Delta Air Lines (DAL) is set to announce its earnings on July 11, following a strong Q1 performance with record revenue and high-end earnings guidance. CEO Ed Bastian highlights robust demand for air travel and a healthy customer base. Analysts expect Delta to reaffirm its 2024 EPS guidance of $6.00 to $7.00 and free cash flowThe cash flow statement provides a detailed overview of the cash inflows and outflows of a company over a specified period of time. It includes cash received from operations, inves... More of $3 billion to $4 billion. The forecasted earnings are $2.37 per share, down 11.6% YoY, with a 5.8% YoY revenue increase to $15.5 billion. Analysts maintain a strong buy consensus, seeing Delta’s corporate travel focus as advantageous. Recent stock declines are due to reduced earnings forecasts, industry-wide impacts, profit-taking, high debt, valuation concerns, and economic uncertainty. Despite challenges like supply chain issues, safety concerns, engine problems, capacity constraints, high operating costs, environmental pressures, pilot shortages, thin profit marginsIn the dynamic world of business, profitability is a fundamental metric that encapsulates a company's ability to generate earnings from its operations. Profit margins, expressed as..., and regulatory challenges, Delta has shown a strong recovery post-pandemic, with record 2023 revenue and resumed dividend payments.

Financial Expectations and Analyst Projections

Revenue and Earnings Forecast

Analysts have set high expectations for Delta’s upcoming earnings report. They forecast the airline to post earnings of $2.37 per share, a decrease of 11.6% year-over-year. Meanwhile, revenue is anticipated to reach $15.5 billion, marking a 5.8% year-over-year increase. Delta’s leadership is expected to reaffirm its 2024 guidance, projecting earnings per shareEarnings per share (EPS) is a fundamental financial metric that provides valuable insights into a company's profitability. This widely used indicator helps investors and analysts g... (EPS) between $6.00 and $7.00 and free cash flow ranging from $3 billion to $4 billion.

Market Sentiment and Analyst Ratings

Morgan Stanley analyst Ravi Shanker has highlighted Delta as one of the cleanest stories in the airline industry. He is particularly optimistic about Delta’s significant exposure to corporate travel compared to its peers and has assigned an Overweight (Buy) rating to the stock, naming it a “top pick.” This bullish sentiment is shared by other analysts, with the consensus recommendation from 21 analysts tracked by S&P Global Market Intelligence standing at Strong Buy.

Potential Market Impact

A positive or negative surprise from Delta’s guidance update could significantly impact its share price and the broader airline sector. Options trading suggests a potential 6% swing in Delta’s share price following the earnings report. Historically, Delta’s shares fell by 2.3% after its last earnings announcement. Notably, United Airlines (UAL), Copa Holdings (CPA), and Alaska Air (ALK) are the airline stocks most closely correlated with Delta, likely to be influenced by its earnings report.

