Dollar Tree (DLTR) is set to report earnings next week (Wednesday, September 4, 2024) amid heightened tension in the discount retail sector following a 30% earnings decline for Dollar General (DG). The decline led to DG’s worst trading day ever, with concerns over “financially constrained” customers. Wells Fargo analyst Edward Kelly believes DG’s turnaround efforts are faltering due to macroeconomic factors, competition, and underinvestment, particularly in labor. The intensified competition, especially from Walmart (WMT), is also impacting DG’s market share. Evercore ISI analyst Michael Montano echoes these sentiments, noting the difficulty of maintaining market share in a slower growth environment. Companies like Walmart, Aldi, and ultra-low-cost brands are disrupting DG’s business model by offering lower-priced items. Dollar Tree (DLTR) shares dropped by 14% during the week as attention remains on the challenges facing Dollar General.

Dollar General’s Earnings Decline and Sector Implications

Dollar General recently reported a 30% decline in earnings, marking its worst trading day ever. The company attributed this decline to the challenges of “financially constrained” customers, reflecting broader economic pressures impacting lower-income consumers. According to Wells Fargo analyst Edward Kelly, Dollar General’s turnaround efforts have encountered substantial hurdles. Kelly notes that a combination of macroeconomic factors, competition, and underinvestment is significantly affecting the company’s performance.

Kelly emphasizes that Dollar General may need to undertake aggressive actions to restore investor confidence, particularly by making substantial investments in labor, both in terms of hours and wages. The macroeconomic environment, characterized by inflationary pressures and reduced discretionary spending, is putting additional strain on Dollar General’s customer base. Additionally, increased competition from larger retailers, such as Walmart (WMT), is exacerbating the challenges.

Evercore ISI analyst Michael Montano echoed these sentiments, highlighting that Dollar General’s struggle to maintain market share is particularly evident in a slower growth environment where Walmart continues to outperform. Leo Nelissen, an Investing Group Leader on Seeking Alpha, pointed out that Walmart, along with Aldi and ultra-low-cost brands like Temu, are disrupting Dollar General’s business model by offering more competitively priced items and greater value at scale.

Dollar Tree’s Performance in the Spotlight

As Dollar General’s difficulties capture the market’s attention, Dollar Tree’s stock has also felt the impact, shedding 14% over the week. Investors are anxious about whether Dollar Tree might face similar challenges or capitalize on Dollar General’s missteps. Dollar Tree’s upcoming earnings report will provide crucial insights into the company’s ability to navigate the current economic environment and maintain its competitive position.

Dollar Tree’s business model focuses on offering a wide range of products at a fixed price point, which has historically attracted cost-conscious consumers. However, the current economic landscape, marked by inflation and increased competition from low-cost retailers, poses new challenges. Dollar Tree’s ability to manage these factors while maintaining profitability will be closely scrutinized by investors.

Why Dollar Tree and Dollar General Are Critical for Investors

Both Dollar Tree and Dollar General are important for investors to monitor due to their significant presence in the discount retail sector. These companies serve as key indicators of consumer behavior, particularly among lower-income households, which are more susceptible to economic fluctuations. The performance of these retailers can offer valuable insights into broader economic trends, such as consumer spending patterns, inflationary pressures, and the competitive landscape within the retail sector.

For Dollar Tree, the upcoming earnings report will be a crucial barometer of the company’s ability to adapt to a challenging environment. If Dollar Tree demonstrates resilience and continues to grow despite the headwinds faced by Dollar General, it could reinforce confidence among investors and position the company favorably against its competitors.

On the other hand, if Dollar Tree shows signs of similar struggles, it could indicate that the discount retail sector as a whole is under more pressure than previously anticipated. Investors will be closely watching for any signals that suggest how these companies plan to navigate the competitive pressures from retail giants like Walmart and the broader economic challenges that impact their core customer base.

Insights

- Low-cost competitors are significantly impacting the discount retail market.

- Dollar General is struggling due to macroeconomic pressures and competition.

- Significant investment in labor may be necessary for DG’s recovery.

