As the financial world eagerly anticipates the upcoming week, three bellwether companies, FedEx, Micron Technology, and Nike, are set to release their quarterly earnings reports. Each of these companies holds significant weight in their respective industries, and their performances will provide crucial insights into broader economic trends. This detailed preview will delve into the expected outcomes and key analyses for each of these industry giants.

FedEx: Navigating Through Challenges

FedEx is considered a bellwether company by investors due to its pivotal role in global logistics and transportation, which provides a comprehensive snapshot of economic activity. As a major player in shipping and delivery services, FedEx handles a vast volume of goods, enabling it to offer real-time insights into consumer demand, manufacturing output, and international trade. Its financial performance and shipping volumes are often seen as leading indicators of broader economic health, reflecting trends in commerce and supply chain efficiency. Consequently, FedEx’s earnings reports and forecasts are closely watched by investors to gauge economic momentum and potential shifts in market conditions.

FedEx (FDX) is poised to disclose its fiscal fourth-quarter results after the market closes on Tuesday. The logistics behemoth has had a tumultuous year, with its stock hitting a year-to-date high in March following an optimistic full-year outlook revision due to expense reductions. However, the road ahead appears challenging.

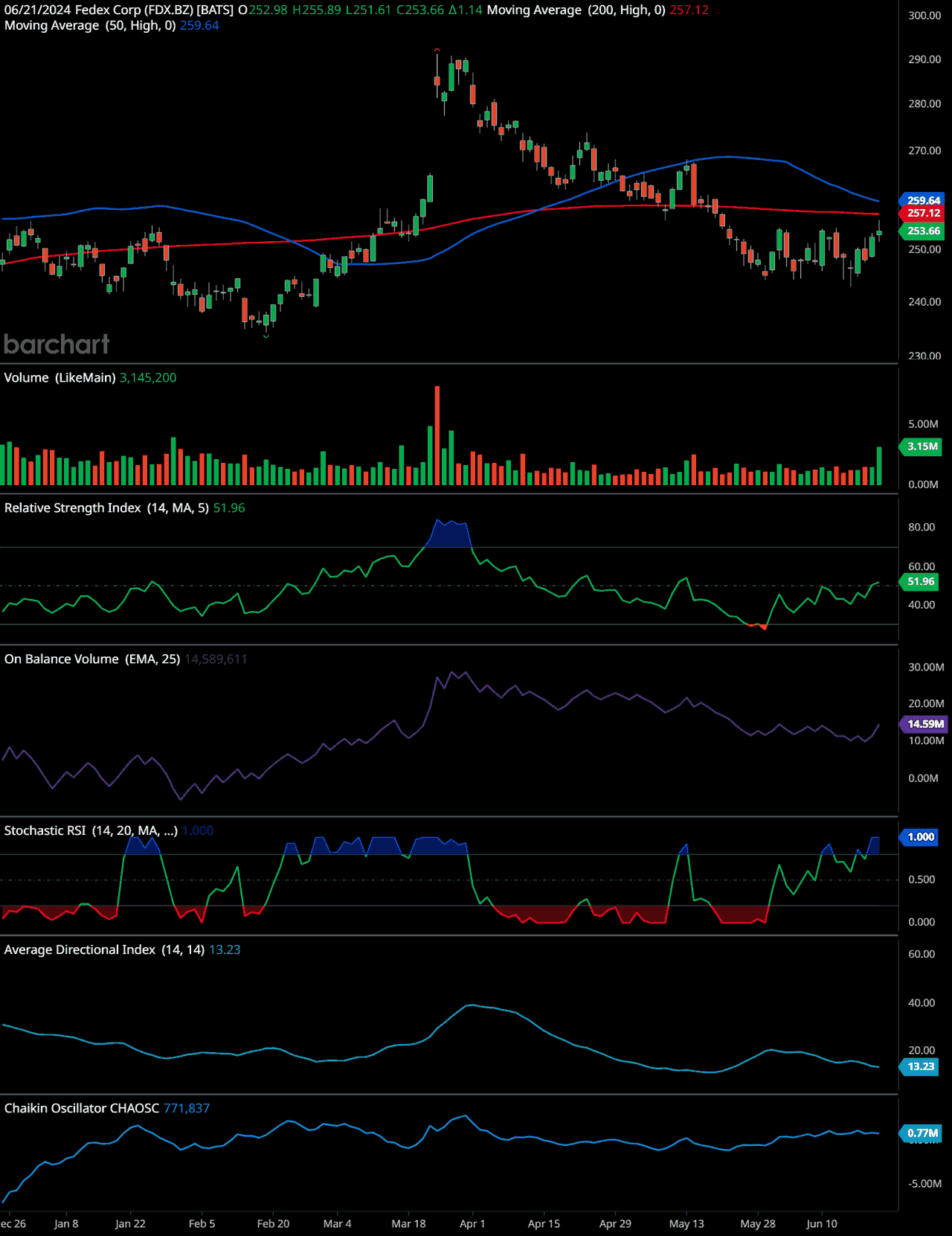

FDX Technical Analysis

Price and Moving Averages:

- The stock is currently trading at $253.66.

- The 50-day moving average (MA) is at $259.64, and the 200-day MA is at $257.12.

- The price is below the 50-day MA and slightly above the 200-day MA, indicating a potential struggle between short-term bearish sentiment and longer-term support.

Volume:

- The volume on the latest trading day is 3,145,200, showing an increase, which could indicate a rising interest in the stock, either for buying or selling.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI):

- The RSI is at 51.96, suggesting that the stock is in neutral territory, not overbought or oversold.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV):

- The OBV is trending upward at 14,589,611, which is a positive sign, indicating that volume on up days is higher than on down days. This can be a bullish indicator.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...:

- The Stochastic RSI is at 1.000, which is very high, suggesting that the stock might be overbought in the short term and could see a pullback.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX):

