In the realm of cancer treatment, advancements in cellular therapies have been causing waves of excitement and anticipation. Among these, CAR-T therapies stand out as revolutionary treatments, offering hope to patients with certain types of cancer, particularly multiple myeloma. As we approach the end of June, all eyes are on the FDA as it prepares to make critical decisions that could significantly broaden the use of two CAR-T therapies. These decisions not only hold immense significance for patients and healthcare professionals but also carry substantial financial implications for the developers of these groundbreaking therapies.

The FDA’s Imminent Decision: Carvykti and Abecma

As of April 5, the FDA is poised to determine whether to approve Johnson & Johnson and Legend Biotech’s Carvykti for use in multiple myeloma patients following just one relapse. This decision, if positive, could pave the way for Bristol Myers Squibb’s Abecma to also receive approval for similar use. Currently, these therapies are limited to patients with more advanced stages of the disease in the United States. However, if the FDA grants approval, it could open up access to these life-saving treatments for a broader range of patients, potentially transforming the landscape of multiple myeloma treatment.

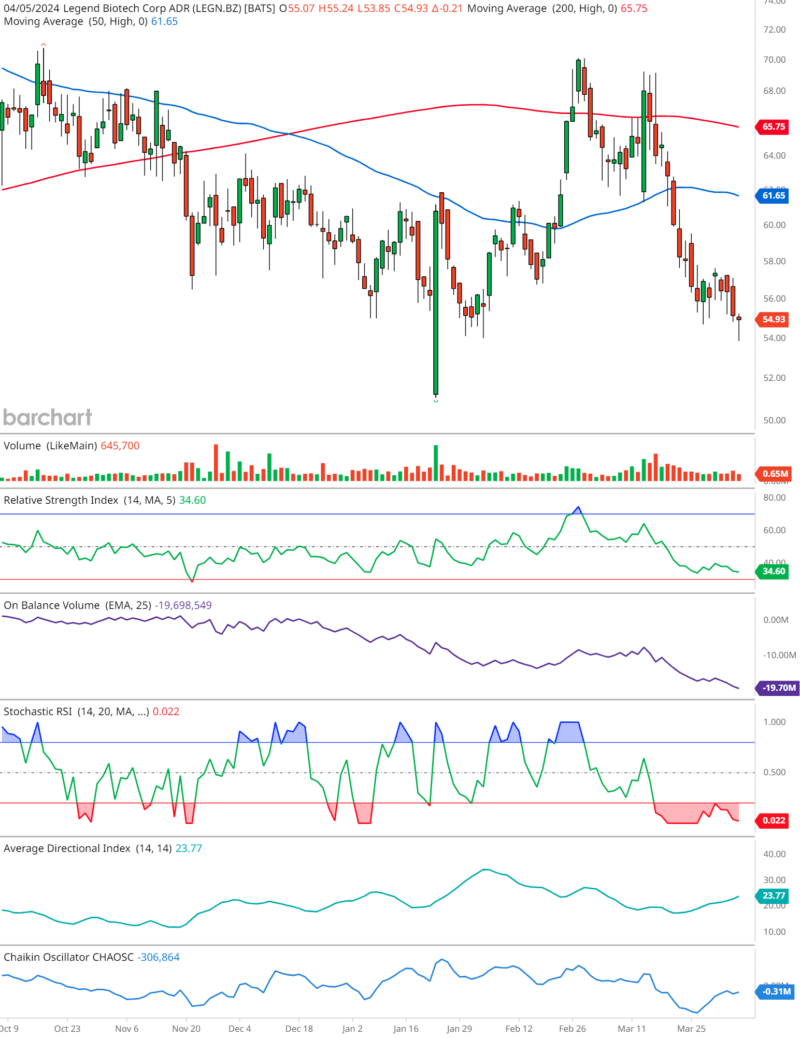

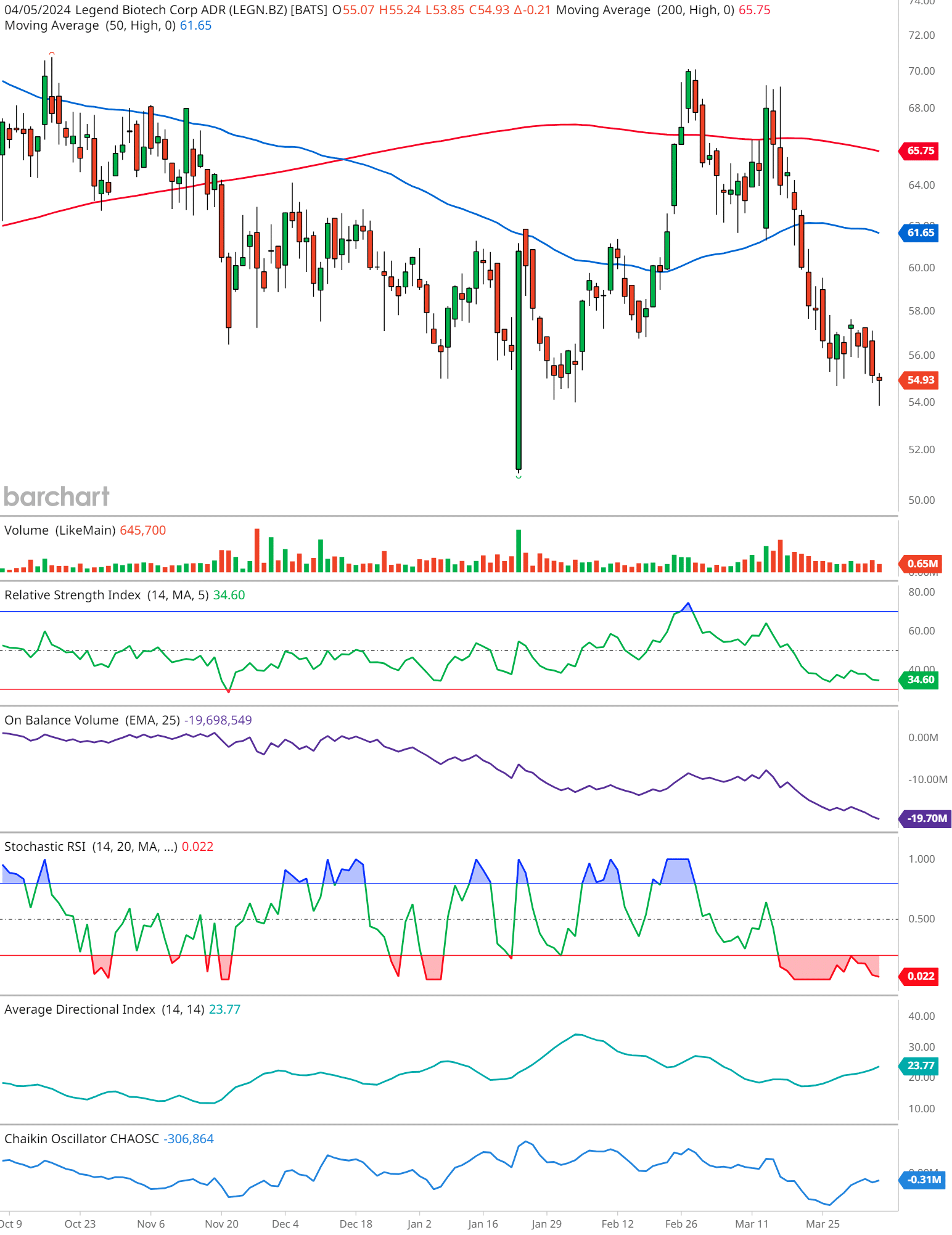

LEGN Technical Analysis

The candlestick pattern, captured as of April 5, 2024, exhibits a downtrend, characterized by a series of lower highs and lower lows. The stock, at last glance, stands at $54.93, having edged down by $0.21.

Moving Averages:

A vital component to consider is the intersection of the 50-day moving average (MA) in blue, and the 200-day MA in red. The 50-day MA broke below the 200-day MA, forming a ‘death cross,’ back in December of 2023. With the 50-day MA at 61.65 and the 200-day MA at 65.75, investors should brace for possible headwinds.

Volume Analysis:

The trading volume accompanying the downward price action does not present a significant spike. With a relatively steady volume just below the 1 million mark at 645,700, this suggests a lack of urgency among traders, which might temper the bearish sentiment.

Relative Strength Index (RSI):

The RSI trails at 34.60, hovering near the oversold threshold of 30. This could foreshadow a potential rebound, as prices often correct when the RSI dips into oversold or overbought extremes.

