In the dynamic world of retail, each earnings report brings its own narrative. While Dollar Tree (DLTR) faced a sell-off on earnings and weak guidance recently, today’s attention turns to Dollar General (DG) as it reports its Q4 (January) earnings results. Despite a beat on EPS and revenue, Dollar General’s guidance for Q1 (April) EPS fell below analyst expectations, albeit with better-than-expected FY25 revenue guidance.

Surprise Beat Amidst Nervous Anticipation

With a history of EPS misses in three of the past five quarters, investors approached Dollar General’s earnings report with a degree of uncertainty. However, the company delivered a double-digit EPS beat, its first in the past 11 quarters. This unexpected performance likely provided a positive surprise for investors, especially following the disappointing results from its peer, Dollar Tree.

Examining Same Store Comps and Customer Trends

A key metric in retail analysis is same store comps, which reflects the growth in sales from existing stores. In Q4, Dollar General reported a modest increase of +0.7%, driven primarily by a nearly +4% growth in customer traffic. However, this growth was offset by a decline in average transaction size. Notably, comp growth was solely driven by the consumables category, while other categories like home, seasonal, and apparel experienced declines.

On the earnings call, Dollar General highlighted the impact of inflation over the past two years on customer behavior, leading to trade-offs within the store. Discretionary categories witnessed continued pressure on sales, while private brand sales saw accelerated share growth and penetration. The company’s comp guidance for the new fiscal year suggests a decent improvement, with expectations set at +2.0-2.7%.

Margin Pressures and Leadership Transition

Despite the positive earnings beat, margins faced challenges, with gross marginGross margin is a critical financial metric that plays a pivotal role in evaluating a company's financial health and profitability. It is a percentage that indicates how efficientl... falling to 29.5% in Q4 from 30.9% a year ago. Dollar General attributed this decline to factors such as increased shrink and inventory markdowns, lower inventory markups, and a higher proportion of sales coming from the lower-margin consumables category. The magnitude of the EPS beat was surprising given the margin compression, indicating analysts may have anticipated even worse margins.

This quarter also marked an important transition for Dollar General, with the return of Todd Vasos as CEO. Having previously served in this role from June 2015 to November 2022, Vasos returned in October 2023 amidst the company’s struggles. He aims to refocus Dollar General on the basics of store operations, supply chain efficiency, and customer service. Initiatives include SKU reduction and revitalizing less productive aspects of the business.

