Brazilian Supreme Court Justice Alexandre de Moraes has ordered internet service providers to block access to X (formerly Twitter) in Brazil due to the platform’s refusal to appoint a local legal representative to manage government censorship requests. Justice de Moraes also directed banks to freeze funds held by Starlink, another company owned by Elon Musk, as collateral for fines against X for non-compliance. This move has attracted international criticism, including from investor Bill Ackman, who warned that Brazil’s actions could deter investment.

X, a social media platform, and Starlink, a satellite internet provider, are key players in the global discourse on free speech versus regulatory oversight. Musk’s defiance of Brazilian court orders and the reinstatement of blocked accounts have escalated tensions. The investor community, particularly Ackman, has expressed concern that Brazil’s actions may make it an unattractive investment destination, drawing parallels to China’s past actions.

X and Starlink: Key Players in Free Speech and Global Connectivity

X and Starlink, both owned by Elon Musk, are crucial players in their respective domains. X, as a social media platform, is central to global communication and information sharing, while Starlink aims to revolutionize global internet connectivity through a network of low Earth orbit satellites. For investors, these companies represent two sides of a modern technological and political debate: the balance between free speech and regulatory oversight.

Elon Musk, known for his commitment to preserving free speech, has positioned X as a platform resistant to censorship. This approach has made X popular among users advocating for unregulated dialogue but has also put the company at odds with governments that demand stricter control over content. Starlink, meanwhile, represents a cutting-edge solution to internet connectivity, particularly in underserved or remote regions. Its technological advancements and global reach make it a significant player in the communications sector, promising vast growth opportunities for investors.

Legal Battle in Brazil: A Clash of Ideals

The legal actions against Musk’s companies in Brazil stem from a broader effort by the Brazilian government to control information and regulate online content, particularly in the aftermath of political unrest linked to supporters of former President Jair Bolsonaro. The Brazilian Supreme Court’s decision to block access to X and freeze Starlink funds is seen by Musk as an infringement on free speech. He has openly criticized Justice de Moraes, accusing him of overstepping his authority and violating Brazilian law.

Musk’s defiance of the court orders, including his decision to reinstate accounts that were supposed to be blocked in Brazil, has heightened tensions between his companies and the Brazilian judiciary. The conflict has escalated to the point where Brazil has entirely blocked access to X due to its non-compliance with the court’s demands and the absence of a legal representative in the country.

Investor Reaction: Bill Ackman’s Critique

The legal and political turbulence surrounding X and Starlink has sparked reactions from the global investment community. Hedge fund billionaire Bill Ackman, head of Pershing Square Capital Management, has voiced strong criticism of Brazil’s actions. In a post on X, Ackman labeled the court’s decision to block X and freeze Starlink’s funds as “illegal,” warning that such actions could lead to Brazil becoming an “uninvestable market.” He drew parallels to China’s previous actions, which led to capital flight and a collapse in valuations, suggesting Brazil might face a similar fate if it does not reverse these decisions promptly.

Ackman’s comments underscore the concerns of many investors who see the Brazilian government’s actions as potentially detrimental to the country’s attractiveness as a destination for foreign investment. When regulatory measures appear unpredictable or excessively stringent, investors may perceive a heightened risk, prompting them to withdraw their investments or avoid entering the market altogether.

Implications for Investors: Why Following X and Starlink Matters

For investors, understanding the dynamics around X and Starlink is critical for several reasons. Firstly, both companies are at the forefront of technological innovation—X in social media and Starlink in satellite internet services. Their operations, decisions, and challenges can have far-reaching implications across various sectors, including technology, communications, and finance.

Secondly, Musk’s ongoing legal battle in Brazil highlights the risks associated with regulatory and political environments in emerging markets. The ability or failure of companies like X and Starlink to navigate these challenges can set precedents that affect investor confidence in similar markets worldwide.

Lastly, the response of the Brazilian government to these issues could serve as a bellwether for other countries grappling with similar concerns about censoring free speech online. As governments around the world seek to balance regulation with innovation, the outcomes of cases like this will be closely monitored by investors looking to gauge future risks and opportunities.

Insights

- Brazil’s actions highlight the global challenge of the left-leaning New World Order trying to censor free speech to remain in power (most of their agendas are unpopular).

- The response from international investors shows potential economic repercussions for Brazil.

- The situation underscores the risks involved in investing in emerging markets with unpredictable regulations.

The Essence (80/20)

- Core Topics:

- Legal Conflict in Brazil: Brazil’s Supreme Court blocks access to X and freezes Starlink funds due to regulatory non-compliance, sparking international controversy.