- The ADX is at 13.23, indicating a weak trend. A value below 20 suggests that the stock is not in a strong trend, whether upward or downward.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...:

- The Chaikin Oscillator is at 771,837, a positive value, which suggests that accumulation (buying pressure) is outweighing distribution (selling pressure).

Trend Analysis:

- The stock has been in a downtrend since peaking near $295 in March. There was a recent attempt to recover, but the price has struggled to break above the 50-day MA, indicating resistance.

Support and Resistance Levels:

- Immediate resistance is at the 50-day MA ($259.64).

- Further resistance is at recent highs around $270.

- Support is at the 200-day MA ($257.12) and recent lows around $245.

Time-Frame Signals:

- 3 Months: Hold. The stock is in a consolidation phase with weak trend strength and needs to break above the 50-day MA for a clearer upward movement.

- 6 Months: Hold. The indicators are mixed, with some positive signs like OBV and Chaikin Oscillator, but the overall trend is weak.

- 12 Months: Buy. If the stock manages to break above the 50-day MA and maintain above the 200-day MA, it could indicate a longer-term bullish trend, supported by increasing OBV.

Overall, the stock is showing signs of potential accumulation and recovery, but the weak trend and overbought Stochastic RSI suggest caution in the short term. A clear breakout above the 50-day MA would be a strong bullish signal.

Financial Expectations

UBS Global Research analyst Thomas Wadewitz, who rates the stock as Outperform (equivalent to Buy), highlights several headwinds that could temper the positive impact of FedEx’s cost-saving initiatives. Wadewitz points to lower airfreight prices and increased incentive pay as factors that might dampen FedEx’s financial performance.

For the fiscal fourth quarter, Wadewitz projects earnings per shareEarnings per share (EPS) is a fundamental financial metric that provides valuable insights into a company's profitability. This widely used indicator helps investors and analysts g... (EPS) to be $5.49, marking an 11.1% increase year-over-year (YoY). Industry analysts share a slightly more conservative view, anticipating earnings of $5.36 per share on revenue of $22.1 billion, a modest 0.7% YoY growth.

Market Reactions and Analyst Insights

Despite the challenges, FedEx remains a critical player in the logistics sector. The company’s ability to navigate through these obstacles while maintaining profitability will be closely scrutinized. Investors and analysts alike are keen to see how FedEx balances cost-saving measures with the operational challenges posed by the current economic environment.

