Salesforce (CRM) – Anticipating the Fiscal First-Quarter Results

As the only Dow Jones stock on the earnings calendar for the upcoming week, Salesforce (CRM) is set to disclose its fiscal first-quarter results after the market closes on Wednesday, May 29, 2024. The anticipation surrounding this announcement is significant, with many investors keen to understand the company’s performance and future prospects.

Low Expectations, High Potential

Expectations are relatively low for Salesforce heading into this earnings release. This creates a scenario where the company has a low bar to clear, which could work in its favor. Despite the modest expectations, several growth drivers remain robust, including larger enterprise IT budgets that are likely to support price increases. Analysts suggest that these factors could help Salesforce surpass the low expectations set by the market.

Earnings and Revenue Forecast

Wall Street analysts predict a substantial year-over-year increase in Salesforce’s earnings, projecting a rise of 40.2% to $2.37 per share, which aligns with the average estimate from analysts. On the revenue front, Salesforce is expected to report $9.1 billion, reflecting a 10.9% year-over-year growth. This anticipated revenue growth underscores the company’s ability to continue expanding its market share and enhancing its product offerings.

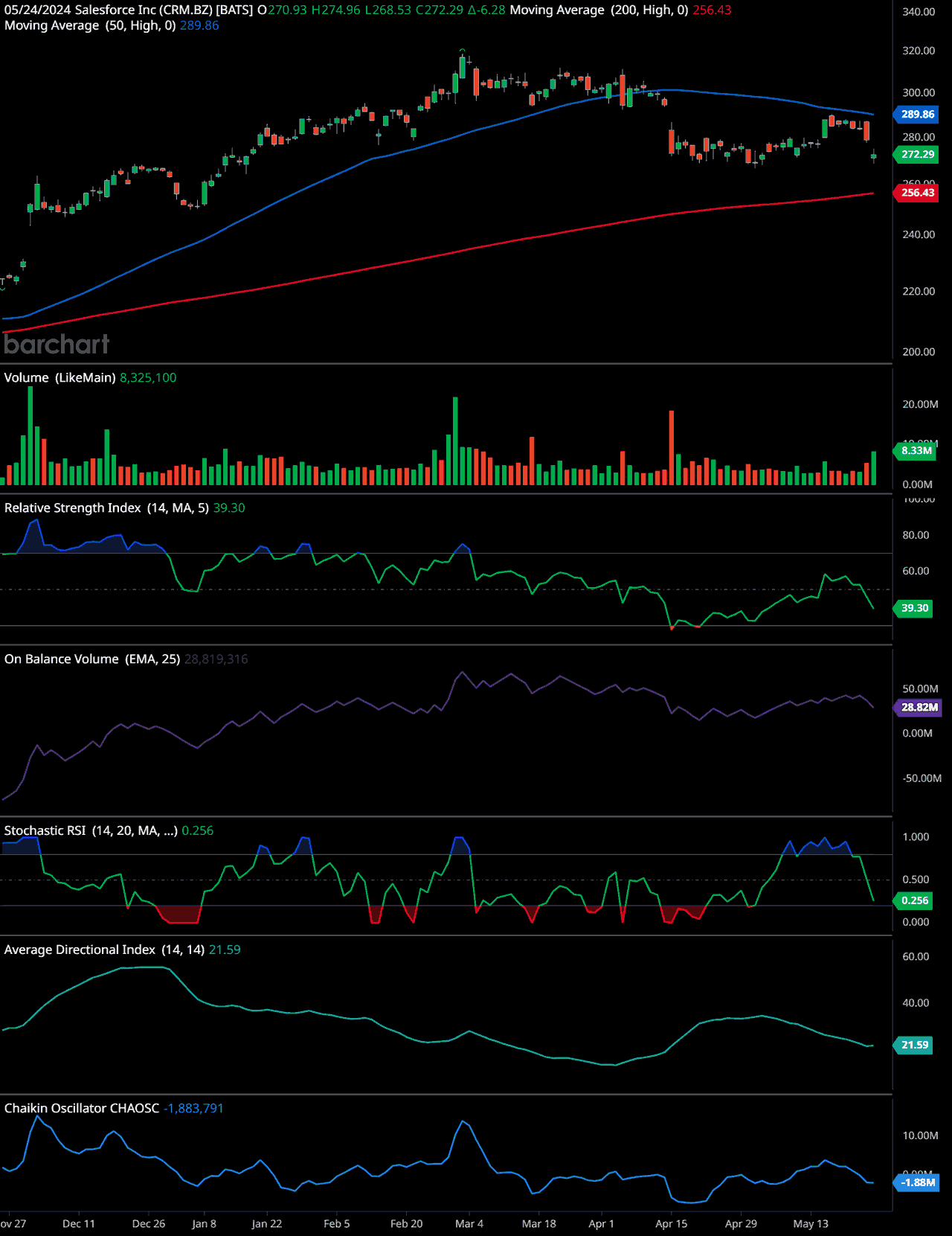

CRM Technical Analysis

Price Movement and Moving Averages: The stock is currently priced at $272.29, having increased by $6.28 on the latest trading day. The 50-day moving average (MA) is at $289.86, while the 200-day MA is at $256.43. The price is below the 50-day MA, indicating a bearish trend in the short term. However, it is above the 200-day MA, suggesting a potential long-term bullish trend.

Volume: The trading volume is 8,325,100, with a recent spike indicating increased trading activity. Higher volume on down days compared to up days can indicate selling pressure.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is at 39.30. An RSI below 30 typically indicates that the stock is oversold, while above 70 suggests it is overbought. At 39.30, the stock is approaching oversold territory but isn’t quite there yet.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV is 28,819,316, showing a general upward trend. This suggests that volume on up days is outpacing volume on down days, which can be a bullish signal.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: The Stochastic RSI is at 0.256, indicating the stock is oversold (below 0.20 is considered oversold, above 0.80 is considered overbought). This might suggest a potential buying opportunity if the price starts to recover.