- Free Speech vs. Censorship: The case underscores the tension between preserving free speech and enforcing censorship by left-leaning elites.

- Investor Concerns: Global investors, like Bill Ackman, view Brazil’s actions as potentially damaging to its investment climate.

The Guerilla Stock Trading Action Plan

Diversify Investments: Consider diversifying portfolios away from Brazil to mitigate potential losses from regulatory volatility in emerging markets.

Monitor Legal Developments: Stay updated on Brazilian court rulings and legal battles involving X and Starlink.

Assess Market Risks: Evaluate investment risks in Brazil and similar markets where left-leaning politicians that advocate for censorship are in power.

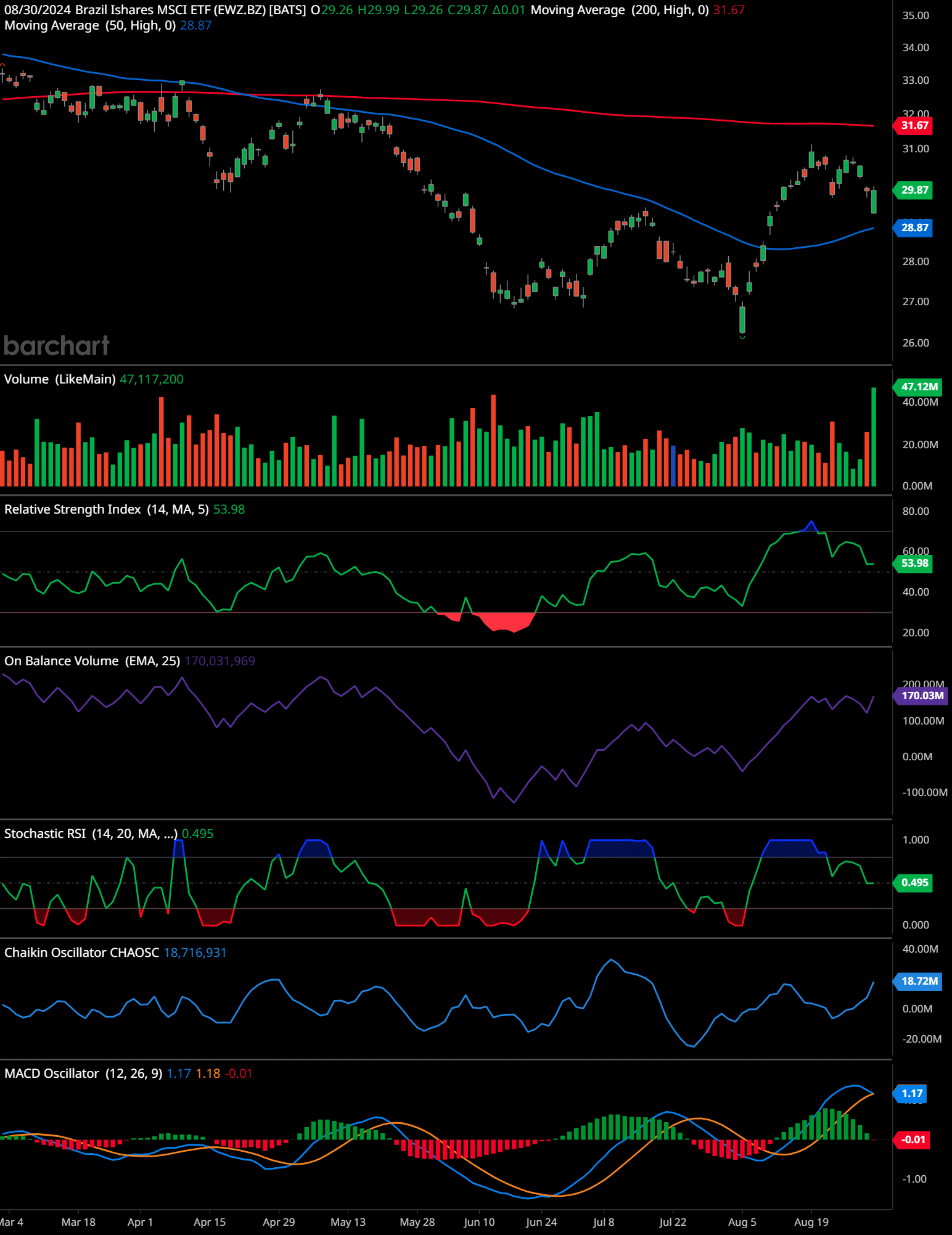

Brazil Ishares MSCI ETF (EWZ) Technical Analysis (daily)

