In the realm of medical breakthroughs, Merck & Company (MRK) has recently made waves with the approval of its groundbreaking drug, Winrevair, by the Food and Drug Administration (FDA). This innovative medication marks a significant milestone in the treatment of Pulmonary Arterial Hypertension (PAH), offering hope to patients grappling with this debilitating condition.

A Paradigm Shift in PAH Treatment

PAH is a progressive lung disorder characterized by the thickening of blood vessel walls in the lungs, leading to elevated blood pressure and subsequent strain on the heart. Traditionally, available treatments have focused on alleviating symptoms rather than addressing the underlying cause of the disease. However, Winrevair represents a paradigm shift in PAH management, targeting the root cause of the condition and offering a glimmer of hope to patients.

The Science Behind Winrevair

Winrevair, scientifically known as sotatercept, operates by blocking proteins that contribute to the thickening of blood vessel walls in the lungs. By doing so, it helps to mitigate symptoms such as shortness of breath, fatigue, and chest pain, while also improving exercise capacity and overall quality of life for patients. Administered every three weeks, Winrevair has demonstrated promising results in clinical trials, showcasing its potential to revolutionize PAH treatment.

Insights from Clinical Trials

The FDA’s approval of Winrevair was underpinned by compelling clinical trial data from the Merck-run Stellar trial. This trial enrolled 323 individuals with PAH who were stable on existing medications, randomized to receive either Winrevair or a placebo. The results were striking, with Winrevair-treated participants exhibiting significant improvements in exercise duration, quality of life, and a reduced risk of disease progression compared to those on a placebo.

Addressing Unmet Needs in PAH Management

The conventional arsenal of PAH medications primarily comprises vasodilators aimed at symptom management. However, these treatments fall short in addressing the underlying disease progression, leaving patients vulnerable to continued deterioration in health and high mortality rates. Winrevair’s novel mechanism of action offers a beacon of hope for patients, promising not just symptom relief but also disease modification.

A Look at Market Dynamics

Merck’s acquisition of Winrevair through an $11.5 billion buyout of Acceleron Pharma underscores the immense potential of this breakthrough therapy. With an estimated $35 billion in annual sales projected by the middle of the next decade, Winrevair is poised to become a cornerstone in Merck’s pharmaceutical portfolio, catering to a significant unmet need in the PAH market.

Challenges and Considerations

While Winrevair heralds a new era in PAH treatment, it’s not without its challenges. The drug’s pricing, set at $14,000 per vial, has raised eyebrows, with some analysts expressing concerns about affordability and access for patients. Additionally, like any medication, Winrevair comes with potential side effects, including elevated hemoglobin levels and other manageable adverse events.

