Dollar General reported a solid financial performance for Q1 2024, with net sales increasing by 6.1% to $9.9 billion. This growth was driven by market share gains in consumable and non-consumable product sales, and the opening of 197 new stores. Same-store sales grew by 2.4%, largely due to a 4% increase in consumer traffic. Despite a decline in the average transaction amount, the consumable category saw robust growth. The company also attracted middle and higher-income customers. However, challenges included economic pressures on core customers and shrink reduction.

Efforts to reduce shrink include moving away from self-checkout in 12,000 stores and enhancing supply chain and in-store operations. Despite these challenges, Dollar General achieved a gross profitIn the world of finance and accounting, the term "gross profit" holds significant importance as it provides a fundamental snapshot of a company's financial health. Also known as gr... of 30.2% of sales, though this was down by 145 basis points primarily due to increased shrink. Operating profit decreased by 26.3% to $546 million, with a 29.5% decrease in EPS to $1.65. Inventory management and operational enhancements contributed to a 247% increase in cash flows from operations.

Dollar General reaffirmed its financial guidance for 2024, expecting net sales growth of 6% to 6.7% and EPS between $6.80 and $7.55. The company remains committed to value and convenience, reflected in its operational priorities and ESG goals.

Key Drivers of Sales Growth

The increase in same-store sales was primarily fueled by a 4% growth in consumer traffic. However, this was slightly offset by a decline in the average transaction amount, attributed to fewer items per basket. The consumable category experienced robust growth, as customers relied on Dollar General for essential items at value prices. This growth was somewhat counterbalanced by declines in the home, seasonal, and apparel categories. March saw the strongest growth, benefiting from the Easter holiday shifting from April to March this year, while February and April experienced relatively similar performance.

Customer Behavior and Market Dynamics

The softness in discretionary categories during Q1 highlights the continued economic pressure on Dollar General’s core customers. These customers remain highly value-oriented in their shopping behavior, as evidenced by the increased share of private brand sales and engagement with items priced at or below $1. Despite these challenges, Dollar General successfully attracted middle and higher-income customers from adjacent cohorts. The company’s competitive pricing and strong value proposition are expected to drive ongoing growth across diverse customer segments.

Shrink Reduction Efforts

Shrink remains the most significant headwind for Dollar General. To combat this issue, the company has implemented an end-to-end approach to shrink reduction, focusing on the supply chain, merchandising, and in-store operations. Key initiatives include ensuring timely and complete deliveries, reducing inventory levels, and enhancing front-end presence in stores. Notably, Dollar General has moved away from self-checkout in approximately 12,000 stores, a strategic shift aimed at reducing shrink and improving customer engagement. This change is expected to yield more significant positive impacts in the latter half of 2024 and into 2025.

In retail, “shrink” refers to the loss of inventory that can be attributed to various factors such as theft, damage, spoilage, vendor fraud, and administrative errors. It represents the difference between the recorded inventory on the books and the actual inventory physically present in the store or warehouse. Shrinkage is a critical issue for retailers because it directly impacts their profitability and operational efficiency.

Key Causes of Shrink in Retail:

- Theft: This includes both external theft (shoplifting) and internal theft (employee theft).

- Damage: Products that are damaged during handling, storage, or transit and cannot be sold.

- Spoilage: Perishable goods that spoil before they can be sold.

- Vendor Fraud: Discrepancies in the quantity or quality of goods received from suppliers.

- Administrative Errors: Mistakes in pricing, inventory management, or record-keeping that lead to inaccurate inventory counts.

Impact of Shrink:

- Financial Losses: Shrink directly reduces the amount of sellable inventory, leading to financial losses for the retailer.

- Reduced Profit MarginsIn the dynamic world of business, profitability is a fundamental metric that encapsulates a company's ability to generate earnings from its operations. Profit margins, expressed as...: Loss of inventory means higher costs and lower profits.

- Operational Inefficiency: Frequent inventory discrepancies can disrupt operations, leading to inefficiencies.

- Increased Security Costs: Retailers often have to invest in additional security measures to prevent theft and fraud, adding to operational costs.

Strategies to Reduce Shrink:

- Improved Inventory Management: Implementing robust inventory tracking systems to ensure accurate inventory records.

- Employee Training: Educating employees on the importance of shrink prevention and how to identify potential issues.

- Enhanced Security Measures: Using surveillance cameras, security tags, and hiring security personnel to deter theft.

- Regular Audits: Conducting regular inventory audits to identify and address discrepancies promptly.

- Vendor Management: Establishing clear contracts and monitoring deliveries from vendors to prevent fraud and errors.

Understanding and managing shrink is crucial for retailers to maintain their profitability and ensure smooth operations.