The Essence (80/20)The Origins and Evolution of the 80/20 Principle The Discovery by Vilfredo Pareto In 1897, Italian economist Vilfredo Pareto uncovered a striking pattern in his study of wealth and...: Dollar General is facing substantial challenges from both economic pressures and increasing competition from Walmart, Aldi, and other low-cost retailers. The company’s underinvestment in critical areas like labor is contributing to its difficulties. Analysts suggest a need for aggressive action and strategic investment to restore market confidence.

The Action Plan – What Dollar Tree and Dollar General Should Do Next:

- Focus on differentiating product offerings to stand out from competitors like Walmart and Aldi.

- Dollar General should increase investments in labor to enhance customer experience and operational efficiency.

- Reassess pricing strategies to remain competitive against ultra-low-cost rivals.

Blind Spots

Here are four potential blind spots for Dollar General (DG) and Dollar Tree (DLTR), along with remedies to address each:

1. Over-Reliance on Traditional Discount Model

- Blind Spot: Dollar General and Dollar Tree may be overly dependent on its traditional discount model, which is being challenged by newer, ultra-low-cost competitors like Aldi and Temu. This focus might prevent DG from innovating or diversifying its offerings.

- Remedy: Develop a differentiated product or service line that adds unique value to customers, such as exclusive brands, personalized shopping experiences, or enhanced loyalty programs. Investing in technology-driven solutions, like mobile apps or e-commerce platforms, can also broaden customer engagement.

2. Underinvestment in Employee Experience

- Blind Spot: The company’s apparent underinvestment in labor (both in wages and working hours) could be leading to high turnover rates, poor customer service, and reduced store performance.

- Remedy: Implement a strategic investment in employee wages, training, and benefits to boost morale, reduce turnover, and improve customer experience. A well-trained and motivated workforce can become a competitive advantage, directly impacting sales and customer loyalty.

3. Ignoring Local Market Variations

- Blind Spot: DG’s and DLTR’s standardized approach might overlook the unique preferences and needs of different local markets, resulting in a mismatch between store offerings and customer expectations.

- Remedy: Use data analytics to better understand local consumer behavior and tailor product assortments, pricing, and promotions to each market’s specific needs. Incorporating local sourcing and community engagement initiatives can also strengthen brand presence in diverse regions.

4. Neglecting the Digital Transformation

- Blind Spot: Dollar Tree may not be adequately leveraging digital channels and e-commerce opportunities, especially as competitors expand their online presence and digital offerings.

- Remedy: Accelerate digital transformation by enhancing the company’s e-commerce platform, investing in digital marketing, and integrating omnichannel retail strategies. Providing options like online ordering with in-store pickup or delivery can attract tech-savvy consumers and create new revenue streams.

By addressing these blind spots, Dollar Tree can better position itself to withstand competitive pressures and adapt to changing market dynamics.

