RTX stock saw a significant increase on July 25, 2024, following a strong second-quarter earnings report and improved full-year guidance. The company reported better-than-expected Q2 results with earnings of $1.41 per share on $19.7 billion revenue, surpassing Wall Street’s estimates. Key drivers include a 10% year-over-year sales growth, an increased full-year earnings guidance, and an improved revenue outlook. Notably, Pratt & Whitney showed strong aftermarket demand for jet engine parts, indicating a recovery in commercial aviation. RTX’s $206 billion backlog and $2.2 billion in free cash flowThe cash flow statement provides a detailed overview of the cash inflows and outflows of a company over a specified period of time. It includes cash received from operations, inves... More further demonstrate strong future demand and cash generation capabilities. Consequently, RTX shares rose by 9%, reaching a record high of $114.09, reflecting renewed investor confidence.

Better-Than-Expected Q2 Results

Strong Sales Growth

RTX reported a notable increase in sales for Q2 2024, achieving $19.7 billion in revenue, a 10% year-over-year growth. This figure easily surpassed Wall Street’s consensus estimate of $17.8 billion, reflecting a strong demand for RTX’s products and services across its various segments.

Adjusted Earnings Per Share (EPS)

The company’s adjusted earnings per shareEarnings per share (EPS) is a fundamental financial metric that provides valuable insights into a company's profitability. This widely used indicator helps investors and analysts g... (EPS) reached $1.41, significantly exceeding the $1.19 anticipated by analysts. This 9% year-over-year increase in EPS highlights RTX’s ability to convert its sales growth into substantial profit gains.

Raised Full-Year Guidance

Improved Earnings Outlook

RTX has revised its full-year earnings guidance upward to a range of $5.35 to $5.45 per share, up from the previous range of $5.25 to $5.40 per share. This new guidance is considerably higher than the consensus analysts’ expectation of $4.95, indicating a stronger performance outlook for the remainder of the year.

Enhanced Revenue Projections

In addition to raising its earnings guidance, RTX has also increased its full-year revenue forecast to $79.1 billion at the midpoint, up from the previous estimate of $78.5 billion. This adjustment reflects the company’s confidence in sustaining its growth trajectory.

Strong Commercial Aerospace Performance

Pratt & Whitney’s Contribution

Pratt & Whitney, RTX’s jet engine unit, demonstrated remarkable performance with strong aftermarket demand for spare parts, signaling a recovery in the commercial aviation sector. This demand surge played a crucial role in driving the company’s overall sales growth.

Large Backlog Ensures Future Demand

Substantial Backlog

RTX reported a substantial backlog of $206 billion, comprising $129 billion in commercial and $77 billion in defense orders. This backlog indicates strong future demand for RTX’s products and services, providing a solid foundation for continued growth.

Robust Free Cash Flow Generation

Cash Flow Highlights

The company generated $2.2 billion in free cash flow during Q2 2024, a significant increase from $193 million in the previous year. This robust cash generation underscores RTX’s ability to effectively convert earnings into cash, enhancing its financial flexibility.

Key Factors Driving Q2 2024 Performance

Collins Aerospace

Collins Aerospace, one of RTX’s segments, reported a 10% increase in sales, reaching $7 billion. This growth was driven by a 12% rise in commercial aftermarket and a 10% increase in commercial Original Equipment (OE).

Pratt & Whitney

Pratt & Whitney’s sales surged by 19% to $6.8 billion, fueled by a 33% increase in commercial OE and a 16% growth in military sales. This strong performance contributed significantly to RTX’s overall revenue growth.

Raytheon Segment

Although the Raytheon segment experienced a 3% decline in sales due to divestitures, adjusted sales saw a 4% increase. However, operating profit was impacted by significant charges related to a fixed-price development contract.

Cost Synergies and Profitability

Realized Cost Synergies

RTX achieved $120 million in incremental gross cost synergies during the quarter, contributing to improved profitability and margin expansion across all segments. These cost efficiencies played a crucial role in enhancing the company’s overall financial performance.

Upgraded Outlook and Investor Confidence

Revised Full-Year Guidance

Based on its strong quarterly performance, RTX has raised its full-year adjusted sales and EPS guidance. The company now expects adjusted sales between $78.75 billion and $79.5 billion and adjusted EPS between $5.35 and $5.45. This optimistic outlook has bolstered investor confidence in RTX’s future prospects.

Insights

- RTX’s Q2 earnings surpassed expectations, driving stock price up.

- Significant sales growth across aerospace and defense segments.

- Raised full-year guidance highlights strong future performance.

- Pratt & Whitney’s aftermarket demand signals aviation sector recovery.

- Strong free cash flow and backlog underpin future stability.

The Essence (80/20)

- Core Financial Performance: RTX’s Q2 earnings of $1.41 per share on $19.7 billion revenue exceeded expectations, demonstrating robust financial health.

