The U.S. is witnessing a surge in business bankruptcies, highlighting significant economic distress across various sectors. Bankruptcy filings have increased by over 40% as of mid-2024, indicating widespread financial difficulties from small businesses to large corporations. The restaurant industry is particularly affected, with numerous well-known chains filing for bankruptcy amid rising costs and reduced consumer spending. Additionally, fast food chains, convenience stores, and the retail sector are facing closures, reflecting broader economic challenges.

The economic downturn is particularly severe in the Midwest, with a high rate of business closures and abandoned properties, signaling potential risks for regional investors. The banking sector is also under pressure, with many branches closing. Retail giants like Big Lots and Rite Aid are struggling, with declining sales and bankruptcy filings.

For investors, this economic environment necessitates a careful reassessment of risks, especially in sectors directly impacted by these trends, such as retail, food service, and regional markets facing economic distress.

Rising Bankruptcy Filings Point to Economic Strain

Recent data shows a significant increase in U.S. business bankruptcy filings, with numbers rising over 40 percent year-over-year as of June 30th, 2024. This alarming trend reflects the broader economic strain that businesses are facing, from small restaurants to major retail chains. Unlike other economic indicators that may be subject to interpretation, bankruptcy filings provide a clear and unambiguous measure of financial distress. The surge suggests that many businesses are struggling to survive amid rising costs, declining consumer spending, and other economic challenges.

The Restaurant Industry Faces a “Restaurant Apocalypse”

The restaurant sector has been particularly hard hit, with several well-known chains filing for bankruptcy in 2024. These include:

- Roti

- Buca di Beppo

- World of Beer

- Rubio’s

- Melt Bar & Grilled

- Kuma’s Corner

- Red Lobster

- Tijuana Flats

- Sticky’s Finger Joint

- Boxer Ramen

This wave of closures, often dubbed a “restaurant apocalypse,” reflects a broader trend in the hospitality industry. The rise in operational costs, coupled with reduced consumer spending, has left many restaurants struggling to maintain profitability. For investors, this indicates a sector-wide downturn that may not recover soon, affecting both individual companies and the broader foodservice market.

Fast Food Chains and Convenience Stores Struggle to Survive

The difficulties are not limited to sit-down restaurants; even fast food chains and convenience stores are feeling the pinch. Recently, dozens of KFC locations owned by franchisee EYM Chicken abruptly shut down across Illinois, Indiana, and Wisconsin, affecting nearly 100 employees. Similarly, Team Schierl Cos., which owned 25 convenience stores in Michigan and Wisconsin, ceased operations due to its landlord’s bankruptcy filing. These closures are significant for investors as they indicate a ripple effect that extends beyond individual businesses, impacting supply chains, employment, and local economies.

Midwest Hit Hard by Economic Woes

The economic distress appears to be particularly severe in the Midwest, where multiple business closures have occurred in recent months. The region’s economic challenges are further highlighted by the plight of Gary, Indiana, which has the highest abandoned home rate in the U.S. at 31.41 percent. The city’s population dropped by 18.2 percent from 2010 to 2020, reflecting broader economic hardships. For investors, this localized distress suggests potential risks in areas heavily reliant on traditional industries, signaling caution for those looking to invest in regional markets.

Banking Sector Under Pressure

The banking industry is also showing signs of strain. Major banks, including Bank of America, Chase, and Wells Fargo, have closed 41 branches in just two weeks, reflecting the broader shift toward online banking and reduced demand for physical locations. While this trend might be attributed to changing consumer preferences, it also raises questions about the overall health of the banking sector. Investors should monitor these developments closely, as reduced branch presence could signal deeper issues within the financial sector.

Retail Store Closures Signal Further Troubles

The retail sector is experiencing significant turbulence, with thousands of store closures announced in 2024. Discount retailer Big Lots has increased its planned store closures to a maximum of 315, a sharp rise from the 150 previously announced. The company reported a 10.2% decline in net sales year-over-year in Q1 2024, with full-year sales down 13.6%. This downturn suggests that Big Lots, like many other retailers, is struggling to adapt to changing consumer behaviors and economic conditions. Investors should be aware that continued store closures could further impact the company’s financial health and market position.

Rite Aid Faces Bankruptcy and Declining Prospects

Rite Aid, a major pharmacy chain, has also found itself in severe financial trouble. The company has already closed hundreds of stores and filed for bankruptcy, facing losses of $750 million from March 2022 to March 2023 and another $307 million in the second quarter of 2024. With only $135.5 million in cash and $3.3 billion in long-term debt, Rite Aid’s future looks uncertain. This situation is crucial for investors to watch, as it highlights the vulnerability of retail pharmacies amid rising costs and changing healthcare dynamics.