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX): The ADX is at 21.59. Values above 25 typically indicate a strong trend, while values below 20 suggest a weak trend. At 21.59, the trend is not particularly strong but shows some directional movement.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: The Chaikin Oscillator is at -1,883,791, indicating a bearish momentum in the market as it is below zero. This oscillator measures the accumulation-distribution line of the moving average convergence-divergence (MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More).

Time-frame Signals:

- Short-term (3 months): Sell. The stock is below its 50-day MA with bearish momentum indicated by the Chaikin Oscillator and a weak ADX.

- Mid-term (6 months): Hold. The stock is still above the 200-day MA, and if it finds support here, there might be a chance of a rebound.

- Long-term (12 months): Buy. The long-term outlook remains bullish given the price is above the 200-day MA and the OBV suggests accumulation.

This analysis suggests caution in the short term but potential for long-term growth if the stock can maintain above its 200-day moving average.

Dollar General (DG) – Showcasing Top-Line Progress

Wall Street holds a mostly positive outlook on Dollar General (DG) ahead of its fiscal first-quarter earnings report, scheduled for release before the market opens on Thursday. The dollar-store chain has shown notable progress on its top line, beginning in the latter half of 2023, and investors are eager to see if this momentum has carried into the first quarter of 2024.

Sustaining Positive Sales Trends

Analysts believe that Dollar General should have maintained its positive sales trends in the first quarter. However, there are potential factors that could introduce some variability in the results. These include the timing shift of Easter and adverse weather conditions, which may have impacted sales. Additionally, the company likely faced challenges related to shrink (losses from theft and other causes), higher labor costs, and increased promotional markdowns. These pressures are expected to ease in the coming months, providing a more favorable environment for the company’s operations.

Earnings and Revenue Expectations

For Dollar General’s first quarter, analysts, on average, anticipate earnings of $1.57 per share, which represents a 32.9% decline year-over-year. Despite the expected drop in earnings, revenue is projected to reach $9.9 billion, marking a 6.5% year-over-year increase. This revenue growth highlights the company’s ability to attract and retain customers, even amid operational challenges.

