Trump Media & Technology Group (DJT) stock has garnered significant attention due to its volatile performance and connection to former President Donald Trump. Since its public debut, the stock has seen dramatic fluctuations, initially surging to $79 per share but dropping as low as $22.84 by mid-April. Analysts compare DJT to “meme stocks” driven by social media hype rather than traditional financial metrics. An assassination attempt on Trump on July 13, 2024, which he survived with minor injuries, further highlighted the stock’s dependence on his political fortunes. DJT’s Q1 2024 financial report showed a revenue decline to $770,500 from $1.1 million the previous year and a significant loss of $327.6 million. Despite plans to expand into streaming services, the company faces legal and financial challenges, with its valuation under scrutiny. Many investors view their investment as support for the “Make America Great Again” movement.

Volatile Trading

DJT stock has exhibited substantial fluctuations since its debut in March 2024. On its first trading day, the stock soared to $79 per share but has since experienced significant volatility. By mid-April, the price had plummeted to a low of $22.84, reflecting the stock’s unpredictable nature. This erratic performance has caught the attention of investors and analysts alike, prompting comparisons to the phenomenon of “meme stocksA meme stock is a publicly traded company's stock that has seen a significant increase in price and trading volume primarily due to hype and popularity driven by social media platf....”

Meme Stock Comparison

Analysts have drawn parallels between DJT and “meme stocks,” which gain traction primarily through social media hype rather than traditional financial metrics. The volatile trading patterns of DJT mirror those of other stocks that have been propelled by online communities, further emphasizing the speculative nature of this investment.

Trump Assassination Attempt

The attention on DJT stock intensified following a dramatic event at a campaign rally on July 13, 2024. An assassination attempt on Donald Trump, who is pivotal to the company’s image and value, added a layer of uncertainty. Although Trump narrowly escaped serious injury, the incident tragically claimed the life of firefighter Corey Comperatore, who heroically shielded his family. This event highlighted the precarious link between Trump’s personal safety and the stock’s perceived value.

Financial Performance

The financial performance of DJT has also been a focal point for investors. The company’s first-quarter report for 2024 revealed a revenue decline and substantial losses. DJT generated $770,500 in revenue during Q1, down from $1.1 million in the same period the previous year. Additionally, the company reported a significant loss of $327.6 million. These figures have raised concerns about the company’s financial health and long-term viability.

Political Connection

The performance of DJT stock is closely tied to Donald Trump’s political fortunes. Some investors view the stock as a potential bet on the upcoming presidential election, anticipating that Trump’s return to political prominence could positively impact the company’s value. This speculative connection underscores the stock’s sensitivity to political developments.

Platform Expansion

In an effort to diversify and expand its offerings, DJT has announced plans to develop a streaming service and content delivery network. This strategic move aims to enhance the company’s product portfolio and attract a broader user base. Investors are closely watching these developments, hoping they will provide a much-needed boost to the company’s performance.

Investor Sentiment

Many retail investors regard their investment in DJT as more than just a financial opportunity. They view it as a means of supporting Trump’s “Make America Great Again” movement. This emotional connection has contributed to the stock’s popularity among certain investor segments, despite its financial challenges.

Legal and Financial Challenges

DJT faces a range of legal and financial challenges that could impact its stability. These include lawsuits from co-founders and concerns about Trump’s ongoing legal troubles. These issues add another layer of complexity to the stock’s outlook, making it a risky investment for many.

Valuation Concerns

The company’s valuation has been a point of contention among analysts. With a price-to-salesThe Price-to-Sales (P/S) ratio is a fundamental financial metric that provides valuable insights into a company's valuation. This ratio, often used by investors and analysts, compa... ratio of around 1,000, some experts question whether DJT’s current valuation is justified given its financial performance. These concerns have fueled debates about the stock’s true worth and future potential.

Insights

- DJT stock’s volatility is partly driven by social media and Trump’s political influence.

- The assassination attempt on Trump underscores the stock’s dependency on his safety and political future.

- DJT’s financial performance and legal issues pose significant risks to its stability.

The Essence (80/20)The Origins and Evolution of the 80/20 Principle The Discovery by Vilfredo Pareto In 1897, Italian economist Vilfredo Pareto uncovered a striking pattern in his study of wealth and...

- Core Topics: Stock volatility, Trump’s political influence, financial performance, meme stock comparison, platform expansion, investor sentiment, legal challenges, valuation concerns.

- Description: DJT stock’s performance is heavily influenced by its connection to Donald Trump and social media hype, showing extreme volatility. Financially, the company is struggling with declining revenues and substantial losses, while planning to expand its digital platform. Legal challenges and valuation concerns add further risk.

