The latest news on Coinbase Global (COIN) stock has excited investors due to several key developments. Coinbase stock has seen a remarkable 180.18% return over the past year, significantly outperforming the S&P 500’s 26.69% return.

Positive analyst sentiment highlights growth potential, profitability, and the benefits of increased blockchain adoption.

Coinbase is diversifying its offerings and solidifying its market leadership in the cryptocurrency space.

Investors are eagerly awaiting the upcoming earnings report on August 1, 2024, which could further boost confidence.

The cryptocurrency market is projected to grow significantly, with various forecasts predicting substantial increases in market size and revenue over the coming years. This anticipated growth is driven by the increasing adoption of digital assets, demand for operational efficiency in financial systems, and rising interest in blockchain technology.

Positive Analyst Sentiment

The optimism surrounding Coinbase is not just limited to its stock performance; it is also echoed by several analysts who are bullish on the company’s future prospects. The positive sentiment stems from multiple factors that suggest a bright future for Coinbase.

Growth Potential

Analysts believe that Coinbase is poised for continued growth. Despite its recent successes, there is a consensus that the company still has significant room for expansion. This growth potential is driven by the increasing mainstream adoption of cryptocurrencies and blockchain technology.

Profitability

Coinbase’s profitability is another critical factor contributing to its appeal. The company has demonstrated remarkable growth in its financial performance, which makes it an attractive investment option. This profitability, coupled with its strong market position, enhances its overall investment appeal.

Blockchain Adoption

Recent developments in blockchain technology have made it more accessible and user-friendly. As a major player in the cryptocurrency space, Coinbase stands to benefit significantly from these advancements. The easier use of blockchain technology is expected to drive more users to Coinbase’s platform, thereby boosting its growth.

Expanding Ecosystem

Coinbase continues to diversify its offerings, thereby strengthening its position in the crypto market. The company provides a range of services, including secure bitcoin wallets, trading platforms, and other crypto-related products. This expanding ecosystem not only enhances the user experience but also solidifies Coinbase’s market leadership.

Market Leadership

As one of the most prominent cryptocurrency exchanges, Coinbase is well-positioned to benefit from the growing mainstream adoption of digital assets. Its market leadership is a testament to its ability to innovate and adapt in the rapidly evolving cryptocurrency landscape.

Anticipation of Upcoming Earnings

Investors are eagerly awaiting Coinbase’s next earnings report, scheduled for August 1, 2024. Strong financial results could further boost investor confidence and drive the stock price higher. The anticipation of these earnings underscores the market’s optimism about Coinbase’s future performance.

Crypto Market Dynamics

The overall performance of the cryptocurrency market and regulatory developments play a crucial role in influencing Coinbase’s stock. Positive trends in the crypto market or regulatory clarity can significantly impact Coinbase’s fortunes. Investors are closely watching these dynamics, as any favorable developments could further enhance Coinbase’s growth prospects.