Financial Highlights

Gross profit for Q1 was 30.2% of sales, a decrease of 145 basis points. This decline was primarily due to increased shrink and markdowns, a higher mix of consumable sales, and lower inventory markups, partially offset by a reduced LIFO provision. Shrink alone accounted for a 59 basis point headwind. SG&A expenses were 24.7% of sales, up by 97 basis points, driven by higher retail labor costs, depreciation, incentive compensation, and maintenance expenses.

Operating profit decreased by 26.3% to $546 million, or 5.5% of sales. Net interest expense decreased to $72 million from $83 million in the previous year. The effective tax rate increased to 23.3% from 21.8%, due to the impact of certain rate-affecting items and stock-based compensation expenses. Earnings per shareEarnings per share (EPS) is a fundamental financial metric that provides valuable insights into a company's profitability. This widely used indicator helps investors and analysts g... (EPS) decreased by 29.5% to $1.65, exceeding the high end of internal expectations.

Inventory and Cash Flow Management

Merchandise inventories at the end of Q1 were $6.9 billion, a 5.5% decrease compared to the prior year. Non-consumable inventory saw a significant reduction of 19.1%. The company generated $664 million in cash flows from operations, an increase of 247%, primarily due to improved working capital management. Capital expenditures totaled $342 million, covering investments in new stores, remodels, relocations, distribution, transportation projects, and strategic initiatives. Shareholders received $130 million in quarterly dividends.

Financial Outlook for 2024

Dollar General reaffirmed its financial guidance for fiscal 2024, anticipating net sales growth of 6% to 6.7%, same-store sales growth of 2% to 2.7%, and EPS in the range of $6.80 to $7.55. The company also expects a negative impact on EPS of approximately $0.50 due to higher incentive compensation expenses and an effective tax rate of 22.5% to 23.5%. Capital expenditures are projected to be between $1.3 billion and $1.4 billion. The number of planned remodels has been increased to 1,620 stores, while the number of new store openings has been adjusted to 730.

Operational Enhancements

Dollar General’s operational priorities include driving profitable sales growth, capturing growth opportunities, maintaining a low-cost operator position, and investing in its diverse teams. The company has increased employee presence at the front end of stores to enhance customer engagement and improve checkout experiences. Inventory management has been prioritized with specialized shifts and training, resulting in improved customer perceptions of in-stock levels.

Supply Chain and Merchandising Improvements

Efforts to improve on-time and in-full deliveries (OTIF) have led to significant improvements. The company is exiting 12 temporary warehouse facilities and progressing on new distribution centers in Arkansas and Colorado. These initiatives aim to reduce transportation costs and improve inventory flow. Dollar General is also refreshing its sorting process within distribution centers, enhancing efficiency and on-shelf availability.

In merchandising, Dollar General remains committed to providing value through private brand offerings, affordable national brands, and maintaining the $1 price point. Despite inflationary pressures, the company continues to carry approximately 2,000 items at or below $1 in most stores. Efforts to reduce inventory by eliminating secondary SKUs and simplifying in-store activities are expected to save time and improve the overall experience for associates and customers.

Commitment to Community and ESG Goals

Dollar General’s commitment to serving its communities is reflected in its annual “Serving Others” report, which highlights ongoing ESG efforts and goals. The company’s extensive network of stores, located within five miles of approximately 75% of the U.S. population, positions it uniquely to meet customer needs. By focusing on value and convenience, Dollar General aims to continue enhancing customer service, supporting associates, and creating long-term shareholder value.

Insights

- Net sales increased by 6.1% to $9.9 billion.

- Same-store sales grew by 2.4%, driven by a 4% increase in consumer traffic.

- Operating profit decreased by 26.3% to $546 million.

- Inventory management improvements led to a 247% increase in cash flows from operations.

- Dollar General expects 2024 net sales growth of 6% to 6.7%.

The Essence (80/20)The Origins and Evolution of the 80/20 Principle The Discovery by Vilfredo Pareto In 1897, Italian economist Vilfredo Pareto uncovered a striking pattern in his study of wealth and...

- Core Topics: Financial performance, market share gains, store expansions, same-store sales growth, customer traffic, shrink reduction, operational enhancements, financial guidance, and ESG goals.

- Details: Dollar General saw strong sales growth driven by increased market share and store expansions. Same-store sales increased due to higher consumer traffic. Efforts to combat shrink and improve operations are key priorities. Financial performance showed mixed results with notable decreases in operating profit and EPS, but strong cash flowThe cash flow statement provides a detailed overview of the cash inflows and outflows of a company over a specified period of time. It includes cash received from operations, inves... More improvements and positive financial outlook for 2024.

