The CBOE Volatility Index (VIX), commonly known as Wall Street’s “fear gauge,” experienced a significant spike on September 3, 2024. This sudden rise in the VIX was driven by a combination of factors that underscored growing market anxiety and investor uncertainty. The VIX, which measures expected market volatility, is a critical tool for institutional investors seeking to hedge against potential downturns in the stock market. Understanding the events that led to this increase provides valuable insight into the current market climate and highlights why monitoring the VIX and related economic indicators is crucial for investors.

Market Selloff Drives Volatility

One of the primary drivers behind the sharp increase in the VIX was a broad market selloff. On September 3, the S&P 500 dropped by 1.9%, marking its steepest decline in nearly a month. This significant downturn in stocks naturally led to heightened market volatility and uncertainty, pushing the VIX higher. The VIX is often used by institutional investors as a hedge against long positions during market pullbacks. As the market began to tumble, the demand for these hedges increased, reflecting growing concerns about further declines.

Economic Concerns Fuel Market Anxiety

Adding to the market’s woes were weak economic data points that amplified investor fears. The ISM manufacturing index for August revealed a larger contraction than anticipated, raising alarms about the overall health of the U.S. economy. The report’s employment index also hinted at potential challenges ahead, just days before a crucial jobs report was scheduled for release. These disappointing figures not only cast a shadow over the current economic landscape but also heightened uncertainty about the future, contributing to the surge in volatility.

For investors, economic indicators like the ISM manufacturing index are essential to watch because they provide early signals about the state of the economy. A contracting manufacturing sector can suggest broader economic weakness, which may lead to lower corporate earnings and, consequently, lower stock prices. This connection between economic data and market performance underscores the importance of staying informed about such indicators.

September: A Historically Volatile Month

The timing of these developments is also significant. September has historically been a volatile month for the stock market, often due to a mix of seasonal factors and upcoming economic data releases. As the market entered this traditionally turbulent period, investors were likely positioning themselves for potential volatility. The anticipation of key events, such as the Federal Reserve’s interest rate decision on September 18, added to the uncertainty, further driving the demand for hedges and contributing to the VIX’s rise.

Understanding the historical context of market behavior is crucial for investors. By recognizing patterns, such as increased volatility in September, investors can better prepare for potential market swings and adjust their portfolios accordingly.

Technology Sector Weakness Amplifies Fears

Another significant factor contributing to the VIX spike was the pronounced weakness in the technology sector, particularly among semiconductor stocks. Nvidia, a leading player in the AI chip market, saw its shares plummet by 7.2% on September 3. This sharp decline not only dragged down the broader tech sector but also intensified overall market uncertainty.

The technology sector, especially companies like Nvidia, is a key driver of market sentiment. As one of the major forces behind recent market rallies, any signs of weakness in tech stocks can have a ripple effect, leading to broader market declines. For investors, keeping a close eye on the performance of tech giants is essential, as these companies often set the tone for market movements.

The Magnitude of the VIX Move

The VIX’s surge of 38.13% on September 3 reflects a dramatic rise in investor anxiety and expectations of increased market volatility in the near term. This significant increase suggests that investors were bracing for further market turbulence, likely due to the combination of the factors discussed above. With hedges still relatively cheap, institutional investors appeared to move quickly to purchase VIX insurance against potential market pullbacks, further driving the index higher.

The magnitude of this VIX move is a reminder of how quickly market sentiment can shift. For investors, the VIX serves as an important barometer of market fear and uncertainty. Monitoring the VIX and understanding its drivers can help investors make more informed decisions, particularly during periods of heightened volatility.

Insights

- Broad market selloffs significantly drive the VIX higher.

- Economic data releases directly impact market volatility.

- September’s historical volatility shapes investor strategies.

- Sector-specific declines can amplify overall market anxiety.

Essence (80/20)

- Core Topics: Market selloff, economic concerns, September volatility, technology sector weakness, and VIX surge.

