The U.S. stock market experienced heightened volatility this week, driven by several significant events. From a disappointing U.S. jobs report for September 2024 to notable corporate news, here are the critical developments that impacted market movements and why they are essential for investors to monitor.

Disappointing U.S. Jobs Report for September 2024

The U.S. jobs report for September 2024 was a pivotal event this week, revealing that the U.S. economy added only 142,000 nonfarm payroll jobs—well below market expectations. This weaker-than-anticipated job growth raised concerns about the strength of the economic recovery and sparked uncertainty regarding the Federal Reserve’s future policy decisions on interest rates. As investors digest this data, they are increasingly focused on the potential for the Fed to adjust its monetary policy to counteract slowing economic momentum. Monitoring these developments is crucial for investors, as the U.S. jobs report directly impacts interest rate decisions, which, in turn, affect borrowing costs, consumer spending, and overall economic activity.

Market Sell-Off and Tech Sector Weakness

Following the release of the U.S. jobs report for September 2024 and other economic indicators, the stock market experienced a significant sell-off. The S&P 500 and Nasdaq both saw considerable declines, with the tech sector, including companies like Nvidia and Broadcom, bearing the brunt of the downturn. This marked one of the worst weeks for the stock market since March 2023, highlighting the tech sector’s heightened sensitivity to broader economic signals. Tech giants like Nvidia and Broadcom are particularly critical for investors to watch, given their substantial roles in artificial intelligence (AI) and semiconductor technology, sectors that have been key drivers of market performance in recent years.

