In a recent move, Morgan Stanley has bestowed its vote of confidence upon Delta Air Lines (DAL), elevating it to a top pick and raising its price target from $77 to $85. This upward adjustment suggests a substantial upside of 77.5% in the stock’s value. But that’s not all; Morgan Stanley has also upped its “bull case valuation” for Delta shares to $110 from $90, highlighting an even more optimistic scenario for investors.

Push into Premium

The rationale behind Morgan Stanley’s bullish stance stems from Delta’s strategic push into premium services. The airline’s proactive efforts to enhance its premium offerings are expected to position it favorably amidst the evolving landscape of airline demand. Analysts at Morgan Stanley draw parallels between Delta’s trajectory and that of Abercrombie & Fitch (ANF), a company that successfully reinvented itself as a premium and relevant specialty retailer, thereby garnering favor from investors.

Unleashing Potential Rewards

According to Morgan Stanley, Delta’s pivot towards premium services is not merely a strategic maneuver but a catalystA stock catalyst is an engine that will drive your stock either up or down. A catalyst could be news of a new contract, SEC filings, earnings and revenue beats, merger and acquisit... More for unlocking substantial value. In a hypothetical scenario mirroring Abercrombie’s transformation, where Delta’s valuation doubles to 12-times price-to-earningsThe price-to-earnings ratio, often abbreviated as P/E ratio, is a fundamental metric used by investors and analysts to evaluate the relative value of a company's shares in the stoc... from its current less than 6-times, the stock could soar to around $110 compared to its current $47 level. This projection underscores the potential for handsome rewards awaiting investors who seize the opportunity early.

Stronger Post-Pandemic Resilience

Morgan Stanley’s optimism regarding Delta is grounded in the belief that the airline, along with much of the industry, emerged from the pandemic stronger than before. Structural shifts within the industry, coupled with Delta’s internal business adjustments and execution, have fortified its position. Despite surpassing pre-pandemic revenue levels and effectively reinstating pre-pandemic EBIT figures, Delta’s stock still languishes well below its 2014 peak price-to-earnings ratio of around 12x. This disparity presents an enticing opportunity for investors to capitalize on Delta’s undervaluation.

