NVIDIA’s Q1 FY 2025 earnings call highlighted record-breaking results, with a revenue of $26 billion, an 18% sequential and a 262% year-over-year increase. The data center segment was a key driver, contributing $22.6 billion, a 23% sequential and 427% year-over-year growth, driven by the demand for NVIDIA Hopper GPU computing platform. Cloud providers, like OpenAI, Tesla, and Meta, are leveraging NVIDIA’s AI infrastructure, yielding high returns on investment. The automotive sector also saw significant AI advancements, notably Tesla’s expansion to 35,000 H100 GPUs for autonomous driving. Despite challenges in China, NVIDIA introduced new products tailored for the market. The new SpectrumX Ethernet solution and the Grace Hopper Superchip are set to enhance AI and networking performance. Gaming revenue stood at $2.65 billion, consistent with seasonal expectations. NVIDIA’s outlook for Q2 FY 2025 is optimistic, expecting $28 billion in revenue, continued innovation, and strategic partnerships.

Financial Highlights

Record Revenue

NVIDIA reported a revenue of $26 billion for Q1 FY 2025, an 18% sequential increase and a staggering 262% year-over-year rise, surpassing their outlook of $24 billion. This exceptional growth reflects NVIDIA’s strong market position and the increasing demand for their cutting-edge technologies.

Data Center Dominance

The data center segment was a significant contributor to NVIDIA’s revenue, posting $22.6 billion, up 23% sequentially and 427% year-over-year. This surge was driven by the ongoing robust demand for the NVIDIA Hopper GPU computing platform, which has become integral to various industries’ AI and data processing needs.

Data Center Insights

Enterprise and Consumer Internet Growth

Strong sequential growth in the data center segment was led by enterprise and consumer internet companies. Large cloud providers continued to ramp up their deployment of NVIDIA AI infrastructure, representing mid-40s as a percentage of total data center revenue. These providers are leveraging NVIDIA GPUs to enhance their AI capabilities, yielding significant returns on investment.

Training and Inference Advances

Training and inference AI on NVIDIA CUDA has become a crucial revenue driver for cloud providers. For every dollar spent on NVIDIA AI infrastructure, providers can earn up to five dollars in GPU instance hosting revenue over four years. This compelling return on investment underscores the value of NVIDIA’s solutions in the AI ecosystem.

Strategic Collaborations and Innovations

Key Partnerships

NVIDIA’s integration with leading cloud providers makes it easier for customers to utilize their GPU instances. High-profile AI companies like OpenAI, Tesla, Meta, and many others are building on NVIDIA AI in the cloud, driving substantial growth and innovation.

Automotive Sector Expansion

NVIDIA’s AI infrastructure is also making significant strides in the automotive industry. Tesla, for instance, expanded its AI training cluster to 35,000 H100 GPUs, enabling breakthroughs in autonomous driving technology. The automotive sector is poised to be a major revenue driver for NVIDIA’s data center business this year.

Consumer Internet Highlights

Meta’s announcement of Llama3, trained on a cluster of 24,000 H100 GPUs, was a notable highlight this quarter. Llama3 powers Meta AI, an assistant available across Facebook, Instagram, WhatsApp, and Messenger, and has sparked a wave of AI development across industries. As generative AI penetrates more consumer applications, NVIDIA expects continued growth opportunities.

Geographic Diversification

Sovereign AI Initiatives

NVIDIA’s data center revenue is diversifying geographically as countries invest in Sovereign AI—developing AI capabilities using domestic infrastructure. Nations like Japan, France, Italy, and Singapore are building substantial AI infrastructure with NVIDIA’s support, aiming to achieve technological independence and drive economic growth.

China Market Dynamics

Despite significant revenue declines in China due to export control restrictions, NVIDIA has introduced new products tailored for the Chinese market that do not require export licenses. This strategic adaptation is crucial for maintaining competitiveness in a challenging environment.

Product and Technology Developments

Hopper and Blackwell GPU Innovations

The Hopper GPU architecture continues to drive the majority of NVIDIA’s compute revenue. Innovations in CUDA algorithms have accelerated LLM inference on H100 by up to 3x, reducing costs for serving popular models like Llama3. NVIDIA’s next-generation AI factory platform, Blackwell, promises even greater performance enhancements, supporting AI production at an unprecedented scale.

