In the realm of Latin American fast-food retail, Arcos Dorados (ARCO) stands as a significant player, operating McDonald’s franchises across the region. However, despite its prominent position, the company has seen a notable dip in its stock value, down more than 12% in the year 2024. Analyst Thiago Bortoluci from Goldman Sachs, however, suggests that this downward trend presents an enticing buying opportunity for investors.

Arcos Dorados (ARCO) serves as a franchise operator for McDonald’s eateries, holding exclusive rights for owning, managing, and franchising McDonald’s restaurants across 20 countries and territories in Latin America and the Caribbean. These regions include Argentina, Aruba, Brazil, Chile, Colombia, Costa Rica, Curacao, Ecuador, French Guiana, Guadeloupe, Martinique, Mexico, Panama, Peru, Puerto Rico, Trinidad and Tobago, Uruguay, the U.S. Virgin Islands of St. Croix and St. Thomas, and Venezuela. Established in 2007, the company is headquartered in Montevideo, Uruguay.

Analyst Insights: The Case for Arcos Dorados

According to Bortoluci, the ongoing sell-off of Arcos Dorados stock is unjustified, presenting investors with a unique chance to acquire shares in one of Brazil’s fastest-growing retailers. Bortoluci emphasizes the robust performance of same-store sales and the company’s continual expansion, particularly in regions where competition remains limited.

Furthermore, despite concerns over the expiration of the franchise agreement in 2027, Bortoluci suggests that the possibility of an extension could lead to a re-rating of the company’s stock. Despite the initial decline in stock value at the beginning of the year, Bortoluci believes that the current scenario is too compelling for investors to overlook.

Financial Performance and Strategic Outlook

Arcos Dorados’ financial performance showcases positive growth and profitability, driven by strategic initiatives. Total revenue for the company exceeded $1.2 billion in the last quarter and $4.3 billion for the full year, marking a historical high in U.S. dollar terms. Additionally, adjusted EBITDAUnderstanding Adjusted EBITDA: A Comprehensive Guide In the world of finance and business valuation, financial metrics play a crucial role in assessing a company's health, performa... saw significant growth, reaching almost $133 million in the quarter and over $472 million for the full year.

Net income also saw a notable increase, with almost $56 million reported for the quarter and over $181 million for the full year. The company’s system-wide comparable sales grew by 32.4% in the fourth quarter, reflecting the efficacy of its strategic approach.

Growth Initiatives Driving Future Prospects

Looking ahead, Arcos Dorados remains focused on furthering its growth trajectory through various initiatives. The company plans to continue expanding its digital platforms, delivery services, and drive-thru channels to cater to evolving customer preferences.

One key objective is to identify 40% of sales by the end of 2025 through personalized offers and loyalty programs, indicating a commitment to enhancing customer engagement and retention. Additionally, Arcos Dorados aims to accelerate its restaurant openings, with plans to open 80 to 90 Enhanced Experience of the Future (EOTF) restaurants in 2024.