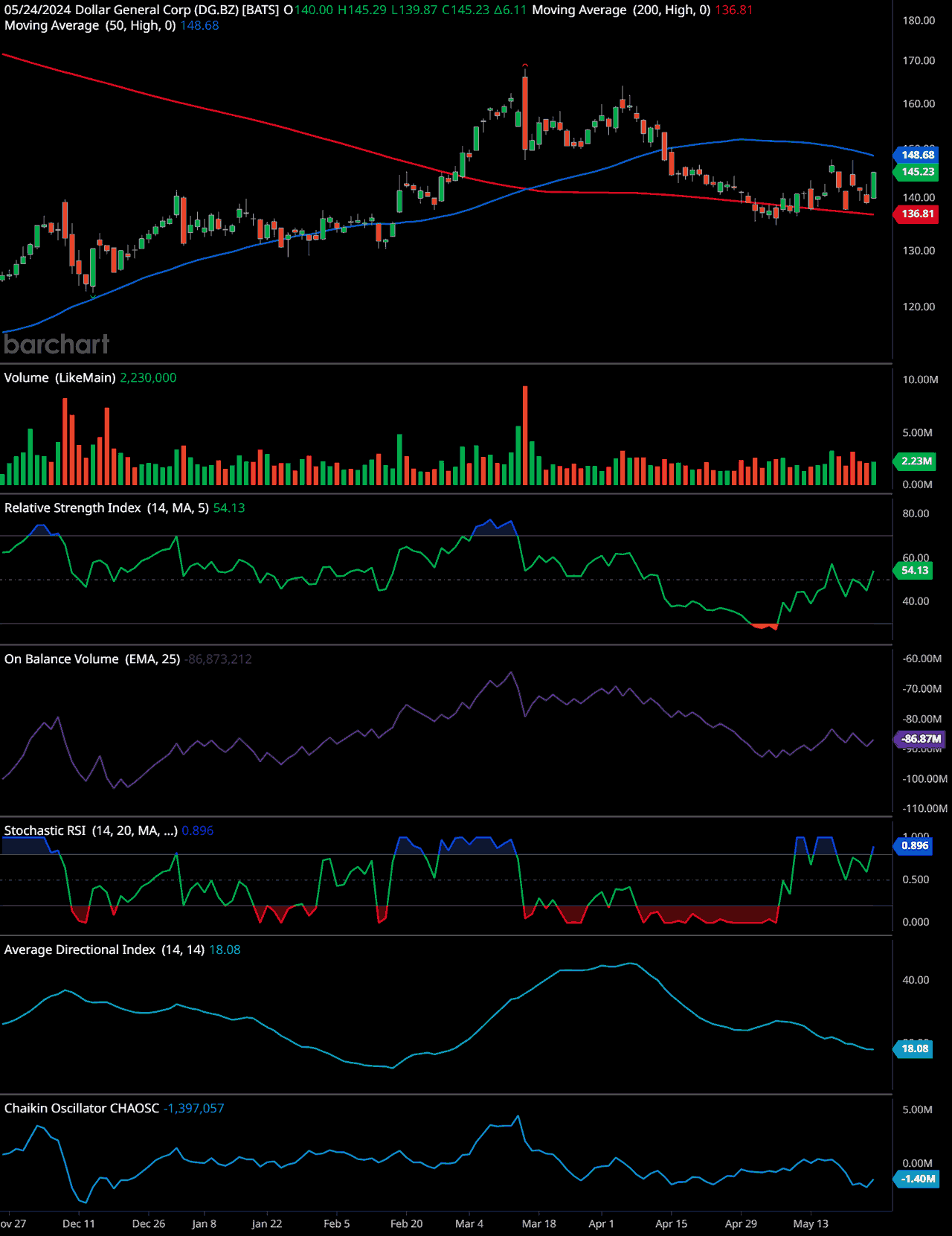

DG Technical Analysis

Price Movement and Moving Averages:

- The stock has experienced a generally upward trend since late November, with notable peaks around mid-February and mid-April.

Volume:

- Volume is represented in the middle section and has varied significantly, with higher volume spikes occurring at key price movements.

- Recent volume levels are around 2.23M, indicating a healthy trading interest.

Relative Strength Index (RSI):

- The RSI is at 54.13, suggesting a neutral to slightly bullish momentum. An RSI above 70 indicates overbought conditions, while below 30 indicates oversold conditions.

On Balance Volume (OBV):

- OBV is trending upwards at 86,873,212, reflecting that volume is supporting the price increase. This is a bullish sign.

Stochastic RSI:

- The Stochastic RSI is at 0.896, indicating the stock is close to being overbought. Values above 0.8 typically indicate overbought conditions, while values below 0.2 indicate oversold conditions.

Average Directional Index (ADX):

- ADX is at 18.08, which suggests that the current trend is weak. Values above 25 indicate strong trend strength.

Chaikin Oscillator:

- The Chaikin Oscillator is at -1,397,057, indicating bearish accumulation/distribution. A positive value suggests buying pressure, while a negative value suggests selling pressure.

