Netflix (NFLX), the streaming giant that revolutionized the way we consume entertainment, has once again grabbed headlines with its Q2’24 earnings report. With EPS surpassing consensus estimates and revenue projections slightly missing the mark, the company’s financial outlook remains a topic of keen interest among investors and industry observers alike.

Key Financial Highlights from the Q2’24 Earnings Report

In its quarterly letter to investors, Netflix provided a comprehensive overview of its financial performance and future projections. Here are the key highlights:

1. EPS Surpasses Consensus Estimates

Netflix reported a Q2 EPS of $4.68, exceeding the consensus estimate of $4.54. This impressive performance underscores the company’s ability to generate substantial profits in an increasingly competitive streaming landscape.

2. Revenue Projections and Growth Outlook

While Netflix fell slightly short of consensus revenue estimates for Q2, forecasting $9.49 billion compared to the expected $9.51 billion, the company remains optimistic about its revenue growth trajectory. It anticipates a 16% increase in revenue for Q2’24, translating to 21% growth on a F/X neutral basis. This growth is primarily attributed to price adjustments in specific markets, such as Argentina, and currency devaluations relative to the US dollar.

3. Expectations for Paid Net Additions and Global ARM

Netflix anticipates a decrease in paid net additions in Q2’24 compared to the previous quarter, citing typical seasonality patterns. However, it forecasts year-over-year growth in global Average Revenue per Membership (ARM) on a F/X neutral basis for the same period.

4. Full-Year Revenue Growth and Operating Margin Forecast

For FY24, Netflix expects revenue growth of 13% to 15%, based on F/X rates at the end of Q1’24. Additionally, the company revised its operating marginThe operating margin is a critical financial metric that measures a company's ability to generate profit through its core operations. It provides valuable insights into a company's... forecast upward to 25%, up from the previous estimate of 24%. This revision reflects Netflix’s commitment to increasing its operating margin annually, despite potential fluctuations in foreign exchange rates.

Strategic Shift: Moving Beyond Quarterly Membership Numbers Reporting

One of the most significant announcements in Netflix’s quarterly letter was its decision to cease reporting quarterly membership numbers starting from next year. Instead, the company will focus on revenue, operating margin, and engagement metrics as primary indicators of its financial health and customer satisfaction.

Rationale Behind the Decision

Netflix justified this strategic shift by highlighting its evolving business model and the diminishing significance of membership growth as a sole performance metric. With substantial profitability and the diversification of revenue streams, such as advertising and additional member features, Netflix views memberships as just one component of its growth trajectory.

Emphasis on Revenue and Operating Margin

As the company transitions away from quarterly membership reporting, it will continue to prioritize revenue and operating margin metrics. Additionally, Netflix will provide annual revenue guidance alongside existing forecasts for operating margin and free cash flowThe cash flow statement provides a detailed overview of the cash inflows and outflows of a company over a specified period of time. It includes cash received from operations, inves... More, providing investors with a more comprehensive understanding of its financial outlook.

