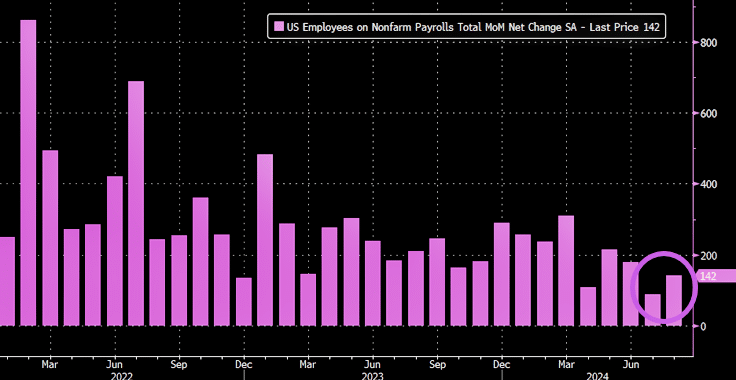

The latest jobs report presents mixed signals. On the downside, August payrolls increased by only 142,000, below the estimated 165,000, but still an improvement over July’s revised 89,000. Furthermore, job figures for the past four months have been revised down, continuing a trend where six of the last seven reports have been adjusted lower. On the upside, the unemployment rate decreased from 4.3% to 4.2%, a key level suggesting the Federal Reserve will likely opt for a smaller rate cut of 25 basis points instead of 50. Despite disappointing payroll growth, other indicators, such as wage gains and employment increases in the household survey, show an economy not slowing as much as anticipated. However, upcoming inflation data will play a crucial role in the Fed’s final rate decision.

Ongoing Revisions and Sectoral Insights

A recurring trend continued with the Bureau of Labor Statistics (BLS) sharply revising prior months’ data downward. June’s payrolls were revised down by 61,000, from 179,000 to 118,000, and July’s figures were reduced by 25,000. This pattern of downward revisions, now affecting four consecutive job reports and six of the past seven, has raised concerns about the reliability of initial job data in the US jobs report. Notably, the manufacturing sector faced a significant decline, losing 24,000 jobs in August—the second worst month for the sector in three years.

Positive Signals and Implications for Rate Cuts

While many focus on the weaker-than-expected payrolls figure, there are signs of resilience in the labor market. Employment gains in the household survey accelerated, the unemployment rate fell, and wage growth continued to rise. This data in the US jobs report suggests that while the economy may not be slowing as quickly as some investors fear, it is not robust enough to justify an aggressive 50 basis point rate cut at the Federal Reserve’s next meeting. Instead, a smaller 25 basis point cut appears more likely.

Insights

- Payroll growth was lower than expected but still an improvement over July.

- The unemployment rate fell, reducing the likelihood of a steep rate cut.

- Revisions suggest a consistent trend of downward adjustments in job reports.

- The manufacturing sector saw significant job losses, marking its second-worst month in three years.

- Next week’s inflation data will be critical for determining Fed policy.

The Essence (80/20)

The core topics to understand from the report are the mixed job data, with disappointing payroll figures offset by a decline in the unemployment rate. The revisions to past months’ data suggest continued uncertainty. Key areas of focus include the labor market trends, potential Federal Reserve rate cuts, and the implications of upcoming inflation data.

The Guerilla Stock Trading Action Plan

Monitor upcoming inflation data closely, as it will determine the Federal Reserve’s next steps. Businesses and investors should prepare for a likely 25bps rate cut while remaining flexible to adjust strategies if data points to more significant economic slowing.

Blind Spot

Overreliance on the unemployment rate could overlook other indicators like wage growth, manufacturing job losses, and inflation data, which could significantly impact the economy and Fed policy.

Investor Takeaway: Awaiting Further Clarity

For investors, the mixed signals from this jobs report imply that the Federal Reserve’s decision on rate cuts remains uncertain, hinging on upcoming economic data, including next week’s inflation figures. While the downward payroll revisions suggest caution, steady wage growth and falling unemployment rates indicate underlying economic strength. This balancing act in the US jobs report will be crucial for market participants to monitor as they navigate the Fed’s next move.

By following the US jobs reports closely, investors can better understand the economic landscape and adjust their strategies accordingly, especially given the significant influence these figures have on interest rate decisions and overall market sentiment.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.