Grace Hopper Superchip

The Grace Hopper Superchip, now shipping in volume, powers some of the world’s most energy-efficient supercomputers. New systems leveraging Grace Hopper are achieving remarkable performance and efficiency, setting new standards in the industry.

Networking Solutions

NVIDIA’s new SpectrumX Ethernet networking solution is optimized for AI and is expected to become a multi-billion-dollar product line within a year. SpectrumX enhances networking performance for AI processing, opening new market opportunities for NVIDIA.

AI PCs and Gaming

AI PCs

NVIDIA’s GeForce RTX GPUs, equipped with CUDA Tensor Cores, are well-suited for AI applications. Collaborations with Microsoft and game developers are bringing AI performance optimizations to Windows, enhancing the gaming and AI experience on PCs.

Gaming Revenue

Gaming revenue stood at $2.65 billion, down 8% sequentially but up 18% year-over-year. This performance is consistent with seasonal expectations, and the market reception for GeForce RTX Supers GPUs remains strong.

Professional Visualization and Automotive Growth

Professional Visualization

Revenue from professional visualization was $427 million, driven by generative AI and Omniverse industrial digitalization. New Omniverse Cloud APIs are enabling developers to integrate digital twin and simulation technologies into their applications, with adoption by major industrial software makers.

Automotive Revenue

Automotive revenue reached $329 million, up 17% sequentially and 11% year-over-year. Growth was driven by the ramp of solutions with global OEM customers and strength in NVIDIA’s self-driving platforms.

Financial Outlook

NVIDIA provided a robust outlook for Q2 FY 2025, expecting revenue to reach $28 billion, plus or minus 2%. Sequential growth is anticipated across all market platforms, with gross margins projected to be in the mid-70s percent range. The company also announced a 10-for-1 stock split and a 150% increase in dividends, reflecting strong confidence in future performance.

Insights

- NVIDIA achieved $26 billion in Q1 FY 2025 revenue, exceeding expectations.

- Data center revenue surged due to strong demand for Hopper GPUs.

- Major cloud providers are heavily investing in NVIDIA AI infrastructure.

- New SpectrumX Ethernet and Grace Hopper Superchip innovations.

- Automotive AI advancements, notably by Tesla, driving growth.

The Essence (80/20)

- Core Topics: Record revenue growth, AI and data center dominance, strategic partnerships, and geographic diversification.

- Description: NVIDIA’s financial performance in Q1 FY 2025 reflects its robust market position and growing demand for AI solutions. The data center segment led by Hopper GPUs significantly contributed to revenue, with major cloud providers leveraging NVIDIA’s technology. Innovations like the SpectrumX Ethernet solution and Grace Hopper Superchip, along with strategic adaptations in China, underscore NVIDIA’s capability to drive technological advancements and economic growth.

The Action Plan For Data Centers and Tech Companies

- Leverage AI Infrastructure: Companies should invest in NVIDIA’s AI infrastructure to enhance capabilities and maximize ROI, particularly with NVIDIA CUDA.

- Adopt New Technologies: Embrace new NVIDIA innovations like the SpectrumX Ethernet solution and Grace Hopper Superchip for improved performance and efficiency.

- Expand Partnerships: Form strategic partnerships with NVIDIA to drive innovation and growth in various sectors, including automotive and professional visualization.

Blind Spot

- Geopolitical Risks: While adapting products for the Chinese market, ongoing geopolitical tensions and export control restrictions may pose risks to long-term strategies.

