there is some accumulation or buying interest in the stock.

Stochastic RSI: The Stochastic RSI is at 0.880, which is near the upper range, suggesting the stock is approaching overbought conditions. This may indicate a potential pullback if buying momentum does not continue.

Chaikin Oscillator: The Chaikin Oscillator is at -10.12M, showing a negative money flow, which indicates that selling pressure may still be present despite the recent rebound.

MACD Oscillator: The MACD line has crossed above the signal line, and the histogram is now positive. This indicates a potential shift to bullish momentum, but it is still in the early stages and requires confirmation with continued upward movement.

Time-Frame Signals:

3-Month: Hold/Buy. The recent MACD crossover and RSI above 50 suggest short-term bullish potential. A break above the 50-day moving average could confirm this trend.

6-Month: Hold. The stock remains below both the 50-day and 200-day moving averages, indicating that the longer-term trend is still uncertain. Watch for a break above the $5.98 resistance level for a stronger bullish signal.

12-Month: Hold/Sell. The overall trend remains neutral to bearish unless the stock breaks above the 200-day moving average. A sustained move above this level would be needed for a more bullish outlook.

The chart indicates a potential for short-term recovery if the stock breaks above the 50-day moving average, but the longer-term trend remains uncertain and slightly bearish unless the stock can move above the 200-day moving average.

Past performance is not an indication of future results, and this article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Why Investors Should Keep an Eye on Airline Stocks

As the Federal Reserve looks toward potential interest rate cuts, Wall Street may shift its attention to deep-value stocks trading at low earnings multiples. In this context, airline stocks could emerge as significant winners in the months ahead. Given the positive outlook for profitability and revenue growth, investors should consider monitoring the airline sector for opportunities to invest in airlines stock that may be on the verge of a strong recovery.

Airline stocks Frequently Asked Questions

1. Why has the S&P 500 Passenger Airlines index fallen in the past five years?

The S&P 500 Passenger Airlines index has fallen by over 42% in the past five years, primarily due to the COVID-19 pandemic in 2020, which significantly reduced passenger traffic and affected airline stock prices.

2. What recent comments did United Airlines CEO Scott Kirby make about the airline industry?

United Airlines CEO Scott Kirby mentioned that the company has been preparing for a moment when industry-wide domestic capacity would adjust, and he suggested that this inflection point could be just 30 days away.

3. What are the International Air Transport Association’s (IATA) profitability projections for airlines in 2024?

The IATA projects that airline net profits will reach $30.5 billion in 2024, up from the $25.7 billion forecast in December 2023. Operating profits are expected to reach $59.9 billion in 2024.

4. What is the expected return on invested capital for airlines in 2024?

The return on invested capital for airlines is expected to be 5.7% in 2024, according to the IATA.

5. How much revenue is the airline industry expected to generate in 2024?

The airline industry is expected to reach a record high of $996 billion in total revenues in 2024, reflecting a 9.7% increase from the previous year.

6. What are the projected total expenses for airlines in 2024?

Total expenses for airlines are expected to reach a record $936 billion in 2024, marking a 9.4% increase.

7. How many travelers does the IATA expect in 2024?

The IATA forecasts a record high of 4.96 billion total travelers in 2024.

8. How could Federal Reserve actions affect airline stocks in the future?

Once the Federal Reserve starts cutting interest rates, Wall Street may focus on deep-value stocks trading at low multiples to earnings, which could benefit airline stocks.

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

- Nvidia just poured $160 million into Applied Digital Stock… and it skyrocketed 76% in a day! 🚀 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.