Prenetics Global (NASDAQ: PRE) has experienced an increase in stock price due to several factors:

- Strategic Partnership: David Beckham joined as a strategic investor and co-founder of a new health and wellness brand, IM8, leveraging his 145 million social media followers. IM8 aims to compete with AG1, which earned $150 million in its first year and is valued at $1.2 billion.

- Growth Potential: The partnership is expected to boost Prenetics Global’s revenue to over $250 million next year.

- Strong Financial Position: As of March 2024, the company had $71 million in cash and no debt, allowing for investment in growth initiatives.

- Low Valuation: The stock’s low price-to-salesThe Price-to-Sales (P/S) ratio is a fundamental financial metric that provides valuable insights into a company's valuation. This ratio, often used by investors and analysts, compa... ratio of 0.2x suggests it is undervalued.

- Recent Rebound: The stock price has risen 30% in the last thirty days, attracting more investor interest.

Despite these positives, challenges include declining recent revenue and some analysts’ skepticism about future prospects. Thorough research is recommended before investing.

Prenetics, a leading genomics-driven health sciences company, is transforming prevention, early detection, and treatment through innovative technologies. Their prevention arm, CircleDNA, offers the world’s most comprehensive consumer DNA test using whole exome sequencing. Insighta, a joint venture with Prof. Dennis Lo, focuses on multi-cancer early detection technologies. ACT Genomics, their treatment unit, is the first Asia-based company to receive FDA clearance for comprehensive genomic profiling of solid tumors with ACTOnco.

Strategic Partnership with David Beckham

Beckham’s Social Media Influence

One of the most significant factors behind the recent surge in Prenetics Global’s stock is the announcement of David Beckham joining as a strategic investor and co-founder of a new health and wellness brand called “IM8.” Beckham’s involvement is particularly impactful due to his massive social media following of 145 million people. This extensive reach provides IM8 with unprecedented exposure, potentially translating into significant publicity and customer interest for the brand.

Competing with Established Brands

IM8 is positioned as a direct competitor to AG1, a product that generated $150 million in revenue in its first year and is currently valued at $1.2 billion. The comparison to AG1 suggests substantial growth potential for IM8, which, in turn, could significantly benefit Prenetics Global. The association with Beckham, who is well-regarded for his personal experience with top medical professionals, nutrition experts, and fitness coaches, adds a layer of credibility and expertise to the new brand.

Potential for Revenue Growth

The partnership with Beckham and the launch of IM8 are seen as significant opportunities for Prenetics Global. Some investors are optimistic that these developments could increase the company’s collective revenue to over $250 million by next year. This potential for substantial revenue growth is a key driver behind the recent positive sentiment surrounding Prenetics Global’s stock.

Financial Strength and Low Valuation

Strong Cash Position

As of March 2024, Prenetics Global reported having $71 million in cash and no debt. This strong cash position provides the company with the necessary resources to fund its growth initiatives, including the launch and expansion of the IM8 brand. The availability of substantial cash reserves is a reassuring factor for investors, indicating the company’s ability to invest in its future growth without relying on external financing.

Attractive Valuation

Despite the recent stock price increase, Prenetics Global’s stock was trading at a relatively low price-to-sales ratio of 0.2x. Some investors view this as an undervaluation compared to other companies in the healthcare industry. The low valuation presents a potential opportunity for investors who believe in the company’s growth prospects, particularly in light of the new partnership with Beckham and the launch of IM8.

Recent Stock Rebound and Investor Confidence

Stock Price Movement

Prenetics Global’s stock price has rebounded by 30% in the last thirty days, which has attracted more investor attention and momentum. The announcement of Beckham’s involvement and the creation of IM8 have undoubtedly played a significant role in this recent positive movement. Shares have risen from $6 towards the $7-$8 range shortly after the announcement, reflecting increased investor confidence in the company’s future prospects.

Global Expansion Potential

David Beckham’s international appeal and business acumen could help Prenetics Global expand its global presence, particularly in markets where Beckham has a strong following. This potential for global expansion further enhances the growth prospects for the company, adding another layer of optimism for investors.

Challenges and Skepticism

Declining Revenue and Analyst Skepticism

Despite the positive developments, Prenetics Global has faced challenges, including declining revenue in recent periods. Additionally, some analysts remain skeptical about the stock’s prospects, with at least one forecast predicting a potential significant drop in the stock price. These challenges highlight the importance of conducting thorough research and considering both the potential upsides and risks before making any investment decisions.