- Sales Growth: 10% year-over-year sales growth, driven by strong performance in aerospace and defense segments.

- Raised Guidance: Full-year earnings and revenue guidance increased, indicating confidence in sustained growth.

- Pratt & Whitney Performance: Significant aftermarket demand for jet engine parts, highlighting commercial aviation sector recovery.

- Free Cash Flow and Backlog: $2.2 billion in free cash flow and a $206 billion backlog suggest strong future demand and cash generation.

The Guerilla Stock Trading Action Plan

- Monitor Financial Reports: Regularly review RTX’s quarterly earnings for continued performance above market expectations.

- Focus on Key Segments: Invest in or track segments showing strong growth, such as Pratt & Whitney’s commercial and military sales.

- Leverage Guidance Updates: Use RTX’s revised full-year guidance to adjust investment strategies.

- Watch Industry Trends: Stay informed about the commercial aviation recovery to understand its impact on RTX’s performance.

- Evaluate Cash Flow and Backlog: Assess RTX’s free cash flow and backlog metrics to gauge long-term stability and growth potential.

Blind Spot

While RTX’s financials and guidance are strong, potential risks include market volatility, supply chain disruptions, and geopolitical tensions affecting the aerospace and defense sectors.

Regulatory Changes: Potential new regulations in the aerospace and defense sectors could impact RTX’s operations and profitability, necessitating compliance adaptations.

Technological Disruptions: Advances in technology by competitors could outpace RTX’s innovations, potentially reducing its market share in key segments.

Supplier Dependence: Heavy reliance on specific suppliers for parts and materials could lead to disruptions if those suppliers face issues or fail to meet demands.

Economic Downturns: Global economic slowdowns or recessions could reduce demand for aerospace and defense products, adversely affecting sales and revenue projections.