The Action Plan – What Dollar General Should Do

- Enhance Customer Engagement: Focus on increasing front-end store presence and improving checkout experiences.

- Reduce Shrink: Implement comprehensive shrink reduction strategies across supply chain and in-store operations.

- Optimize Inventory Management: Continue improving working capital management and inventory efficiency.

- Expand Market Reach: Open new stores and remodel existing ones to attract diverse customer segments.

- Maintain Competitive Pricing: Ensure value proposition through affordable pricing and private brand offerings.

Blind Spot

Potential overlooked details include the impact of economic pressures on long-term customer loyalty and the effectiveness of shrink reduction measures. Additionally, the balance between expanding store footprint and maintaining operational efficiency may present challenges.

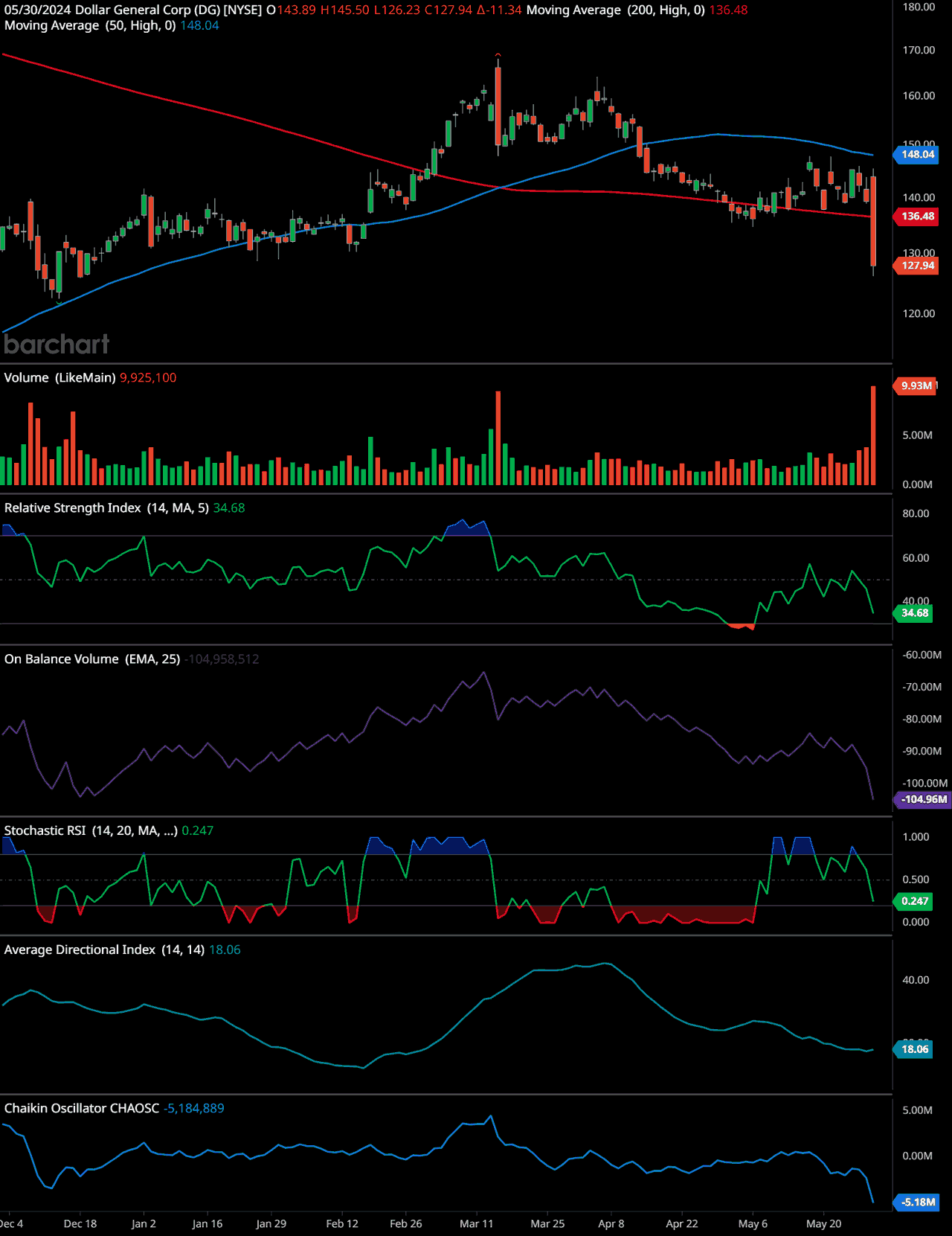

Dollar General (DG) Technical Analysis

Price and Moving Averages:

- The stock opened at 143.89, reached a high of 145.50, a low of 126.23, and closed at 127.94, down 11.34 points.

