In the fast-paced world of telecommunications, giants like AT&T and Verizon are constantly vying for subscribers in an increasingly competitive market. However, recent challenges in the public markets have cast a shadow over their performance, and Verizon’s latest quarterly results have done little to improve the narrative. Let’s dive into the details of Verizon’s performance, its implications for investors, and analyze the market sentiment surrounding telecom stocks.

Verizon’s Quarterly Results: Mixed Signals for Investors

Verizon reported a net loss of 158,000 users in its consumer wireless postpaid phone business, marking a significant year-over-year improvement. Despite this, the Business Group’s net postpaid phone user additions of 90,000 were down approximately 33% year-over-year, representing about 20% of its annual revenues. Overall, Verizon lost 68,000 monthly bill-paying wireless phone subscribers, which was better than analysts’ expectations of a 100,000 loss.

While the company’s adjusted earnings per shareEarnings per share (EPS) is a fundamental financial metric that provides valuable insights into a company's profitability. This widely used indicator helps investors and analysts g... of $1.15 beat the consensus estimate of $1.12, its operating revenue of $33 billion lagged expectations by $0.20 billion. Additionally, free cash flowThe cash flow statement provides a detailed overview of the cash inflows and outflows of a company over a specified period of time. It includes cash received from operations, inves... More of $2.70 billion fell significantly short of the $4 billion expected.

Market Sentiment and Investor Concerns

Verizon’s quarterly results come amidst ongoing challenges as the company works to navigate the post-pandemic landscape. Investors are left wondering where key metrics will normalize going forward, particularly in a highly competitive market environment. Until there’s more clarity about the future trajectory of the business, investors may continue to seek opportunities elsewhere, especially considering the impact of high interest rates on rate-sensitive sectors like Telecom.

