Weak Financial Performance and Meme Stock Behavior

DJT stock (Trump Media & Technology Group Corp) has faced a substantial decline in recent months, driven by multiple factors affecting its market standing. The company’s financial performance has been particularly weak, with only $836,900 in revenue for Q2 2024 and a net loss of $16.4 million. These results have not justified the company’s high market valuation, causing concern among investors about the sustainability of its current price levels.

Moreover, DJT stock has been characterized as a “meme stockA meme stock is a publicly traded company's stock that has seen a significant increase in price and trading volume primarily due to hype and popularity driven by social media platf...,” with its price movements largely influenced by market sentiment rather than solid fundamentals. This behavior has contributed to high volatility and increased risk for investors.

What Happened to DJT Stock?

DJT stock (Trump Media & Technology Group Corp) has experienced a significant decline in value over recent months, losing more than 70% of its value since its peak in March 2024. Several key factors have contributed to this downturn:

Broader Market Conditions: General market volatility and economic uncertainties have further exacerbated the decline in DJT stock.

Weak Financial Performance: The company reported low revenue of $836,900 and a loss of $16.4 million for Q2 2024. These poor financial results do not align with its previously high market valuation, causing investors to question its sustainability.

Meme Stock Behavior: DJT stock has been viewed as a “meme stock,” with its price movements largely driven by market sentiment and social media hype rather than solid financial fundamentals. This has led to heightened volatility and risk for investors.

Expiring Lockup Period: An upcoming expiration of a lockup period around September 19-20, 2024, currently prevents insiders, including Donald Trump, from selling shares. This has raised concerns about potential insider selling, adding pressure to the stock.

Political Factors: DJT stock price has been seen as a proxy for Donald Trump’s political prospects. As the race between Trump and Kamala Harris has tightened, the stock has declined, reflecting the uncertainty around the election outcome.

Competition Concerns: Trump’s return to posting on X (formerly Twitter) has led to doubts about the value proposition of Truth Social, the platform run by Trump Media. Investors question whether it can compete effectively in a crowded social media market.

Overvaluation and Lack of Transparency: Even after its recent decline, DJT stock remains highly overvalued, trading at over 1,000 times its annual revenue. The company’s lack of transparency on key performance metrics, such as active user numbers, has made it difficult for investors to assess its true market value.

Lockup Expiration and Political Influences

An upcoming expiration of a lockup period around September 19-20, 2024, which currently prevents insiders, including Donald Trump, from selling shares, has created concerns about potential selling pressure. The uncertainty around this event has contributed to the decline in DJT stock price.

Political factors have also played a role in the stock’s performance. DJT stock price is often viewed as a barometer of Trump’s election prospects. As the political race between Trump and Kamala Harris tightens, the stock has seen downward pressure, reflecting investor concerns about future political outcomes.

Competition, Overvaluation, and Lack of Transparency

Trump’s recent return to posting on X (formerly Twitter) has raised questions about the competitive edge of Truth Social, the platform operated by Trump Media. This development has led investors to question the platform’s value proposition in a crowded social media market.

Despite recent declines, DJT stock remains highly overvalued, trading at more than 1,000 times its annual revenue. The company’s lack of transparency on key metrics, such as active user numbers, has further complicated investor assessments of its true market value.

Market Conditions and Future Outlook

Broader market conditions, including economic uncertainties and volatility, have likely accelerated the decline in DJT stock price. The stock has lost over 70% of its value since its peak in March 2024, wiping out billions in market capitalization.

