In a move that promises to revolutionize the landscape of cloud and artificial intelligence solutions, Oracle and Palantir have announced a groundbreaking partnership. This collaboration aims to deliver secure cloud and AI solutions tailored to the needs of businesses and governments worldwide. By combining Oracle’s distributed cloud infrastructure with Palantir’s leading AI and decision acceleration platforms, the partnership seeks to unlock the full potential of data, driving efficiency, sovereignty compliance, and competitive advantage.

The Partnership: A Strategic Alliance for Innovation

Under the terms of the agreement, Palantir will transition Foundry workloads to Oracle Cloud Infrastructure. Additionally, Palantir’s Gotham and AI Platforms will be made deployable across Oracle’s distributed cloud, encompassing public cloud regions, dedicated regions, and specialized offerings such as Oracle Alloy and Oracle EU Sovereign Cloud. This strategic alignment will enable organizations to leverage Palantir’s advanced platforms for data integration and decision-making within Oracle’s expansive cloud ecosystem.

Breaking Boundaries: Uniting Cloud and AI

With Oracle’s unparalleled cloud footprint and sovereign AI capabilities, the partnership promises to eliminate the traditional trade-off between innovation and compliance. Rand Waldron, Vice President at Oracle, emphasizes the company’s unique position as the only hyperscaler capable of delivering comprehensive AI and cloud solutions globally. By integrating Oracle’s performance, scalability, and flexibility with Palantir’s data and AI prowess, customers across industries stand to gain a decisive competitive edge.

A Shared Vision: Safeguarding Western Interests

Both Oracle and Palantir are committed to safeguarding Western interests and institutions worldwide. Josh Harris, Executive Vice President at Palantir, underscores Oracle Cloud Infrastructure’s ability to meet the stringent regulatory, performance, and security requirements of global clients. By leveraging Oracle’s infrastructure, Palantir aims to amplify its impact and enable clients to fully harness the benefits of cloud and AI technologies.

Unrivaled Capabilities: Cloud Services for Every Environment

Oracle Cloud Infrastructure offers a comprehensive suite of over 100 cloud services and applications, including cutting-edge innovations in generative AI. Whether in commercial, sovereign, or government air-gapped environments, Oracle’s cloud services provide consistent performance and pricing, simplifying deployment and management for organizations of all sizes.

Palantir AI Platform: Transforming Decision-Making

Palantir’s Artificial Intelligence Platform (AIP) empowers organizations to harness the power of large language models securely within their networks and operations. By seamlessly integrating disparate data sources and systems, Palantir’s platform enables a unified view of critical information, enhancing decision-making at scale. Oracle’s AI strategy complements Palantir’s capabilities, extending generative AI services and infrastructure to accelerate decision-making processes further.

Joint Endeavors: Advancing Defense Industry Capabilities

Oracle and Palantir will collaborate to sell and support cloud and AI services across government and commercial sectors. With Oracle’s extensive experience in defense and intelligence, coupled with Palantir’s cutting-edge technologies, the partnership promises to deliver powerful capabilities to the defense industry. Together, they are poised to drive innovation and address the evolving challenges faced by high-stakes missions.

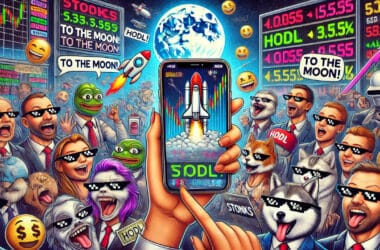

PLTR Technical Analysis

The 50-day moving average is at $23.48, above the closing price, suggesting a bearish signal in the short term. The 200-day moving average is at $18.72, which is well below the current price, indicating a bullish trend over the longer term.

The volume for the day was relatively low at 12,877 shares, which might indicate less trading activity and potentially less confidence in the direction of the price movement.

The Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI) is at 41.01, indicating that the stock is neither overbought nor oversold at the moment.

The On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV) shows a number of 253,493,845, which can suggest the general trend in volume flow and potentially the interest in the asset.

The Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... is registering 0.000, which typically indicates oversold conditions. However, this could also point to strong bearish momentum if the reading is consistent.

The Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX) stands at 16.18, indicating a weak trend. This suggests that the stock is in a consolidation phase or that the trend is not strong either way.

The Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... is at -34,449,953. A negative value in the Chaikin Oscillator can indicate selling pressure.