Micron Technology: Riding the Semiconductor Wave

Micron Technology is considered a bellwether company by investors due to its significant influence in the semiconductor industry, particularly in the production of memory and storage solutions such as DRAM and NAND flash. As a key supplier to a diverse range of sectors, including computing, data centers, automotive, and mobile devices, Micron’s performance provides valuable insights into the health and trends of these markets. The company’s financial results, technological advancements, and demand forecasts are closely monitored as indicators of broader technological and economic trends. Additionally, Micron’s position in the supply chain makes it a critical gauge for understanding the impact of global supply and demand dynamics, trade policies, and innovation cycles in the tech industry.

Micron Technology (MU) has been a standout performer in the semiconductor sector, with its shares surging over 60% this year. The company is set to release its fiscal third-quarter earnings after the market closes on Wednesday. Wedbush analyst Matt Bryson, who also rates the stock as Outperform, sees further upside potential.

Financial Expectations

Bryson recently raised his price target for Micron to $170 from $130, suggesting an additional 22% upside from current levels. He attributes this optimism to the average selling price (ASP) for memory chips, which has exceeded expectations embedded in Micron’s guidance.

Analysts expect Micron to report earnings of 51 cents per share, a significant turnaround from the per-share loss of $1.43 in the same period last year. Revenue is forecasted to reach $6.7 billion, reflecting an impressive 77.6% YoY growth.

Market Reactions and Analyst Insights

Micron’s robust performance underscores the strength of the semiconductor market. As technology demand continues to grow, Micron’s ability to capitalize on this trend will be crucial. Investors will be particularly interested in the company’s guidance for the upcoming quarters, as it could signal continued strength or potential headwinds in the semiconductor industry.

MU Technical Analysis

Price and Moving Averages:

- The stock is currently trading at $139.54.

- The 50-day moving average (MA) is at $127.43, and the 200-day MA is at $94.90.

- The price is above both the 50-day and 200-day MAs, indicating a strong upward trend.

Volume:

- The volume on the latest trading day is 51,189,600, showing a significant increase, which indicates strong interest in the stock, likely driven by recent price movements.

Relative Strength Index (RSI):

- The RSI is at 56.09, suggesting that the stock is in neutral territory, not overbought or oversold, but leaning slightly towards overbought.

On Balance Volume (OBV):

- The OBV is at 199,142,295, indicating a consistent accumulation phase, as volume on up days is higher than on down days. This is a bullish signal.

Stochastic RSI:

- The Stochastic RSI is at 0.130, which is very low, suggesting that the stock might be oversold in the short term and could see a bounce back.

Average Directional Index (ADX):

- The ADX is at 32.63, indicating a strong trend. Values above 20 generally suggest a strong trend, whether upward or downward.

Chaikin Oscillator:

- The Chaikin Oscillator is at -1,792,758, a negative value, which suggests that distribution (selling pressure) is outweighing accumulation (buying pressure) in the short term.

Trend Analysis:

- The stock has been in a strong uptrend, with prices well above the 50-day and 200-day moving averages. However, there is a recent pullback, indicating potential short-term profit-taking or consolidation.

Support and Resistance Levels:

- Immediate resistance is at recent highs around $150.

- Support is at the 50-day MA ($127.43) and previous consolidation levels around $120.

Time-Frame Signals:

- 3 Months: Hold. The stock is in a strong uptrend, but recent pullback and negative Chaikin Oscillator suggest potential short-term volatility.

- 6 Months: Buy. The overall trend is strong, and the current pullback might present a good buying opportunity if the stock finds support at or above the 50-day MA.

- 12 Months: Buy. The strong trend supported by high OBV and a positive ADX suggests that the stock has long-term bullish potential.

Overall, Micron Technology is in a strong upward trend, with potential for continued growth. The recent pullback could be an opportunity for accumulation, provided that the stock maintains support above key moving averages.