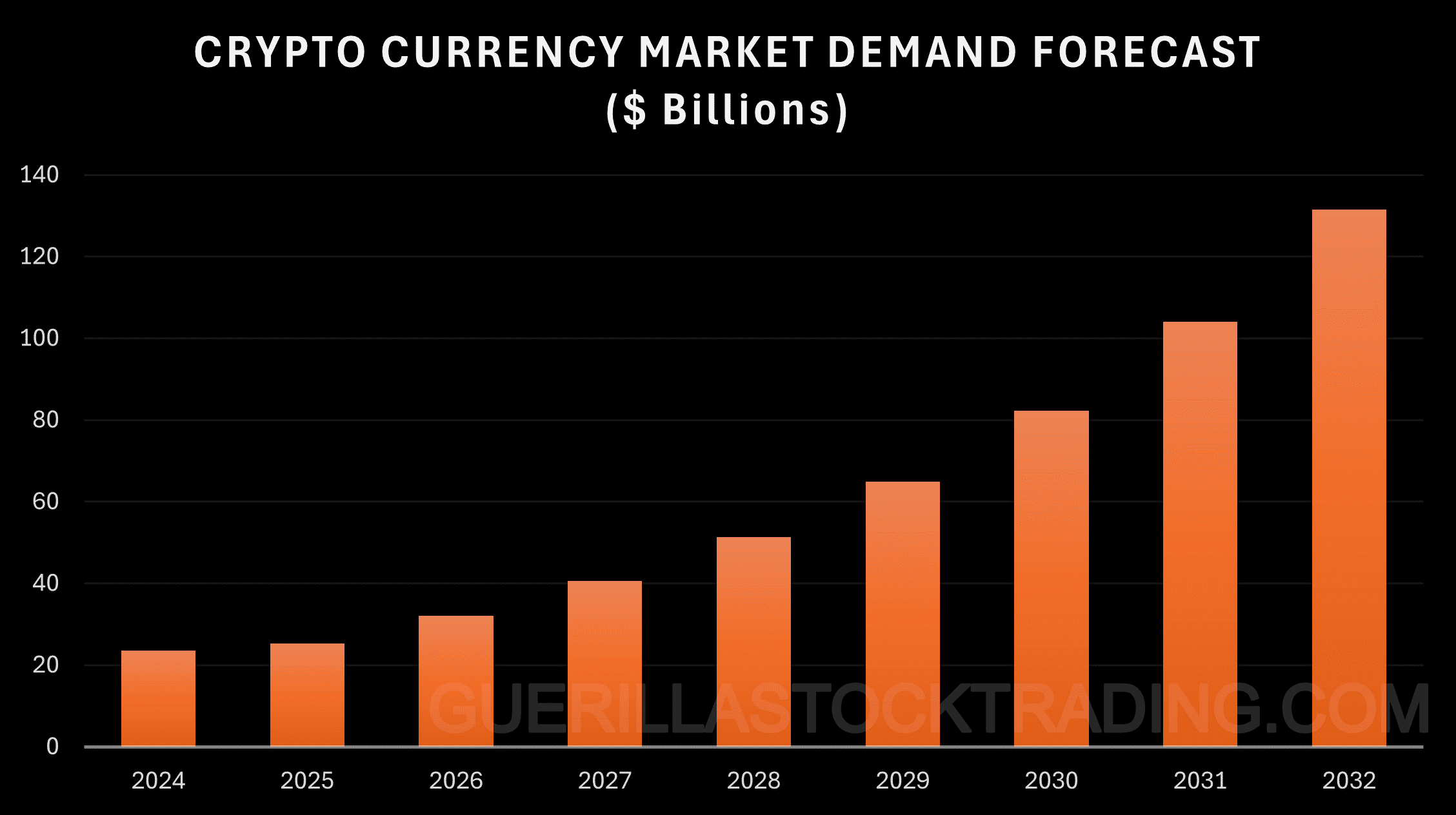

Cryptocurrency Market Demand Forecasts

The excitement around Coinbase is also bolstered by positive forecasts for the cryptocurrency market. Several projections highlight the significant growth expected in the coming years:

- The global cryptocurrency market is projected to reach $131.5 billion by 2032, growing at a CAGRThe world of finance is replete with complex concepts, but one that stands as a cornerstone for investors seeking to gauge returns is the Compound Annual Growth Rate (CAGR). Often ... of 7.77% from 2024 to 2032.

- Another forecast estimates the market will reach $11.71 billion by 2030, growing at a CAGR of 12.5% from 2023 to 2030.

- A more conservative estimate projects the market to reach $2.2 billion by 2026, growing at a CAGR of 7.1% during the forecast period.

- One source estimates the market size will reach $1,902.5 million in 2028, exhibiting a CAGR of 11.1% during 2021-2028.

- Revenue in the cryptocurrencies market is projected to reach $51.5 billion in 2024, with an expected annual growth rate (CAGR 2024-2028) of 8.62%.

While there are variations in the specific projections, the overall trend points to continued expansion of the cryptocurrency market. This growth is driven by factors such as increasing adoption of digital assets, growing demand for operational efficiency in financial systems, and rising interest in blockchain technology.

Insights

- Coinbase’s stock performance significantly outpaces the S&P 500.

- Analysts are optimistic about Coinbase’s growth and profitability.

- Blockchain adoption is simplifying, benefiting major players like Coinbase.

- Investors anticipate positive outcomes from the upcoming earnings report.

- The cryptocurrency market is projected to grow substantially.

The Essence (80/20)The Origins and Evolution of the 80/20 Principle The Discovery by Vilfredo Pareto In 1897, Italian economist Vilfredo Pareto uncovered a striking pattern in his study of wealth and...

Core Topics:

- Stock Performance: Coinbase’s stock has shown exceptional growth, returning 180.18% over the past year.

- Analyst Sentiment: Analysts are bullish, citing growth potential, profitability, and market leadership.

- Blockchain Adoption: Simplified blockchain technology is advantageous for Coinbase.

- Ecosystem Expansion: Diversified offerings in secure wallets and trading platforms.

- Market Projections: The cryptocurrency market is expected to grow significantly, with various forecasts projecting substantial increases in market size.

The Guerilla Stock Trading Action Plan

- Monitor Stock Performance: Regularly track Coinbase’s stock to capitalize on its growth trend.

- Analyze Earnings Reports: Pay close attention to the earnings report on August 1, 2024, for investment decisions.

- Stay Informed on Blockchain Developments: Keep up with blockchain advancements that could benefit Coinbase.

- Evaluate Market Trends: Assess broader cryptocurrency market trends to understand Coinbase’s potential.

