In the ever-evolving landscape of the fast-food industry, McDonald’s (MCD) stands as a stalwart, consistently adapting to consumer trends and global economic conditions. As a testament to its resilience and strategic foresight, the company recently announced its first-quarter earnings, surpassing analyst expectations and providing insights into its future trajectory.

Impressive Q1 Performance

McDonald’s reported a first-quarter earnings per shareEarnings per share (EPS) is a fundamental financial metric that provides valuable insights into a company's profitability. This widely used indicator helps investors and analysts g... (EPS) of $2.66, surpassing the consensus estimate of $2.54. Moreover, the company’s revenue for the quarter stood at $6.17 billion, exceeding the consensus forecast of $5.75 billion. This robust performance is indicative of McDonald’s continued relevance and competitive strength in the market.

Global Comparable Sales Growth

One of the key highlights of McDonald’s Q1 report was its global comparable sales growth, which increased by 1.9%. This growth was primarily driven by positive comparable sales in the U.S. and International Operated Markets segment. However, comparable sales in the International Developmental Licensed Markets segment experienced a slight decline due to the ongoing impact of the conflict in the Middle East.

Segment-wise Performance

Breaking down the sales performance by segment, the U.S. market saw a notable increase in comparable sales, rising by 2.5% in Q1. Similarly, the International Operated Markets segment recorded a commendable growth rate of 2.7%. On the other hand, the International Developmental Licensed Markets segment witnessed a slight decline of 0.2% in comparable sales.

Financial Metrics

In addition to its strong sales performance, McDonald’s also reported a 5% increase in consolidated revenues, or 4% in constant currencies. Furthermore, the company’s systemwide sales experienced a 3% growth, mirroring the constant currency growth rate.

Outlook for FY24

Looking ahead, McDonald’s expects a “moderating” growth in its topline performance for the fiscal year 2024. The company cited broad-based consumer pressures and a slowdown in industry traffic as factors influencing this outlook. Despite these challenges, McDonald’s remains confident in its ability to navigate the market dynamics, emphasizing its position of strength in the industry.

Strategic Initiatives

To drive future growth and innovation, McDonald’s announced plans to test a larger burger later in the year. This move reflects the company’s commitment to catering to evolving consumer preferences and staying ahead of the competition. Additionally, McDonald’s aims to accelerate the pace of restaurant openings in FY24, aligning with its global expansion strategy.

Earnings Call Insights

Insights gleaned from McDonald’s Q1 earnings conference call underscored the company’s proactive approach to addressing market challenges. Despite acknowledging the prevailing consumer pressures and industry slowdown, McDonald’s reiterated its confidence in its operational resilience and strategic direction.