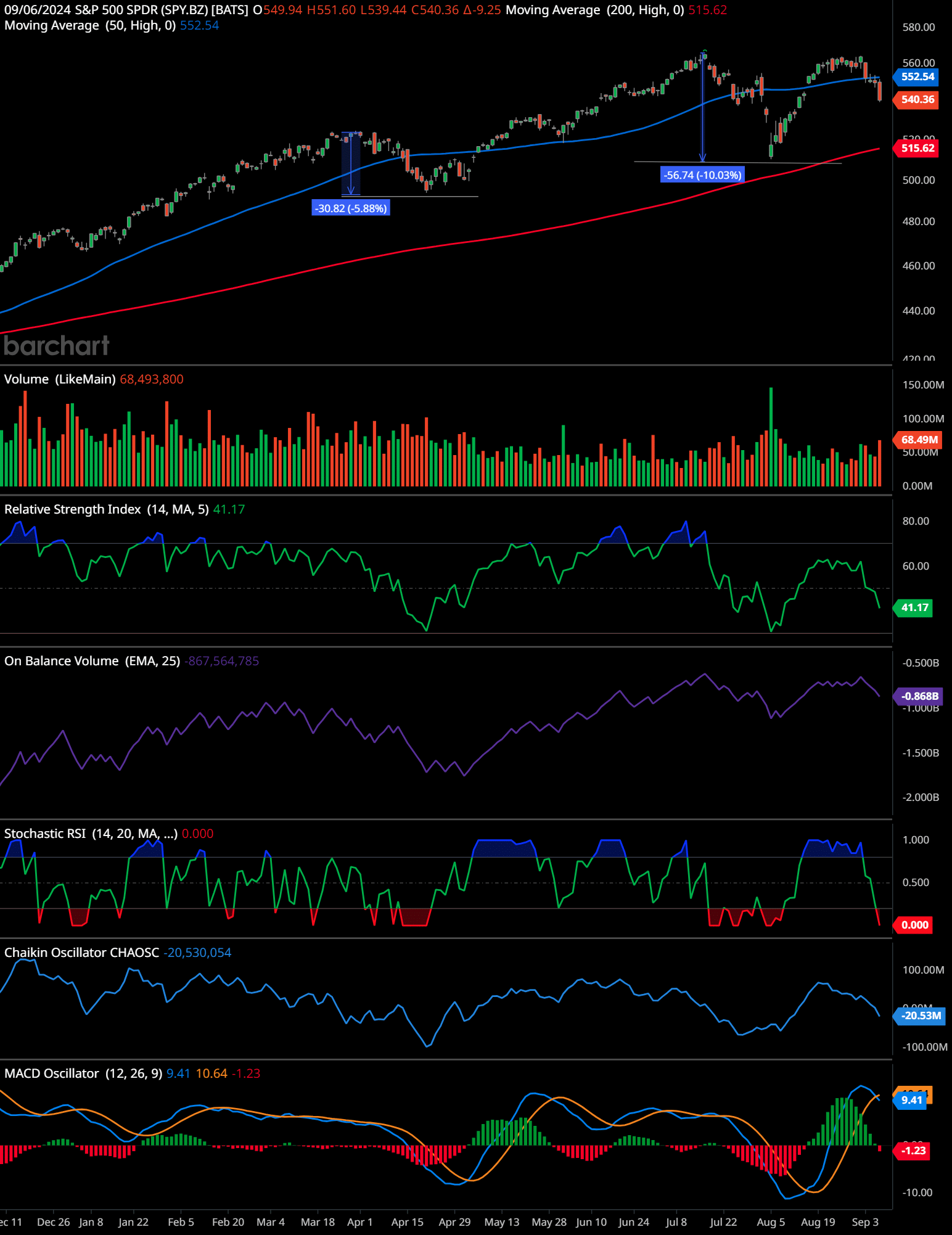

SPY Technical Analysis (daily)

The daily chart for the S&P 500 SPDR (SPY) ETF shows a recent decline, with the price closing at 540.36, which is below the 50-day moving average (552.54) and approaching the 200-day moving average (515.62). This is a bearish signal indicating a potential continuation of the downward trend if support levels do not hold.

Key Support and Resistance Levels:

Support levels are currently around 515.62 (the 200-day moving average) and approximately 490, which is where the previous significant correction found support. Resistance levels are around 552.54 (the 50-day moving average) and near 570, where the recent high was formed before the decline.

Volume Analysis:

Volume shows increased activity during recent declines, which indicates selling pressure. The On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV) is declining, suggesting that there is more volume on down days compared to up days, which is a bearish signal.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI):

The RSI is at 41.17, which is below the neutral level of 50 and trending downwards. This indicates bearish momentum, but it is not yet in oversold territory (below 30).

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...:

The Stochastic RSI has crossed below 0.5, showing strong bearish momentum. It is currently at 0, which indicates that the security is potentially oversold in the short term.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...:

The Chaikin Oscillator is at -20.53M, indicating distribution and suggesting selling pressure is outweighing buying pressure.

MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More (Moving Average Convergence Divergence):

The MACD line is below the signal line with values of 9.41 (MACD) and 10.64 (signal line), and the histogram is negative at -1.23. This is a bearish signal, indicating downward momentum.

Future Trend Analysis:

The overall trend is bearish, with multiple indicators confirming selling pressure and a loss of momentum. The price is below the 50-day moving average and moving towards the 200-day moving average, which is a critical support level. If the price breaks below the 200-day moving average, further downside could be expected. However, if support around 515.62 holds, there may be a consolidation phase or a potential bounce back toward the 50-day moving average.

Time-Frame Signals:

12-Month: Hold, pending confirmation of either a continued downtrend or a reversal after retesting key support levels.

3-Month: Sell, as indicators suggest further downward movement unless the 200-day moving average holds.

6-Month: Hold, potential for a bounce or consolidation at or near the 200-day moving average.