- Market Selloff: Broad declines, particularly in major indices like the S&P 500, directly increase volatility.

- Economic Concerns: Weak ISM manufacturing data and employment indices trigger fears about economic health.

- September Volatility: Seasonal patterns lead investors to brace for potential turbulence.

- Technology Sector Weakness: Significant declines in major tech stocks like Nvidia magnify market fears.

- VIX Surge: Institutional investors purchase VIX as a hedge against anticipated market pullbacks.

The Guerilla Stock Trading Action Plan

- Monitor key economic indicators and their impact on market sentiment.

- Understand historical trends to anticipate periods of increased volatility.

- Stay updated on sector-specific developments, particularly in technology.

- Evaluate investment strategies for hedgingFinancial hedging is a strategy used to reduce or eliminate the risk of financial losses that may arise from unfavorable price movements. More against market downturns.

Blind Spot

The focus on U.S. market volatility may overlook global economic developments or geopolitical factors influencing investor behavior.

CBOE Volatility Index ($VIX) Technical Analysis

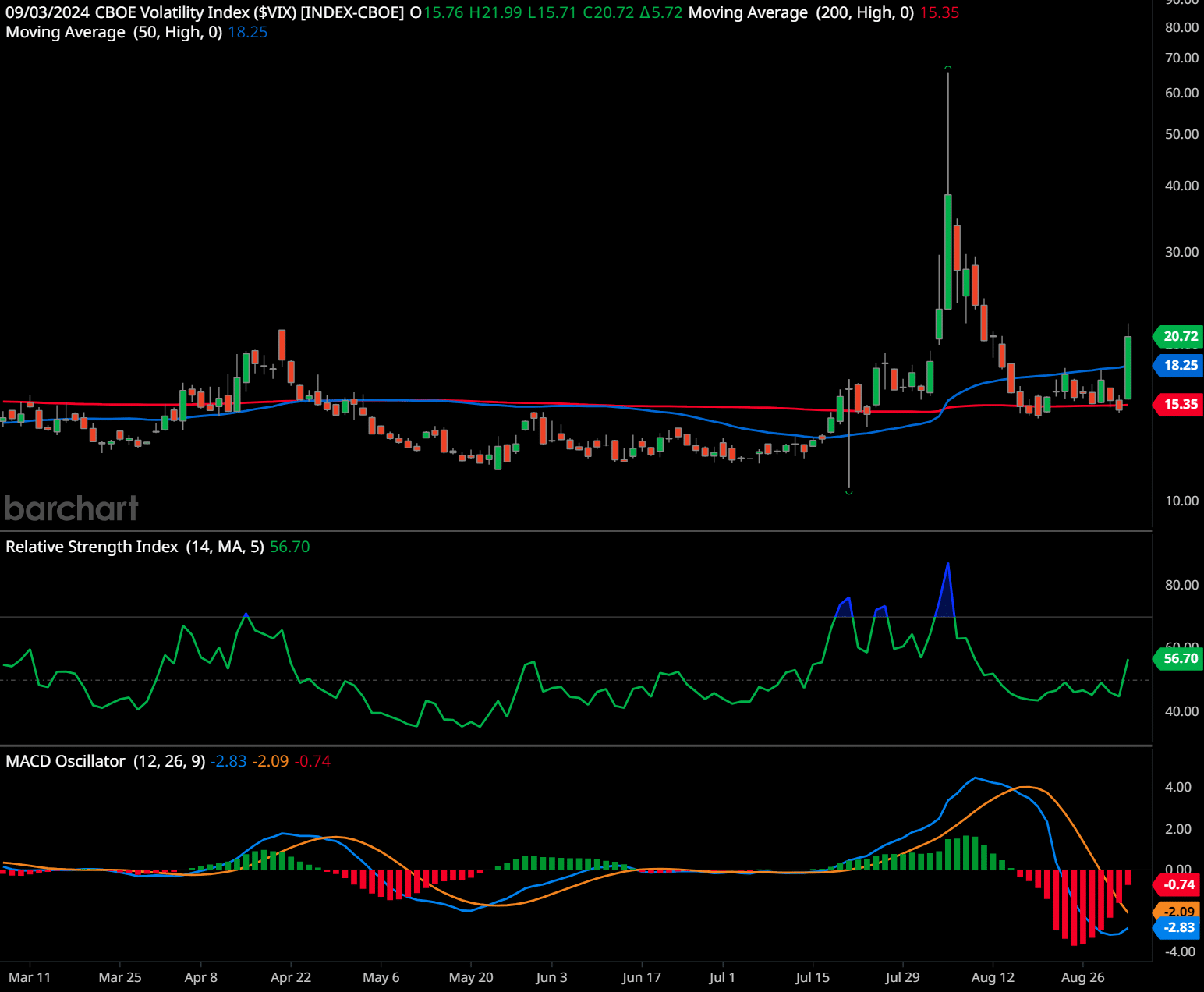

The chart displays the daily movement of the CBOE Volatility Index (VIX) with key technical indicators such as the Moving Averages, Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI), and MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More Oscillator.

Trend Analysis: The VIX recently experienced a sharp upward spike, reaching a high near 80 before retracing back to around 20.72, where it currently sits. The blue 50-day moving average is at 18.25, and the red 200-day moving average is at 15.35, indicating that the VIX is trading above both moving averages. This suggests bullish momentum, but recent price action shows some consolidation between 15 and 21, suggesting a period of indecision.

Support and Resistance Levels:

- Support Level: Around 15.35 (200-day moving average), and the recent low near 15.

- Resistance Level: Around 21, which coincides with the recent highs and is just above the 50-day moving average.

Relative Strength Index (RSI): The RSI is currently at 56.70, indicating moderate strength. It has bounced back from the oversold region, suggesting that bullish momentum might be returning but is not yet in overbought territory.

MACD Oscillator: The MACD line is crossing above the signal line, moving from negative to positive territory. The histogram shows a diminishing bearish momentum, which could indicate a potential bullish crossover.

