Palantir Technologies reported a strong start to 2024 in their Q1 earnings call, highlighting a 21% year-over-year revenue increase to $634 million. This growth is driven by the adoption of their AI platform, AIP (Artificial Intelligence Platform), particularly in the U.S. commercial sector, which saw a 68% revenue increase and added 41 new customers. Palantir’s U.S. Government business also showed notable growth, including a $178 million contract with the U.S. Army under the Titan program. The company’s strategic expansion efforts, including intensive boot camps, have significantly shortened deal cycles, exemplified by rapid conversions of trial engagements into major contracts. Palantir expects to maintain strong unit economics and high throughput, continuing its trajectory of accelerated business growth.

Palantir’s Artificial Intelligence Platform, also referred to as AIP, brings capabilities powered by large language models (LLMs) to various Foundry applications.

Palantir Awarded Contract for TITAN Ground Station Prototypes

The Army Contracting Command – Aberdeen Proving Ground (ACC-APG) disclosed on March 6, 2024, that Palantir Inc. has been selected to undertake Phase 3 of the Other Transaction Agreement (OTA) for the development and delivery of Tactical Intelligence Targeting Access Node (TITAN) ground station prototypes. The OTA is valued at $178.4 million and includes the creation of 10 TITAN prototypes, split into five Advanced and five Basic variants. Additionally, this phase involves integrating new critical technologies, facilitated by an OTA agreement which enables the Army to utilize innovative solutions from non-traditional defense contractors.

During the competitive prototyping stage, Palantir emerged as the preferred vendor by meeting the Army’s operational needs and integrating feedback obtained from Soldier Touch Points into their TITAN Advanced prototype. The prototypes underwent rigorous evaluation in a capstone demonstration which underscored Palantir’s capability to meet the specific requirements laid out in the competition. This award follows their successful demonstration and understanding of the project’s needs.

TITAN represents a significant leap forward in the Army’s Intelligence, Surveillance, and Reconnaissance capabilities. Incorporating Artificial Intelligence and Machine Learning, TITAN is designed to swiftly process and analyze data from diverse sensors spanning Space, High Altitude, Aerial, and Terrestrial layers. This technology is pivotal in providing enhanced intelligence support, which is crucial for targeting, situational awareness, and facilitating Multi-Domain Operations. By reducing the time from sensor detection to engagement, TITAN aims to deliver a substantial strategic advantage on the battlefield.

Insights

- Palantir’s AIP is significantly impacting enterprise AI adoption, leading to rapid customer and revenue growth.

- Strategic government contracts are bolstering Palantir’s market position and revenue streams.

- The company’s innovative boot camps are effectively shortening deal cycles and boosting customer acquisition.

- Palantir’s focus on expanding both new and existing customer engagements is evident in their aggressive growth strategy.

The Essence (80/20)

Palantir’s core business strategy revolves around leveraging its AIP technology to transform and accelerate enterprise and government operations. This strategy has resulted in significant revenue growth, particularly in the U.S. commercial sector. The company is also capitalizing on government contracts, where it is becoming increasingly entrenched as a critical operational tool.

The Action Plan

To capitalize on its current momentum, Palantir should continue to expand its boot camp programs to attract more customers rapidly. It should also focus on deepening relationships with existing customers to expand their use of AIP. Strategic investments in marketing and customer success teams could further accelerate adoption and customer satisfaction. Lastly, exploring new markets and sectors where AIP can be applied could provide new growth avenues.

Blind Spot

While the focus on AIP and government contracts is strong, there may be an underestimation of potential challenges in international markets, especially given the economic headwinds in Europe. Additionally, over-reliance on U.S. commercial and government sectors might limit diversification and expose the company to sector-specific downturns.