DG Technical Analysis

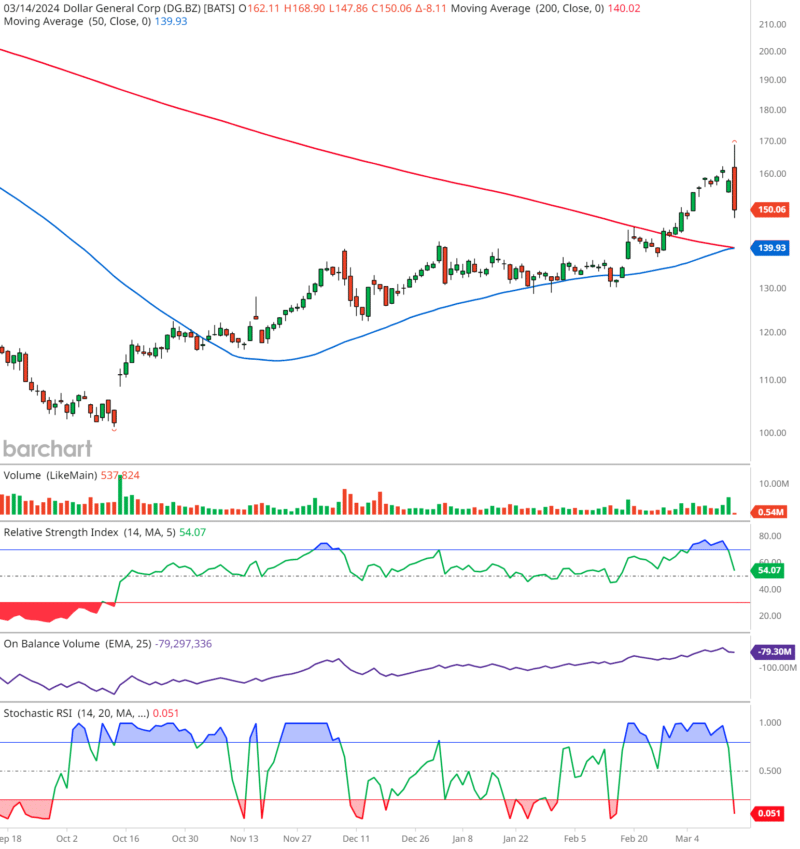

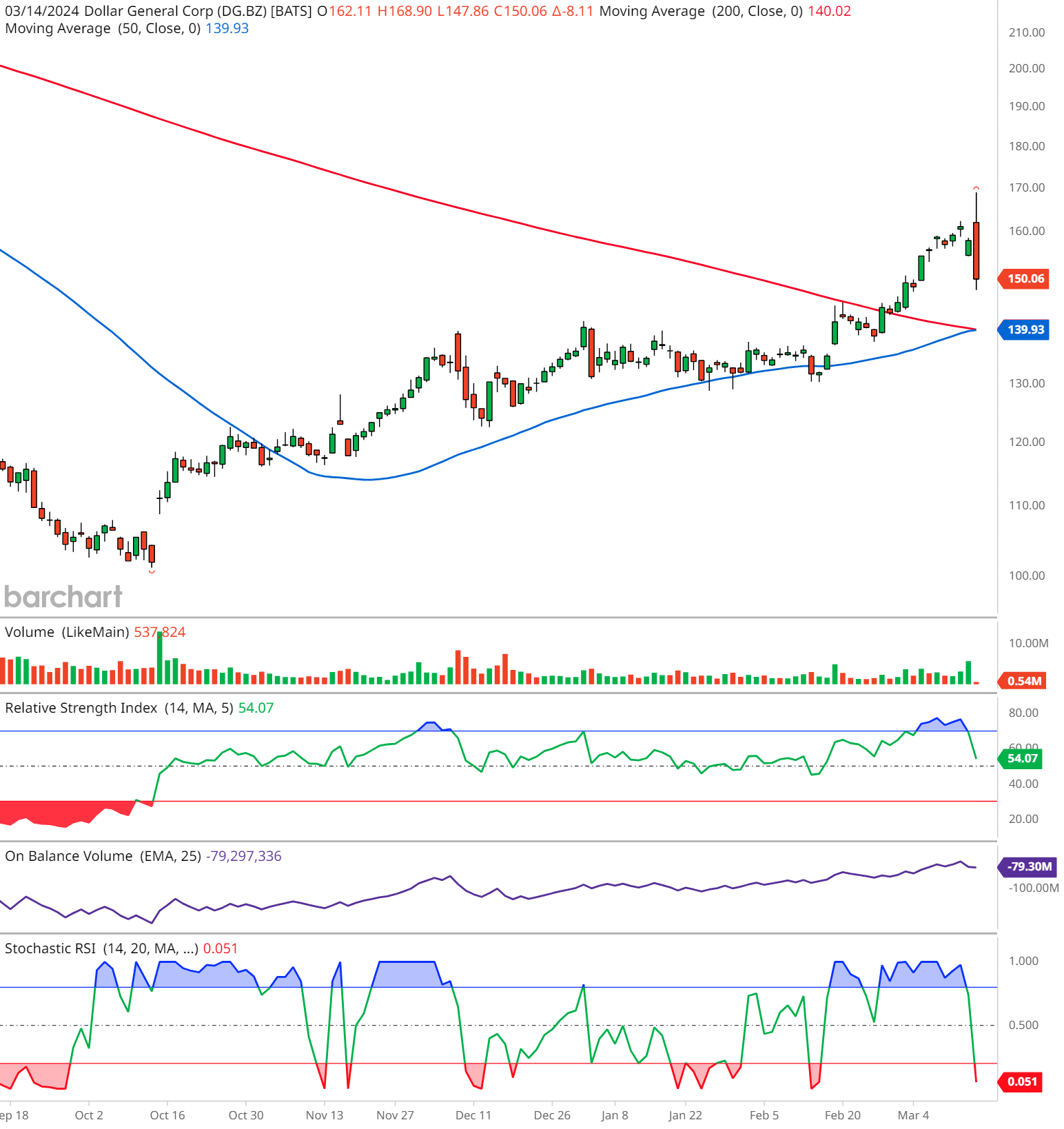

The price action has recently crossed above the 50-day moving average (the blue line), which is a bullish signal. However, the 50-day moving average remains below the 200-day moving average (the red line), often seen as a key indicator for long-term trends; this suggests that while there has been recent bullish momentum, the longer-term trend may still be bearish. However, DG stock is very close to a Resurrection CrossWhen the 50 day moving average crosses above the 200 day moving average, it is called a Resurrection Cross. Conversely, when the 50 day moving average crosses below the 200 day mov... of the 50-day moving average crossing above the 200-day moving average.

The volume shows significant trading activity on certain days, which could correlate with key market events or company-specific news.

The Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI) is around 54.07, indicating that the stock is neither overbought nor oversold, giving a neutral signal.

The On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV) is trending upwards, suggesting that buying pressure is prevalent, and the current trend may continue.

Lastly, the Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... indicator is very low, which could indicate that the stock is in an oversold condition. This sometimes precedes a possible reversal in the price if other factors align.

The Road Ahead: Navigating Macro Headwinds

While Dollar General’s first full quarter under Vasos’s leadership showcased promising results amidst challenging market conditions, macroeconomic headwinds remain a concern. As a retailer catering primarily to lower-income demographics, the impact of inflation poses significant challenges. However, Vasos’s strategic direction and focus on operational fundamentals provide a ray of optimism for Dollar General’s future.

In conclusion, Dollar General’s Q4 earnings report paints a nuanced picture of resilience amidst adversity. While there are margin pressures and macroeconomic challenges ahead, the company’s leadership transition and strategic initiatives under Todd Vasos offer hope for sustained growth and resilience in the competitive retail landscape.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.