On Balance Volume (OBV):

The OBV with an EMA of 25 shows a downtick to -19,698,549. A descending OBV indicates that selling volume is predominating, potentially signaling a bearish outlook if the trend continues.

Stochastic RSI:

Currently, the Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... is bottoming out at 0.022, indicative of strong bearish momentum and corroborating the oversold conditions suggested by the standard RSI.

Average Directional Index (ADX):

With an ADX of 23.77, the strength of the prevailing trend is moderate. The value, being below 25, implies that the trend’s momentum is not particularly strong, which may hint at a consolidating or reversing market.

Chaikin Oscillator:

The Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... is deeply negative at -306,864. This measure of the Accumulation/Distribution Line suggests that the stock is facing substantial selling pressure, another point for bears.

In synthesizing these indicators, we arrive at a cautious stance on LEGN.BZ. While the proximity to the oversold territory could suggest a near-term bounce, the overall bearish signals emitted by the death cross, OBV, and Chaikin Oscillator cannot be dismissed lightly.

Investors would do well to watch for any bullish reversal patterns on the candlestick chart or a shift in momentum indicated by the RSI and Stochastic RSI for a more definitive assessment.

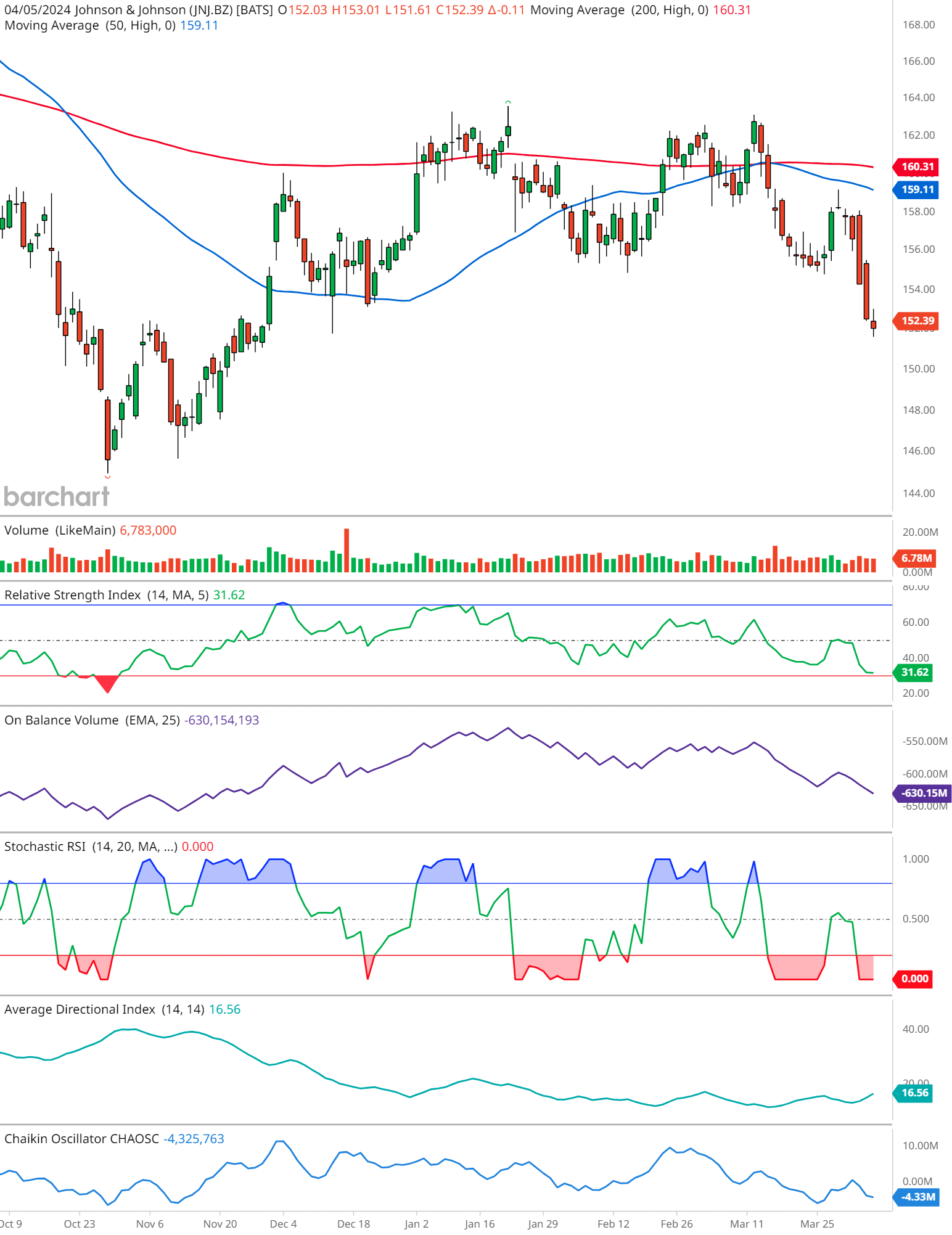

JNJ Technical Analysis

Moving Averages:

- JNJ is currently exhibiting a slight decline as it trades at $152.39, marginally lower than its 50-day moving average (MA) of $159.11. This could be a bearish signal.

- The 200-day MA, represented by the red line, is positioned at $160.31, above the 50-day MA, suggesting a bearish crossover in the longer term.

Volume:

- There’s an uptick in trading volume, indicative of increased market activity. However, the direction of the trend remains to be confirmed by other indicators.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI):

- The RSI stands at 31.62, nearing the oversold threshold of 30. This implies that JNJ might see a rebound as traders recognize it as undervalued, provided other conditions support a recovery.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV):

- The OBV is on a downward slope, which typically indicates bearish sentiment among investors as selling pressure overwhelms buying interest.

Stochastic RSI:

- The Stochastic RSI is bottoming out, which can be a sign of potential upward price momentum in the near term if it crosses above the oversold line.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADI):

- With an ADI value of 16.56, the trend strength appears weak. This means that the current price movement is not showing strong bearish or bullish tendencies.

Chaikin Oscillator:

- The Chaikin Oscillator value is negative, which may indicate selling pressure. This aligns with the bearish signals from the OBV.