Insights

- U.S. business bankruptcies are at a historic high, reflecting significant economic distress.

- The Midwest is experiencing particularly severe economic challenges.

- Reduced discretionary income is impacting consumer spending and retail viability.

- The banking sector is contracting with branch closures, indicating a shift towards digital.

The Essence (80/20)The Origins and Evolution of the 80/20 Principle The Discovery by Vilfredo Pareto In 1897, Italian economist Vilfredo Pareto uncovered a striking pattern in his study of wealth and...

- Core Topic 1: Rising Bankruptcy Rates: Business bankruptcies in the U.S. have surged over 40% in the past year, signaling deep economic problems.

- Core Topic 2: Retail and Restaurant Closures: Numerous retail chains and restaurants are shutting down due to financial strain, with the Midwest particularly affected.

- Core Topic 3: Economic Impact on Consumers: Decreased discretionary income and higher living costs are causing a decline in consumer spending, further exacerbating economic woes.

- Core Topic 4: Shrinking Banking Sector: Banks are closing branches rapidly as the economy weakens and digital banking becomes more prevalent.

The Guerilla Stock Trading Action Plan

- Adapt to the shift toward digital banking by learning and utilizing online financial services.

- Monitor economic indicators like bankruptcy filings and retail sales to anticipate further economic downturns.

- Diversify investments to mitigate risks associated with business closures and retail bankruptcies.

- Support local businesses and communities impacted by closures through local spending and advocacy and move away from financial support of large multinational corporations.