Recent Stock Performance and Market Challenges

DAL Technical Analysis

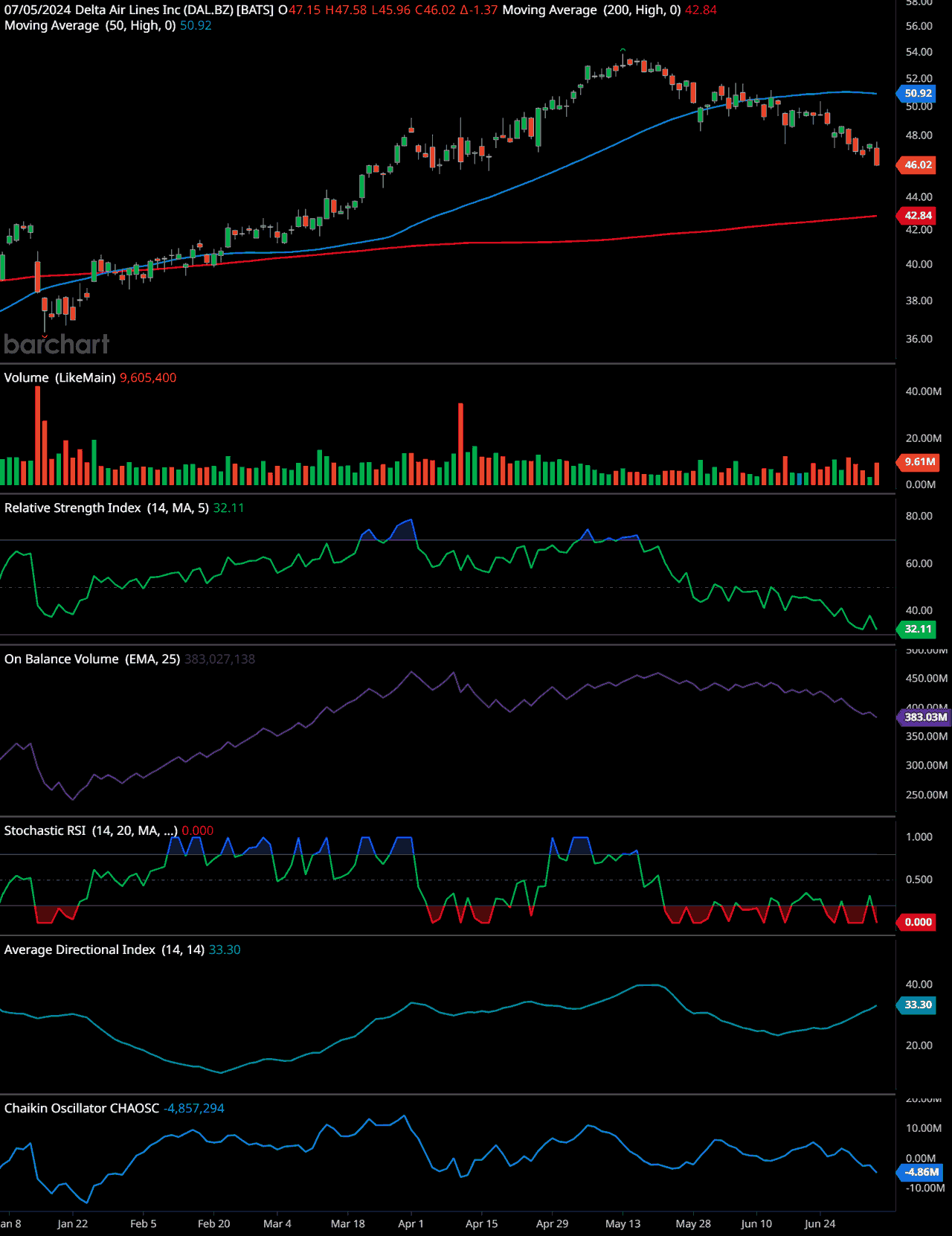

This chart shows Delta Air Lines Inc. (DAL) as of July 5, 2024. The stock price has been in an overall uptrend since the beginning of the year, but there has been a recent pullback from its highs around $54 to its current price of $46.02. The 50-day moving average (blue line) is currently at $50.92, indicating recent bullishness, while the 200-day moving average (red line) is at $42.84, showing a longer-term bullish trend.

Volume indicates a recent increase in selling pressure, with 9,605,400 shares traded.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI) is at 32.11, which is close to the oversold territory, suggesting the stock might be undervalued in the short term.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV) shows a slight downtrend, indicating that volume on down days is higher than on up days.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... is at 0, suggesting that the stock is oversold.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX) is at 33.30, indicating a strong trend, though it doesn’t specify direction.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... is at -4.857,294, indicating selling pressure.

Time-Frame Signals:

- 3-month horizon: Hold. The stock is currently oversold and might rebound, but further confirmation is needed.

- 6-month horizon: Hold. Wait for signs of trend reversal and more positive indicators.

- 12-month horizon: Buy. The long-term trend is still bullish, and current pullback may present a buying opportunity if the overall market conditions remain stable.