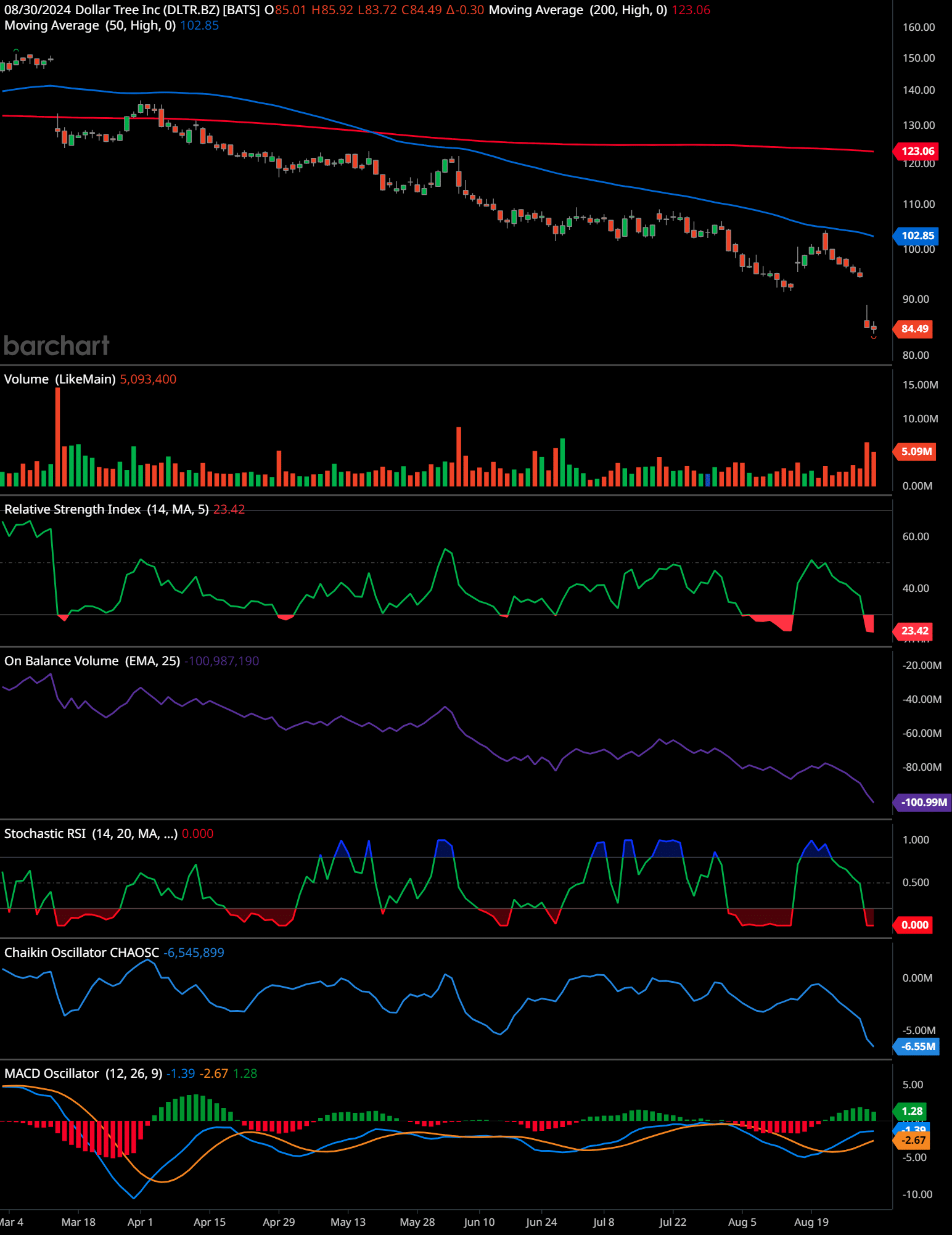

DLTR Technical Analysis (daily)

The chart for Dollar Tree Inc. (DLTR) shows a clear downtrend over the past several months, characterized by a series of lower highs and lower lows. The stock is trading below both its 50-day moving average (currently at 102.85) and 200-day moving average (currently at 123.06), indicating bearish momentum.

Volume analysis shows a recent spike, suggesting that there was significant selling pressure, especially as the stock price declined sharply in the past few days. This increased volume on the downside indicates strong bearish sentiment.

The Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI) is currently at 23.42, which is in the oversold territory (below 30). This suggests that the stock may be due for a short-term bounce or consolidation. However, the RSI remaining in the oversold area also indicates sustained selling pressure.

The On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV) is showing a negative trend (-100.99M), confirming that the overall volume flow is aligned with the downtrend, and there are more sellers than buyers in the market.

The Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... is at 0, indicating that the stock is in an extreme oversold condition. This could signal a potential short-term reversal or relief rally, but the broader trend remains bearish.

The Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... is at -6.55M, showing that the money flow is also negative, further reinforcing the bearish trend.

The Moving Average Convergence Divergence (MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More) shows a bearish crossover, with the MACD line at -2.67 and the signal line at 1.28. The histogram is also negative, reflecting accelerating downward momentum.

Support Levels:

The nearest support level appears to be around 83.72, which corresponds to the recent low. If this level is breached, the next support could be around 80, a psychological level where the stock could find temporary relief.

Resistance Levels:

The immediate resistance level is the 50-day moving average at 102.85. Above this, significant resistance is around the 200-day moving average at 123.06, which coincides with a previous high.

Future Trend Indication:

The chart indicates a continuation of the downtrend, with further potential downside risk if the stock breaks below the recent support level at 83.72. However, given the oversold conditions indicated by the RSI and Stochastic RSI, there may be a short-term relief rally or consolidation. The long-term trend remains bearish unless the stock can break above the 50-day and 200-day moving averages with sustained buying volume.