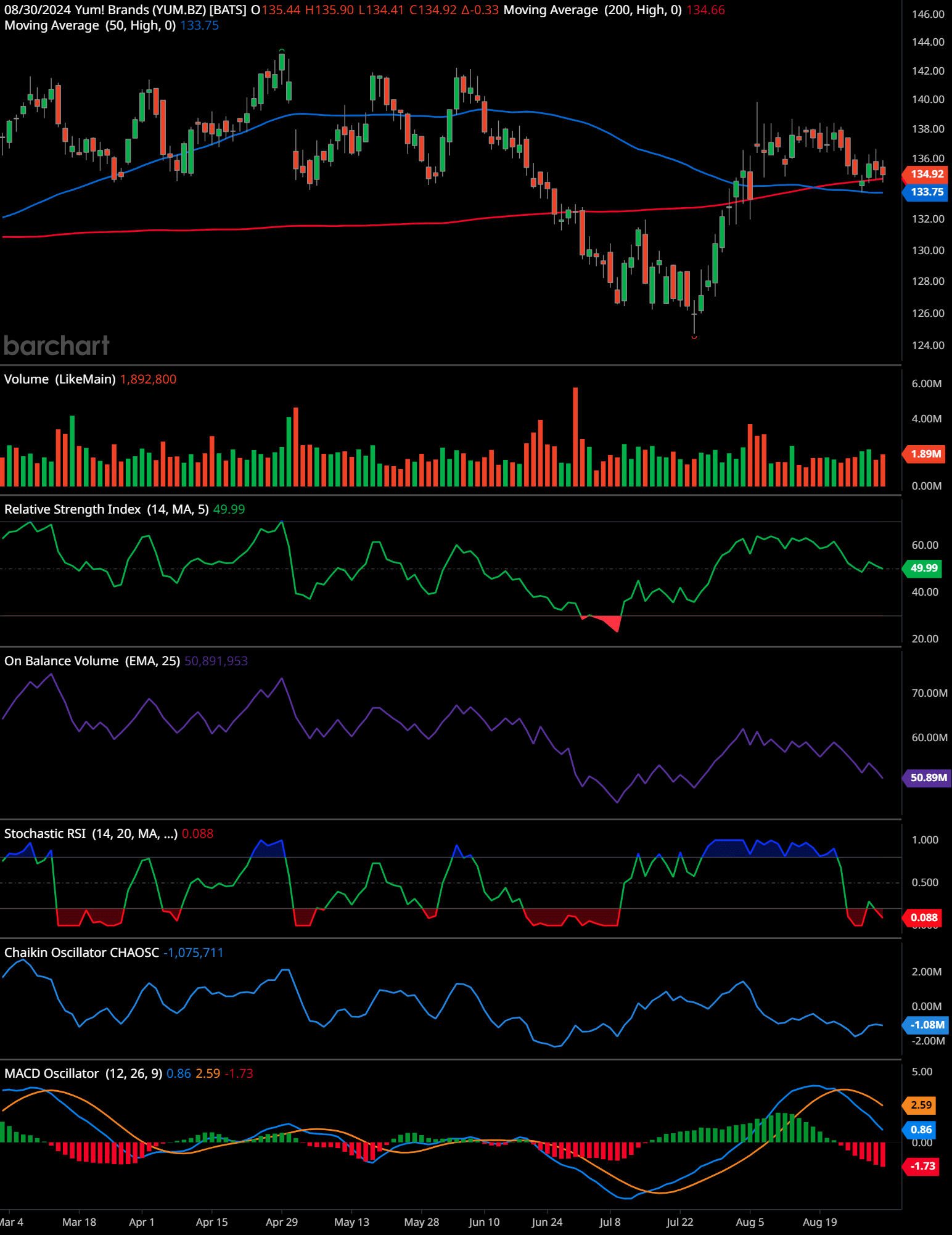

Yum! Brands (YUM) Technical Analysis (daily)

The chart is of Yum! Brands (YUM) on a daily timeframe and shows a combination of candlesticks, moving averages, volume, and several technical indicators including the Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI), On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV), Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ..., Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati..., and MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More Oscillator.

The price action indicates the following:

- Trend Analysis: The stock has been in a broad range-bound movement since March, with noticeable swings between highs of around 146 and lows near 124. The 200-day moving average (red line) at 134.66 acts as a long-term trend indicator and is currently above the price, suggesting a bearish or neutral long-term outlook. The 50-day moving average (blue line) is at 133.75 and currently converging towards the 200-day moving average, which could signal an important upcoming move. The price is sitting close to both moving averages, indicating potential consolidation or indecision.

- Support and Resistance Levels:

- Support: Immediate support is around 133-134, near the current levels of both the 50-day and 200-day moving averages, and a prior consolidation area. Further support is around 128, where the price bounced off twice in May and June.

- Resistance: The stock faces resistance at around 138, near recent swing highs from early August. Additional resistance is seen near 146, the high from late May.

- Relative Strength Index (RSI): The RSI is at 49.99, which is neutral, indicating that the stock is neither overbought nor oversold. This suggests no strong momentum in either direction at the moment.

- On-Balance Volume (OBV): The OBV has been trending lower, which suggests that the stock is experiencing more selling pressure than buying pressure over time. This can indicate distribution, which is typically bearish.

- Stochastic RSI: The Stochastic RSI is at 0.088, which is in the oversold territory. This could indicate a potential for a short-term bounce or reversal upward.

- Chaikin Oscillator: The Chaikin Oscillator is at -1.075,711, which shows a bearish divergence and indicates selling pressure. It aligns with the bearish trend seen in the OBV.

- MACD Oscillator: The MACD line (0.86) is above the signal line (-1.73), but the histogram shows decreasing bullish momentum with a recent crossover to the downside. This could suggest that the bullish momentum is weakening and that a bearish crossover may be imminent.

Time-Frame Signals:

- 3 Months: “Hold” – The stock is currently at a critical support level around 133-134. There is a potential for a short-term bounce given the oversold Stochastic RSI. However, overall momentum is weak, and there is a risk of further downside if the support fails.

- 6 Months: “Sell” – With the OBV trending downwards and the MACD showing a weakening bullish momentum, the medium-term outlook appears bearish. The 200-day moving average is also trending down, indicating potential further weakness.

- 12 Months: “Hold” – If the stock manages to maintain support at current levels (133-134), it may remain range-bound or see a recovery towards the upper resistance levels (138 and 146). However, a break below these supports would indicate further downside risk, making the long-term outlook uncertain.

Future Trend Indication:

The chart suggests that the stock is currently in a consolidation phase near significant moving averages, indicating indecision. Given the bearish signals from the OBV, Chaikin Oscillator, and MACD, there is a risk of a bearish breakdown if the support levels fail. Conversely, a short-term bounce is possible due to the oversold Stochastic RSI. Overall, the trend appears neutral to bearish in the short term, with risks of further downside if selling pressure continues.

