Investors are always on the lookout for stocks showing signs of upward momentum, especially those breaking above significant resistance levels. Recently, Alaska Air (ALK) has caught the attention of many as it surpasses a crucial resistance point. This development could mark an enticing opportunity for those seeking stocks in the early stages of an uptrend.

Alaska Airlines Expands Service to San Francisco Bay Area

Alaska Airlines is strengthening its presence in the vibrant San Francisco Bay Area by introducing convenient, nonstop flights between California’s renowned wine country and Las Vegas. Set to commence on October 1, 2024, this daily, year-round service from Charles M. Schulz-Sonoma County Airport marks the airline’s seventh nonstop destination from the region.

Enhanced Connectivity

With the addition of the Las Vegas route, Alaska Airlines is set to operate 13 peak day departures by fall, further bolstering its connectivity in the region. This comprehensive network includes nonstop services to key destinations such as Los Angeles, Burbank, Orange County, Seattle, Portland, San Diego, and now Las Vegas. The airline’s commitment to providing seamless travel options underscores its dedication to serving the needs of passengers in the San Francisco Bay Area.

Analysts Bullish on Alaska Air (ALK)

UBS has initiated coverage of Alaska Air (ALK) with a Buy rating and a price target of $54. The analyst’s optimism stems from the stock’s recent underperformance following the announcement of its deal with Hawaiian Holdings (HA). Despite this setback, the analyst views the current price levels as an attractive entry point for investors. According to the research note, the firm anticipates positive outcomes for Alaska Air, regardless of whether the deal proceeds or not.

Positive Industry Outlook

Looking ahead, UBS foresees several favorable industry dynamics that could propel Alaska Air’s growth over the next 12-18 months. These include improvements in revenue per available seat mile, a moderation in cost pressures, and an uptick in business travel. The firm believes that these factors collectively present a “solid 3:1 upside/downside reward” for investors at the current valuation.

ALK Technical Analysis

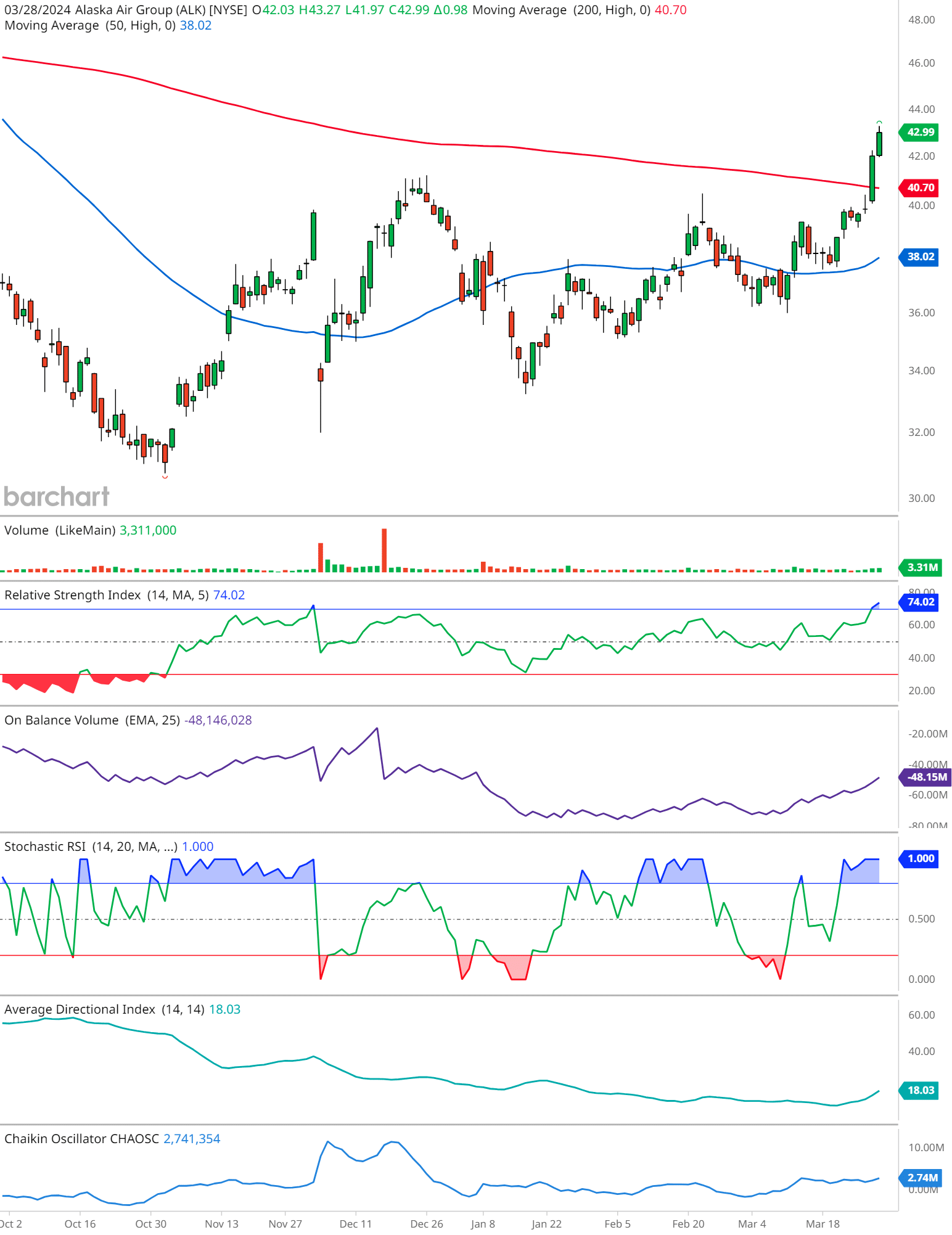

Price and Moving Averages: The stock closed at $42.99, with a significant upward move breaking through both the 50-day moving average (blue line) at $38.02 and the 200-day moving average (red line) at $40.70. This is typically a bullish signal.

Volume: The chart indicates a trading volume of 3.31 million shares, which is associated with the price movement, giving weight to the breakout.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is at 57.4, which suggests that the stock is neither overbought nor oversold.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV line is upward trending, indicating accumulation and a positive sign that buying pressure is supporting the price increase.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: The Stochastic RSI is around 1.00 for both K and D lines, signaling that the stock might be in an overbought territory, but it’s also indicative of strong momentum.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADI): The ADI value is 18.03, suggesting that the trend is not very strong. Generally, an ADI over 25 would indicate a strong trend.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: The Chaikin Oscillator is positive at 2,741,354, showing buying pressure, which can be considered bullish.

This chart analysis reflects a bullish breakout for ALK, supported by volume and buying pressure, although the trend’s strength (ADI) is not robust. RSI levels are neutral, but the Stochastic RSI hints at a potential short-term overbought condition.

Alaska Air’s breakout above a key resistance level and its strategic expansion efforts in the San Francisco Bay Area position it as a compelling choice for investors seeking early-stage uptrends. With analyst coverage indicating bullish sentiment and a positive industry outlook, Alaska Air (ALK) appears primed for potential growth in the coming months. As the airline continues to expand its route network and capitalize on emerging opportunities, it remains a stock worth watching for those looking to capitalize on evolving market trends.

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

- Nvidia just poured $160 million into Applied Digital Stock… and it skyrocketed 76% in a day! 🚀 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.