Time-Frame Signals:

3 Months: Sell, as the stock remains in a strong downtrend with bearish momentum and is trading below key moving averages.

6 Months: Hold, given the potential for a short-term bounce due to oversold conditions, but wait for confirmation of a trend reversal.

12 Months: Hold, with caution. The stock needs to show significant signs of recovery by crossing above key resistance levels to change the overall trend direction to bullish.

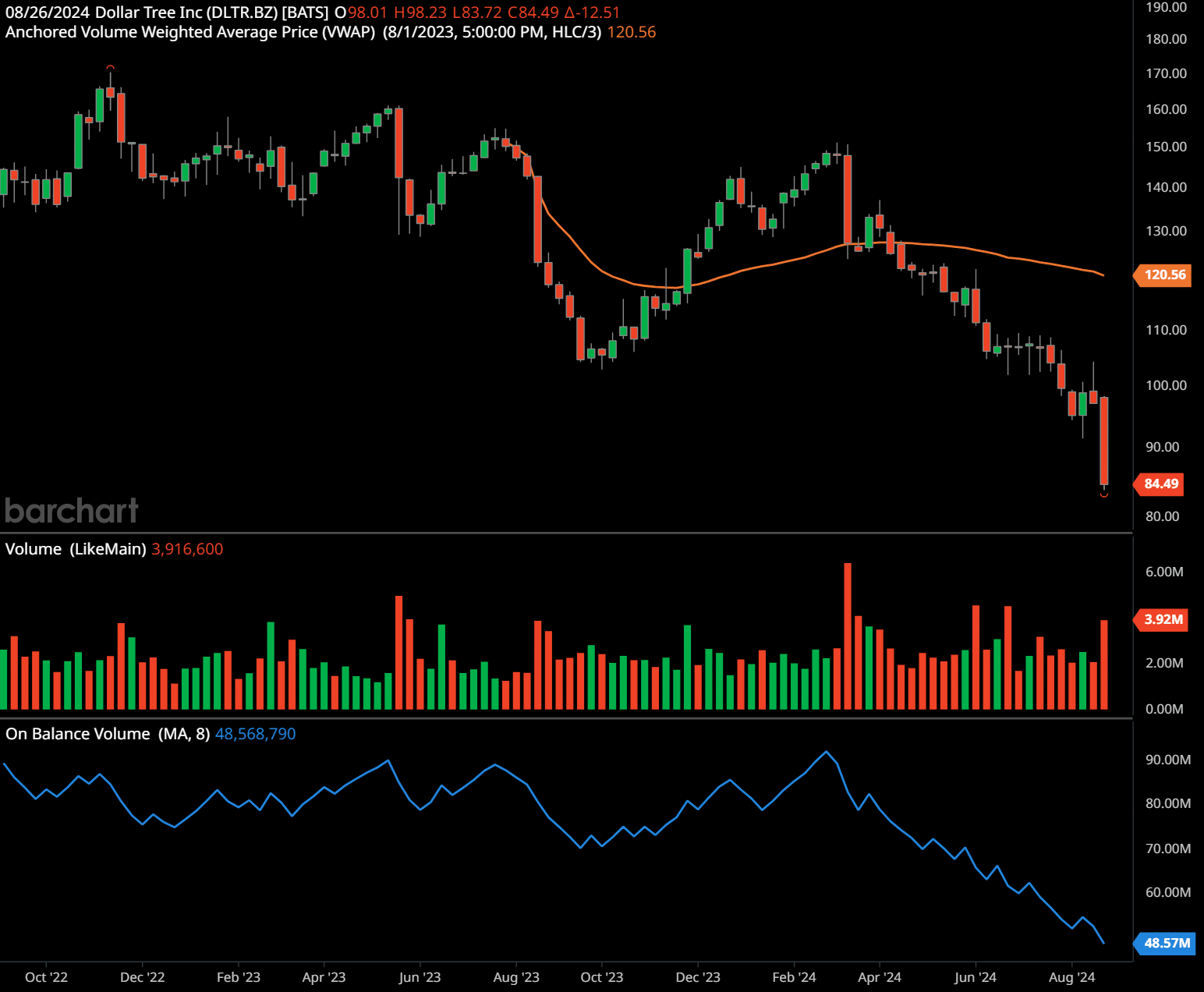

DLTR Technical Analysis (weekly)

The weekly chart for Dollar Tree Inc. (DLTR) shows a significant downtrend that began around the start of 2023 and has continued to the present. The stock price is now significantly below the Anchored Volume Weighted Average Price (VWAP) of 120.56, which indicates a strong bearish trend.

