In the fast-paced world of finance, every quarter brings a new set of expectations and surprises. Domino’s Pizza (DPZ), a household name synonymous with cheesy goodness, recently made waves in the market with its impressive Q1 earnings report. Let’s delve into the details of DPZ’s stellar performance and what lies ahead for this pizza giant.

A Taste of Success: Q1 Earnings Breakdown

Domino’s Pizza (DPZ) has delivered a slice of good news to investors, with its Q1 earnings per shareEarnings per share (EPS) is a fundamental financial metric that provides valuable insights into a company's profitability. This widely used indicator helps investors and analysts g... (EPS) surpassing expectations. Revenue saw a healthy 5.9% year-over-year increase, reaching $1.08 billion, aligning closely with analyst forecasts.

However, what truly ignited investor enthusiasm was the robust performance of DPZ’s US comparable store sales and the insightful commentary shared during the earnings call.

US Comp Growth: A Delicious Turnaround

After a string of lackluster quarters, DPZ witnessed a remarkable turnaround in its US comparable store sales, reporting a substantial 5.6% growth in Q1. This positive momentum follows a gradual improvement, with Q4 showing +2.8%, Q3 at -0.6%, and Q2 at +0.1%. The company’s earlier projection of soft international comps in the first half, followed by improvement in the second half, played out as anticipated, with international comps standing at +0.9%.

Winning Strategies

DPZ’s achievement in US comp growth was underpinned by increased order counts in both carryout and delivery segments for the second consecutive quarter. Notably, this growth extended across all income brackets, with lower-income cohorts benefiting from the value propositions offered by DPZ.

Strategic Partnerships and Initiatives: Ingredients for Success

In Q1, DPZ marked a significant milestone by launching marketing initiatives through its partnership with Uber Eats. With an estimated 65% of Uber customers expected to be incremental to DPZ, this collaboration holds promise, especially considering Uber’s predominantly higher-income customer base.

The Power of Promotions

DPZ’s Emergency Pizza promotion emerged as a standout performer, outshining traditional buy-one-get-one (BOGO) offers. This promotion not only drove increased orders but also facilitated the acquisition of new members into DPZ’s loyalty program, further enhancing customer engagement and retention.

Loyalty Pays Off

The Domino’s Rewards program continued to demonstrate its effectiveness in driving strong US comps during Q1. The decision to lower the minimum spend required to earn points to just $5 proved instrumental in attracting more carryout customers, contributing to the program’s success.

Looking Ahead: A Savory Forecast

DPZ remains optimistic about its prospects for 2024, buoyed by the anticipated benefits from the Uber Eats partnership and the revitalized loyalty program. The company expects US comps to surpass its long-term guidance of 3%, with each quarter of the year projected to achieve 3% or more growth.

Innovation on the Menu

Exciting developments await as DPZ unveils its first product innovation of the year – New York Style Pizza, set to launch today. With a focus on enhancing customer experience and expanding its offerings, DPZ is poised for continued success in the competitive pizza market.