Past performance is not an indication of future results. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. ❤️

Stock Decline and Contributing Factors

Delta Air Lines has experienced a notable decline in its stock price recently, influenced by several key factors:

- Reduced Earnings Forecast: Delta revised its 2024 earnings forecast downward, now expecting full-year EPS between $6 and $7, down from the initial projection of over $7. This adjustment has raised investor concerns.

- Industry-Wide Impact: The stock decline wasn’t isolated to Delta. Other major airlines, including United, American, and Southwest, also saw their stocks drop following Delta’s announcement, reflecting broader sector concerns.

- Profit-Taking: Delta’s stock had a strong performance in 2023, rising over 20%. The recent decline may partly be due to investors taking profits after this significant run-up.

- High Debt Levels: Despite progress in reducing debt, Delta still has a high debt-to-equity ratio of 5.7, which may be worrisome for some investors.

- Valuation Concerns: With the stock price near its 52-week high and up more than 80% from its 2022 low, some investors might believe the improved operational environment is already priced into the stock.

- Economic Uncertainty: Ongoing inflation and economic uncertainty have been persistent concerns for the airline industry, potentially affecting investor sentiment.

Strong Recovery and Financial Health

Despite these challenges, Delta has demonstrated a strong recovery from the pandemic. The airline reported record annual revenue of $54.7 billion in 2023 and continued to perform well in 2024, delivering record-breaking first-quarter results. Additionally, Delta has resumed dividend payments, indicating improved financial health.

Airline Industry Challenges

The airline industry is currently facing several challenges:

- Supply chain issues: Airlines are experiencing significant delays in aircraft deliveries and maintenance due to shortages of spare parts. This is causing some carriers to ground planes and seek expensive leases to cover fleet gaps.

- Safety concerns: Recent incidents, such as the Boeing 737 MAX 9 door plug detachment, have led to groundings and inspections, impacting operations and finances of airlines like Alaska and United.

- Engine problems: Issues with Pratt & Whitney engines have forced many aircraft to be removed from service for quality checks, affecting airlines’ operational capacity.

- Capacity constraints: The industry is still recovering from the pandemic, with global airline capacity at 97% of 2019 levels. This, combined with supply chain issues, is limiting growth potential.

- High operating costs: Airlines face significant expenses for fuel, labor, maintenance, and other operational costs, which continue to rise.

- Environmental concerns: The industry is under pressure to reduce its carbon footprint, requiring investments in new technologies and sustainable aviation fuels, which are currently more expensive than conventional jet fuel.

- Pilot shortage: There’s an ongoing shortage of pilots, expected to grow to 65,000 by 2030, which could constrain industry growth.

- Thin profit margins: Despite projections of record revenue in 2024, profit margins remain slim. IATA estimates a return on invested capitalReturn on Invested Capital (ROIC) is a vital financial metric that assesses a company's efficiency in allocating capital to profitable investments. It provides valuable insights in... of 5.7%, which is below the cost of capital.

- Regulatory challenges: Airlines are calling for regulatory relief and business-friendly policies to improve their financial position and ability to invest in sustainability initiatives.

Insights

- Delta’s strong Q1 performance sets a positive tone for its upcoming earnings report.

- Analysts remain bullish due to Delta’s premium consumer mix and corporate travel exposure.

- Stock decline factors include revised earnings forecast, high debt, and broader economic concerns.

- Industry-wide challenges continue to impact operational capacity and growth potential.

The Essence (80/20)The Origins and Evolution of the 80/20 Principle The Discovery by Vilfredo Pareto In 1897, Italian economist Vilfredo Pareto uncovered a striking pattern in his study of wealth and...

Core Topics:

- Financial Performance: Delta’s strong Q1 results and guidance for 2024, indicating robust revenue and earnings despite industry challenges.

- Market Position: Delta’s advantage in corporate travel and a diversified revenue stream, contributing to a positive analyst outlook.

- Stock Analysis: Factors affecting recent stock performance, including revised earnings forecasts, industry-wide impacts, and investor profit-taking.