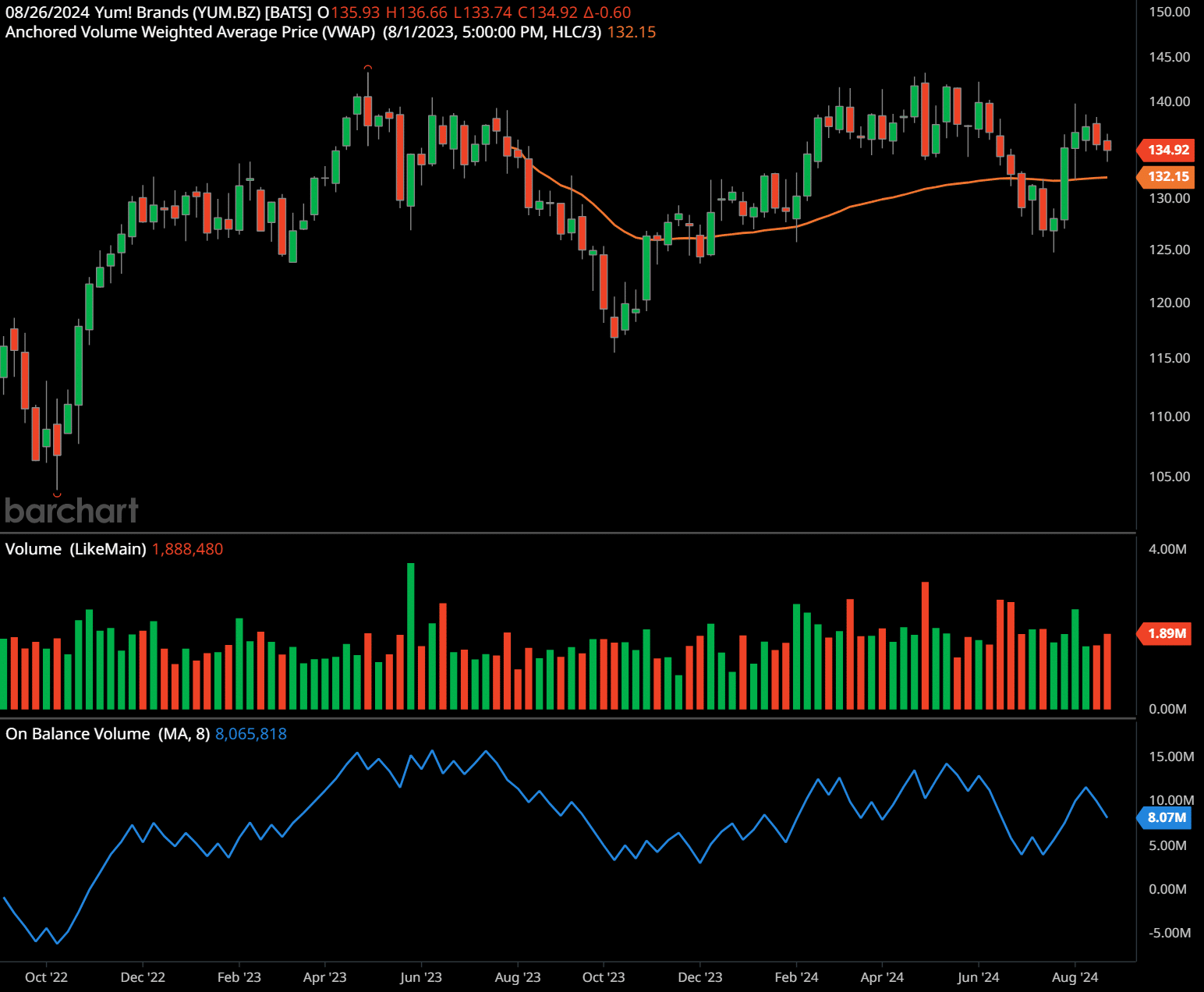

Yum! Brands (YUM) Technical Analysis (weekly)

The chart for Yum! Brands (YUM) on a weekly timeframe shows candlestick patterns, volume data, an Anchored Volume Weighted Average Price (VWAP) line, and the On-Balance Volume (OBV) indicator.

- Trend Analysis: The chart shows that the stock has been in a broad upward trend since October 2022, reaching a peak around June 2023 at approximately 146 before declining. The recent price action shows consolidation around 134.92, slightly above the Anchored VWAP line at 132.15, which may act as a dynamic support level. The price is currently hovering around this VWAP, suggesting a balance point between buyers and sellers.

- Support and Resistance Levels:

- Support: The stock has key support at 132, aligning with the Anchored VWAP, which has been a key price level since early 2023. A more significant support level is around 125, which has held on multiple occasions between March and May 2023. If the price breaks below these levels, it may indicate further downside.

- Resistance: Immediate resistance is around 140, where the stock has recently failed to break above. Another major resistance is at 146, the previous high reached in June 2023.

- Volume Analysis: The volume has remained relatively steady, with occasional spikes, particularly during March and June 2023, suggesting that key movements may have had strong participation from market participants. Current volume does not show a significant increase, indicating that there isn’t a strong conviction in either direction.

- On-Balance Volume (OBV): The OBV has been in a declining trend since June 2023, which indicates a bearish divergence from the price action. This suggests that the stock may be experiencing distribution, with selling pressure outweighing buying pressure over the medium term.