Market Analysis of Verizon’s Stock

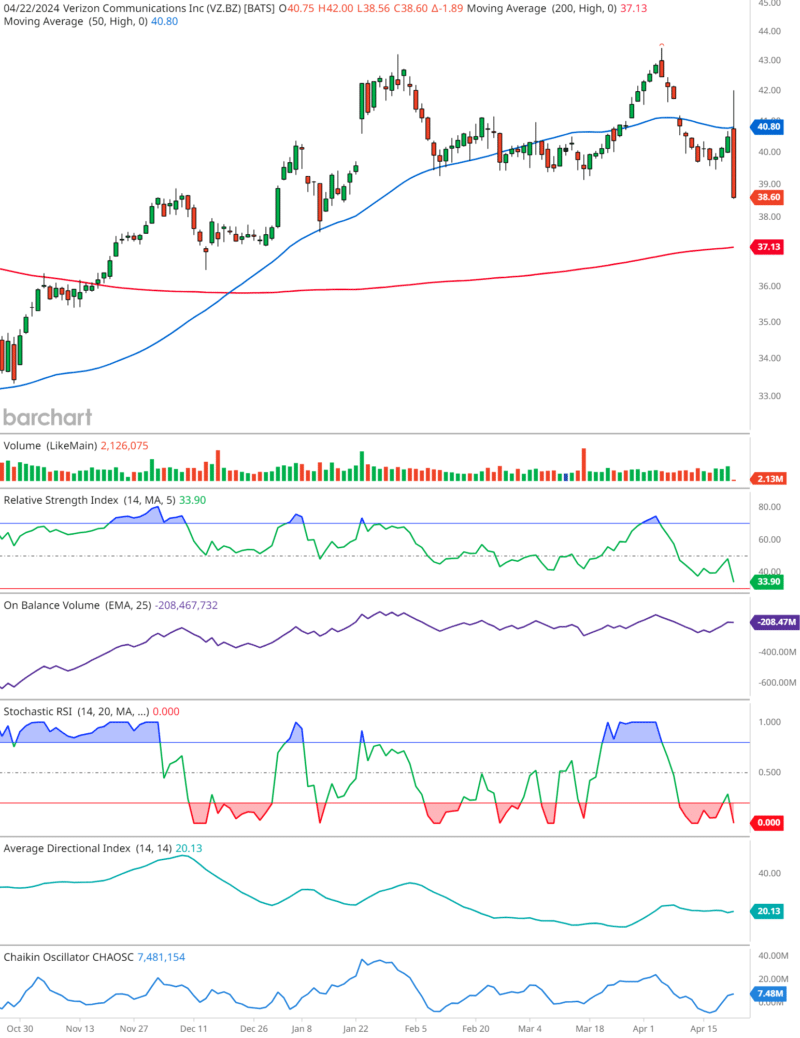

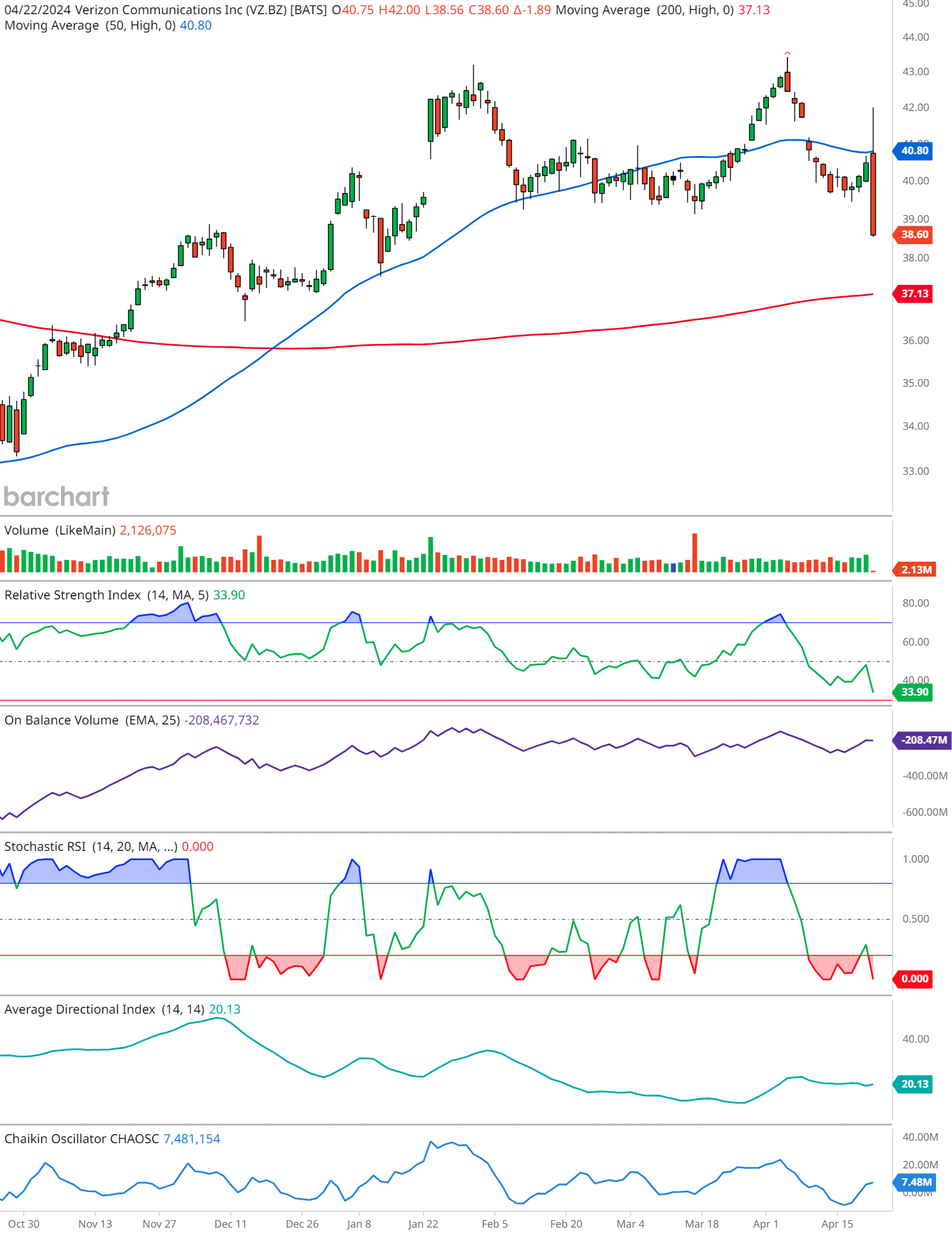

Analyzing Verizon’s stock performance, several indicators provide insights into the current market sentiment:

- Moving Averages: The stock price is currently trading below the 50-day moving average (blue line) but remains above the 200-day moving average (red line), indicating potential short-term bearish momentum while maintaining a long-term uptrend.

- Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is at 53.90, signaling neutral territory. This suggests that the stock is neither overbought nor oversold.

- Volume: Volume appears relatively stable, with no significant spikes indicating heightened market activity.

- On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV is on a slight decline, suggesting moderate selling pressure in recent trades.

- Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: The Stochastic RSI is at 0.0000, indicating the stock has been in the oversold region. This could potentially signal an upcoming price increase or a reversal in the short term.

- Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX): With a value of 20.13, the ADX shows a weak to moderate trend, indicating that the current trend is not particularly strong.

- Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: The Chaikin Oscillator indicates a declining buying pressure, as the oscillator is on the lower side.

In conclusion, Verizon’s quarterly results reflect the challenges and uncertainties facing telecom giants in a competitive market landscape. Mixed performance metrics and market indicators suggest that investors are adopting a cautious approach, awaiting further clarity on the company’s future trajectory. As Verizon continues to navigate market dynamics and competitive pressures, investors should closely monitor developments and market indicators to make informed investment decisions.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.