The mixed signals from the technical indicators for JNJ suggest that the stock is currently facing bearish pressure, with a potential for a short-term rebound if the Stochastic RSI turns positive. The near oversold RSI condition could trigger some buying interest, but overall market sentiment appears cautious, reflected in the declining OBV and the negative Chaikin Oscillator.

Investors might want to keep a close watch on the RSI and Stochastic for signs of a reversal. If the price remains below both MAs and volume increases on down days, it may suggest a continued downtrend.

A Closer Look at European Endorsement and FDA Scrutiny

Interestingly, European regulators have already endorsed the earlier use of Abecma and Carvykti based on compelling trial data demonstrating their ability to prolong patients’ lives without disease progression. However, the FDA’s stance has been somewhat more cautious. Last year, the agency delayed its decision on Abecma and convened an advisory meeting in March to scrutinize the data for both Carvykti and Abecma more closely.

Addressing Safety Concerns: Balancing Efficacy and Risk

One of the primary concerns raised during the FDA’s advisory meeting was an apparent increase in the risk of death observed in the early stages of clinical trials for both Carvykti and Abecma. However, the companies developing these therapies attribute this finding to limitations in the “bridging therapies” that study participants could receive while awaiting CAR-T treatment. Panelists reviewing the data expressed confidence that such issues were unlikely to occur as frequently in real-world practice.

The Road Ahead: Potential Safety Restrictions and Implications

Despite the optimism surrounding the efficacy of Carvykti and Abecma, the regulatory scrutiny they have faced suggests that the FDA may impose new safety restrictions if it chooses to clear them for earlier use. While this could potentially delay their broader adoption, it also underscores the agency’s commitment to ensuring the safety and well-being of patients.

A Critical Moment in Cancer Therapy Evolution

In conclusion, the FDA’s upcoming decisions regarding the expanded use of Carvykti and Abecma mark a pivotal moment in the evolution of cancer therapy, particularly for multiple myeloma patients. The potential approval of these CAR-T therapies for use after just one relapse could significantly enhance treatment options and outcomes for countless individuals battling this devastating disease. As we await the FDA’s verdict, it’s essential to recognize the delicate balance between efficacy and safety that regulators must navigate to bring these promising therapies to those in need. Ultimately, the decisions made in the coming months will not only shape the future of CAR-T therapy but also offer renewed hope to patients and their loved ones in the fight against cancer.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.