Show Me the Money

Based on the available information, there are no specific details yet about the exact health and wellness products that IM8 will offer. Internet research results indicate that:

- IM8 is described as focusing on “cutting-edge consumer health products”.

- The details of the brand and its products will be announced at a later date.

- IM8 is positioned as a new health and wellness brand co-founded by David Beckham and Prenetics.

- The brand appears to be aimed at leveraging Beckham’s experience with top medical professionals, nutrition experts, and fitness coaches throughout his career.

While the specific products are not yet disclosed, the partnership between Beckham and Prenetics suggests that IM8 may offer products related to areas such as nutrition, fitness, and general wellness. However, it’s important to note that this is speculative, and we’ll have to wait for the official announcement to know the exact nature of the products IM8 will offer.

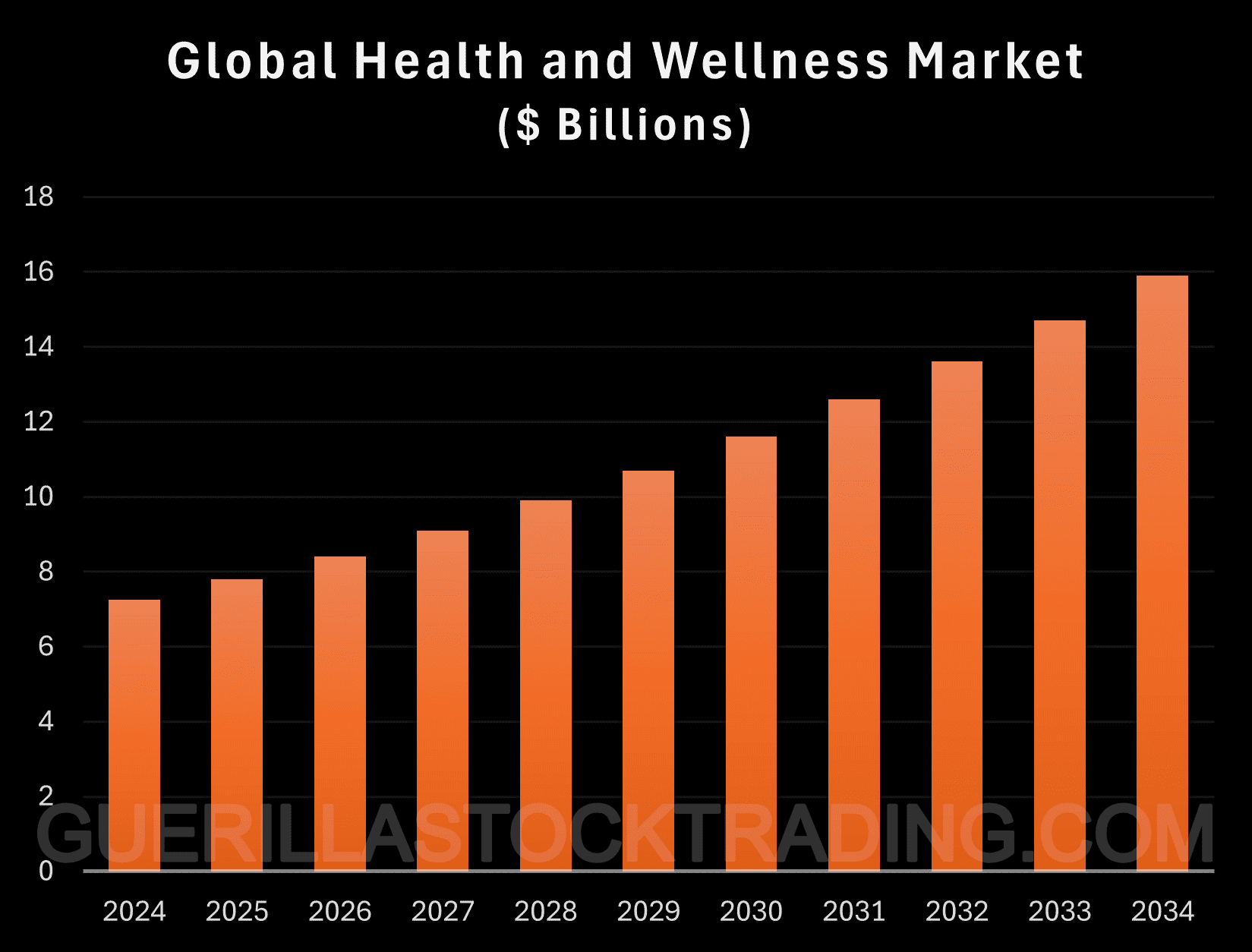

Global Health and Wellness Products Market

The global health and wellness products market is forecast to experience significant growth in the coming years:The market is estimated to be valued at approximately US$ 7.24 billion in 2024 and is projected to reach US$ 15.98 billion by 2034, growing at a compound annual growth rateThe world of finance is replete with complex concepts, but one that stands as a cornerstone for investors seeking to gauge returns is the Compound Annual Growth Rate (CAGR). Often ... (CAGR) of 8.2% from 2024 to 2034.

Key factors driving this growth include:

- Increasing consumer awareness and focus on preventive health measures

- Rising disposable incomes

- Growing demand for natural and organic products

- Expanding e-commerce and online retail channels

The market is segmented by product categories, with packaged food products accounting for a 29.8% share. Beauty and personal care products are also expected to be a significant and fast-growing sector. Geographically, North America currently dominates the market and is expected to maintain its leading position during the forecast period. However, emerging markets like India are projected to see rapid growth, with India forecasted to witness a 9.8% CAGR in health and wellness product sales through 2034.It’s worth noting that different reports may provide slightly varying projections. For instance, another forecast suggests the global health and wellness market could reach US$ 6.9 trillion by 2028, growing at a CAGR of 4.9%. While the exact figures differ, both reports indicate substantial growth in the sector.

Insights

- David Beckham’s involvement provides significant brand visibility.

- IM8’s launch diversifies Prenetics’ product line and revenue streams.

- Prenetics’ strong cash position supports growth initiatives.

- The stock’s recent rebound indicates increased investor confidence.