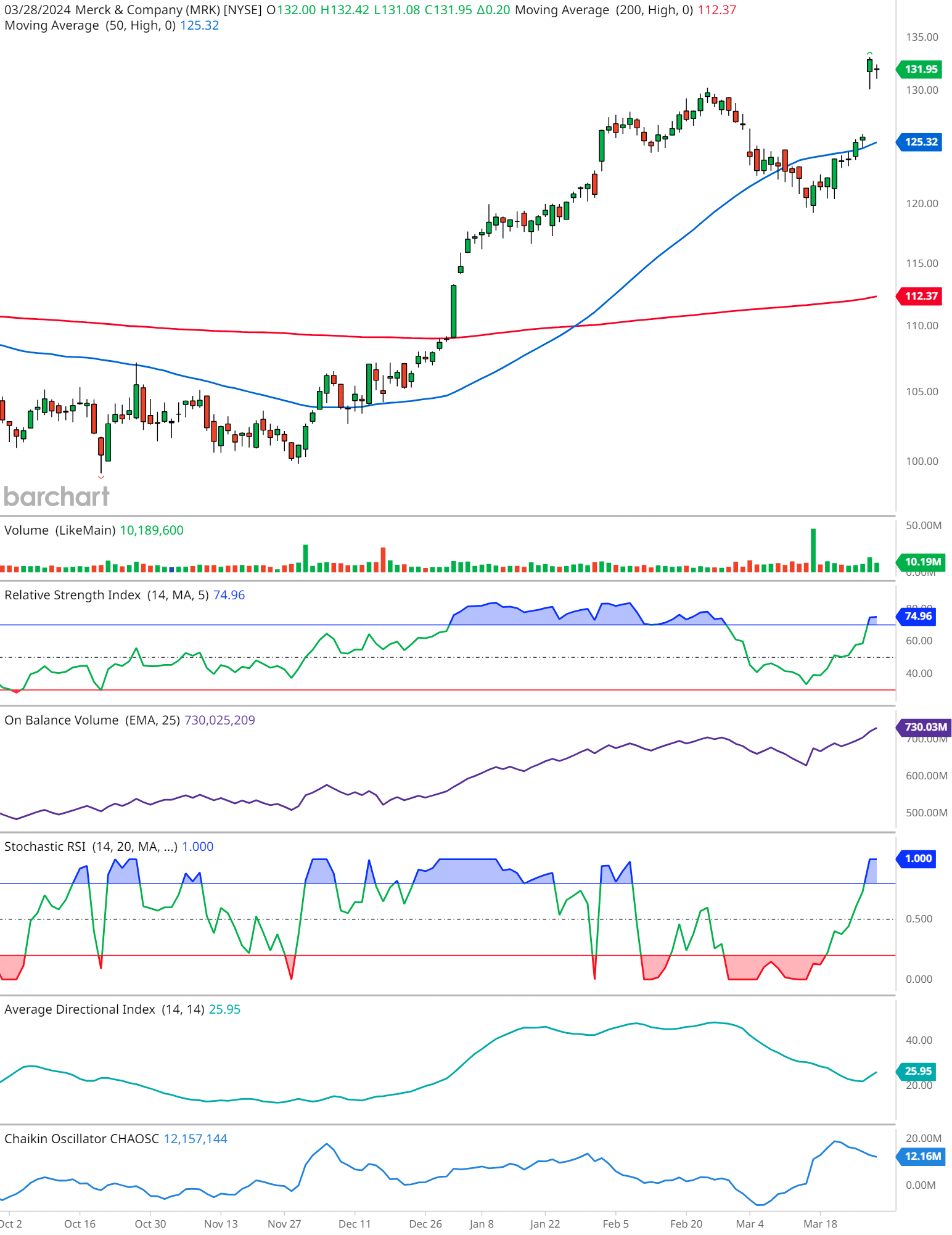

MRK Technical Analysis

Price Action: The stock appears to be in a general uptrend. On the provided date, the stock opened at $132.00, reached a high of $132.42, and closed at $131.95. It is trading above both the 50-day moving average (DMA) at $125.32 (indicated by the blue line) and the 200-DMA at $112.37 (indicated by the red line), which suggests a bullish trend.

Volume: The volume for the day was 10,189,600 shares, indicating the level of trading activity.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The 14-day RSI is at 74.96, which is close to the overbought threshold of 70. This suggests that the stock might be overextended and could potentially face a pullback.

On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV line is trending upwards with a value of 730,025,209, indicating that buying pressure has been dominant, a positive sign for bullish momentum.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: The Stochastic RSI is at 1.000, which is in the overbought range. This could indicate a possible reversal or a temporary pullback in the near term.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX): The ADX is at 25.95, which indicates a moderate trend strength. The value suggests that the uptrend is present but not exceptionally strong.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: The Chaikin Oscillator has a value of 12,157,144, and it being positive can be considered a bullish signal, suggesting accumulation.

Remember, while the indicators suggest an ongoing uptrend, the proximity to overbought levels on both the RSI and Stochastic RSI could signal a potential retracement.

Looking Ahead

As Winrevair prepares to enter the market, all eyes are on its real-world impact on patients’ lives. With its potential to transform the treatment landscape for PAH, this groundbreaking medication holds promise for improving outcomes and offering renewed hope to individuals battling this challenging condition.

In conclusion, Merck’s Winrevair represents a significant leap forward in the management of Pulmonary Arterial Hypertension, offering both clinicians and patients a much-needed lifeline in the fight against this debilitating disease.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.