- Diversify Investments: Consider other crypto-related investments to balance the portfolio.

Blind Spots

Potential Regulatory Risks: While the overall outlook is positive, regulatory developments could impact Coinbase’s operations and stock performance. Investors should stay informed about any regulatory changes in the cryptocurrency space.

Market Volatility: Cryptocurrency markets are known for their high volatility. Sudden changes in the value of cryptocurrencies can significantly impact Coinbase’s revenue and stock performance, posing a risk to investors relying on stable returns.

Technological Risks: While blockchain technology is advancing, it is still relatively new and evolving. Potential technical issues, security breaches, or failures in blockchain infrastructure could disrupt Coinbase’s operations and erode investor confidence.

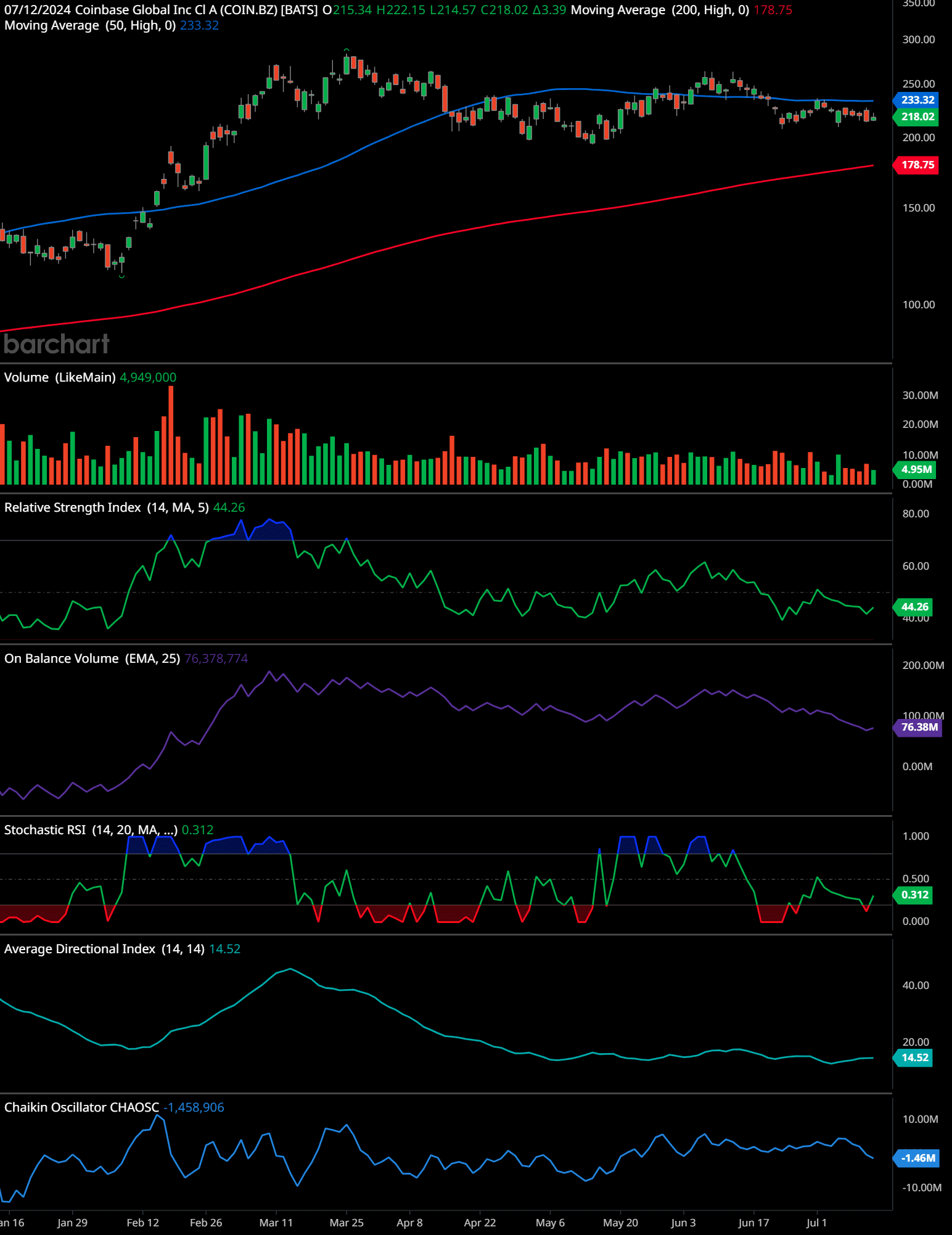

COIN Technical Analysis

The chart for Coinbase Global Inc (COIN) shows the stock price is currently $218.02 as of July 14, 2024. The chart presents the following observations:

Moving Averages: The 50-day moving average (blue line) is at $233.32, while the 200-day moving average (red line) is at $178.75. The stock price is below the 50-day MA, indicating short-term bearish sentiment, but above the 200-day MA, suggesting long-term bullish potential.