The Essence (80/20)The Origins and Evolution of the 80/20 Principle The Discovery by Vilfredo Pareto In 1897, Italian economist Vilfredo Pareto uncovered a striking pattern in his study of wealth and...

Core Topics for Understanding:

- Strategic Partnership with David Beckham: Leveraging his vast social media presence, Beckham’s role as a co-founder of IM8 aims to boost Prenetics’ market visibility and revenue.

- Growth Opportunities: The expected revenue increase and market positioning of IM8 as a competitor to successful brands like AG1.

- Financial Health: Prenetics’ strong cash reserves and lack of debt provide a solid foundation for expansion.

- Market Valuation: The stock’s low price-to-sales ratio indicates potential undervaluation and investment opportunity.

- Recent Stock Performance: A 30% increase in stock price over thirty days reflects growing investor interest and market momentum.

The Action Plan – What Prenetics Global Should Do Next

- Leverage Beckham’s Influence: Utilize his social media platforms for marketing campaigns to increase brand awareness and customer acquisition for IM8.

- Expand Product Line: Accelerate the launch of IM8 products and explore new health and wellness categories to diversify revenue streams.

- Financial Management: Continue to manage cash reserves prudently, investing in high-potential growth initiatives while maintaining financial health.

- Market Engagement: Engage with investors and market analysts to highlight the company’s strengths and future growth potential to drive stock valuation.

Blind Spots

Potential Overlooked Detail:

- The reliance on Beckham’s brand might overshadow potential operational challenges or market competition. It’s crucial to ensure the product quality and company’s operational efficiency to sustain growth beyond celebrity influence.

- Overdependence on a Single Partnership: The success of Prenetics Global’s growth strategy is heavily tied to the partnership with David Beckham and the IM8 brand. While this partnership offers substantial benefits, it also poses a risk if the collaboration does not yield the expected results. Overreliance on a single high-profile partnership can be risky if market dynamics or Beckham’s personal brand undergo significant changes.

- Market Competition and Saturation: The health and wellness market is highly competitive and increasingly saturated with numerous established players and new entrants. Prenetics Global must differentiate its products effectively to compete with well-established brands like AG1. Failure to stand out in a crowded market could hinder the anticipated revenue growth and market penetration of the IM8 brand.

Addressing these blind spots requires diversifying partnerships and collaborations, ensuring high product quality, and developing strong, unique selling propositions for new products to stay competitive.

