Tesla’s stock price experienced a significant drop, falling over 7% in premarket trading on July 24, 2024, following a disappointing second-quarter earnings report. Tesla’s adjusted earnings per shareEarnings per share (EPS) is a fundamental financial metric that provides valuable insights into a company's profitability. This widely used indicator helps investors and analysts g... (EPS) for Q2 was 52 cents, falling short of the 62 cents consensus estimate, despite revenue of $25.5 billion exceeding the expected $24.77 billion. The mixed results, especially lower-than-expected auto gross margins, led to cautious outlooks from several analysts. Citi, Goldman Sachs, and UBS all revised their price targets for Tesla downwards and maintained neutral or sell ratings, citing weaker-than-expected margins and the need for further promotions in the current auto lineup. Despite the negative reaction, Tesla remains seen as a leader in autonomous technology, though significant progress is expected over the next two to three years. The recent stock decline is part of a broader pattern of volatility, with Tesla’s stock fluctuating significantly over the past year.

Stock Price Decline

On Wednesday, July 24, 2024, Tesla’s stock price fell over 7% in premarket trading. This sharp decline was triggered by the company’s second-quarter earnings report, which did not meet analysts’ expectations, especially concerning earnings and free cash flowThe cash flow statement provides a detailed overview of the cash inflows and outflows of a company over a specified period of time. It includes cash received from operations, inves... More.

Earnings Miss

Tesla’s quarterly results revealed a shortfall in earnings, with the company reporting adjusted earnings per share (EPS) of $0.52, missing the consensus estimate of $0.62. Despite this, Tesla’s revenue for Q2 was $25.5 billion, slightly surpassing the consensus estimate of $24.77 billion.

Current Stock Price

As of July 24, 2024, Tesla’s stock price stood at $224.546. This reflects a significant decrease from its previous levels, influenced by the mixed Q2 results.

Mixed Q2 Results

The Q2 earnings report highlighted mixed results for Tesla. While revenue exceeded expectations, the earnings fell short, leading to a cautious response from analysts and investors.

Analyst Reactions

Citi’s Perspective

Citi analyst Itay Michaeli lowered Tesla’s price target from $274 to $258, maintaining a Neutral rating. Michaeli noted that Tesla’s Q2 results were “somewhat worse than expected,” particularly regarding auto gross margins excluding credits. The analyst anticipates modest pressure on Tesla’s shares, citing the Q2 auto margin and near-term outlook commentary. Michaeli suggested that if consensus estimates are adjusted downward and the stock experiences a pullback, the setup for October could improve, especially if updates on full-self driving technology show significant progress.

Goldman Sachs’ Outlook

Goldman Sachs reduced Tesla’s price target from $248 to $230 while keeping a Neutral rating. The firm’s analyst highlighted that Tesla’s auto business gross marginGross margin is a critical financial metric that plays a pivotal role in evaluating a company's financial health and profitability. It is a percentage that indicates how efficientl... was weaker than expected, impacted by pricing pressures and costs. Despite recognizing Tesla as a leader in autonomous technology, Goldman Sachs believes it will take two to three years for the company to achieve conditionally unsupervised eyes-off capability at scale.

UBS Analysis

UBS analyst Joseph Spak pointed out the stress on Tesla’s automotive business in Q2. Spak noted that while Tesla’s units are increasing, the current auto lineup is “limited,” potentially necessitating continued promotions. Additionally, the Q2 results included a significant $622 million restructuring charge. UBS maintained a Sell rating and a $197 price target, suggesting that the upcoming Robo-taxi day on October 10 could be a “sell-the-news” event.

Market Reaction

The stock market’s response to Tesla’s earnings report was notably negative, reflected in the sharp decline in Tesla’s stock price during premarket trading. This reaction underscores investors’ disappointment with the company’s performance, particularly in terms of earnings and gross margins.

Broader Context

Despite the recent drop, Tesla’s stock has experienced considerable volatility over the past year. The 52-week range for Tesla’s stock has been between $138.80 and $278.98, highlighting the fluctuations in its market value.

Insights

- Tesla’s Q2 adjusted EPS missed expectations.

- Auto gross margins were weaker than anticipated.

- Analysts have revised price targets downward but maintain neutral or sell ratings.

- Tesla is still considered a leader in autonomous technology.

Essence (80/20)

Core Topics:

- Stock Price Decline: Tesla’s stock fell over 7% in premarket trading post-Q2 earnings.

- Earnings Miss: EPS of 52 cents vs. 62 cents expected; revenue of $25.5B vs. $24.77B expected.

- Analyst Reactions: Downgraded price targets from Citi, Goldman Sachs, and UBS; cautious outlook due to weak auto margins and need for promotions.

