In the dynamic world of biotechnology, identifying promising investment opportunities requires a keen eye for innovation and potential breakthroughs. Arcellx (ACLX), a rising star in the biotech arena, has been gaining significant attention from analysts and investors alike. With a series of positive developments on the horizon, Arcellx is positioned as a compelling candidate for growth in 2024 and beyond. In this article, we explore the recent endorsements and exciting prospects that have catapulted Arcellx into the spotlight.

Table of contents

Needham’s Bullish Stance

Needham, a respected player in the world of financial analysis, recently reaffirmed its confidence in Arcellx by raising the firm’s price target on ACLX shares. The new target of $71, up from $65, reflects Needham’s optimistic outlook for the company. Furthermore, Needham has bestowed upon Arcellx the prestigious title of “Top Pick for 2024” and added the stock to its Conviction List.

A Remarkable 2023 Performance

Arcellx had an exceptional year in 2023, with its stock surging by an impressive 75%. This remarkable performance caught the attention of investors and analysts, paving the way for high expectations in the year ahead.

The iMMagine-1 Study and Filing in 2025

One of the key catalysts driving Needham’s bullish sentiment is the anticipated pivotal interim readout from the iMMagine-1 study. Expected in the second half of 2024, this crucial milestone is poised to be a game-changer for Arcellx. The positive results from this study will serve as a strong foundation for the company’s regulatory filing in 2025, opening up the potential for significant value creation.

Early 2024: Disclosure of Clinical Design

Needham also highlights an exciting opportunity for value creation in early 2024. This opportunity stems from Arcellx’s plan to disclose its clinical design in earlier line settings. Such disclosure can provide valuable insights into the company’s strategic direction and its potential to address critical medical needs.

Scotiabank’s Optimism

Scotiabank, another notable player in the financial industry, has also expressed a bullish outlook on Arcellx. The firm initiated coverage of ACLX with an Outperform rating and set a price target of $66. This endorsement is grounded in the promising Phase 1 results achieved by Arcellx and the company’s strategic partnership with Gilead’s Kite.

A Potential Game-Changer: Autologous Cell Therapy

Arcellx’s lead asset, anitocabtagene autoleucel, has garnered significant attention. This autologous cell therapy holds immense promise for the treatment of multiple myeloma. Scotiabank sees it as a “potentially best-in-class profile”, underlining the transformative potential of this therapy in addressing a critical medical condition.

Axicabtagene ciloleucel, commonly referred to as “axi-cel,” is a groundbreaking form of immunotherapy used in the treatment of certain types of blood cancers, particularly non-Hodgkin lymphoma and large B-cell lymphoma. This therapy falls under the broader category of CAR-T cell therapy, which stands for Chimeric Antigen Receptor T-cell therapy. It represents a revolutionary approach to cancer treatment by harnessing the patient’s own immune system to target and destroy cancer cells.

The process of axicabtagene ciloleucel therapy involves extracting a patient’s T-cells, a type of immune cell, and genetically modifying them in a laboratory. This modification entails introducing a chimeric antigen receptor (CAR) on the T-cell surface, designed to specifically recognize a protein called CD19 found on the surface of cancerous B-cells. Once these engineered CAR-T cells are reinfused into the patient’s body, they become highly effective in recognizing and eliminating cancer cells that express the CD19 protein. This targeted approach has shown remarkable success in patients who have not responded to conventional treatments, often achieving long-lasting remissions, making axicabtagene ciloleucel a promising advancement in the field of cancer therapy.

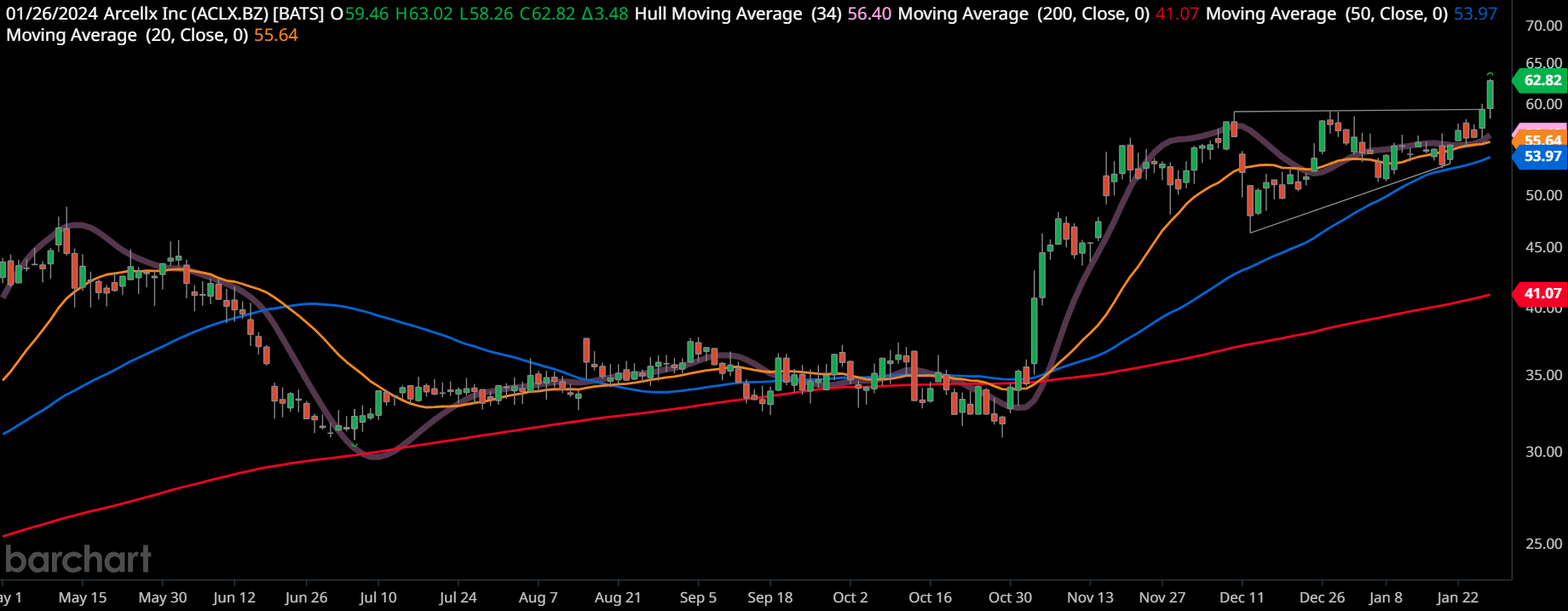

Charting Success: The Ascending Triangle Breakout

For technical analysts and chart enthusiasts, Arcellx’s stock chart has been a source of excitement. It reveals a compelling pattern known as an “Ascending TriangleAn ascending triangle chart pattern is a chart pattern used in technical analysis that is characterized by a flat upper trend line... More breakout”. This consolidation pattern, characterized by a breakout surge in price, signifies the potential for a significant upward movement in the stock’s price.

In the Final Analysis…

Bottom-line: Arcellx’s recent endorsements by Needham and Scotiabank, along with its impressive 2023 performance and promising clinical developments, have firmly placed it on the radar of investors and analysts. With a focus on groundbreaking therapies and a commitment to addressing critical medical needs, Arcellx is poised for an eventful and potentially transformative year in 2024. As the company continues to innovate and achieve key milestones, it may very well become a shining star in the biotech landscape. Investors should keep a close watch on Arcellx as it navigates the exciting path ahead.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.