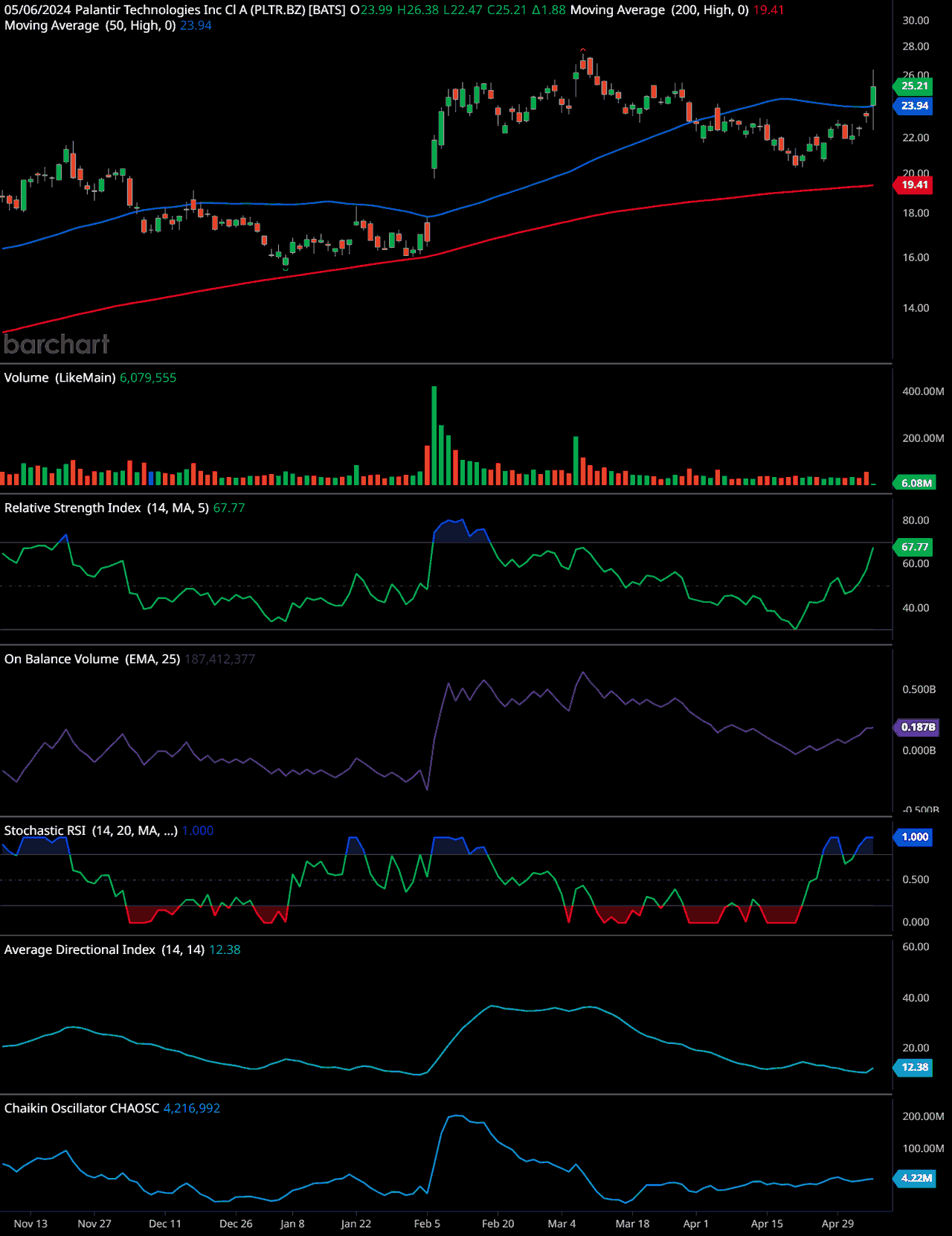

Palantir (PLTR) Technical Analysis

- Price and Moving Averages: The chart depicts the stock price along with the 50-day (blue line) and 200-day (red line) moving averages. The stock price recently crossed above the 50-day moving average, which can be considered a bullish signal. The 200-day moving average remains above the current price, indicating that the stock is still in a long-term downtrend but may be attempting to reverse.

- Volume: There’s a noticeable increase in trading volume coinciding with the price increase, suggesting strong buying interest. This is a positive sign as higher volume during an upward price movement typically confirms the trend.

- Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is currently around 67.77, which is near the upper boundary of the neutral range (70). An RSI above 70 might indicate that the stock is becoming overbought, which could lead to a potential pullback or stabilization in price.

- On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV line is trending upwards, which aligns with the increase in price. This indicates that volume is confirming the price trend, suggesting continued buyer interest.

- Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: This indicator is in the overbought zone, which typically suggests that the stock might be due for a correction or consolidation in the near term, as it indicates that the price has risen too quickly.

- Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX): The ADX value is relatively low at 12.38, indicating that the current trend is weak or the market is ranging. This suggests that while there are bullish signs, the overall trend strength is not very strong, cautioning against overly aggressive positions based on the current data.

- Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: This indicator is above zero, which generally indicates buying pressure. This complements the bullish signals from volume and OBV.

Overall, while there are multiple bullish indicators such as price movement above the 50-day moving average, strong volume, and positive OBV and Chaikin Oscillator readings, caution is advised due to the overbought conditions shown in the Stochastic RSI and the weak trend strength indicated by the ADX. This analysis provides a snapshot of current conditions, which are subject to change as new market data becomes available. Remember, past performance is not an indication of future results, and it’s important to conduct your own research before making investment decisions.

FAQ: Palantir Technologies Q1 2024 Earnings Call

-

What were the key highlights from Palantir Technologies’ Q1 2024 earnings call?

Palantir Technologies reported a 21% year-over-year revenue increase to $634 million, primarily driven by the adoption of their AI platform, AIP, especially in the U.S. commercial sector which saw a 68% revenue increase.

-

How is Palantir’s U.S. Government business performing?

Palantir’s U.S. Government business has shown notable growth, including a $178 million contract with the U.S. Army under the Titan program.

-

What are Palantir’s strategic efforts for business growth?

Palantir has implemented intensive boot camps which have significantly shortened deal cycles and exemplified by rapid conversions of trial engagements into major contracts.

-

What is TITAN and how is Palantir involved?

Palantir has been selected to develop and deliver TITAN ground station prototypes under a $178.4 million Other Transaction Agreement with the U.S. Army, aimed at enhancing the Army’s Intelligence, Surveillance, and Reconnaissance capabilities.

-

What is Palantir’s long-term business strategy?

Palantir’s business strategy revolves around leveraging its AIP technology to transform and accelerate enterprise and government operations, which has led to significant revenue growth and market position strengthening.

-

What potential challenges might Palantir face in international markets?

There may be underestimation of potential challenges in international markets, especially given the economic headwinds in Europe, and an over-reliance on the U.S. commercial and government sectors might limit diversification.

Book Recommendations

- “AI Superpowers: China, Silicon Valley, and the New World Order” by Kai-Fu Lee — Insights into how AI is shaping global business and geopolitics.

- “The Big Nine: How the Tech Titans and Their Thinking Machines Could Warp Humanity” by Amy Webb — Explores the influence of AI on the future of society.

- “Competing in the Age of AI: Strategy and Leadership When Algorithms and Networks Run the World” by Marco Iansiti and Karim R. Lakhani — Provides strategies for businesses looking to harness the power of AI effectively.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.