Volume: The trading volume appears relatively stable, with occasional spikes. The most recent volume is around 4.95M.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is at 44.26, which is below the midpoint of 50. This suggests that the stock is neither overbought nor oversold but leaning towards bearish sentiment.

On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV is declining, indicating that volume on down days is outweighing volume on up days. This is typically a bearish signal.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: The Stochastic RSI is at 0.312, which is on the lower side, suggesting that the stock may be oversold and could experience a potential rebound.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX): The ADX is at 14.52, which is relatively low. This indicates a weak trend strength, suggesting that the stock may not have a strong directional movement currently.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: The Chaikin Oscillator is at -1.46M, indicating bearish momentum as the oscillator is negative.

Time-Frame Signals:

- 3-Month Horizon: Hold. The stock shows signs of short-term bearishness, but there could be potential for a rebound given the oversold Stochastic RSI.

- 6-Month Horizon: Hold. With the stock above the 200-day MA, long-term bullishness is intact, but short-term indicators suggest caution.

- 12-Month Horizon: Buy. The long-term perspective remains positive with the price above the 200-day MA and potential for a trend reversal.

Past performance is not an indication of future results. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

Coinbase Global’s impressive stock performance, positive analyst sentiment, and the favorable outlook for the cryptocurrency market have created a sense of excitement among investors. As the company continues to innovate and expand its offerings, it is well-positioned to capitalize on the growing mainstream adoption of digital assets. With strong growth potential, profitability, and a leadership position in the crypto space, Coinbase stands out as a promising investment in the rapidly evolving cryptocurrency and blockchain sector.

Coinbase Global (COIN) Stock FAQ

1. How has Coinbase stock performed over the past year?

Coinbase stock has shown remarkable growth, with a 180.18% return over the past year, significantly outperforming the S&P 500’s 26.69% return during the same period.

2. What is the sentiment of analysts towards Coinbase stock?

Several analysts are bullish on Coinbase, citing multiple reasons to be optimistic about the stock’s future, including its growth potential, profitability, and the expanding ecosystem.

3. Why do analysts believe Coinbase has growth potential?

Analysts believe that Coinbase still has substantial room for growth, suggesting that its recent success may be just the beginning.

4. How profitable is Coinbase?

Coinbase is experiencing remarkable growth and profitability, making it an attractive investment option.

5. How does blockchain adoption benefit Coinbase?

Recent developments have made blockchain easier to use, which could benefit Coinbase as a major player in the cryptocurrency space.

6. What services does Coinbase offer?

Coinbase offers a variety of services including secure bitcoin wallets, trading platforms, and other crypto-related products, which help diversify its offerings and strengthen its market position.

7. What is Coinbase’s position in the cryptocurrency market?

As one of the most prominent cryptocurrency exchanges, Coinbase is well-positioned to benefit from the growing mainstream adoption of digital assets.

8. When is Coinbase’s next earnings report?

Investors are anticipating Coinbase’s next earnings report, scheduled for August 1, 2024. Strong financial results could further boost investor confidence.

9. How do crypto market dynamics affect Coinbase’s stock?

The overall cryptocurrency market’s performance and regulatory developments can significantly impact Coinbase’s stock. Any positive trends or regulatory clarity in the crypto space could be seen as beneficial for Coinbase.

10. What is the projected growth of the global cryptocurrency market by 2029?

The global cryptocurrency market is projected to reach $64.41 billion by 2029, growing at a CAGR of 7.77% from 2024 to 2029.

11. What are the projections for the cryptocurrency market by 2030?

One forecast estimates the market will reach $11.71 billion by 2030, growing at a CAGR of 12.5% from 2023 to 2030.

12. What is the conservative estimate for the cryptocurrency market by 2026?

A more conservative estimate projects the market to reach $2.2 billion by 2026, growing at a CAGR of 7.1% during the forecast period.

13. What is the estimated market size for cryptocurrencies by 2028?

One source estimates the market size will reach $1,902.5 million in 2028, exhibiting a CAGR of 11.1% during 2021-2028.

14. What are the revenue projections for the cryptocurrencies market in 2024?

Revenue in the cryptocurrencies market is projected to reach $51.5 billion in 2024, with an expected annual growth rate (CAGR 2024-2028) of 8.62%.

15. What are the key drivers for the growth of the cryptocurrency market?

The overall trend points to continued expansion of the cryptocurrency market, driven by factors such as increasing adoption of digital assets, growing demand for operational efficiency in financial systems, and rising interest in blockchain technology.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.