This chart shows the daily time frame for the Brazil iShares MSCI ETF (EWZ), which is a representation of the Brazilian equity market. A detailed analysis of the chart, including indicators, moving averages, volume, and oscillators, reveals the following insights:

Trend Analysis:

The ETF appears to be recovering from a prior downtrend that started around the beginning of March 2024 and continued until mid-May 2024. Since mid-May, the price has shown signs of stabilization and a gradual uptrend, with higher lows forming around the end of May and early July. Recently, the price has moved above the 50-day moving average (blue line at 28.87) but remains below the 200-day moving average (red line at 31.67). This suggests that while short-term momentum is positive, the longer-term trend remains bearish, as indicated by the position of the price relative to the 200-day moving average.

Support and Resistance Levels:

The immediate support level is around 28.87, close to the 50-day moving average, where the price has bounced back previously. Below this, there is a stronger support zone around 27.00, which corresponds to the recent low observed in mid-July 2024. On the resistance side, the first significant resistance level is around 31.00, which is close to the 200-day moving average and aligns with the recent highs in mid-August 2024. A break above 31.00 would be a strong bullish signal, potentially leading to a retest of the next resistance at 33.00, the highs from March 2024.

Indicator Analysis:

- Volume: Volume has been relatively strong recently, especially during upward price movements, suggesting that the buying interest is supported by volume. The spike in volume on the latest candlestick indicates a strong interest in the current price action, which could potentially lead to a breakout in either direction.

- Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is at 53.98, indicating a neutral to slightly bullish momentum. It is above the midpoint of 50 but not in the overbought territory (70+), suggesting there is room for further upward movement if buying continues.

- On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV is rising, which indicates that volume is favoring the bullish side. This supports the view that the uptrend could continue if volume remains positive.

- Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: The Stochastic RSI is at 0.495, near the middle of its range, indicating a neutral position. It is not signaling an overbought or oversold condition, which suggests that the market could move in either direction depending on future momentum.

- Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: The Chaikin Oscillator is showing a reading of 18.72M, which is above zero, indicating that money flow is currently positive. This further supports the short-term bullish trend.

- MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More Oscillator: The MACD line (blue) is slightly above the signal line (orange) at 1.17, with a small negative histogram reading (-0.01). This indicates that the bullish momentum is still present but weakening. The close proximity of the MACD and signal line suggests a potential cross, which could either confirm a continuation of the uptrend or signal a reversal.

Future Trend Indication:

Overall, the chart suggests a cautiously bullish outlook in the short term. The recent price action above the 50-day moving average, supported by strong volume, positive RSI, and money flow indicators, points to the possibility of continued upward movement. However, the price remains below the 200-day moving average, a critical resistance level that needs to be breached for a more sustained bullish trend. A breakout above 31.00, the 200-day moving average, would strengthen the bullish case and likely attract more buying interest, potentially leading to a rally towards the 33.00 level. Conversely, if the price fails to hold above the 50-day moving average (28.87) and breaks below the support at 27.00, it could signal a resumption of the longer-term downtrend.

Time-Frame Signals:

3-Month Signal: Hold – Wait for confirmation of a breakout above 31.00 or a breakdown below 27.00.

6-Month Signal: Hold – The market shows mixed signals; further clarity is needed based on movement around key moving averages.

12-Month Signal: Hold – The longer-term trend is uncertain until the 200-day moving average is decisively breached either up or down.