- Market Volatility: Reflects broader volatility trends in Tesla’s stock over the past year.

Detailed Descriptions:

- Stock Price Decline: Immediate reaction to Q2 earnings report indicating a market sell-off.

- Earnings Miss: Highlights the gap between Tesla’s reported earnings and market expectations.

- Analyst Reactions: Analysts foresee continued challenges but acknowledge Tesla’s leadership in autonomous technology.

- Market Volatility: Emphasizes Tesla’s fluctuating stock price, influenced by performance and investor sentiment.

The Guerilla Stock Trading Action Plan

- Monitor Stock Performance: Regularly check Tesla’s stock price and market conditions.

- Analyze Earnings Reports: Pay close attention to future earnings reports for signs of improvement or further challenges.

- Follow Analyst Updates: Track updates from major analysts like Citi, Goldman Sachs, and UBS for insights on Tesla’s outlook.

- Evaluate Market Trends: Consider broader market trends and Tesla’s role within the autonomous vehicle industry.

Blind Spot

The focus on earnings and stock price might overshadow Tesla’s strategic developments and technological advancements, which could influence long-term performance beyond immediate financial results.

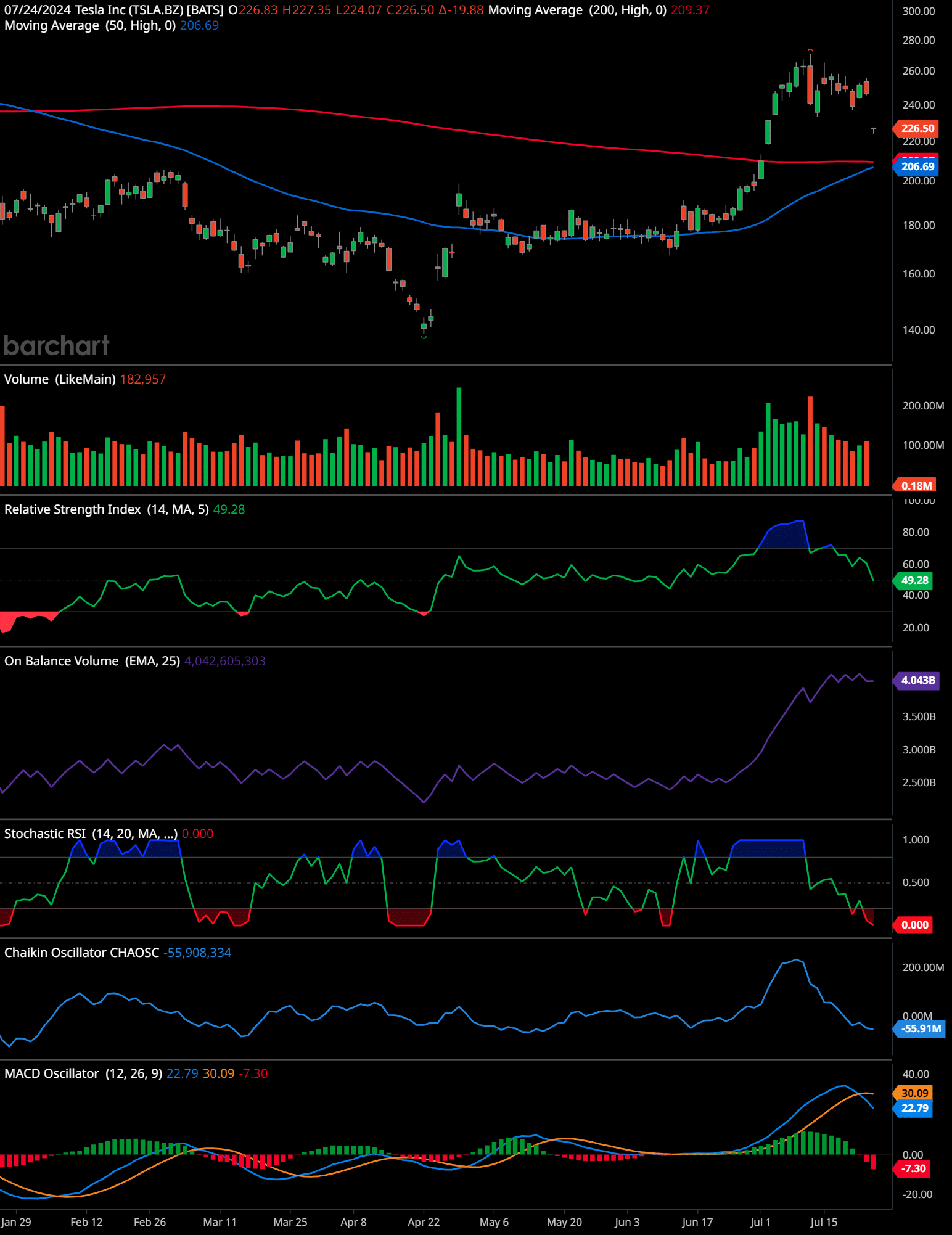

TSLA Technical Analysis

The chart for Tesla Inc. (TSLA) shows a notable price movement over the past few months. Here is a detailed technical analysis:

Trend Analysis:

Tesla’s stock had a downward trend from February to late April, with prices falling below both the 50-day and 200-day moving averages. In early May, the stock began consolidating sideways before initiating a strong upward movement in late May, breaking above both moving averages. The recent trend shows some consolidation near the $260 mark, with a slight pullback observed.