Time-Frame Signals:

- 1 Year: “Hold” – The stock is currently consolidating around a key support level near the Anchored VWAP at 132.15. The declining OBV suggests potential weakness, but the stock may remain range-bound between 132 and 140. If the price holds above 132, a neutral to slightly bullish outlook is warranted.

- 2 Years: “Sell” – Given the bearish divergence in the OBV and the price’s failure to break above the recent high of 146, the medium-term outlook suggests a potential downward trend. If the stock breaks below the 132 support level, further downside could be expected towards the next significant support at 125.

- 3 Years: “Hold” – Over the longer term, the stock remains in a broader uptrend since October 2022, but the recent weakness and consolidation near support levels suggest uncertainty. The outcome will depend on whether the stock can maintain above the key support levels or if it breaks down further.

Future Trend Indication: The weekly chart suggests that the stock is currently at a critical point, balancing between support at 132 and resistance at 140. The bearish divergence in the OBV and the price’s inability to break above 140 may indicate a potential downside risk. If the price breaks below the 132 support level, it could signal a continuation of the downward trend. Conversely, a sustained move above 140 would indicate renewed bullish momentum.

Past performance is not an indication of future results, and this article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Broader Implications for Investors

The current wave of bankruptcies and closures across multiple sectors is a stark reminder of the challenges facing the U.S. economy. The rising cost of living, declining consumer discretionary income, and economic uncertainty suggest that more businesses may face difficulties in the coming months. For investors, this environment requires a careful reassessment of risk, particularly in sectors directly impacted by these trends, such as retail, food service, and regional markets in distressed areas like the Midwest.

Understanding these developments and their potential impact on the broader market is essential for making informed investment decisions. As businesses continue to navigate this challenging landscape, staying informed and agile will be key for investors looking to safeguard and grow their portfolios.

Frequently Asked Questions about the U.S. Economy and Recent Business Closures

FAQs

1. What evidence suggests that the U.S. economy is facing difficulties?

Evidence includes a significant rise in business bankruptcy filings, with over 40% more filings compared to the previous year, and numerous closures of businesses across various sectors.

2. Which restaurant chains have filed for bankruptcy recently?

Prominent restaurant chains that have filed for bankruptcy include Roti, Buca di Beppo, World of Beer, Rubio’s, Melt Bar & Grilled, Kuma’s Corner, Red Lobster, Tijuana Flats, Sticky’s Finger Joint, and Boxer Ramen.

3. Why are many restaurants in the U.S. closing?

Restaurants are closing due to financial distress brought on by declining consumer spending, rising costs, and other economic challenges.

4. How is the fast food industry affected by the current economic situation?

The fast food industry has seen abrupt closures, such as the shutdown of up to 25 KFC locations in the Midwest, impacting nearly 100 employees.

5. What is happening to gas stations and convenience stores in the Midwest?

Several gas stations and convenience stores, including The Store locations owned by Team Schierl Cos., have shut down due to bankruptcy filings and financial troubles.

6. Why is the Midwest particularly affected by the current economic downturn?

The Midwest is facing significant economic challenges, leading to multiple business closures, including restaurants, gas stations, and retail stores.

7. What is happening in Gary, Indiana?

Gary, Indiana, has the highest rate of abandoned homes in the U.S. at 31.41%, and its population has declined by over 18% between 2010 and 2020.

8. How has the banking industry been affected?

The banking industry is also affected, with 41 bank branches closing in just two weeks as the shift towards online banking continues.

9. Which retail stores are shutting down in the U.S.?

Thousands of retail stores have announced closures in 2024, including Big Lots, which may close up to 315 stores.

10. Why is Big Lots closing so many stores?

Big Lots is closing stores due to a significant decline in sales, financial losses, and amendments to credit agreements.

11. What is the current situation of Rite Aid?

Rite Aid is in serious financial peril, having filed for bankruptcy and closed hundreds of stores, with substantial financial losses in recent years.

12. Why are many U.S. businesses being boarded up?

Many businesses are closing due to a decrease in discretionary consumer spending, rising costs, and an overall decline in economic conditions.

13. What has caused the cost of living crisis in the U.S.?

The cost of living crisis has been driven by rising prices, inflation, and stagnant wages, making it difficult for many Americans to afford basic necessities.

14. How are Americans coping with the current economic conditions?

Most Americans are struggling to make ends meet, cutting back on discretionary spending, and seeking ways to manage their finances from month to month.

15. What might the future of the U.S. economy look like?

If current trends continue, the U.S. economy may face further deterioration, leading to more business closures, job losses, and economic instability.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.