Volume analysis indicates an increase in selling pressure, particularly in the last few weeks as the stock declined sharply to its current level of 84.49. The increased volume on the downside suggests that the selling pressure is strong and persistent.

The On-Balance Volume (OBV) shows a steady decline, currently at 48.57 million. This declining OBV indicates that more volume is occurring on down days than on up days, confirming that the bearish trend is being supported by significant selling volume.

Support Levels:

The nearest support level is around 83.72, which aligns with the recent low. A break below this level could trigger further downside, with potential support around 80, which is a psychological level and a potential area for some buyers to step in.

Resistance Levels:

Immediate resistance is at 120.56, which is the Anchored VWAP. If the stock manages to rebound, this level would need to be breached to indicate a potential trend reversal. Above this, resistance could also be seen around 130, a level that was tested multiple times in the past.

Future Trend Indication:

The chart indicates a continuation of the downtrend in the near term, with the potential for further downside if the support level around 83.72 is breached. Given the strong selling momentum and the current positioning below the Anchored VWAP, the bearish trend is likely to persist unless there is a significant catalystA stock catalyst is an engine that will drive your stock either up or down. A catalyst could be news of a new contract, SEC filings, earnings and revenue beats, merger and acquisit... More to change the sentiment. Any potential reversal would require a break above 120.56 with sustained volume.

Time-Frame Signals:

1 Year: Sell, as the stock remains in a long-term downtrend with significant resistance overhead.

2 Years: Hold, given the potential for a gradual recovery over a longer time frame, but remain cautious unless the stock shows signs of breaking above key resistance levels.

3 Years: Hold, with the possibility for a trend change if macroeconomic conditions or company fundamentals improve. Watch for signs of a bottoming pattern or sustained buying volume.

Past performance is not an indication of future results. This article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

The discounter sector is at a critical juncture, with Dollar Tree’s earnings report expected to shed light on the future direction of the industry. As Dollar General faces significant challenges, Dollar Tree’s performance will be a key indicator of whether it can withstand the same economic and competitive pressures. Investors will be keen to see if Dollar Tree can emerge as a resilient player in this environment, or if the struggles faced by Dollar General are indicative of broader issues within the sector.

The outcome of Dollar Tree’s earnings will likely have far-reaching implications not just for its own stock, but for the entire discount retail industry, making it an important event for investors to follow closely.

Frequently Asked Questions (FAQ)

1. When will Dollar Tree (DLTR) report its earnings?

Dollar Tree (DLTR) will report its earnings next week.

2. Why is there tension in the discounter sector?

Tension is high in the discounter sector due to Dollar General (DG) reporting a 30% earnings decline and warning about “financially constrained” customers, which led to its worst trading day ever.

3. What did Wells Fargo say about Dollar General’s (DG) turnaround efforts?

Wells Fargo believes that Dollar General’s (DG) turnaround efforts are facing problems due to macroeconomic factors, competition, and underinvestment. Analyst Edward Kelly noted that these factors are taking a toll on the retailer.

4. What actions does Edward Kelly suggest Dollar General (DG) take to overcome its challenges?

Edward Kelly suggests that Dollar General (DG) needs to make a significant investment in labor, such as increasing hours and rates, to restore confidence in the chain.

5. What factors are affecting Dollar General’s (DG) performance?

The performance of Dollar General (DG) is being affected by the macroeconomic environment, pressure on lower-income consumers, and intensified competition, particularly from Walmart (WMT).

6. What did Evercore ISI analyst Michael Montano say about Dollar General’s (DG) market share?

Michael Montano highlighted that Dollar General (DG) is facing challenges in maintaining its market share as Walmart (WMT) continues to gain ground in a slower growth environment.

7. Which competitors are disrupting Dollar General’s (DG) business model?

Competitors such as Walmart, Aldi, and ultra-low-cost brands like Temu are disrupting Dollar General’s (DG) business model by offering even more lower-priced items and value at scale.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.