RTX Technical Analysis

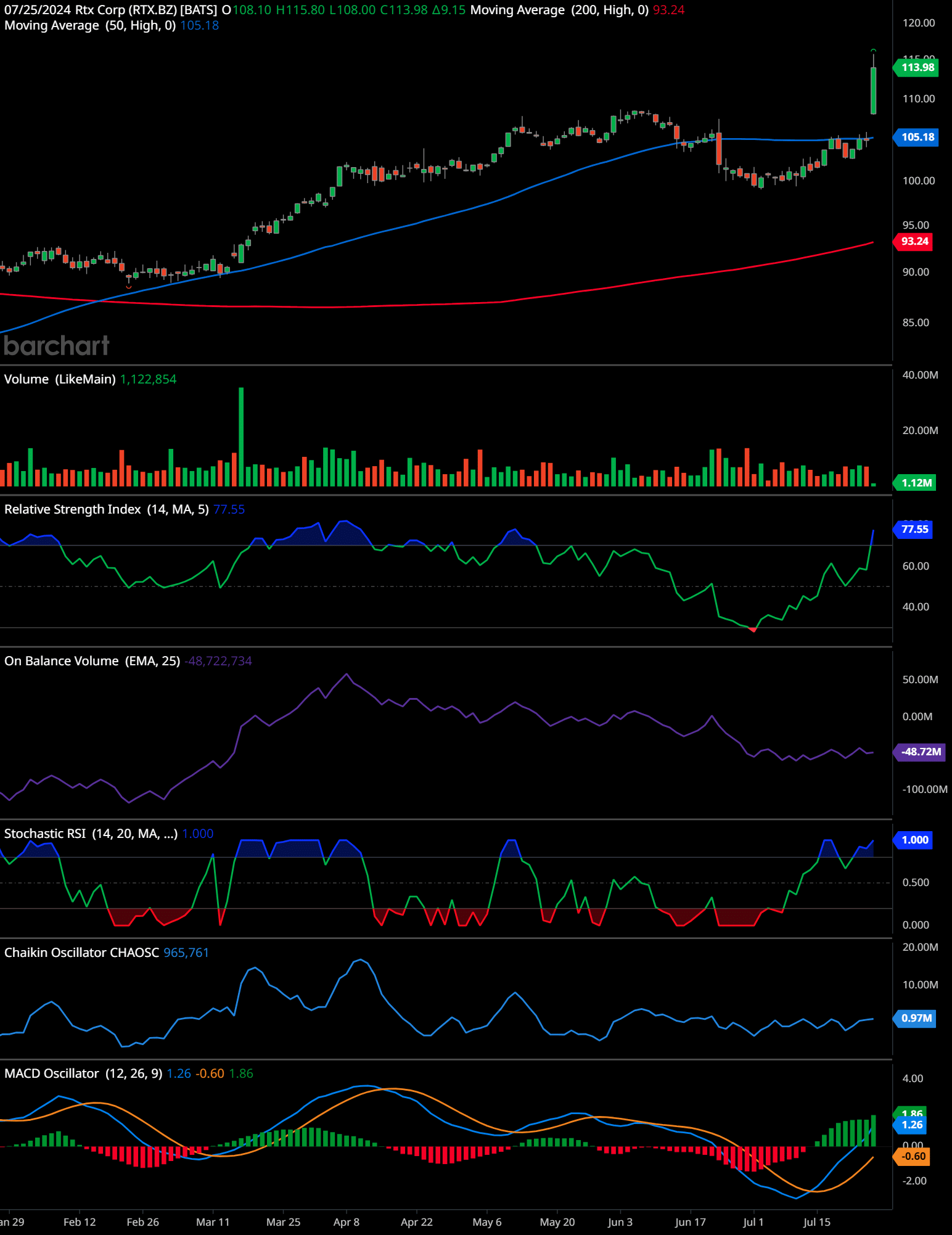

The chart for RTX Corp (RTX) shows several key technical indicators that provide insights into its price movement and potential future performance. Here’s a comprehensive analysis:

- Price Trend and Moving Averages: The stock price has been in an upward trend, recently spiking to a new high of $113.98. It is trading above both the 50-day (blue line at $105.18) and 200-day (red line at $93.24) moving averages, indicating a strong bullish trend.

- Volume: The trading volume has spiked significantly, indicating increased buying interest. The volume bar shows a notable increase to over 1.12 million shares.

- Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is at 77.55, which is in the overbought territory. This suggests that the stock might be overvalued in the short term and could face a potential pullback.

- On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV shows a downward trend, which could indicate that the recent price increases are not fully supported by volume, potentially hinting at a divergence.

- Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: The Stochastic RSI is at 1.00, indicating that the stock is overbought. This further supports the RSI’s indication of a possible short-term pullback.

- Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: The Chaikin Oscillator is at 965,761, which shows increasing money flow into the stock. This is a bullish sign indicating strong buying pressure.

- MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More (Moving Average Convergence Divergence): The MACD line (blue) is above the signal line (orange) and both are above the zero line, showing bullish momentum. The histogram is also positive, reinforcing the bullish sentiment.

Time-Frame Signals:

- 3 Months: Buy – The strong bullish momentum and support from moving averages suggest continued upward movement in the short term.

- 6 Months: Hold – Potential for consolidation or minor pullbacks given the overbought RSI and Stochastic RSI indicators.

- 12 Months: Buy – Overall bullish trend supported by the MACD and moving averages suggests a positive long-term outlook.

Past performance is not an indication of future results. This article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions 🧡.

Looking Ahead

The combination of better-than-expected Q2 results, strong sales growth, an improved earnings outlook, and robust free cash flow generation has driven RTX’s stock price to new heights. As a result, RTX shares surged approximately 9% by noon ET on July 25, 2024, reaching a record high of $114.09. These positive developments have reaffirmed RTX’s position as a stable and attractive investment option in the aerospace and defense sector, promising continued growth and profitability in the coming quarters.

Frequently Asked Questions about RTX Stock Performance

1. Why did RTX stock increase significantly on July 25, 2024?

RTX stock rose significantly due to the company’s strong second quarter earnings report and improved full-year guidance.

2. What were the key financial results for RTX in Q2 2024?

RTX reported earnings of $1.41 per share on revenue of $19.7 billion, surpassing Wall Street’s consensus estimates of $1.19 per share on sales of $17.8 billion.

3. How much did RTX’s sales grow year-over-year?

RTX’s sales grew by 10% year-over-year, demonstrating robust demand for its products and services.

4. What is the new full-year earnings guidance for RTX?

RTX increased its full-year earnings guidance to a range of $5.35 to $5.45 per share, up from the previous range of $5.25 to $5.40 per share.

5. What is the revised full-year revenue guidance for RTX?

RTX raised its full-year revenue guidance to $79.1 billion at the midpoint, up from $78.5 billion previously.

6. Which segment of RTX led the strong performance in Q2 2024?

Pratt & Whitney, RTX’s jet engine unit, led the way with strong aftermarket demand for spare parts, indicating a recovery in the commercial aviation sector.

7. How large is RTX’s backlog?

RTX reported a $206 billion backlog, suggesting strong future demand for its products and services.

8. How much free cash flow did RTX generate in Q2 2024?

RTX generated $2.2 billion in free cash flow during the quarter, demonstrating its ability to convert earnings into cash.

9. What were the sales figures for Collins Aerospace in Q2 2024?

Collins Aerospace reported sales of $7 billion, with a notable 12% rise in commercial aftermarket and a 10% rise in commercial Original Equipment (OE).

10. What was the performance of Pratt & Whitney in Q2 2024?

Pratt & Whitney reported sales surged by 19% to $6.8 billion, fueled by a 33% increase in commercial OE and 16% growth in military sales.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.