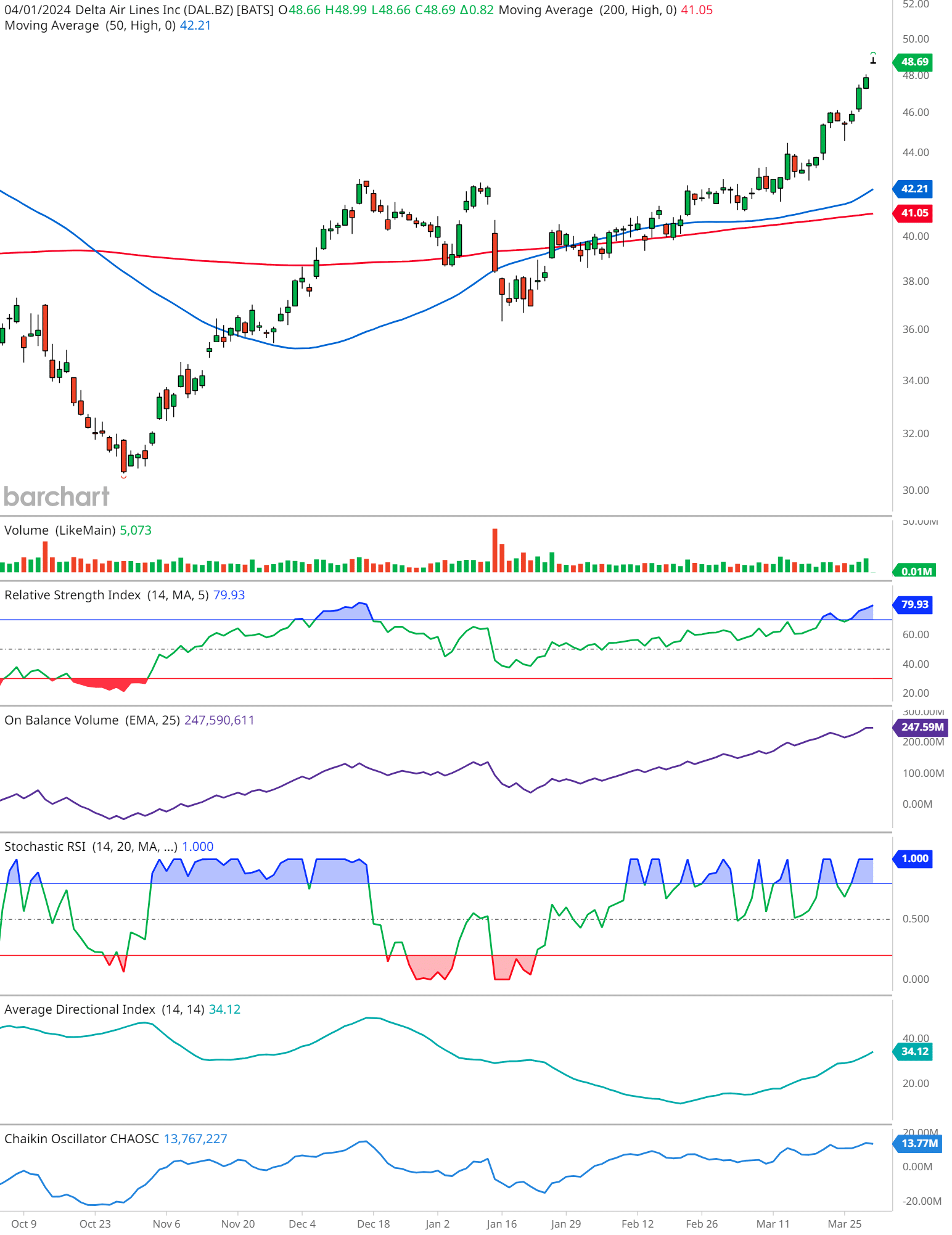

DAL Technical Analysis

Moving Averages: The 50-period MA is above the 200-period MA, indicating that the short-term momentum is higher than the long-term momentum, suggesting a bullish trend.

Volume: The volume pane indicates the number of shares traded. A spike in volume can correspond to significant price moves, but in this chart, the volume appears consistent and does not show unusual spikes.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): This momentum oscillator measures the speed and change of price movements on a scale from 0 to 100. An RSI above 70 typically indicates that a stock is overbought, while below 30 indicates oversold. The RSI for DAL is around 79.93, which could suggest that the stock is entering overbought territory.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): This indicator uses volume flow to predict changes in stock price. The rising OBV line suggests positive volume pressure that can lead to higher prices.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: This is a momentum oscillator to determine overbought or oversold conditions. It’s currently indicating a value near 1.000, which is the upper limit and typically signals that the asset is overbought.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADI): This indicator measures the strength of a trend. The ADI is around 34.12, which implies that the current trend is gaining strength and the market is becoming more directional.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: This measures the momentum of the Accumulation Distribution Line using the MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More formula. The positive value suggests that there is buying pressure and that the market may continue to rise.

In summary, the technical indicators on DAL’s chart suggest a strong bullish trend, with several indicators signaling that the stock might be overbought. This could mean that DAL might experience a pullback or correction in the near term. However, the strength of the current trend indicated by the ADI might sustain the bullish momentum for a while longer.

In conclusion, Morgan Stanley’s endorsement of Delta Air Lines as a top pick with a revised price target underscores the airline’s potential for substantial growth. With a strategic focus on premium services and a resilient post-pandemic performance, Delta stands poised to reward investors handsomely. As the airline industry continues its recovery journey, Delta’s trajectory presents a compelling investment opportunity for those willing to bet on its upward momentum.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.