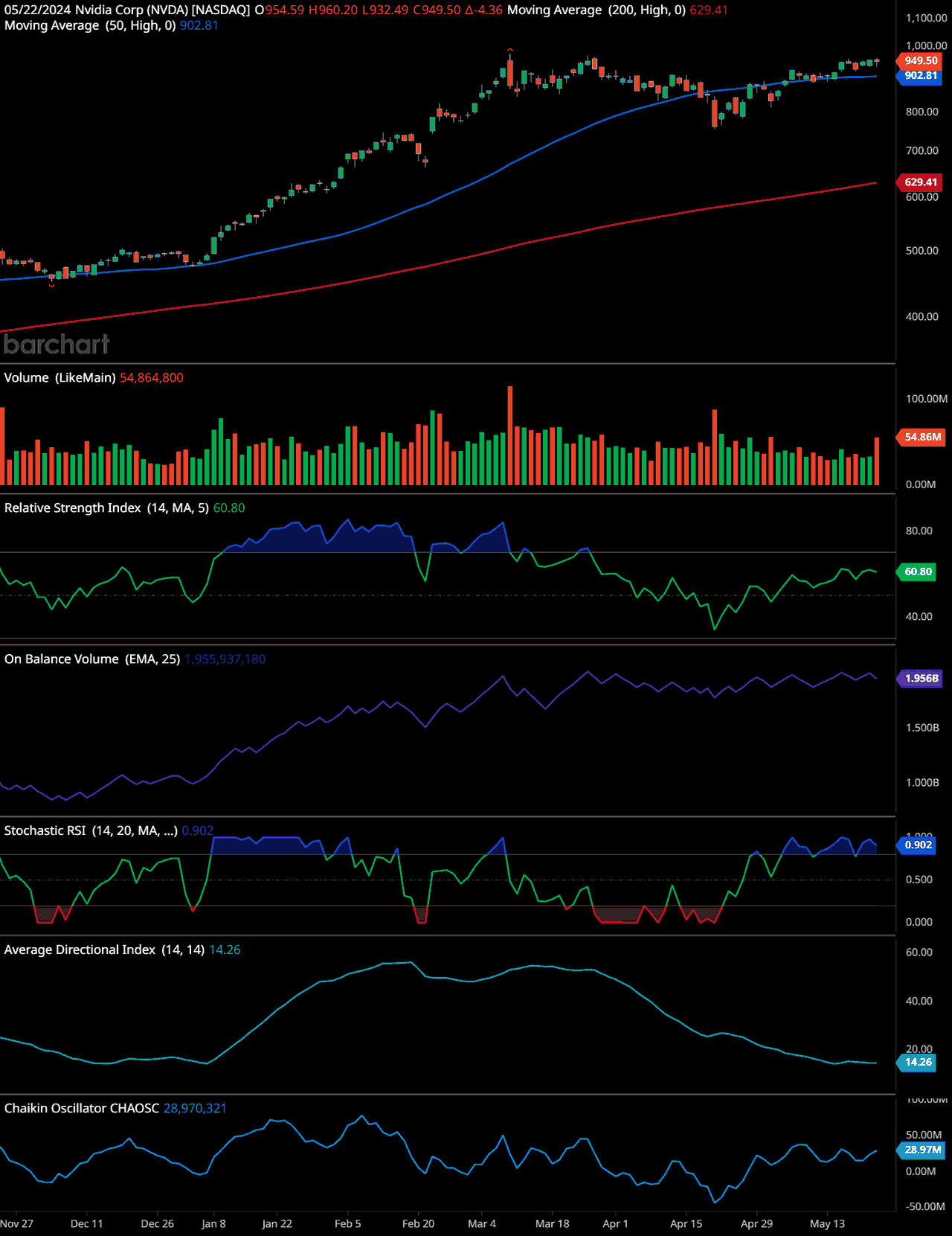

Nvidia (NVDA) Technical Analysis

Price and Moving Averages:

The stock has recently been in an uptrend, as evidenced by the price moving above the 50-day moving average (blue line) at 902.81 and the 200-day moving average (red line) at 629.41. The current price of 949.50 is above both moving averages, indicating a strong bullish trend.

Volume:

Volume data shows significant spikes, indicating periods of high trading activity. The recent volume is 54,864,800, suggesting substantial market interest in the stock.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI):

The RSI is at 60.80. This level suggests that the stock is neither overbought nor oversold but is leaning towards the upper part of the neutral range. Typically, an RSI above 70 indicates overbought conditions, while an RSI below 30 indicates oversold conditions.