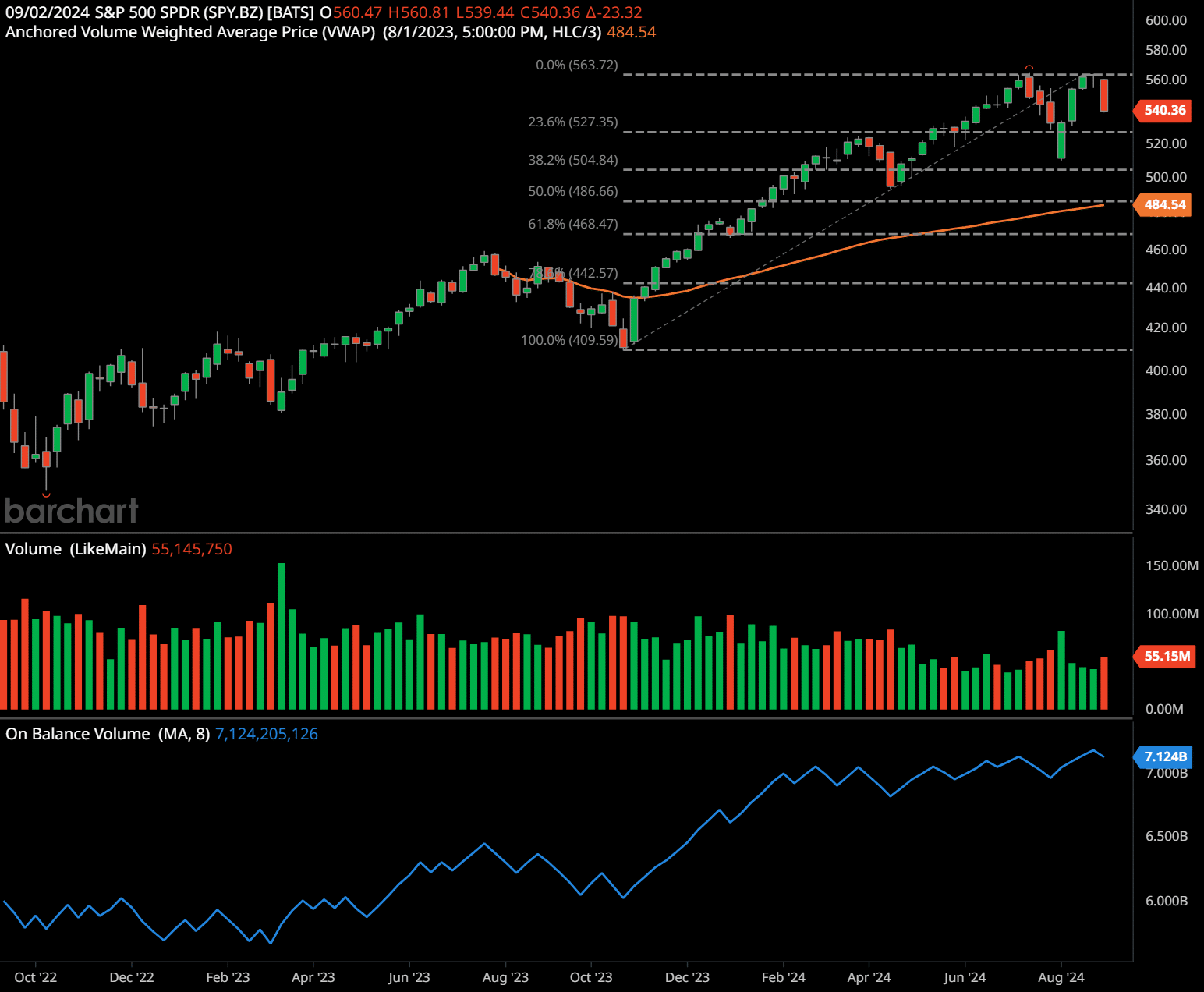

SPY Technical Analysis (weekly)

The weekly chart for the S&P 500 SPDR (SPY) ETF shows that the price is currently at 540.36, which is below the recent peak near 563.72. The chart is marked with Fibonacci retracementFibonacci retracement is a fundamental tool in the arsenal of technical analysts and traders. Rooted in the mathematical principles of the Fibonacci sequence, this technique is wid... levels from the low of 409.59 to the high of 563.72. The key Fibonacci levels to watch are 23.6% at 527.35, 38.2% at 504.84, 50% at 486.66, and 61.8% at 468.47.

Key Support and Resistance Levels:

Support levels are currently around the Fibonacci retracement levels:

- 23.6% at 527.35

- 38.2% at 504.84

- 50% at 486.66

- 61.8% at 468.47

The next critical support level is the Anchored VWAP (Volume Weighted Average Price) from August 1, 2023, which is around 484.54.

Resistance levels are near the recent highs around 563.72 and 540.36, which was a key level where the price faced selling pressure.

Volume Analysis:

The volume remains steady, with moderate increases during periods of price declines, indicating some selling pressure. The On Balance Volume (OBV) remains positive at 7.124B, suggesting that, despite recent declines, buying pressure has been relatively strong over the past year.

Future Trend Analysis:

The chart indicates a mixed outlook for the future trend. The price is currently consolidating below the 23.6% Fibonacci retracement level, suggesting that a pullback could continue towards the 38.2% level (504.84) or even further to the 50% retracement level (486.66) if selling pressure persists. The presence of the Anchored VWAP at 484.54 provides an important support level, which may attract buying interest if tested. A sustained move above 540.36 could signal a retest of the recent high at 563.72.

Time-Frame Signals:

- 1-Year: Hold, potential for sideways movement or slight decline until key support levels are tested.

- 2-Year: Hold, awaiting confirmation of trend direction after testing significant support or resistance levels.

