In a recent development, Mizuho initiated coverage of O’Reilly Automotive (ORLY) with a bullish view, marking it as a “Buy” and setting a price target of $1,225. This move comes as part of Mizuho’s broader coverage initiation of 15 companies across consumer hardlines and consumer internet verticals, indicating an optimistic outlook for the remainder of 2024.

Understanding Mizuho’s Perspective

Mizuho’s analysis suggests that the spending backdrop is expected to evolve into a “more subdued, yet stable” state in the coming months, setting a favorable environment for certain companies within these sectors. Among the 15 companies initiated for coverage, Mizuho has identified eight names for which it holds a positive view.

Top Picks and Sector Trends

Lowe’s (LOW), identified as a top pick within core consumer hardlines and large caps, reflects Mizuho’s confidence in certain segments of the retail market. Similarly, Wayfair (W) stands out within the consumer internet coverage, indicating Mizuho’s belief in the strength of online retail platforms. Additionally, Mizuho highlights Mister Car Wash (MCW) within small caps as another promising investment opportunity.

Supportive Factors for ORLY and the Sector

One of the key supporting factors for O’Reilly Automotive and its peers is the expectation of rate cuts continuing into 2025. Mizuho believes that this anticipated monetary policy will further bolster consumer confidence and spending, particularly in sectors related to home improvement and other home-related activities.

Understanding O’Reilly Automotive’s Business

O’Reilly Automotive, along with its subsidiaries, operates as a retailer and supplier of automotive aftermarket parts, tools, supplies, equipment, and accessories. The company’s product range includes both new and remanufactured automotive hard parts and maintenance items, covering a wide spectrum of needs for vehicle owners.

Among the products offered by O’Reilly Automotive are alternators, batteries, brake system components, belts, chassis parts, driveline parts, engine parts, fuel pumps, hoses, starters, temperature control, water pumps, antifreeze, appearance products, engine additives, filters, fluids, lighting products, and oil and wiper blades. Additionally, the company provides various accessories such as floor mats, seat covers, and truck accessories, catering to diverse customer preferences.