MCD Technical Analysis

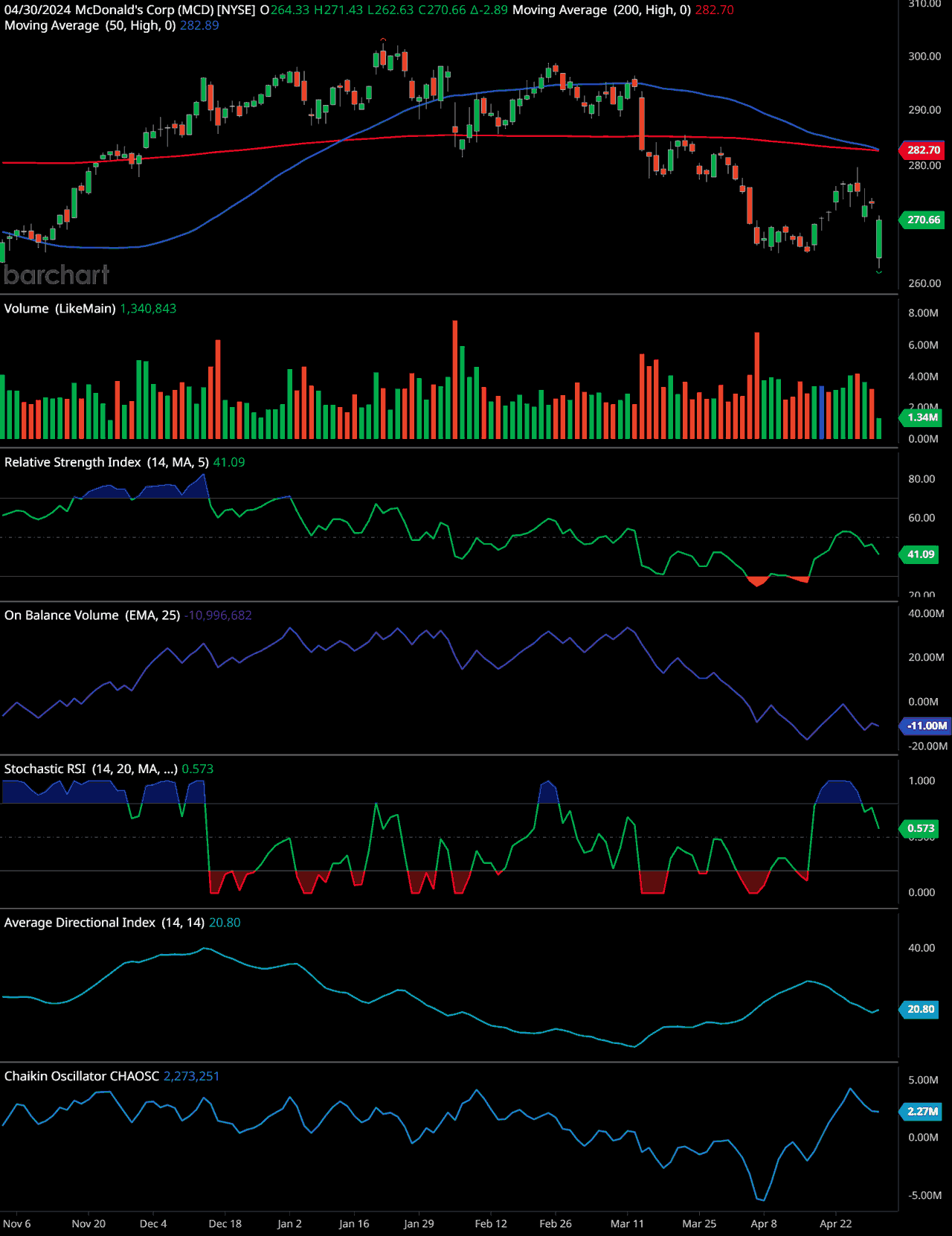

Moving Averages:

- 50-day Moving Average (MA): The blue line indicates the 50-day MA is currently above the most recent closing price, suggesting a potential resistance level at $282.70.

- 200-day Moving Average (MA): The red line, showing the 200-day MA, is above the 50-day MA and also above the most recent closing price, further reinforcing the resistance level.

Volume:

- Volume Analysis: The volume shows variability with some spikes, particularly around large price movements. The recent volume spike could be associated with selling pressure as indicated by the green bars on the last days.

Technical Indicators:

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI):

- The RSI is at 41.09, which is below the midpoint of 50. This suggests that the stock might be slightly leaning towards being oversold, but it’s not in the oversold territory yet.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV):

- The OBV line is trending slightly downwards, which could indicate that selling pressure is outweighing buying pressure as volume is going down with the price.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...:

- Currently at 0.573, this indicates that the stock is neither overbought nor oversold, maintaining a neutral position in the stochastic oscillator.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX):

- At 20.80, the ADX shows a weak trend strength. This suggests that the market is not showing strong directional movement and could be in a consolidative state.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...:

- The Chaikin Oscillator value is positive at 2,273,251, indicating that there might be some underlying buying pressure despite the recent price drop.

Interpretation:

The stock is trading below both key moving averages, which generally indicates a bearish sentiment. However, the presence of a positive Chaikin Oscillator and a not-too-low RSI might suggest some potential for recovery or at least stabilization. The relatively low ADX value points towards a lack of strong trend, which might indicate the stock is currently more range-bound.

Investors might want to watch for potential resistance near the 200-day and 50-day moving averages. Given the mixed signals from volume and momentum indicators, it might be wise to wait for a clearer trend signal or more bullish momentum before considering long positions.

In conclusion, McDonald’s impressive Q1 performance and forward-looking outlook reaffirm its status as a leader in the fast-food industry. Through strategic initiatives, operational efficiency, and a deep understanding of consumer trends, McDonald’s continues to chart a course for sustained growth and relevance in the years to come. As the company adapts to evolving market dynamics, investors and consumers alike can remain confident in McDonald’s ability to deliver value and innovation.

FAQ: McDonald’s Q1 Performance and Outlook

- What were the key financial highlights for McDonald’s in Q1?

- McDonald’s reported earnings per share (EPS) of $2.66, surpassing the consensus estimate of $2.54. The company’s revenue for the quarter was $6.17 billion, which exceeded the expected $5.75 billion.

- How did McDonald’s perform in different market segments during Q1?

- In the U.S. market, McDonald’s saw a 2.5% increase in comparable sales. The International Operated Markets segment recorded a growth rate of 2.7%, while the International Developmental Licensed Markets segment experienced a slight decline of 0.2% in comparable sales.

- What is McDonald’s outlook for fiscal year 2024?

- McDonald’s expects a moderating growth in its topline performance due to broad-based consumer pressures and a slowdown in industry traffic. Despite these challenges, the company remains confident in its strategic positioning and operational resilience.

- What new initiatives is McDonald’s planning to implement for future growth?

- McDonald’s plans to test a larger burger later in the year and aims to accelerate the pace of restaurant openings as part of its global expansion strategy.

- What insights were shared during McDonald’s Q1 earnings conference call?

- The earnings call highlighted McDonald’s proactive approach in navigating market challenges, reaffirming its confidence in operational resilience and strategic direction despite prevailing consumer pressures and industry slowdowns.

- What was McDonald’s stock performance analysis as mentioned in the article?

- Technical analysis indicated that the stock is trading below key moving averages, suggesting a bearish sentiment. However, a positive Chaikin Oscillator and a neutral position in the Stochastic RSI indicate potential for recovery or stabilization.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.