The Guerilla Stock Trading Action Plan

- Monitor Stock Volatility: Stay informed about DJT’s trading patterns and market reactions to political events.

- Assess Financial Health: Regularly review DJT’s financial reports and performance metrics.

- Understand Legal Risks: Keep track of ongoing legal issues involving DJT and Trump.

- Evaluate Platform Expansion: Analyze the potential impact of DJT’s planned streaming service on its user base and revenue.

- Investor Sentiment: Gauge retail investor sentiment and its influence on stock performance.

Blind Spot

The heavy reliance on Trump’s political fate means any significant change in his political career or personal safety could drastically impact DJT’s stock value and investor confidence.

DJT Technical Analysis

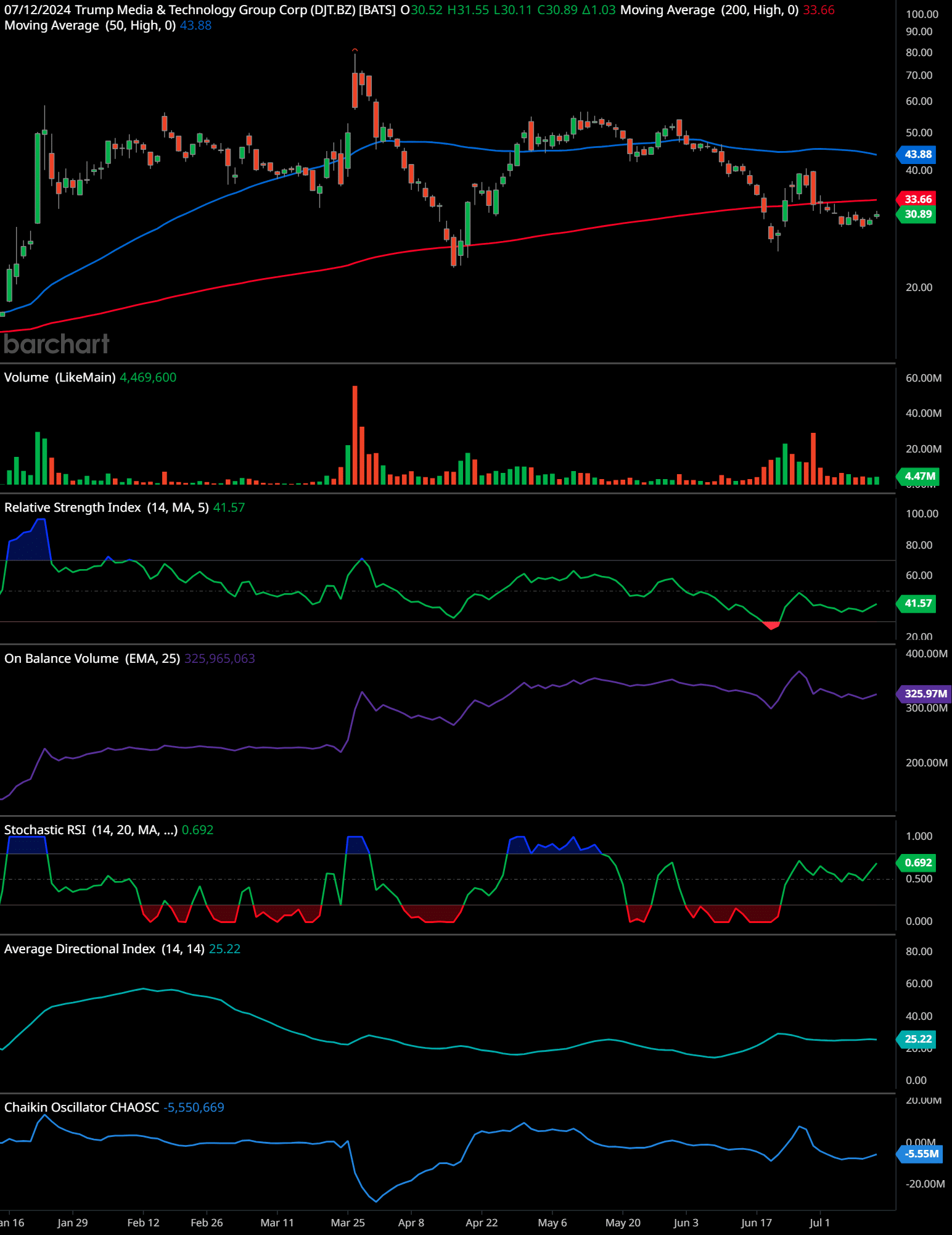

The chart for Trump Media & Technology Group Corp (DJT) displays the following technical indicators and patterns:

Price Trend: The price has been in a general downward trend since mid-May, declining from around $55 to the current level of approximately $30. There was a brief upward movement in late June, but the overall trend remains bearish.