Nike: Rebounding in a Challenging Market

Nike is considered a bellwether company by investors due to its dominant position in the global athletic footwear and apparel market, which makes it a reliable indicator of consumer spending and brand loyalty trends. As a leader in innovation, marketing, and global distribution, Nike’s sales performance and strategic initiatives offer critical insights into the health of the retail sector, shifting consumer preferences, and emerging market opportunities. The company’s ability to navigate economic fluctuations, leverage digital transformation, and capitalize on sports and fitness trends reflects broader economic conditions and consumer confidence. Consequently, Nike’s earnings reports and market strategies are closely watched by investors to gauge the overall direction of consumer behavior and retail market dynamics.

Nike (NKE) is the only Dow Jones stock reporting next week, with its fiscal fourth-quarter results set for release after the market closes on Thursday. The athletic apparel and footwear giant has faced numerous challenges but is poised for a potential rebound.

Financial Expectations

Analysts anticipate Nike to report earnings of 84 cents per share, a 27.3% increase YoY, on revenue of $12.9 billion, a slight 0.2% YoY growth. Oppenheimer analyst Brian Nagel upgraded Nike to Outperform (Buy) from Perform (Hold) and reinstated it as a “top mega-cap pick” ahead of its quarterly results.

Market Reactions and Analyst Insights

Nagel acknowledges the internal and external challenges Nike has faced in recent quarters, including supply chain disruptions and competitive pressures. However, he believes these issues are now priced into the stock. Nagel argues that Nike is “poised to rebound gradually,” driven by senior leadership’s efforts to refocus on product innovation and brand-building.

Nike’s ability to navigate through its challenges and capitalize on its strong brand presence will be key. Investors will be watching closely to see how the company’s strategic initiatives translate into financial performance.