Analysis:

- Volume supports the price movement, but the recent volume spike could suggest increased volatility.

- The RSI indicates a neutral to slightly bullish momentum, while the Stochastic RSI suggests potential overbought conditions in the short term.

- OBV is positive, supporting the bullish trend, but the ADX indicates that the trend strength is weak.

- The Chaikin Oscillator shows selling pressure, which could suggest caution in the short term.

Time-frame Signals:

- 3-Month Horizon: Hold. The stock shows bullish characteristics but with potential short-term overbought conditions and weak trend strength.

- 6-Month Horizon: Buy. The stock is above key moving averages with positive volume trends.

- 12-Month Horizon: Buy. Long-term indicators and moving averages suggest continued upward potential.

Investors should monitor the support level around the 140 mark and resistance around the 150 level, along with changes in volume and RSI for future trading decisions.

Dell Technologies (DELL) – Riding High on Strong Performance

Dell Technologies (DELL) has experienced a remarkable year in terms of stock price performance, more than doubling in value. As the company prepares to release its fiscal first-quarter results after the market closes on Thursday, investors are keen to see if this strong performance will continue.

Capitalizing on AI Demand

Dell is well-positioned to capitalize on the growing demand for artificial intelligence (AI) servers, storage, and PCs. This positioning could significantly boost the company’s long-term earnings potential. Industry analysts forecast that Dell’s full-year earnings per shareEarnings per share (EPS) is a fundamental financial metric that provides valuable insights into a company's profitability. This widely used indicator helps investors and analysts g... could reach $10 by fiscal 2026, approximately 14% higher than the average analyst estimate. This optimistic outlook is driven by Dell’s strategic investments in AI and other high-growth areas.

Earnings and Revenue Projections

For the upcoming earnings report, Wall Street expects Dell to report first-quarter earnings of $1.26 per share, representing a slight decline of 3.8% year-over-year. Revenue is anticipated to be $21.7 billion, reflecting a 6.9% year-over-year increase. This projected revenue growth underscores Dell’s ability to expand its market presence and capitalize on emerging technology trends.