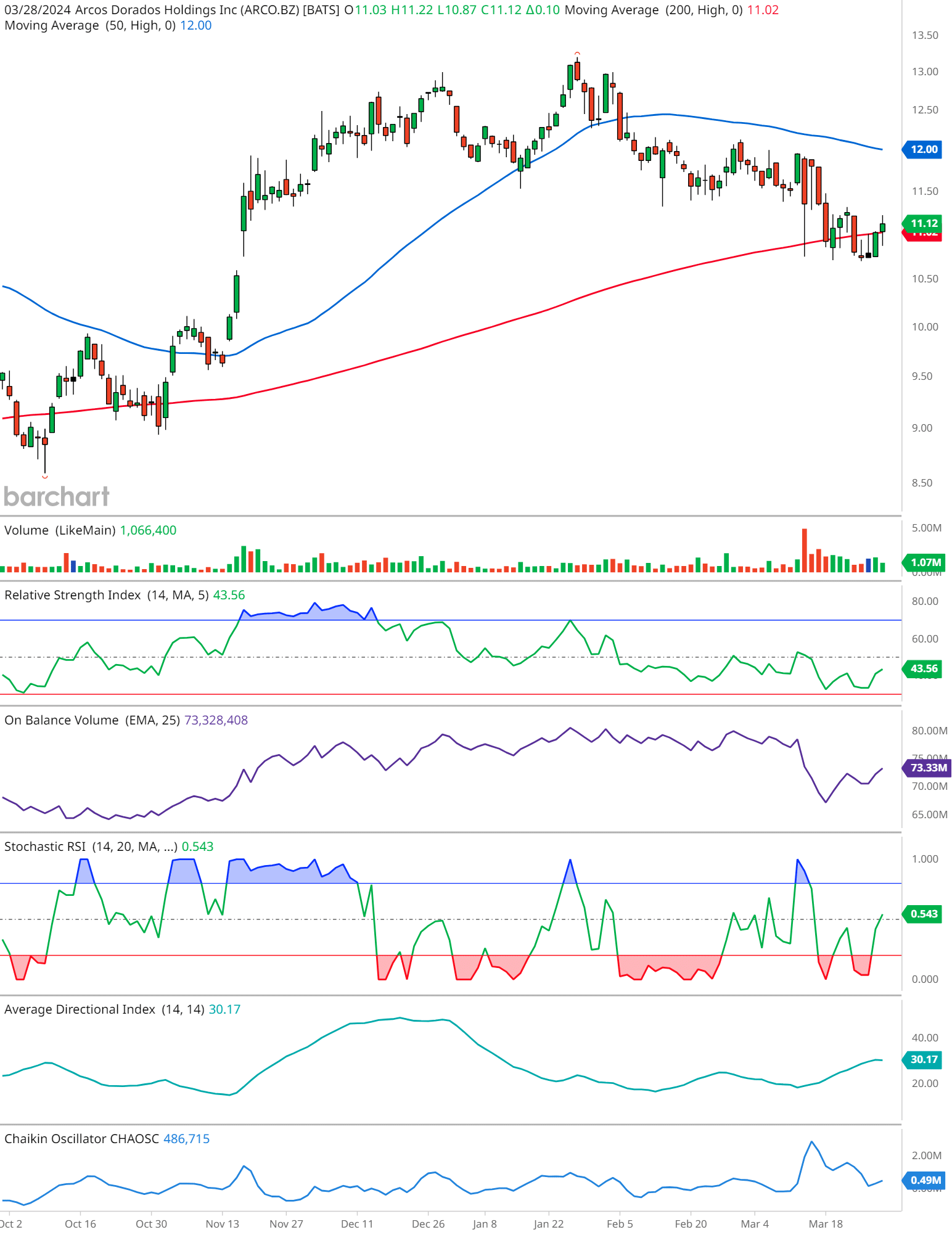

ARCO Technical Analysis

Price Action & Moving Averages:

The stock appears to be trading above the 200-day moving average, indicating a long-term bullish trend. However, it’s currently below the 50-day moving average, suggesting short-term bearish sentiment.

There’s a pattern of decreasing peaks on the price chart, which might signal a downtrend or consolidation phase.

Volume:

The volume shows significant spikes on certain days, which could indicate strong buying or selling pressure on those days.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI):

The RSI is around 45.36, which is neutral. It’s neither in the overbought territory (above 70) nor in the oversold (below 30), suggesting there’s no strong momentum in either direction.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV):

OBV is trending upward, which can imply that buying pressure is dominating and may support a bullish outlook if the trend continues.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...:

The Stochastic RSI is in the middle of the range, which doesn’t provide a clear indication for overbought or oversold conditions.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX):

With an ADX value around 30.17, the strength of the trend is moderate. It suggests that the current trend (whether up or down) is somewhat established, but not strongly so.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...:

The Chaikin Oscillator is above the zero line, which may indicate buying pressure.

Overall Interpretation:

The mixed signals from different indicators suggest a state of equilibrium with no clear trend direction in the short term. Investors might want to wait for a breakout above the 50-day moving average or a clear signal from RSI or Stochastic RSI for a potential directional move.

🧡 Please remember, investing in the stock market involves risks, and past performance is not indicative of future results. Always consider conducting your own research or consulting with a financial advisor.

In conclusion, despite the temporary setback in its stock value, Arcos Dorados presents a compelling investment opportunity in 2024. With strong financial performance, strategic growth initiatives, and favorable market conditions, the company is well-positioned for continued success in the Latin American fast-food retail sector. As investors weigh their options, Arcos Dorados stands out as a promising prospect for those seeking exposure to a dynamic and resilient market leader.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.