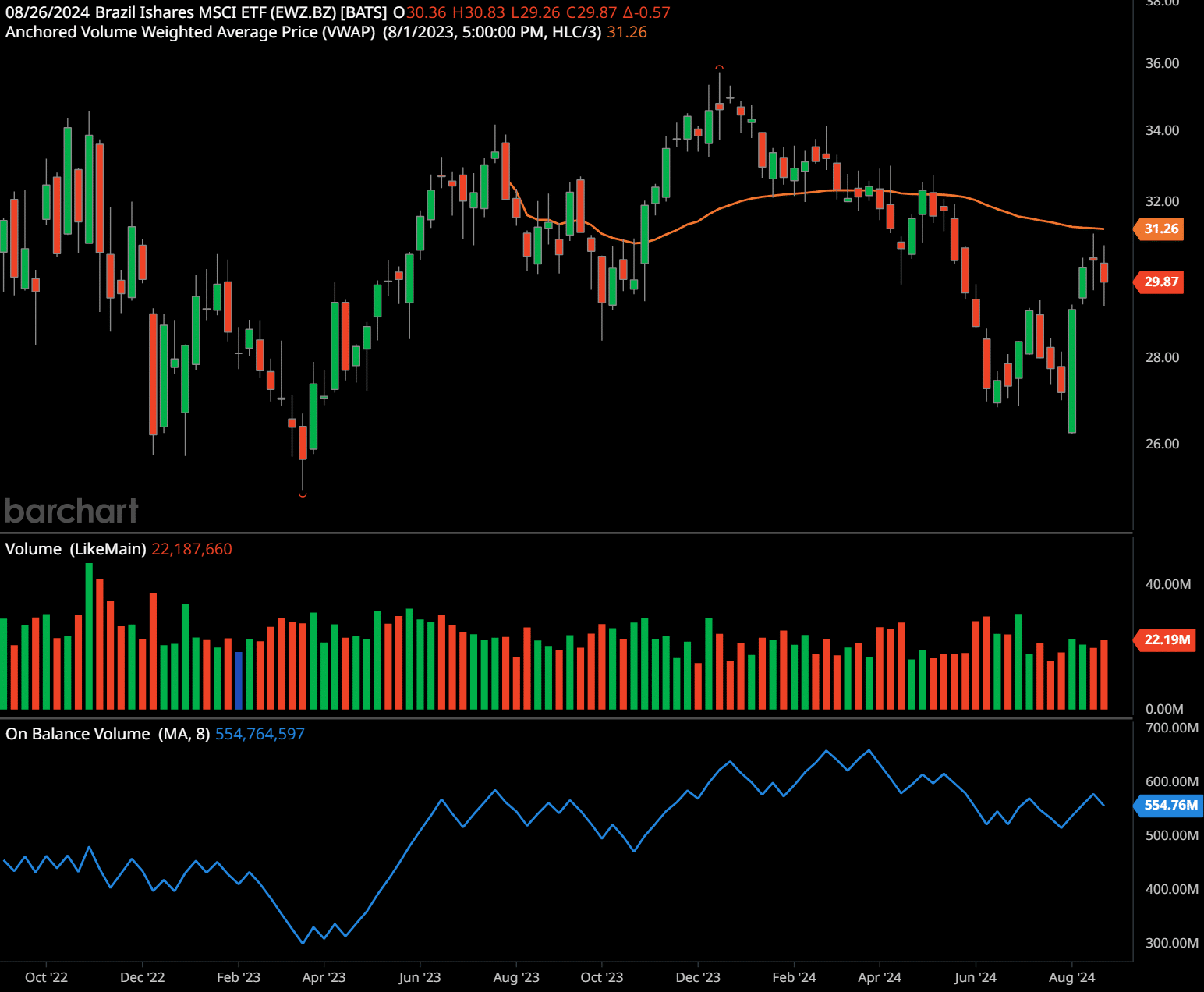

Brazil Ishares MSCI ETF (EWZ) Technical Analysis (weekly)

This chart shows the weekly time frame for the Brazil iShares MSCI ETF (EWZ), which provides a longer-term perspective on the market’s movements. The Anchored Volume Weighted Average Price (VWAP) from August 1, 2023, acts as a dynamic resistance line currently at 31.26, which has been tested but not decisively broken above in recent weeks.

Trend Analysis:

The weekly chart reveals a sideways to slightly downward trend that started in late 2022. The ETF reached a peak near 36.00 in early November 2022 before beginning a downward trend that led to a significant low around 26.00 in May 2024. Since then, the price has attempted to recover but remains capped under the VWAP at 31.26, indicating that selling pressure is still dominant at these levels. The overall trend appears to be a consolidation phase with lower highs and a mixed outlook.

Support and Resistance Levels:

The immediate resistance level is 31.26, near the Anchored VWAP, which aligns with the recent price rejection. A move above this level would be needed for a bullish trend to develop in the medium term. Further resistance is at 33.00, and then at the highs near 36.00 from November 2022. Support is found around the 29.00 level, where the price has found some buying interest recently. A stronger support zone is around 26.00, the May 2024 lows, and represents a critical level that needs to hold to prevent a more significant bearish trend from resuming.

Indicator Analysis:

- Volume: The volume has generally been decreasing since the high in late 2022, indicating a lack of strong conviction among buyers and sellers. This low volume suggests that the recent price movements might not have strong momentum behind them, making the current consolidation phase prone to breakouts or breakdowns.

- On Balance Volume (OBV): The OBV shows a flattening pattern, indicating that there has been little net accumulation or distribution over the past year. This lack of trend in the OBV aligns with the sideways price action, suggesting that market participants remain undecided about the ETF’s future direction.