- The 200-day moving average (red line) is at 136.48, indicating a long-term downtrend as the current price is below this average.

- The 50-day moving average (blue line) is at 148.04, also showing a downward trend, with the current price significantly below this level.

Volume:

- Volume for the day was very high at 9.93 million, suggesting significant selling pressure.

- High volume on a sharp decline often indicates strong bearish sentiment and potential further downside.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI):

- The RSI is at 34.68, which is close to the oversold threshold of 30. This suggests the stock is nearing oversold conditions, which could imply a potential for a short-term bounce or stabilization.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV):

- The OBV is at -104.96 million, showing a declining trend. This indicates that the volume on down days is outweighing the volume on up days, reinforcing the bearish outlook.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...:

- The Stochastic RSI is at 0.247, which is in the lower range, suggesting the stock is oversold. This can be a sign that the price might rebound in the short term.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX):

- The ADX is at 18.06, which indicates a weak trend. Values below 20 typically suggest a non-trending or weakly trending market.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...:

- The Chaikin Oscillator is at -5.18 million, showing significant negative divergence. This indicates a bearish outlook as money flow is leaving the stock.

Time-frame Signals:

- 3-Month Outlook: Sell

- The stock is showing strong bearish indicators with significant selling pressure and negative money flow. The short-term outlook is negative.

- 6-Month Outlook: Hold

- Given the stock’s proximity to oversold conditions, there might be a potential for stabilization or a short-term bounce. However, the overall trend remains bearish, so a cautious hold is recommended.

- 12-Month Outlook: Hold

- While the long-term moving averages suggest a downtrend, oversold conditions and potential for mean reversion could stabilize the stock over a longer period. Holding is recommended with a close watch on any trend reversals or positive developments.

In conclusion, the current technical indicators suggest significant bearish sentiment in the short term with some potential for stabilization in the medium to long term.

Remember, past performance is not an indication of future results. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

Dollar General’s Q1 2024 performance underscores the company’s resilience and strategic focus on value and convenience. Despite challenges, the company remains well-positioned to drive growth and profitability through its comprehensive operational and financial strategies. With a strong foundation and commitment to excellence, Dollar General looks forward to delivering continued value to customers, associates, and shareholders throughout 2024.

Dollar General Q1 2024 Performance FAQs

Book Recommendations and Their Relevance

1. “Good to Great: Why Some Companies Make the Leap… and Others Don’t” by Jim Collins

Description: This book explores how companies can transition from being good to truly great organizations. It provides insights into leadership, disciplined thought and action, and the importance of a company culture that fosters sustained excellence.

Relevance to the Article: Dollar General’s strategic initiatives to drive growth and improve operational efficiency align with the principles discussed in “Good to Great.” The company’s efforts to enhance customer engagement, reduce shrink, and expand its market reach reflect the disciplined strategies and strong leadership required to achieve sustained success.

2. “The Lean Startup: How Today’s Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses” by Eric Ries

Description: This book introduces the concept of the lean startup methodology, emphasizing the importance of continuous innovation, validated learning, and iterative product development. It advocates for a scientific approach to creating and managing successful startups in an age of uncertainty.

Relevance to the Article: Dollar General’s approach to improving inventory management, enhancing supply chain efficiency, and adapting to market conditions resonates with the lean startup principles of continuous improvement and innovation. The company’s focus on optimizing operations and responding to customer needs parallels the iterative and data-driven strategies highlighted in the book.

3. “Measure What Matters: How Google, Bono, and the Gates Foundation Rock the World with OKRs” by John Doerr

Description: This book focuses on the use of Objectives and Key Results (OKRs) as a goal-setting framework to drive growth, align team efforts, and achieve ambitious outcomes. It showcases how leading organizations use OKRs to stay focused and achieve significant results.

Relevance to the Article: Dollar General’s detailed action plan for operational enhancements, financial growth, and community commitment can benefit from the OKR framework outlined in “Measure What Matters.” By setting clear objectives and measurable key results, Dollar General can effectively track progress, maintain alignment across teams, and ensure successful execution of its strategies.

How These Books Tie into the Article

These book recommendations provide frameworks and strategies that align with Dollar General’s efforts to sustain growth, improve operational efficiency, and navigate market challenges. They offer valuable insights into leadership, innovation, and goal-setting that can help the company refine its approach and achieve its long-term objectives.

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

- Nvidia just poured $160 million into Applied Digital Stock… and it skyrocketed 76% in a day! 🚀 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.