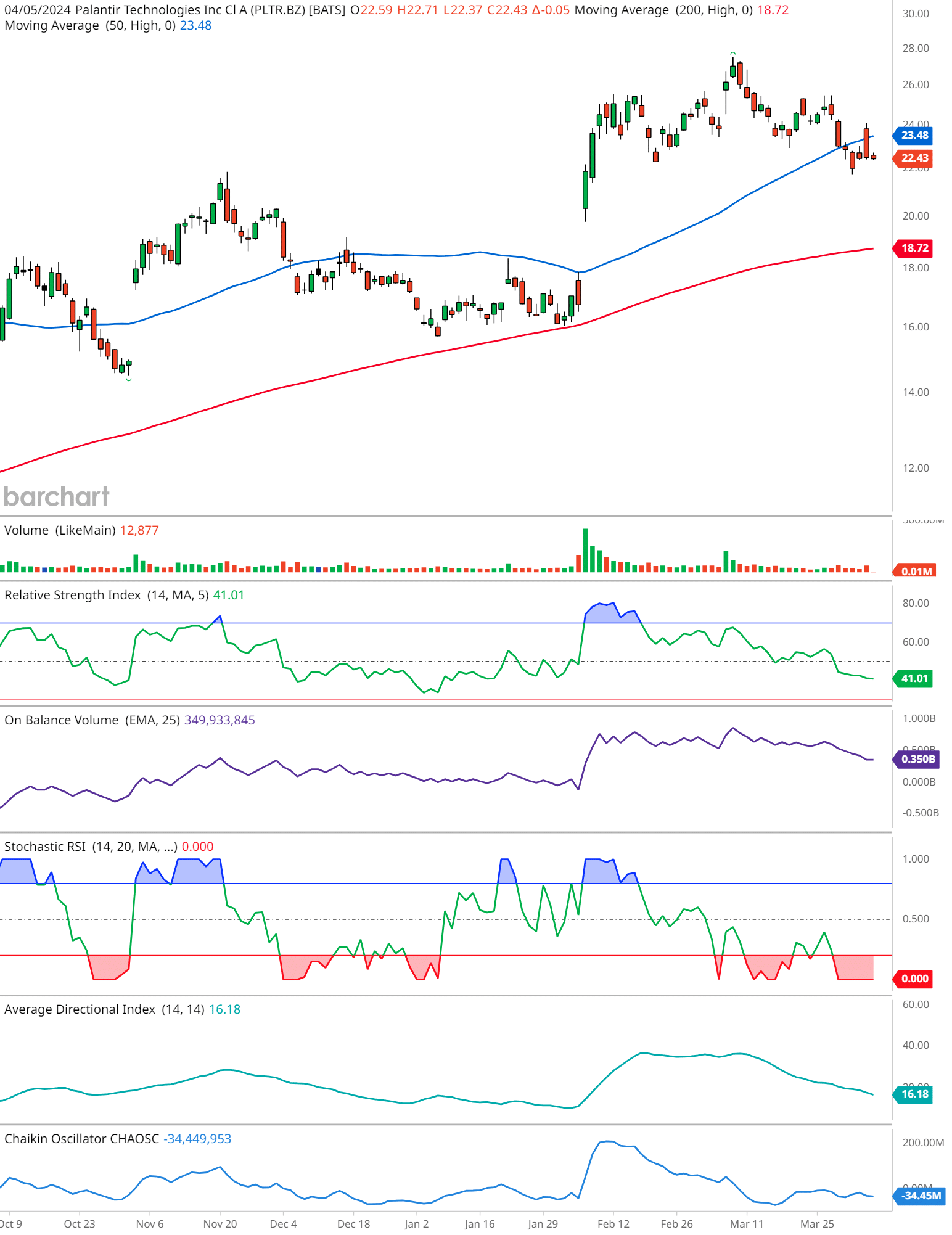

ORCL Technical Analysis

The 50-day moving average is positioned at $119.21, which is lower than the closing price, indicating a bullish trend in the short term.

The 200-day moving average is at $114.72, also below the closing price, suggesting a longer-term bullish trend.

Trading volume was exceptionally low at 67 shares, which may not provide a strong indication of market consensus.

The Relative Strength Index (RSI) is at 56.45, which indicates that the stock is neither overbought nor oversold.

On Balance Volume (OBV) is at 256,909,807, and it’s an indicator that tracks cumulative buying and selling pressure.

The Stochastic RSI is showing a figure of 0.255, indicating that the stock is neither overbought nor oversold but may be heading towards a trend reversal or a continuation pattern.

The Average Directional Index (ADX) reads 27.32, suggesting a somewhat strong trend. The value indicates that the current trend (up or down) is established and likely to continue.

The Chaikin Oscillator is at -3,384,852, which suggests there may be a decrease in buying pressure or an increase in selling pressure for the stock.

In conclusion, the partnership between Oracle and Palantir represents a significant milestone in the evolution of cloud and AI solutions. By merging their expertise and resources, these industry leaders are poised to redefine the boundaries of innovation, empowering organizations to thrive in a rapidly evolving digital landscape. As businesses and governments navigate complex challenges, the collaboration between Oracle and Palantir offers a beacon of hope, promising a future where technology serves as a catalystA stock catalyst is an engine that will drive your stock either up or down. A catalyst could be news of a new contract, SEC filings, earnings and revenue beats, merger and acquisit... More for progress and prosperity.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.