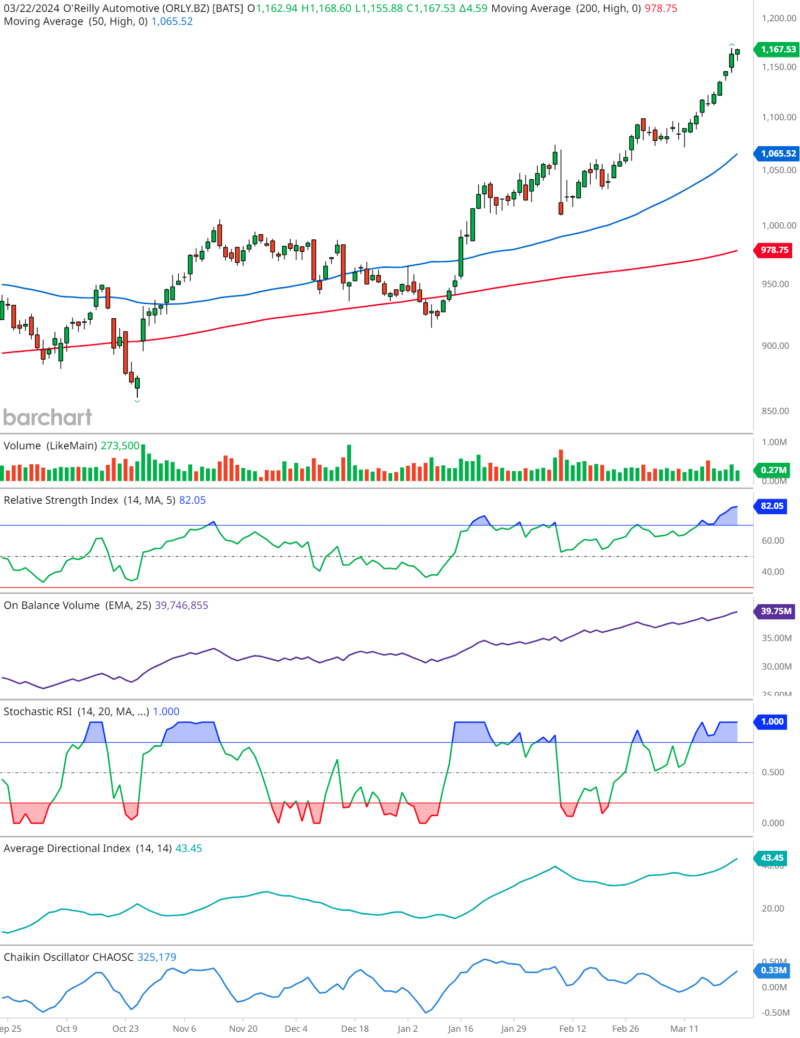

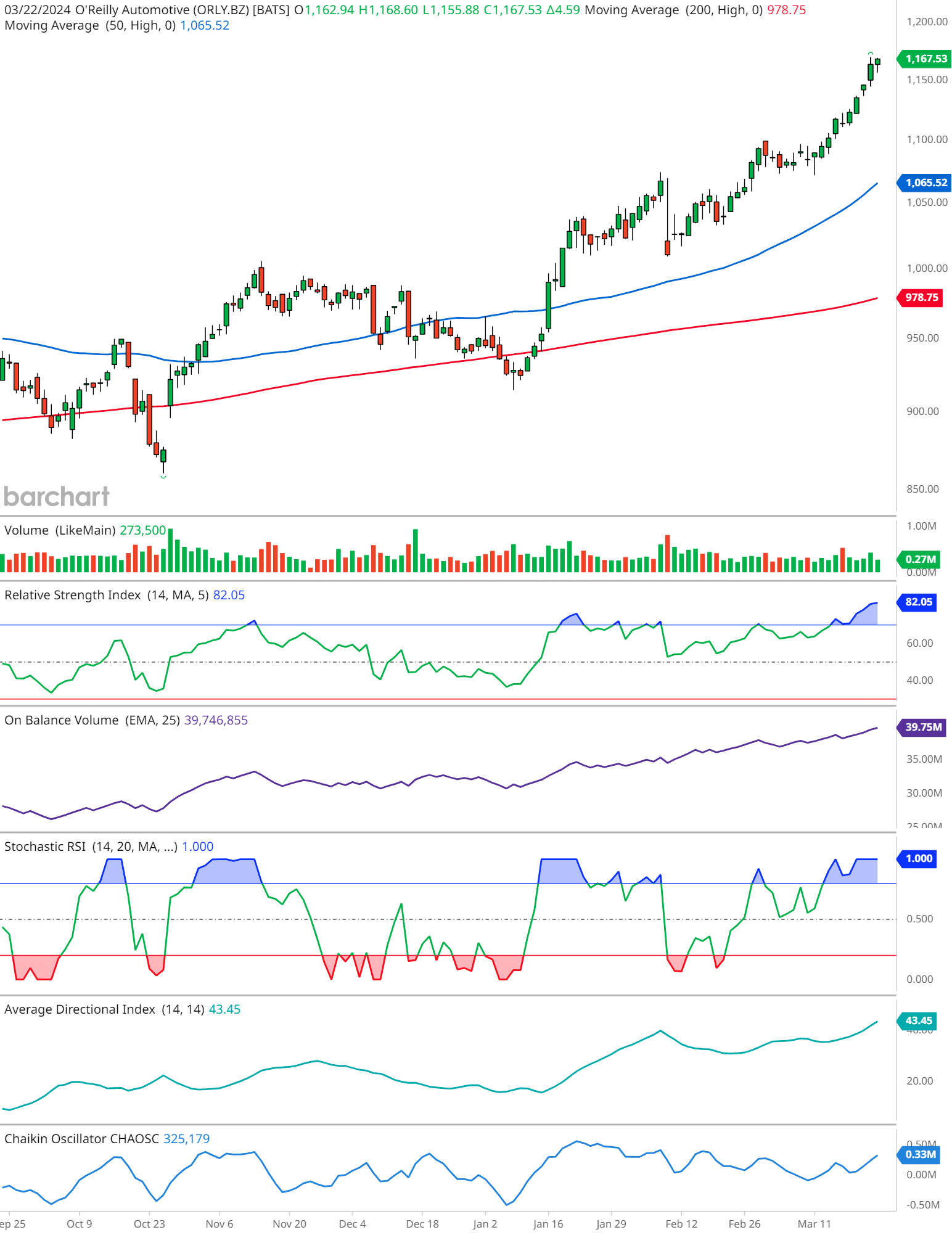

ORLY Technical Analysis

Based on the chart provided for O’Reilly Automotive (ORLY), we’re seeing a positive uptrend, indicated by the consistent higher highs and higher lows above both the 50-day and 200-day moving averages.

The Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI) is above 50, currently around 82, signaling strong bullish momentum but also nearing overbought territory.

The On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV) shows a steady increase, supporting the uptrend with strong volume backing.

The Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... is in the overbought zone, which may indicate a potential pullback or price consolidation in the near term.

The Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADI) is around 43, suggesting a strong trend, and the Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... is positive, indicating buying pressure.

Overall, technical indicators suggest that ORLY is currently in a strong uptrend, but caution is warranted as some indicators are signaling potential overbought conditions that could lead to a short-term pullback or consolidation.

Bottom-line

Mizuho’s bullish initiation of coverage on O’Reilly Automotive reflects its positive outlook not only for the company but also for the broader sector it operates in. With expectations of a stable spending backdrop and supportive monetary policies, O’Reilly Automotive stands poised for potential growth and continued success in the automotive aftermarket industry. Investors may find Mizuho’s analysis compelling as they assess investment opportunities in the evolving landscape of consumer hardlines and consumer internet verticals.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.