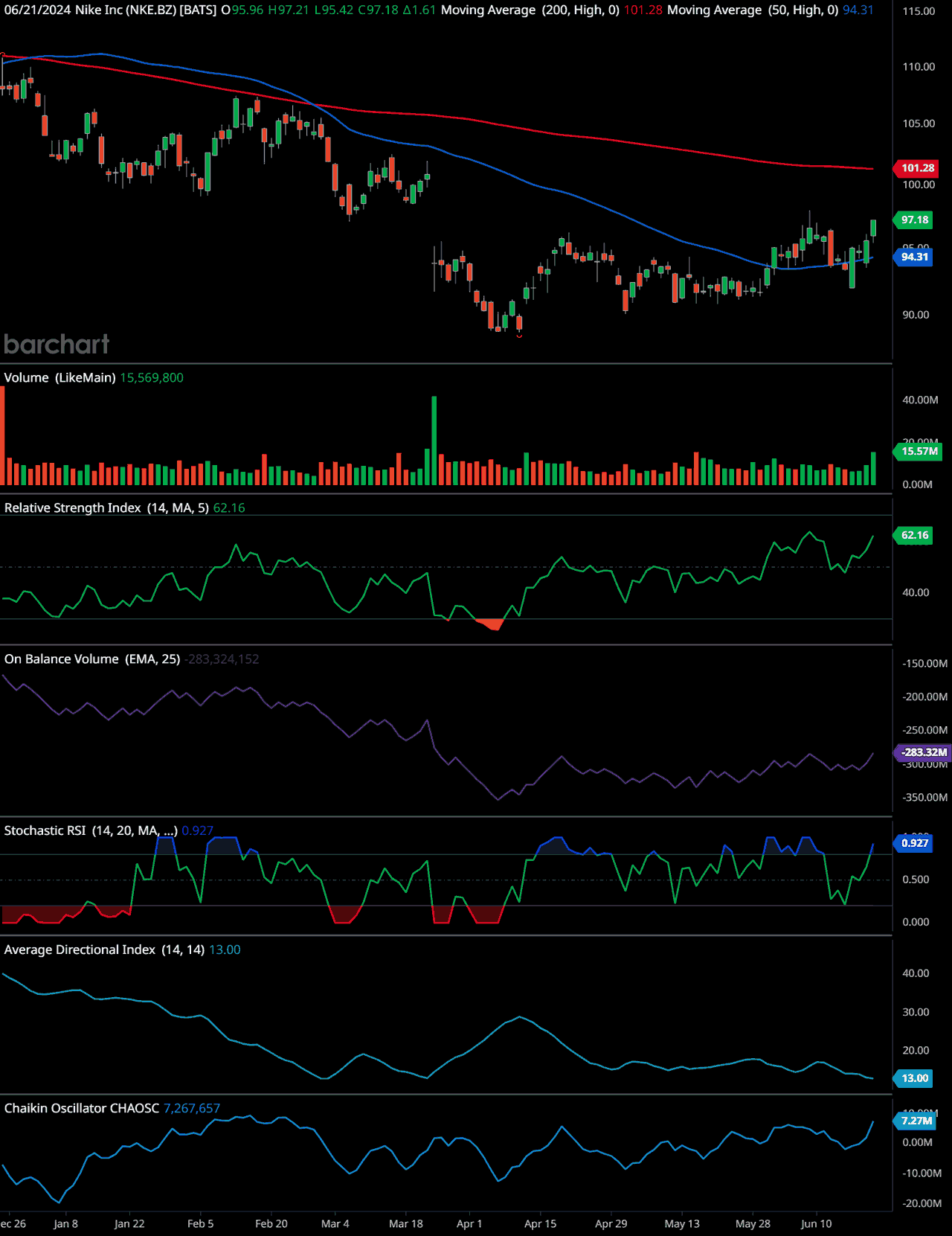

NKE Technical Analysis

Price and Moving Averages:

- The stock is currently trading at $97.18.

- The 50-day moving average (MA) is at $94.31, and the 200-day MA is at $101.28.

- The price is above the 50-day MA but below the 200-day MA, indicating a potential shift from bearish to bullish sentiment if the price can break above the 200-day MA.

Volume:

- The volume on the latest trading day is 15,569,800, showing a significant increase, which indicates strong interest in the stock, likely driven by recent price movements.

Relative Strength Index (RSI):

- The RSI is at 62.16, suggesting that the stock is nearing overbought territory but is still in a bullish momentum.

On Balance Volume (OBV):

- The OBV is at 283,324,152, indicating a consistent accumulation phase, as volume on up days is higher than on down days. This is a bullish signal.

Stochastic RSI:

- The Stochastic RSI is at 0.927, which is high, suggesting that the stock might be nearing overbought conditions in the short term and could see a pullback.

Average Directional Index (ADX):

- The ADX is at 13.00, indicating a weak trend. A value below 20 suggests that the stock is not in a strong trend, whether upward or downward.

Chaikin Oscillator:

- The Chaikin Oscillator is at 7,267,657, a positive value, which suggests that accumulation (buying pressure) is outweighing distribution (selling pressure).

Trend Analysis:

- The stock has been in a downtrend since peaking near $110 in March. However, recent price action shows a recovery, with the stock breaking above the 50-day MA, indicating potential bullish momentum.

Support and Resistance Levels:

- Immediate resistance is at the 200-day MA ($101.28).

- Support is at the 50-day MA ($94.31) and recent lows around $90.

Time-Frame Signals:

- 3 Months: Hold. The stock is showing signs of recovery, but the weak ADX and high Stochastic RSI suggest potential short-term volatility.

- 6 Months: Buy. If the stock can break above the 200-day MA and sustain its upward momentum, it could signal a stronger bullish trend.

- 12 Months: Buy. The overall trend shows potential for recovery and growth, supported by positive OBV and Chaikin Oscillator.

Overall, Nike Inc is showing signs of recovery with potential for continued growth. The recent increase in volume and break above the 50-day MA are positive signals, but the stock needs to break above the 200-day MA to confirm a stronger bullish trend.

Keep in mind that past performance does not indicate future outcomes. It’s essential to do your own research and consider speaking with a financial advisor before making any investment decisions. 🧡

Looking Ahead

The upcoming earnings reports from FedEx, Micron Technology, and Nike will provide valuable insights into the logistics, semiconductor, and athletic apparel industries. Each company’s performance will be a bellwether for broader economic trends, offering investors a glimpse into the future direction of these critical sectors. As the market eagerly awaits these reports, the financial world will be keenly focused on the detailed outcomes and forward guidance provided by these industry giants.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.