Moving Averages: The 50-day moving average (blue line) is at $43.88, and the 200-day moving average (red line) is at $33.66. The price is currently below both moving averages, indicating a bearish trend.

Volume: There has been a spike in volume during mid-May when the price fell sharply, suggesting strong selling pressure. More recently, the volume has been relatively low.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is at 41.57, which is below the neutral level of 50, indicating that the stock is neither overbought nor oversold but leaning towards bearish territory.

On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV shows a declining trend, which aligns with the falling price, indicating that volume is supporting the downtrend.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: The Stochastic RSI is at 0.692, which suggests that the stock might be in a slight oversold condition, but not significantly.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX): The ADX is at 25.22, indicating that the current trend has moderate strength.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: The Chaikin Oscillator is at -5,550,669, suggesting strong selling pressure.

Based on this analysis:

- Short-term (3 months): The stock is likely to continue its downward trend due to bearish indicators. Recommendation: Sell

- Medium-term (6 months): If the price remains below both moving averages and volume doesn’t increase, the stock might continue to face downward pressure. Recommendation: Hold

- Long-term (12 months): Given the current indicators, it is advisable to wait for a clear reversal pattern or improvement in the trend before considering buying. Recommendation: Hold

Past performance is not an indication of future results. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

The buzz surrounding DJT stock is largely driven by its connection to Donald Trump, its volatile trading patterns, and the speculation about its future performance, particularly in relation to the upcoming presidential election. Investors and analysts alike are closely monitoring the company’s developments, recognizing the significant risks and potential rewards associated with this high-profile stock.

Trump Media & Technology Group (DJT) Stock FAQ

- What is the recent performance of DJT stock?

- DJT stock has experienced significant fluctuations since its public debut in March 2024, initially surging to $79 per share but dropping as low as $22.84 in mid-April.

- Why is DJT stock considered volatile?

- The stock has seen substantial volatility, with dramatic price changes occurring within a short period, influenced by various external factors.

- How is DJT stock compared to meme stocks?

- Some analysts liken DJT to a “meme stock” due to its traction from social media hype rather than traditional financial metrics.

- What impact did the assassination attempt on Donald Trump have on DJT stock?

- The assassination attempt added to the stock’s volatility and highlighted its dependence on Trump’s political presence.

- What were the financial results for DJT in the first quarter of 2024?

- DJT reported a revenue decline to $770,500, down from $1.1 million in the same period last year, and a significant loss of $327.6 million.

- How is DJT stock connected to Donald Trump’s political fortunes?

- The stock’s performance is closely tied to Trump’s political activities, with some investors viewing it as a bet on his influence and future prospects.

- What new initiatives has DJT announced?

- DJT has plans to develop a streaming service and content delivery network, which could expand its offerings and user base.

- How do investors perceive their investment in DJT?

- Many retail investors see their investment in DJT as a way to support Trump’s “Make America Great Again” movement, beyond just a financial opportunity.

- What legal challenges does DJT face?

- The company is dealing with lawsuits from co-founders and concerns about Trump’s ongoing legal issues, which may affect the stock’s stability.

- Are there concerns about DJT’s valuation?

- Yes, some analysts question the company’s valuation, especially with a price-to-sales ratio of around 1,000, given its financial performance.

- What drives the buzz surrounding DJT stock?

- The buzz is driven by its connection to Trump, its volatile trading patterns, and speculation about its future performance, particularly regarding the upcoming presidential election.

- How did DJT stock perform on its first trading day?

- DJT stock surged to $79 per share on its first trading day.

- What are the key financial metrics for DJT’s recent performance?

- DJT’s Q1 2024 revenue was $770,500, down from $1.1 million the previous year, with a reported loss of $327.6 million.

- What is the investor sentiment towards DJT stock?

- Many investors are motivated by their support for Trump’s political movement, viewing their investment as part of the larger “Make America Great Again” initiative.

- What potential developments could impact DJT’s future?

- Developments such as the planned streaming service and content delivery network could significantly impact DJT’s future performance.

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

- Nvidia just poured $160 million into Applied Digital Stock… and it skyrocketed 76% in a day! 🚀 - September 8, 2024

- Is Trump Media stock the next meme stock disaster? 📉 Find out why DJT stock is tanking! - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.