- 3-Year: Buy, potential for long-term uptrend if support levels hold and a reversal is confirmed above key resistance levels.

Past performance is not an indication of future results. This article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Interest Rate Speculation Following the U.S. Jobs Report

The weak data from the U.S. jobs report for September 2024 also fueled speculation about the Federal Reserve’s next move. With signs of a slowing economy, discussions have intensified regarding whether the Fed will consider interest rate cuts to stimulate growth. Some market participants now expect an aggressive rate cut due to the softening economic landscape. This speculation adds to the market’s uncertainty, as changes in interest rates can significantly impact various asset classes, from equities and bondsUnited States Treasury securities are debt instruments issued by the United States government to finance its spending. Treasury securities come in a variety of forms, including bil... More to real estate and commodities. Investors should closely monitor the Fed’s policy direction, as it plays a critical role in shaping market expectations and risk sentiment.

Volatility in the Tech and AI Sectors

There has been a noticeable correction in the previously high-flying tech and AI sectors, which were driving much of the market’s gains earlier this year. The change in sentiment followed the disappointing U.S. jobs report for September 2024. This shift in sentiment has added to the broader market downturn. Companies like Nvidia, a leader in AI technology, have seen their stock prices fluctuate as investors reassess growth expectations amid changing economic conditions. For investors, keeping a close watch on these companies is vital, as their performance can provide insights into the future trajectory of technological innovation and its impact on the broader market.

Corporate News and Market Impact

Significant corporate news also played a role in this week’s market volatility. For example, Nvidia lost substantial market value in a single trading day, reflecting shifting investor sentiment. Additionally, 7-Eleven rejected a major takeover bid, highlighting the dynamic nature of corporate strategy in today’s market environment. This came after the U.S. jobs report for September 2024 already added to the uncertainty. Staying informed about such corporate developments is essential for investors, as they can cause rapid changes in stock prices and sector performance.

Global Economic Concerns Add to Market Uncertainty

While the U.S. jobs report for September 2024 was a primary focus, broader global economic concerns also influenced U.S. market sentiment. Issues such as fluctuating oil prices and uncertainties over global demand have contributed to a more cautious or bearish market outlook. Investors should consider these global factors, as they can indirectly shape domestic market reactions.

Navigating a Volatile Market

This week, Wall Street faced significant losses, driven by a combination of disappointing U.S. jobs data, market sell-offs, corporate news, and global economic concerns. For investors, these events underscore the importance of staying informed and understanding the interplay of domestic and global factors that continue to create a complex and volatile investment landscape. Being aware of such developments, especially in light of the latest U.S. jobs report for September 2024, is crucial for making strategic investment decisions in these uncertain times.

Frequently Asked Questions

What was the August jobs report about?

The August jobs report showed that the U.S. economy added only 142,000 nonfarm payroll jobs, which was below expectations. This increased uncertainty about the economy’s health and impacted market expectations regarding Federal Reserve actions on interest rates.

How did the stock market react to the jobs report?

Following the jobs report and other economic indicators, there was a significant sell-off in the stock market. The S&P 500 and Nasdaq experienced notable drops, especially in the tech sector, with companies like Nvidia and Broadcom leading the decline. It was considered the worst week for the stock market since March 2023 or earlier in some sectors.

What are the speculations regarding Federal Reserve actions on interest rates?

The weak economic data led to discussions about the Federal Reserve’s potential actions, with some speculating on possible rate cuts to stimulate the economy. Some market participants expected an aggressive rate cut due to the softening economic indicators.

Why has there been volatility in the tech and AI sectors?

The AI and tech sectors have experienced volatility due to a burnout or correction in the hype that previously drove much of the market’s gains. This shift contributed to the broader market downturn.

What significant corporate news contributed to market volatility?

Significant corporate events, such as Nvidia losing substantial market value in a single day and 7-Eleven rejecting a major takeover bid, contributed to the market’s volatility.

How have global economic concerns affected the U.S. market?

General sentiments regarding global economic health, including concerns over oil prices and global demand, have indirectly influenced U.S. market sentiments, contributing to a cautious or bearish outlook.

- Nvidia just poured $160 million into Applied Digital Stock… and it skyrocketed 76% in a day! 🚀 - September 8, 2024

- Is Trump Media stock the next meme stock disaster? 📉 Find out why DJT stock is tanking! - September 8, 2024

- When was the last time a new drug humbled the world’s best? Summit Therapeutics Stock To Explode 🧬 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.