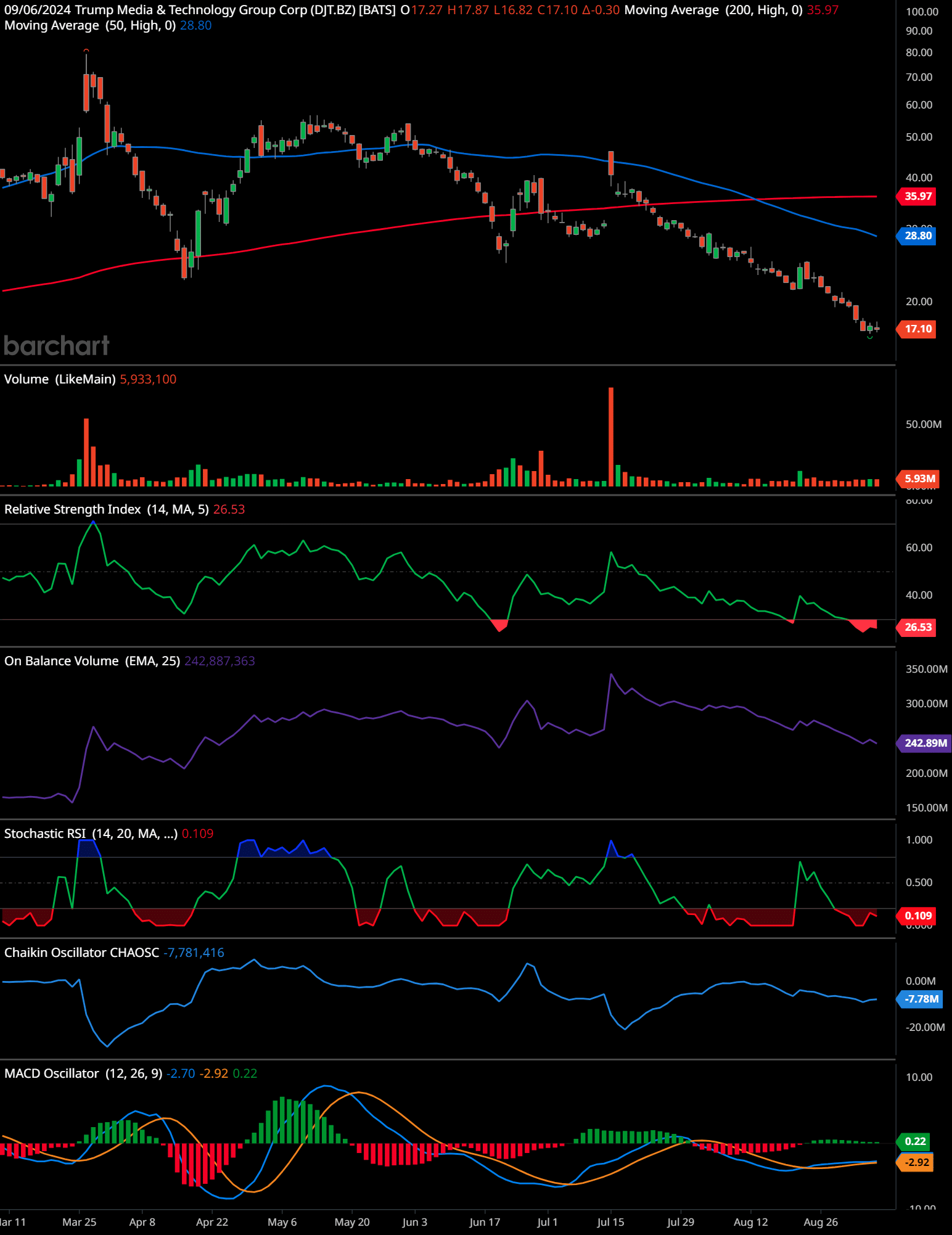

Technical Analysis: DJT Stock Chart Insights

The DJT stock chart indicates a strong bearish trend, with the price trading well below its 50-day and 200-day moving averages. The nearest support level is around $16.50, and if the stock falls below this, the next support is at $15. The resistance level is at $20, with a stronger resistance near the 50-day moving average at approximately $28.80. A break above these levels could signal a potential reversal in the current downtrend.

Technical Indicators Suggest Persistent Weakness

Several technical indicators on the DJT stock chart suggest ongoing selling pressure. The Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI) and Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... indicate oversold conditions, which might suggest a short-term bounce. However, other indicators, such as the On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV), Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati..., and MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More, continue to point toward a bearish trend.

Investor Outlook: Short, Medium, and Long-Term Perspectives

- 3-Month Outlook: Due to the current bearish trend, DJT stock is more likely to continue its decline. A “Hold” position may be advisable only if waiting for a potential short-term bounce.