Future Trend Indication:

The weekly chart suggests a neutral to slightly bearish outlook over the medium term. The price remains below the Anchored VWAP resistance at 31.26, which suggests that bullish momentum is limited. The overall pattern shows a consolidation phase, with support around 29.00 and stronger support at 26.00. A decisive break above 31.26 could change the outlook to more bullish, targeting resistance levels at 33.00 and 36.00. However, failure to break above resistance or a move below 29.00 could lead to retesting the critical support at 26.00. The longer the price stays below the Anchored VWAP, the greater the risk of a downside breakout.

Time-Frame Signals:

1-Year Signal: Hold – Wait for a clear breakout above 31.26 for bullish confirmation or a breakdown below 29.00 for bearish continuation.

2-Year Signal: Hold – Monitor for a sustained move above 33.00 to confirm a longer-term bullish trend; otherwise, the consolidation could persist.

3-Year Signal: Hold – The longer-term trend remains uncertain with mixed signals. A break above 36.00 would suggest a potential long-term uptrend; otherwise, the risk remains to the downside.

Past performance is not an indication of future results, and this article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead: A Watchful Eye on Regulatory Dynamics

The situation in Brazil serves as a critical reminder for investors of the intricate balance between free speech, regulatory oversight, and market stability. As X and Starlink face off against the Brazilian government, their fates may offer valuable insights into how businesses can navigate similar challenges in other jurisdictions. For investors, keeping a close watch on these developments is essential to understanding the evolving landscape of global business, regulation, and technology.

Frequently Asked Questions (FAQs)

1. Why did the Brazilian Supreme Court order the blocking of access to X (formerly Twitter)?

The Brazilian Supreme Court, led by Justice Alexandre de Moraes, ordered the blocking of access to X because the platform refused to appoint a legal representative in Brazil to handle requests related to removing accounts accused of spreading political misinformation.

2. What actions were taken against Starlink in Brazil?

Justice Alexandre de Moraes instructed banks to freeze funds held by Starlink, another company owned by Elon Musk, as collateral for fines imposed on X for non-compliance with court rulings.

3. How have Elon Musk’s companies responded to the Brazilian court’s actions?

Elon Musk has criticized the court’s actions, viewing them as an infringement on free speech. He has also reinstated accounts that were supposed to be blocked in Brazil, escalating the conflict with the Brazilian judiciary.

4. What is the role of X and Starlink in global communication and connectivity?

X, a social media platform owned by Elon Musk, is central to global communication and information sharing, while Starlink aims to revolutionize global internet connectivity through a network of low Earth orbit satellites.

5. Why is Elon Musk’s stance on free speech significant for X?

Elon Musk’s commitment to preserving free speech positions X as a platform resistant to censorship, making it popular among users who advocate for unregulated dialogue. However, this stance also creates conflicts with elected politicians demanding stricter content and censorship controls to stay in power.

6. How has the investment community reacted to the situation in Brazil?

The investment community, including prominent investor Bill Ackman, has criticized Brazil’s actions against X and Starlink. Ackman warned that such actions could make Brazil an “uninvestable market,” drawing parallels to capital flight from China due to similar regulatory measures.

7. What concerns do investors have about Brazil’s actions?

Investors are concerned that Brazil’s unpredictable and stringent regulatory measures could deter foreign investment. They fear increased risk and may withdraw investments or avoid entering the market altogether.

8. Why are X and Starlink important for investors to monitor?

Both X and Starlink are at the forefront of technological innovation. Understanding their operations, challenges, and decisions is crucial as they can have broad implications across various sectors, including technology, communications, and finance.

9. What does the legal battle in Brazil reveal about investing in emerging markets?

The legal battle underscores the risks associated with regulatory and political environments in emerging markets. The ability of companies like X and Starlink to navigate these challenges can influence investor confidence in similar markets worldwide.

10. How could the outcomes of the legal battle in Brazil affect other countries?

The response of the Brazilian government could serve as an example for other countries facing similar issues regarding online content censorship. The outcomes of this case will be closely watched by investors as a gauge for future risks and opportunities.

- Nvidia just poured $160 million into Applied Digital Stock… and it skyrocketed 76% in a day! 🚀 - September 8, 2024

- Is Trump Media stock the next meme stock disaster? 📉 Find out why DJT stock is tanking! - September 8, 2024

- When was the last time a new drug humbled the world’s best? Summit Therapeutics Stock To Explode 🧬 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.