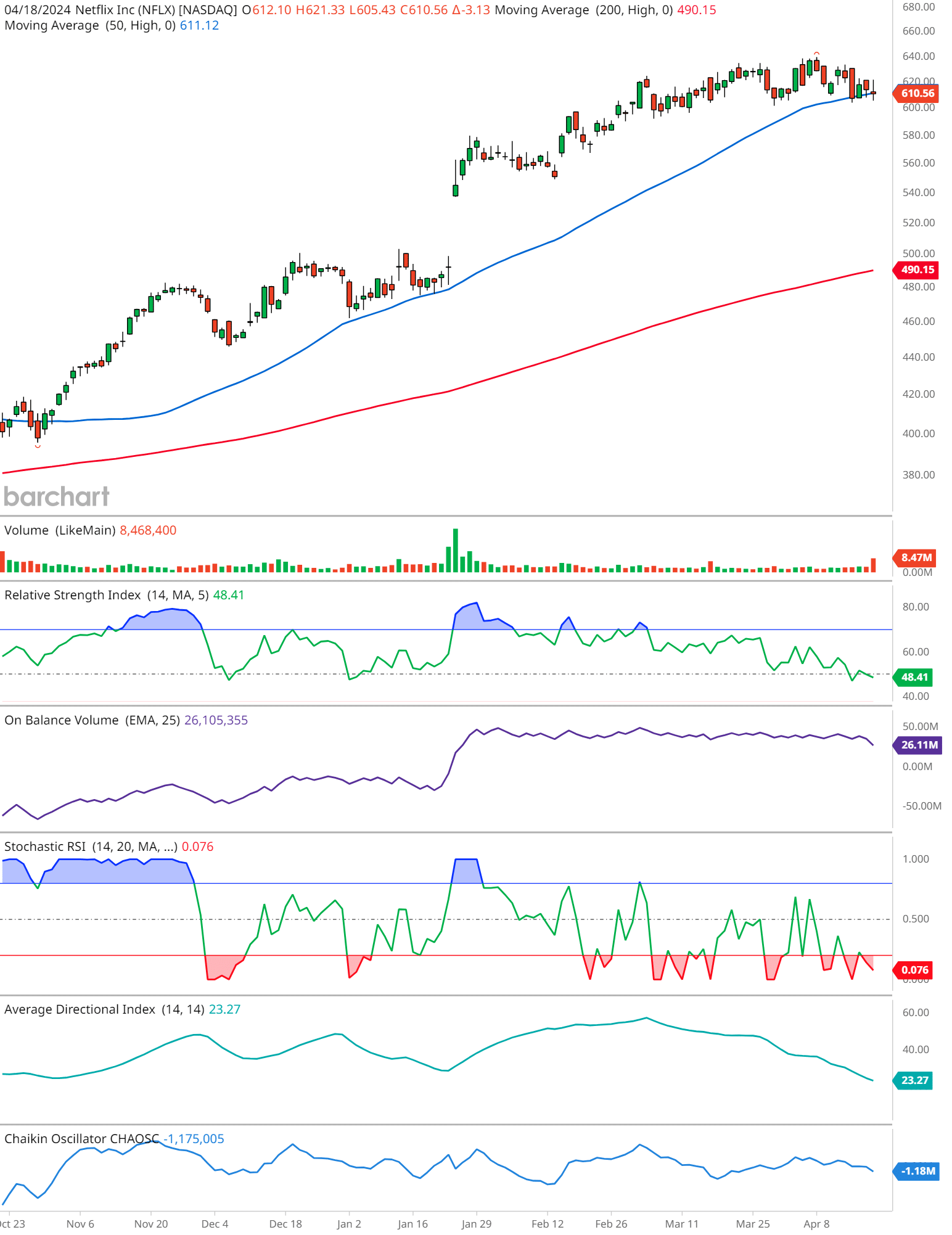

Netflix (NFLX) Technical Analysis

Price and Moving Averages:

- The stock closed at $610.56, below the 50-day moving average (MA) of $611.12, indicating a potential short-term bearish sentiment.

- However, it remains well above the 200-day MA of $490.15, suggesting a bullish trend over the longer term.

Volume:

- The volume for the day was 8,468,400 shares, which does not provide a clear indication of the trend as it’s relatively close to the average volume line.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI):

- The 14-day RSI is at 48.41, which is neutral, indicating neither overbought nor oversold conditions.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV):

- The OBV line is relatively flat, suggesting that there is a balance between buying and selling pressure.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...:

- The Stochastic RSI indicator is in the oversold territory at 0.076, often seen as a potential buy signal, as it may indicate that the stock is undervalued at the current levels.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADI):

- The ADI is at 23.27, which shows a weak trend strength. It indicates that the current trend is not very strong, either bullish or bearish.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...:

- The Chaikin Oscillator is at -1,175,005, which could suggest that there is a bearish momentum as it indicates that the volume of the closing price is lower than the volume of the opening price over a certain period.

In summary, the chart presents a mixed picture. While the price is above the long-term 200-day MA indicating an ongoing bullish trend, some indicators like the Chaikin Oscillator and the position of the price relative to the 50-day MA suggest caution. The Stochastic RSI is pointing towards a potential price increase due to oversold conditions. Investors should keep an eye on these indicators for potential trend reversals or confirmations.

Past performance is not an indication of future results. Always do your own research as the information provided is for informational purposes only and cannot be taken as investment advice.❤️

Navigating the Future of Streaming

Netflix’s Q2’24 earnings report offers valuable insights into the company’s financial strategy and long-term vision. As it navigates an ever-changing media landscape, Netflix remains committed to delivering compelling content, driving revenue growth, and enhancing shareholder value. By refocusing its reporting priorities and adapting to market dynamics, Netflix is poised to maintain its position as a global leader in the streaming industry.

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

- Nvidia just poured $160 million into Applied Digital Stock… and it skyrocketed 76% in a day! 🚀 - September 8, 2024

- Is Trump Media stock the next meme stock disaster? 📉 Find out why DJT stock is tanking! - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.