- 6-Month Outlook: The trend suggests continued downside unless the stock breaks above key resistance levels, making a “Sell” recommendation more appropriate.

- 12-Month Outlook: The extended trend remains bearish, with long-term investors advised to wait for clearer signs of a reversal before considering entry.

Does the Trump Organization Hold Any Stock in Newsmax Media Inc?

Regarding any connection to Newsmax, there is no indication that the Trump Organization holds any stock in Newsmax Media Inc. While Newsmax, a pro-Trump network, is reportedly friendly toward Trump and plans to go public by late 2024 or early 2025, the company remains privately controlled by its founder, Christopher Ruddy. Sheikh Sultan bin Jassim Al Thani, a member of the Qatari royal family, made a significant investment in Newsmax in 2019 and 2020. However, there is no clear evidence that the Trump Organization holds any stock in Newsmax Media Inc, as the company’s shareholder information remains private.

Why Investors Should Monitor DJT Stock and Newsmax Media

DJT stock remains a crucial watch for investors due to its unique position at the crossroads of media, politics, and technology. Despite its challenges, the stock presents both high risks and potentially high rewards. Meanwhile, Newsmax’s plans to go public add another layer of interest for investors looking at media stocks with political influence. Newsmax has confidentially filed for an initial public offering with the Securities and Exchange Commission. It’s hoping to raise $75 million and is planning on trading on the New York Stock Exchange under the symbol NMAX. Monitoring these companies will provide insights into their market dynamics and potential for future growth.

DJT Stock Frequently Asked Questions (FAQs)

1. Why is Trump Media stock (DJT) declining?

Trump Media stock (DJT) is declining due to weak financial performance, meme stock behavior, expiring lockup periods, political factors, competition concerns, overvaluation, lack of transparency, and general market conditions.

2. What are the financial issues affecting Trump Media stock?

The company reported low revenue of $836,900 in Q2 2024 and continued losses of $16.4 million in Q2, which does not justify its high market valuation.

3. How does meme stock behavior influence DJT’s price?

Meme stock behavior, where price movements are driven more by sentiment than fundamentals, has led to high volatility in DJT’s stock price.

4. What is the significance of the expiring lockup period for DJT stock?

The lockup agreement preventing insiders, including Donald Trump, from selling shares is set to expire around September 19-20, raising concerns about potential insider selling pressure.

5. How do political factors affect Trump Media stock?

The stock price is seen as an indicator of Trump’s election chances, and as polls have tightened between Trump and Kamala Harris, the stock has declined.

6. What competition concerns are affecting Trump Media stock?

Trump’s return to posting on X (formerly Twitter) has raised questions about the value proposition of Truth Social, the platform operated by Trump Media & Technology Group.

7. Why is DJT considered overvalued?

Despite recent declines, Trump Media stock is still valued at over 1,000 times its annual revenue, which many investors view as unsustainable.

8. What transparency issues does Trump Media face?

The company does not publish key metrics like active user numbers, making it difficult for investors to assess its true value.

9. How do general market conditions affect Trump Media stock?

Broader economic concerns and market volatility have also contributed to the decline in Trump Media stock.

10. Does the Trump Organization hold any stock in Newsmax Media Inc.?

There is no indication that the Trump Organization holds any stock in Newsmax Media Inc.

11. What is the relationship between Newsmax and Donald Trump?

Newsmax is considered a pro-Trump network, and its founder and CEO Christopher Ruddy is a reported friend of Trump and a member of Trump’s Mar-a-Lago Club.

12. Are there any significant investors in Newsmax?

Newsmax received a significant investment of about $50 million from Sheikh Sultan bin Jassim Al Thani, a member of the Qatari royal family, in 2019 and 2020.

- Nvidia just poured $160 million into Applied Digital Stock… and it skyrocketed 76% in a day! 🚀 - September 8, 2024

- Is Trump Media stock the next meme stock disaster? 📉 Find out why DJT stock is tanking! - September 8, 2024

- When was the last time a new drug humbled the world’s best? Summit Therapeutics Stock To Explode 🧬 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.