In mid-February 2024, the labor market in the United States demonstrated remarkable resilience, with the number of initial claims for unemployment benefits declining to 201,000, down from 213,000 in the previous week. This positive trend defied economists’ forecasts, who had anticipated a slight increase to 216,000, signaling ongoing stability in the employment landscape.

Jobless Claims as a Barometer

Jobless claims serve as a crucial barometer for assessing the health of the labor market, providing insights into the prevalence of layoffs. Despite occasional headlines highlighting layoffs in sectors such as technology and entertainment, the overall trajectory of jobless claims has remained relatively stable this year. Notably, the latest figures represent the lowest number of claims in five weeks, marking a notable downward trend.

Sustained Decline in Claims

The decline in jobless claims is not an isolated occurrence but rather part of a broader trend. New claims reached a peak of 227,000 at the end of January but have since experienced three consecutive weeks of decline. Remarkably, current claims are lower than any point in the previous year, except for a single week in mid-October when they briefly fell to 200,000.

Economic Implications

The unemployment rate stood at 3.7 percent in January, with the economy adding 353,000 jobs during the month. Additionally, employers reported a staggering nine million open job positions at the beginning of the year. These indicators underscore the tightness of the labor market and the robust demand for workers across various sectors.

Impact on Consumer Spending and Monetary Policy

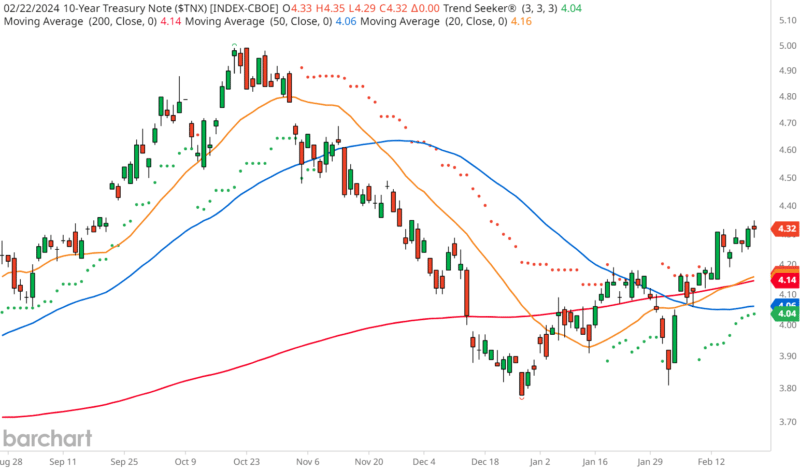

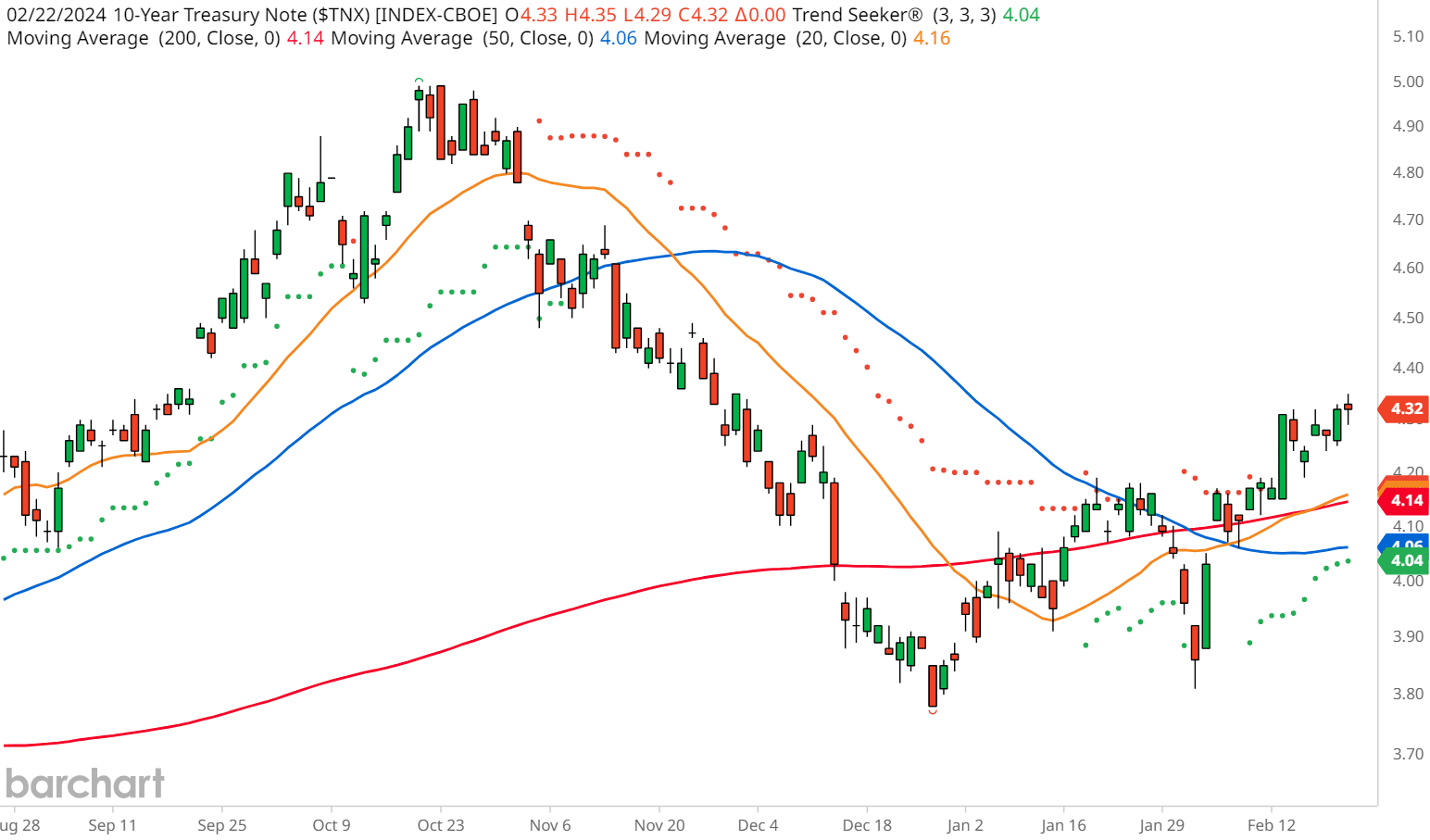

The combination of low unemployment, abundant job vacancies, and declining layoff numbers is expected to bolster consumer confidence and support robust spending patterns. However, this sustained strength in consumer activity presents challenges for the Federal Reserve in managing inflation and interest rates. Following the release of the jobless claims data, yields on U.S. Treasuries experienced upward pressure, reflecting market expectations of a potential shift in monetary policy to address inflationary pressures.

Resilience Amidst Economic Dynamics

As the labor market continues to exhibit resilience and stability, it reinforces broader economic confidence and growth prospects. While challenges persist, including inflationary pressures and monetary policy considerations, the sustained decline in jobless claims underscores the underlying strength of the U.S. economy. Moving forward, policymakers and market participants will closely monitor labor market dynamics for insights into future economic trends and policy actions.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.