DPZ Technical Analysis

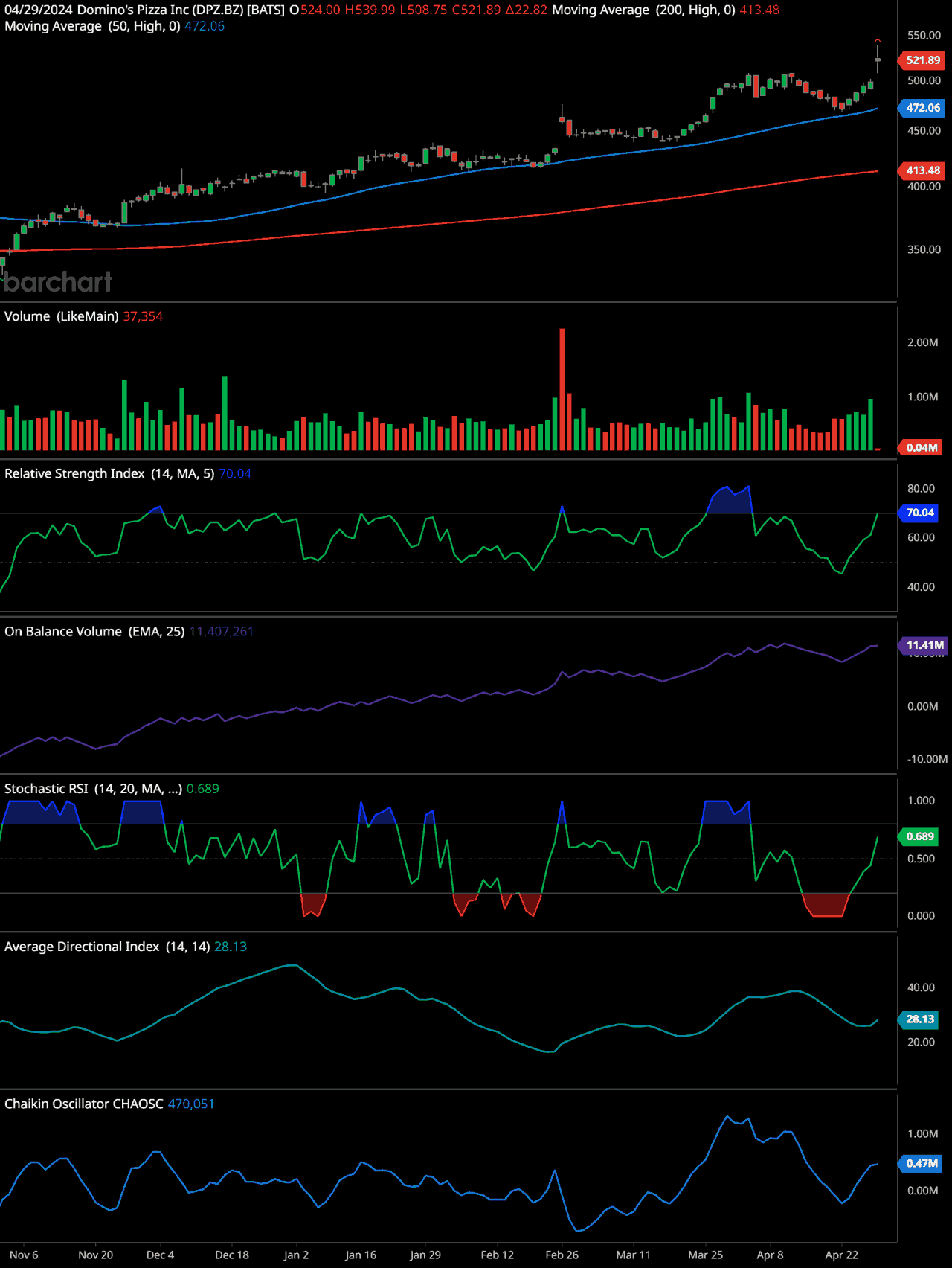

𝗦𝘁𝗼𝗰𝗸 𝗢𝘃𝗲𝗿𝘃𝗶𝗲𝘄:

The stock closed at $521.89, exhibiting an uptrend, as indicated by the price being above both the 50-day and 200-day moving averages (MA). The 200-day MA is serving as strong support at $413.48.

𝗩𝗼𝗹𝘂𝗺𝗲 𝗔𝗻𝗮𝗹𝘆𝘀𝗶𝘀:

The volume shows a few spikes, signaling significant trading activity on certain days. This could correlate with news events or earnings reports.

𝗥𝗲𝗹𝗮𝘁𝗶𝘃𝗲 𝗦𝘁𝗿𝗲𝗻𝗴𝘁𝗵 𝗜𝗻𝗱𝗲𝘅 (𝗥𝗦𝗜):

The RSIIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... is at 70.04, which is just at the threshold of being considered overbought. This suggests caution as there could be a potential pullback or consolidation in price.

𝗢𝗻 𝗕𝗮𝗹𝗮𝗻𝗰𝗲 𝗩𝗼𝗹𝘂𝗺𝗲 (𝗢𝗕𝗩):

The OBVThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... is on an upward trend with the EMA of OBV at 11.47 million, which confirms the uptrend and indicates healthy buying pressure.

𝗦𝘁𝗼𝗰𝗵𝗮𝘀𝘁𝗶𝗰 𝗥𝗦𝗜:

The Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... is around 0.689, which indicates momentum is neither overbought nor oversold. It’s trending towards the upper range, signaling bullish momentum.

𝗔𝘃𝗲𝗿𝗮𝗴𝗲 𝗗𝗶𝗿𝗲𝗰𝘁𝗶𝗼𝗻𝗮𝗹 𝗜𝗻𝗱𝗲𝘅 (𝗔𝗗𝗫):

The ADXThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... is at 28.13, which suggests a strong trend. The value above 25 generally indicates a strong directional trend, confirming the uptrend shown in the stock price.

𝗖𝗵𝗮𝗶𝗸𝗶𝗻 𝗢𝘀𝗰𝗶𝗹𝗹𝗮𝘁𝗼𝗿:

The Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... is at 470,051, which indicates buying pressure as it’s above zero.

𝗖𝗼𝗻𝗰𝗹𝘂𝘀𝗶𝗼𝗻:

The overall indicators suggest a bullish trend for DPZ, but caution is advised given the RSI is bordering on overbought territory. It’s important to monitor for potential pullbacks or sideways movement as a result of the stock entering overbought levels. Keep an eye on company news and the broader market as these can affect stock performance.

A Tasty Start to the Year

In summary, Domino’s Pizza’s Q1 performance sets a promising tone for the rest of 2024. With stellar US comps, strategic partnerships, and innovative initiatives, DPZ is well-positioned to satisfy both investors’ appetites and pizza cravings alike. As the aroma of success permeates the air, it’s clear that Domino’s Pizza is on a trajectory of growth and prosperity in the year ahead.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.