Support and Resistance Levels:

The 50-day moving average at $206.69 is acting as the nearest support level. Another support level is seen around the 200-day moving average at $209.37. On the upside, resistance is likely around $280, which is the recent high.

Volume Analysis:

Volume has shown significant spikes during the upward movement in late May and early June, indicating strong buying interest. Recent volume levels are lower, suggesting a consolidation phase.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI):

The RSI is currently at 49.28, indicating a neutral stance as it hovers around the midpoint of the scale. This suggests neither overbought nor oversold conditions.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV):

The OBV line has been steadily rising, reflecting accumulation as the price increased, which supports the bullish case.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...:

The Stochastic RSI is at 0.000, suggesting the stock is currently in oversold territory, which could imply a potential bounce back in the near term.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...:

The Chaikin Oscillator is at -55,908,334, indicating selling pressure in the short term, which aligns with the recent price pullback.

MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More Oscillator:

The MACD line is below the signal line, with a current value of -7.30, suggesting bearish momentum in the short term.

Time-Frame Signals:

For a 3-month horizon, the stock shows a potential pullback or consolidation, making it a “Hold” as it might need time to gather strength before the next move. For a 6-month horizon, given the overall uptrend and accumulation, it leans towards a “Buy” assuming the support levels hold and bullish indicators resume. For a 12-month horizon, it also suggests a “Buy” as the long-term trend appears bullish with the potential for continued growth, supported by the positive OBV and breaking above moving averages.

Past performance is not an indication of future results. This article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

The recent decline in Tesla’s stock price underscores the market’s sensitivity to the company’s financial performance. While Tesla’s revenue exceeded expectations, the earnings miss and weaker-than-expected gross margins led to a negative market reaction. Analysts have adjusted their price targets and outlooks, reflecting cautious optimism about Tesla’s future performance. As always, stock prices can be volatile around earnings reports, and the situation may evolve as more information becomes available. Investors will be closely watching Tesla’s next steps, particularly regarding advancements in autonomous technology and the upcoming Robo-taxi day.

Frequently Asked Questions about Tesla Stock

1. Why did Tesla’s stock price drop recently?

Tesla’s stock price fell more than 7% in premarket trading on July 24, 2024, following the release of its Q2 earnings report, which fell short of expectations, particularly in terms of earnings and free cash flow.

2. What were Tesla’s Q2 earnings compared to estimates?

On July 23, 2024, Tesla reported Q2 adjusted EPS of 52 cents, missing the consensus estimate of 62 cents. Tesla reported Q2 revenue of $25.5 billion versus the consensus estimate of $24.77 billion.

3. What is Tesla’s current stock price?

As of July 24, 2024, Tesla’s stock price is $224.546.

4. How did analysts react to Tesla’s Q2 earnings report?

Analysts from Citi, Goldman Sachs, and UBS lowered their price targets for Tesla and highlighted issues such as weaker-than-expected auto gross margin and ongoing stress on the automotive business.

5. What was Citi’s new price target for Tesla?

Citi analyst Itay Michaeli lowered the firm’s price target on Tesla to $258 from $274, maintaining a Neutral rating on the shares.

6. What was Goldman Sachs’ new price target for Tesla?

Goldman Sachs lowered the firm’s price target on Tesla to $230 from $248, maintaining a Neutral rating on the shares.

7. What was UBS’s stance on Tesla after the Q2 earnings report?

UBS analyst Joseph Spak maintained a Sell rating with a price target of $197, noting stress on the automotive business and a $622 million restructuring charge in the quarter.

8. How did the market react to Tesla’s Q2 earnings report?

The market reacted negatively to Tesla’s earnings report, evident in the sharp decline in the stock price during premarket trading.

9. How has Tesla’s stock performed over the past year?

Tesla’s stock has shown significant volatility over the past year, with a 52-week range of $138.80 to $278.98.

10. What should investors keep in mind about Tesla’s stock price volatility?

Investors should note that stock prices can be volatile, especially around earnings reports. The situation may evolve as more information becomes available.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.