- Industry Challenges: Ongoing issues like supply chain disruptions, safety incidents, engine problems, high operating costs, environmental concerns, pilot shortages, and regulatory hurdles affecting the airline sector.

The Action Plan – What Delta Airline Investors Will Do

- Monitor Earnings Report: Closely follow Delta’s Q2 earnings announcement and guidance updates for potential market reactions.

- Evaluate Financial Health: Assess Delta’s debt levels, cash flow, and profit margins to understand its financial resilience.

- Analyze Market Trends: Track industry-wide challenges and their impact on Delta and its peers to inform investment decisions.

- Consider Diversification: Explore investment opportunities in other sectors or companies within the airline industry to mitigate risks.

Blind Spots

Potential overemphasis on Delta’s immediate financial metrics may overlook long-term strategic initiatives, such as investments in sustainability and technology, which could drive future growth and resilience.

Customer Sentiment and Loyalty: While financial metrics and market positioning are important, customer satisfaction and loyalty are critical for long-term success. Delta’s ability to maintain high levels of customer service and address any emerging customer concerns could significantly impact its reputation and market share.

Technological and Cybersecurity Risks: The increasing reliance on technology for operational efficiency and customer experience exposes Delta to potential cybersecurity threats. Overlooking the importance of robust cybersecurity measures and the impact of technological disruptions could pose significant risks to its operations and customer trust.

Market Focus on Upcoming Earnings Report

While Delta Air Lines has shown resilience and strong performance, the market’s current focus appears to be on the reduced earnings forecast and potential headwinds. The upcoming earnings report on July 11 will be crucial in shaping investor sentiment and determining the stock’s trajectory in the near term. As Delta navigates these challenges, its ability to maintain strong operational performance and meet financial guidance will be key to restoring investor confidence and driving future growth.

Delta Air Lines Earnings Report FAQs

Frequently Asked Questions

1. When is Delta Air Lines reporting its earnings?

Delta Air Lines (DAL) is due to report earnings on July 11.

2. How did Delta perform in Q1?

Delta delivered record revenue and earnings at the high end of its guidance in Q1.

3. What is the outlook for air travel demand according to Delta’s CEO?

Delta’s CEO Ed Bastian noted that demand for air travel remains strong, with the customer base in a healthy financial position and travel being a top priority.

4. What is Delta’s EPS and free cash flow guidance for 2024?

Delta is expected to reiterate its 2024 guidance for EPS of $6.00 to $7.00 and free cash flow of $3 billion to $4 billion.

5. What are analysts’ expectations for Delta’s upcoming earnings report?

Analysts expect Delta to report earnings of $2.37 per share, down 11.6% year-over-year, with revenue forecasted at $15.5 billion, up 5.8% year-over-year.

6. What is the consensus recommendation for Delta stock?

The consensus recommendation of the 21 analysts following Delta is Strong Buy.

7. How might Delta’s earnings report impact its share price?

A positive or negative surprise with Delta’s guidance update could be a share price catalystA stock catalyst is an engine that will drive your stock either up or down. A catalyst could be news of a new contract, SEC filings, earnings and revenue beats, merger and acquisit... More for the airline sector in general.

8. How did Delta’s stock perform after its last earnings report?

Shares of Delta fell 2.3% after the company’s last earnings report.

9. What are some factors behind Delta’s recent stock decline?

Factors include a reduced earnings forecast, industry-wide impact, profit-taking, high debt levels, valuation concerns, and economic uncertainty.

10. How has Delta performed financially in recent years?

Delta reported record annual revenue of $54.7 billion in 2023 and has shown strong recovery from the pandemic, continuing to perform well in 2024 with record-breaking first-quarter results.

11. What challenges is the airline industry currently facing?

Challenges include supply chain issues, safety concerns, engine problems, capacity constraints, high operating costs, environmental concerns, pilot shortage, thin profit margins, and regulatory challenges.

12. How is Delta addressing its high debt levels?

Delta has made progress in paying down debt, although it still has a high debt-to-equity ratio of 5.7.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.