Time-Frame Signals:

- 3-Month Outlook: Neutral to Bullish. The current price is consolidating above both moving averages, suggesting potential upward movement, but confirmation is needed with a breakout above the 21 resistance level.

- 6-Month Outlook: Neutral. The VIX has experienced volatility and could remain range-bound between 15 and 21 unless a significant market event triggers another spike in volatility.

- 12-Month Outlook: Neutral to Bearish. If the VIX remains below the 21 resistance level and dips below the 15.35 support level, it may signal a return to lower volatility levels.

The chart indicates that the VIX may have some short-term upside potential, especially if it breaks above the 21 resistance level. However, if it fails to break this level and drops below 15, a return to lower volatility is likely.

Past performance is not an indication of future results, and this article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead: Why Investors Should Follow These Developments

The spike in the VIX on September 3, 2024, underscores the importance of staying informed about market developments and economic indicators. The combination of a broad market selloff, weak economic data, seasonal volatility, and weakness in key sectors like technology all contributed to the rise in market uncertainty. For investors, understanding these dynamics is crucial for navigating periods of volatility and making informed investment decisions.

Companies like Nvidia and sectors such as technology play a pivotal role in shaping market sentiment. As such, their performance is closely watched by investors. Additionally, economic indicators like the ISM manufacturing index provide valuable insights into the broader economy, influencing market movements and investor behavior.

In times of increased volatility, the VIX becomes a critical tool for assessing market risk. By following the VIX and related market indicators, investors can better prepare for potential market shifts, ultimately helping them protect their portfolios and capitalize on opportunities during uncertain times.

- Nvidia just poured $160 million into Applied Digital Stock… and it skyrocketed 76% in a day! 🚀 - September 8, 2024

- Is Trump Media stock the next meme stock disaster? 📉 Find out why DJT stock is tanking! - September 8, 2024

- When was the last time a new drug humbled the world’s best? Summit Therapeutics Stock To Explode 🧬 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.