On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV):

The OBV is trending upward, currently at 1,955,937,180. This suggests that the stock is being accumulated, as higher volumes are associated with rising prices.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...:

The Stochastic RSI is at 0.902, which is very close to the upper threshold of 1.0. This indicates that the stock might be nearing overbought conditions, suggesting a potential for a short-term pullback.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX):

The ADX is at 14.26, which is relatively low. This indicates that the current trend (though upward) is not particularly strong. Typically, an ADX above 20 is considered indicative of a strong trend.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...:

The Chaikin Oscillator is at 28,970,321, which is in positive territory. This is a bullish sign, indicating that money flow volume is positive and there is more buying pressure.

Time-frame Signals:

- Short-term (3 months): Hold – The stock is in a strong uptrend, but the high Stochastic RSI suggests a potential short-term pullback. Holding is recommended to avoid buying at a potentially high price.

- Medium-term (6 months): Buy – The overall trend remains bullish, and the positive OBV and Chaikin Oscillator suggest continued accumulation. Any short-term pullbacks might offer better buying opportunities.

- Long-term (12 months): Buy – The long-term outlook is positive with the stock trading above both major moving averages. The ongoing accumulation indicated by OBV suggests a sustained uptrend.

In summary, while a short-term hold is prudent due to potential overbought conditions, the medium to long-term outlook remains positive, suggesting buy opportunities on any short-term dips.

Looking Ahead

NVIDIA’s Q1 FY 2025 performance underscores its dominant position in the AI and data center markets. With continued innovation, strategic partnerships, and geographic diversification, NVIDIA is well-positioned to drive the next wave of technological advancements and economic growth. As the demand for AI infrastructure accelerates, NVIDIA’s comprehensive solutions will play a pivotal role in shaping the future of computing.

Frequently Asked Questions about NVIDIA’s Q1 FY 2025 Earnings Call

- What was NVIDIA’s revenue for Q1 FY 2025?

- NVIDIA reported a revenue of $26 billion for Q1 FY 2025, marking an 18% sequential increase and a 262% year-over-year rise.

- Which segment contributed the most to NVIDIA’s revenue growth?

- The data center segment was a significant contributor, posting $22.6 billion in revenue, up 23% sequentially and 427% year-over-year.

- How are cloud providers benefiting from NVIDIA’s AI infrastructure?

- For every dollar spent on NVIDIA AI infrastructure, cloud providers can earn up to five dollars in GPU instance hosting revenue over four years, demonstrating a compelling return on investment.

- What notable AI companies are utilizing NVIDIA’s AI infrastructure?

- High-profile AI companies like OpenAI, Tesla, and Meta are building on NVIDIA AI in the cloud, driving substantial growth and innovation.

- How is NVIDIA’s AI infrastructure impacting the automotive industry?

- NVIDIA’s AI infrastructure is making significant strides in the automotive industry, with Tesla expanding its AI training cluster to 35,000 H100 GPUs for advancements in autonomous driving technology.

- What is the significance of Meta’s Llama3 announcement?

- Meta’s announcement of Llama3, trained on a cluster of 24,000 H100 GPUs, highlighted the integration of AI across Facebook, Instagram, WhatsApp, and Messenger, driving a wave of AI development across industries.

- How is NVIDIA supporting Sovereign AI development globally?

- NVIDIA is assisting countries like Japan, France, Italy, and Singapore in building substantial AI infrastructure, helping them achieve technological independence and drive economic growth.

- How has NVIDIA adapted to export control restrictions in China?

- NVIDIA has introduced new products tailored for the Chinese market that do not require export licenses, maintaining competitiveness despite significant revenue declines due to export control restrictions.

- What advancements have been made with the Hopper GPU architecture?

- Innovations in CUDA algorithms have accelerated LLM inference on H100 by up to 3x, reducing costs for serving popular models like Llama3, and the next-generation AI factory platform, Blackwell, promises even greater performance enhancements.

- What is NVIDIA’s financial outlook for Q2 FY 2025?

- NVIDIA expects revenue to reach $28 billion, plus or minus 2%, with sequential growth across all market platforms and gross margins projected to be in the mid-70s percent range.

Book Recommendations

- “Artificial Intelligence: A Guide for Thinking Humans” by Melanie Mitchell

- “The AI Advantage: How to Put the Artificial Intelligence Revolution to Work” by Thomas H. Davenport

- “Life 3.0: Being Human in the Age of Artificial Intelligence” by Max Tegmark

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.