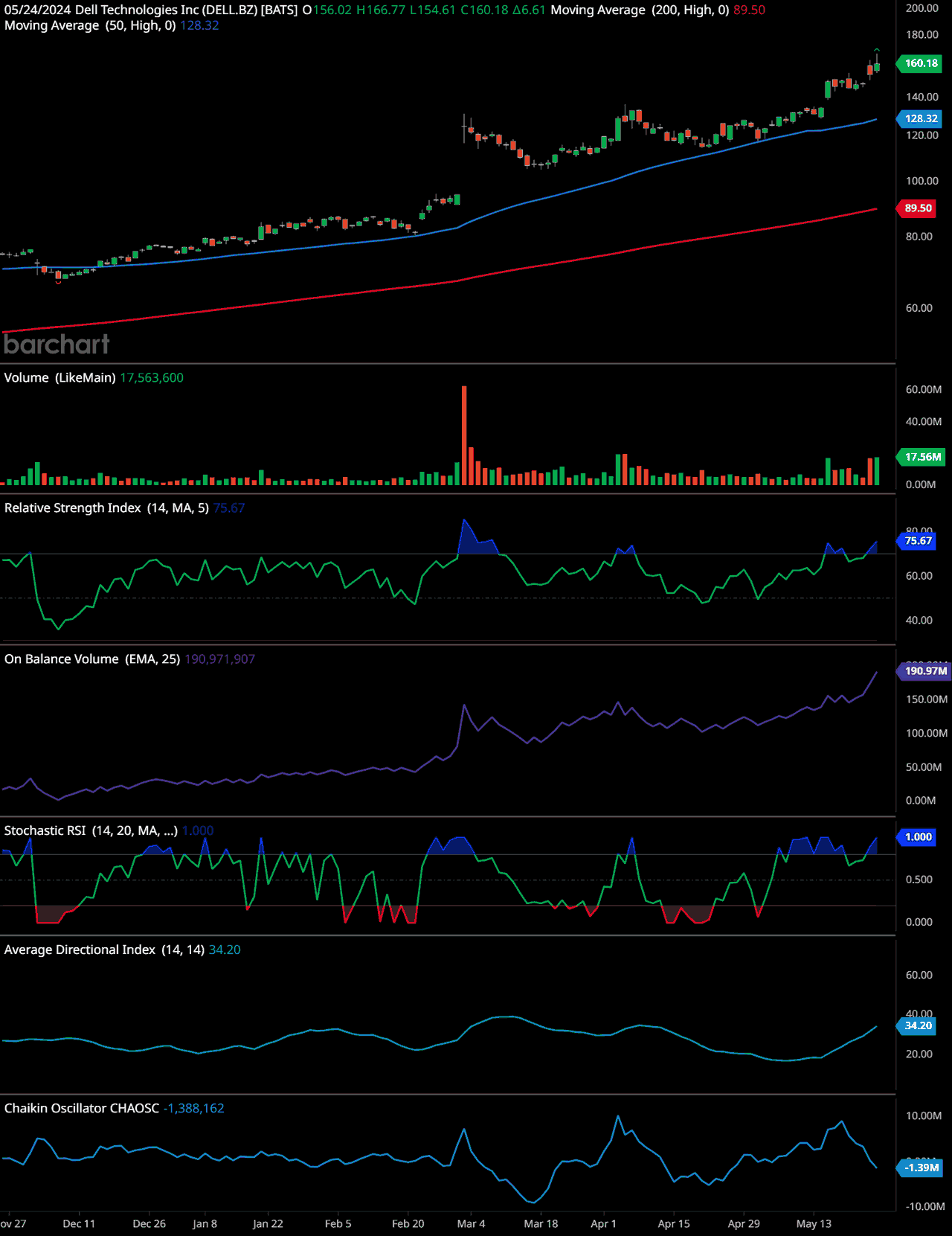

DELL Technical Analysis

Price Trend and Moving Averages: The stock has been on a strong upward trend, evident from the consistent rise in price. The 50-day moving average (blue line) is at 128.32, and the 200-day moving average (red line) is at 89.50. The current price of the stock is 160.18, which is significantly above both moving averages, indicating a strong bullish trend.

Volume: The volume shows a notable spike, with the latest volume at 17,563,600. This increase in volume usually accompanies strong price movements, suggesting that the upward price trend is supported by substantial trading activity.

Relative Strength Index (RSI): The RSI is currently at 75.67. RSI values above 70 typically indicate that a stock is overbought, which can sometimes precede a price correction or consolidation period.

On Balance Volume (OBV): The OBV, which stands at 190,971,907, has been trending upwards. This supports the bullish price trend as it indicates that volume is flowing into the stock.

Stochastic RSI: The Stochastic RSI is at 1.000, indicating an overbought condition. Similar to the RSI, this suggests that the stock might experience a short-term pullback or consolidation.

Average Directional Index (ADX): The ADX is at 34.20. Values above 25 typically indicate a strong trend, and the current value confirms the strength of the ongoing bullish trend.

Chaikin Oscillator: The Chaikin Oscillator is at -1,388,162, indicating some bearish divergence. While the price is rising, the negative value here might suggest a potential slowdown or reversal in momentum.

Time-frame Signals:

3-Month Horizon: Given the strong upward trend, supported by high volume and a strong ADX, a “Buy” recommendation is reasonable. However, be cautious of potential short-term pullbacks due to the overbought RSI and Stochastic RSI.

6-Month Horizon: The bullish trend seems robust, and the upward movement in the OBV suggests continued buying interest. A “Buy” recommendation is suitable, but monitor the RSI and Chaikin Oscillator for signs of a trend change.

12-Month Horizon: If the company continues to perform well fundamentally, the technical indicators support a long-term “Buy.” The price being well above both the 50-day and 200-day moving averages suggests strong long-term momentum.

In summary, Dell Technologies Inc. shows a strong bullish trend with potential short-term overbought conditions. Monitoring the RSI, Stochastic RSI, and Chaikin Oscillator for signs of a pullback is advisable while maintaining a positive long-term outlook.

Looking Ahead

As Salesforce, Dollar General, and Dell Technologies prepare to release their earnings reports next week, investors and analysts are watching closely. Each company faces unique challenges and opportunities that will influence their performance and future prospects. Salesforce’s ability to leverage enterprise IT budgets, Dollar General’s efforts to sustain sales trends amid operational pressures, and Dell’s strategic positioning in the AI market are all key factors that will shape their respective earnings outcomes. With the earnings season in full swing, these reports will provide valuable insights into the health and trajectory of these prominent companies.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.