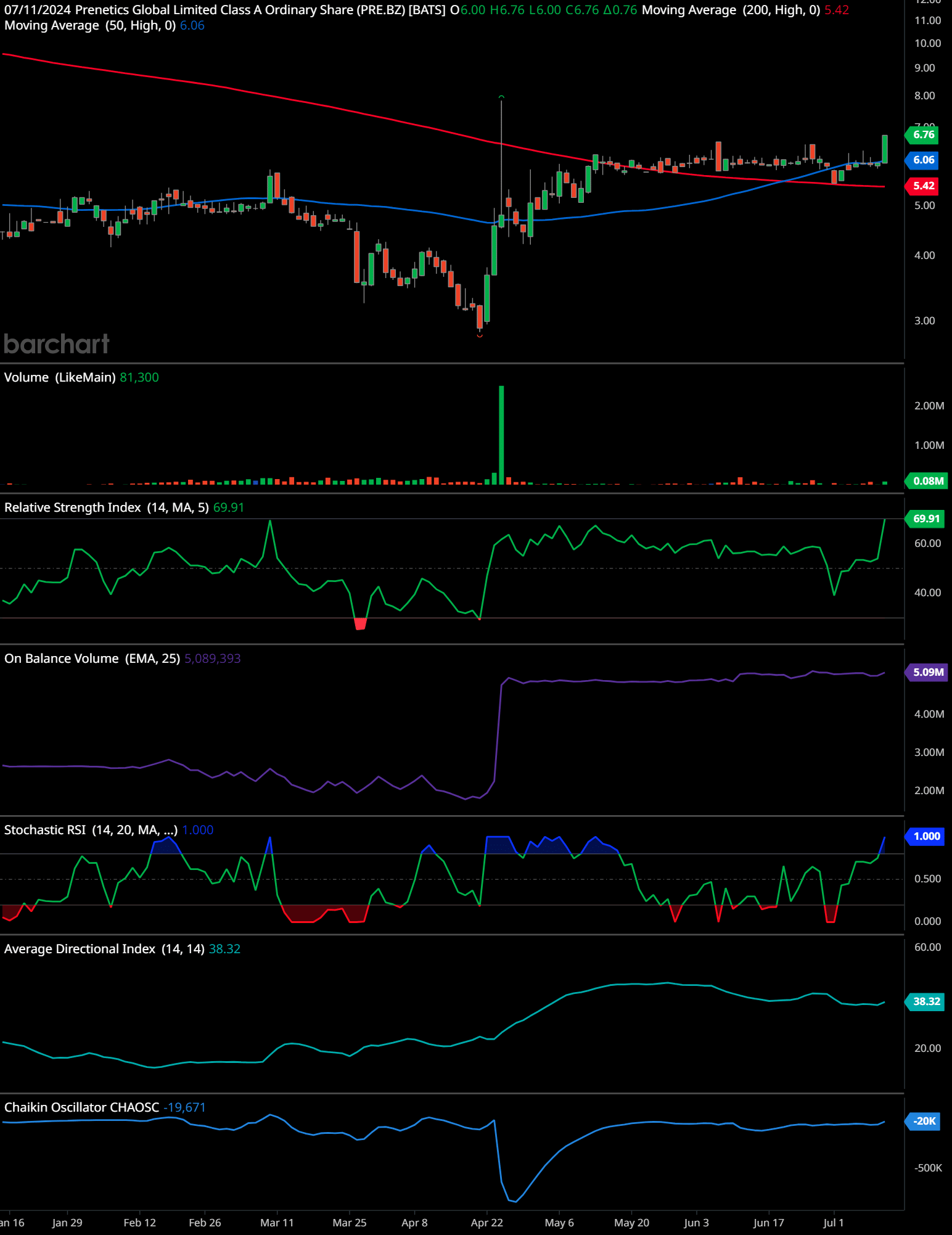

PRE Technical Analysis

Trend Analysis:

The stock has been in a consolidation phase for the past few months, with minor fluctuations around the $5 to $6 range. Recently, there has been an upward breakout, as indicated by the price moving above the 200-day moving average ($6.06). The 50-day moving average ($5.42) is below the current price, suggesting short-term bullish momentum.

Support and Resistance Levels:

Support is observed around the $5.42 level, where the 50-day moving average resides. Resistance is at approximately $7, as seen from previous price peaks.

Volume Analysis:

The recent breakout above the 200-day moving average was accompanied by a spike in volume (81,300), indicating strong buying interest.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI):

The RSI is at 69.91, approaching the overbought territory. This suggests that the stock might face some selling pressure soon, but it also confirms the recent upward momentum.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV):

OBV shows a steady upward trend, reinforcing the idea of accumulation and increased buying interest.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...:

The Stochastic RSI is at its peak (1.000), which indicates the stock is overbought in the short term. A potential pullback or consolidation might occur before any further upward movement.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX):

The ADX is at 38.32, indicating a strong trend. The direction of the trend appears to be upward, aligning with other bullish indicators.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...:

The Chaikin Oscillator is negative (-19,671), which may suggest some underlying weakness in the accumulation/distribution line despite the recent price increase.

Time-Frame Signals:

3-Month Horizon: Hold. The stock shows strong upward momentum but is near overbought levels.

6-Month Horizon: Buy. The overall trend appears positive, with support at the 50-day moving average and potential for further gains.

12-Month Horizon: Hold. The long-term outlook is positive but monitor for any changes in trend strength or market conditions.

Please note that past performance is not an indication of future results. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

David Beckham’s involvement with Prenetics Global is likely to have a significant positive impact on the company’s market value. The partnership provides substantial brand visibility and reach, potential for revenue growth, and enhanced credibility for the new IM8 brand. However, investors must also consider the company’s past revenue challenges and the skepticism expressed by some analysts. The ability of Prenetics Global to capitalize on this partnership and successfully launch and grow the IM8 brand will be crucial in realizing the potential market value increase. As with any investment, it is essential to weigh the opportunities against the risks and make informed decisions based on a comprehensive understanding of the company’s prospects.

Prenetics Global (NASDAQ: PRE) Stock FAQ

Frequently Asked Questions

- What recent announcement has impacted Prenetics Global stock?

- Prenetics Global recently announced that David Beckham has joined as a strategic investor and co-founder of a new health and wellness brand called “IM8”.

- Why is David Beckham’s partnership significant for Prenetics Global?

- David Beckham has a massive social media following of 145 million people, which could provide extensive publicity for the new brand IM8. This partnership is seen as a key factor in driving potential growth for the company.

- What is IM8, and how does it compare to its competitors?

- IM8 is a new health and wellness brand co-founded by David Beckham and Prenetics. It is positioned as a direct competitor to AG1, a product that generated $150 million in revenue in its first year and is currently valued at $1.2 billion.

- How could the partnership with David Beckham affect Prenetics Global’s revenue?

- Some investors believe the partnership with Beckham and the launch of IM8 could potentially increase Prenetics Global’s collective revenue to over $250 million by next year.

- What is Prenetics Global’s current cash position?

- As of March 2024, Prenetics Global had $71 million in cash and no debt. This strong cash position provides the company with resources to fund growth initiatives.

- What is Prenetics Global’s current valuation?

- The stock was trading at a relatively low price-to-sales ratio of 0.2x, which some investors may see as undervalued compared to other companies in the healthcare industry.

- How has Prenetics Global stock performed recently?

- The stock price has rebounded 30% in the last thirty days, which could be attracting more investor attention and momentum.

- What challenges has Prenetics Global faced?

- The company has faced challenges including declining revenue in recent periods. Additionally, some analysts are skeptical about the stock’s prospects, with at least one forecast predicting a potential significant drop in stock price.

- What impact is David Beckham expected to have on Prenetics Global’s market value?

- David Beckham’s involvement is likely to have a significant positive impact due to his massive social media following, credibility, and ability to boost brand visibility and investor confidence.

- What new revenue streams is Prenetics Global exploring?

- The creation of IM8, a new health and wellness brand, diversifies Prenetics’ offerings and opens up new revenue streams.

- How does IM8 enhance Prenetics Global’s competitive edge?

- IM8 is positioned as a direct competitor to established brands like AG1, suggesting significant growth potential for IM8 and Prenetics.

- Why might investors have confidence in Prenetics Global’s future prospects?

- The partnership with a high-profile figure like David Beckham can boost investor confidence in Prenetics’ future prospects.

- How could David Beckham’s international appeal benefit Prenetics Global?

- Beckham’s international appeal and business acumen could help Prenetics expand its global presence, particularly in markets where he has a strong following.

- What factors are driving growth in the health and wellness market?

- Key factors include increasing consumer awareness and focus on preventive health measures, rising disposable incomes, growing demand for natural and organic products, and expanding e-commerce channels.

- What are the market projections for the health and wellness sector?

- Different reports suggest substantial growth in the sector, with projections indicating the global health and wellness market could reach US$ 6.9 trillion by 2028, growing at a CAGR of 4.9%.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.