Personalis (PSNL) has seen a significant rise in its stock price due to several key developments:

- Cross-Licensing Agreement: On July 11, 2024, Personalis and Myriad Genetics entered into an agreement to cross-license patent estates covering tumor-informed approaches to detect minimal residual disease (MRD). This collaboration enhances each company’s operational freedom and broadens patient access to MRD testing.

- NeXT Personal Test Data: On June 4, 2024, Personalis presented data at the American Society for Clinical Oncology (ASCO) demonstrating exceptional performance of their NeXT Personal test for early-stage breast cancer and immunotherapy monitoring.

- Analyst Upgrades: Needham & Company LLC raised their price target for Personalis, reinforcing investor confidence.

- Financial Performance: Strong financial results for the first quarter of 2024, beating EPS and revenue estimates, have bolstered investor sentiment.

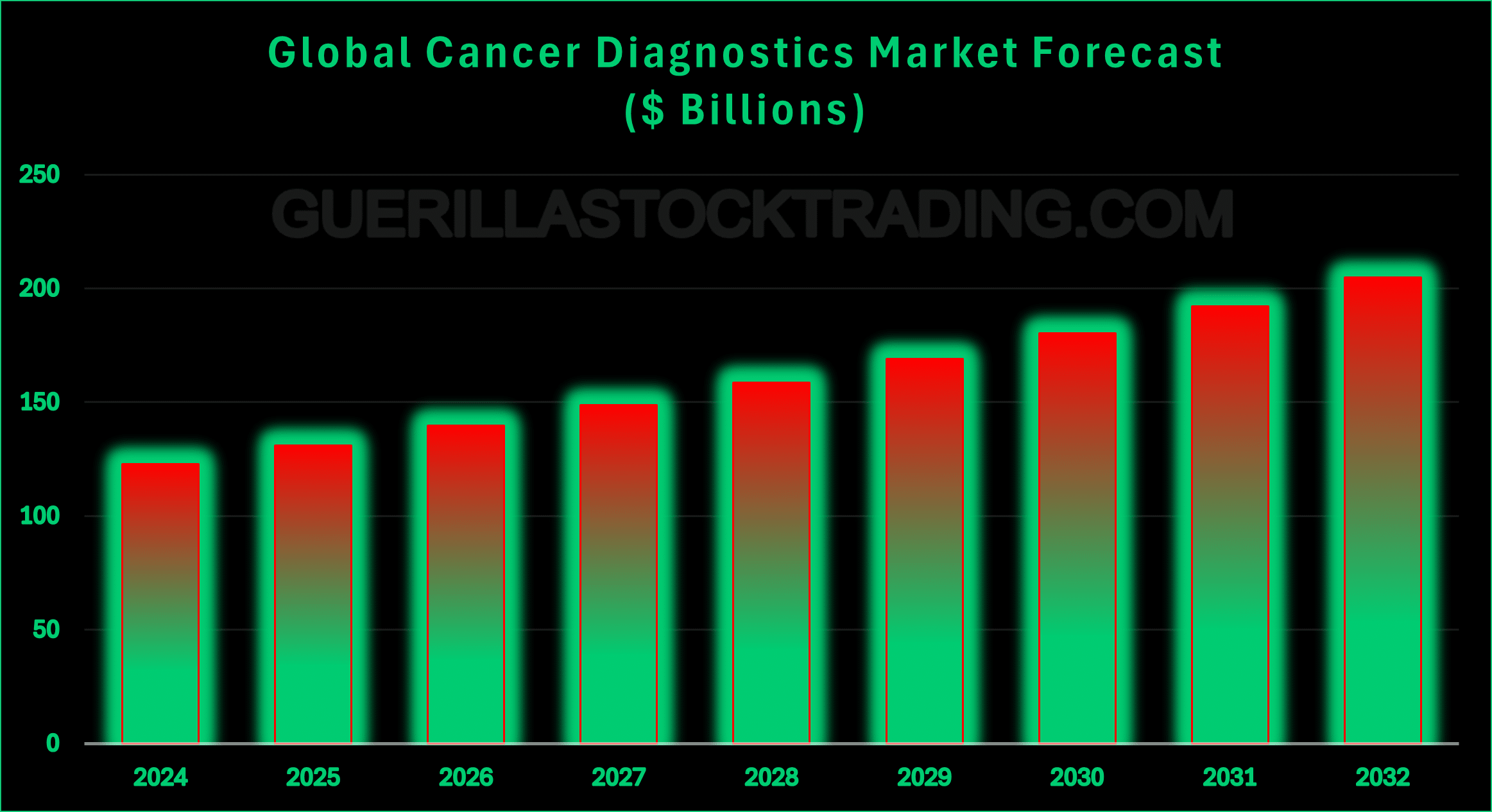

The global cancer diagnostics market is projected to grow significantly, driven by increasing cancer prevalence, technological advancements, and the demand for early detection and accurate diagnosis. Challenges include the high cost of advanced diagnostics and limited access in developing regions, but opportunities abound in strategic collaborations and molecular diagnostics advancements.

Strategic Agreement with Myriad Genetics

On July 11, 2024, Personalis and Myriad Genetics (NASDAQ: MYGN) announced a landmark agreement to cross-license their patent estates. This collaboration focuses on tumor-informed approaches to detect minimal residual disease (MRD), a critical area in oncology. The agreement aims to solidify each company’s freedom to operate within the MRD market, thereby expanding patient access to advanced MRD testing.

Paul J. Diaz, President and CEO of Myriad Genetics, emphasized the importance of this collaboration:

“Myriad and Personalis are each working to re-define the standard for MRD testing and increasing market access to better inform clinical decision making for the treatment and monitoring of oncology patients.”

This agreement is expected to drive broader adoption and reimbursement of MRD testing, ultimately benefiting patients through improved clinical decision-making.

NeXT Personal Test Data Presentation at ASCO

Personalis made a significant impact at the American Society for Clinical Oncology (ASCO) on June 4, 2024, by presenting data on their NeXT Personal test. This ultra-sensitive liquid biopsy test is designed to detect early cancer recurrence and monitor a patient’s response to therapy. The data presented highlighted exceptional detection rates and performance, particularly for early-stage breast cancer and immunotherapy monitoring.

Dr. Rodrigo Toledo from the Vall d’Hebron Institute of Oncology (VHIO) showcased data demonstrating the predictive power of NeXT Personal. His findings revealed that baseline levels and changes in circulating tumor DNA (ctDNA) detected by NeXT Personal are highly indicative of therapy response and clinical outcomes for late-stage cancer patients receiving immunotherapy. The test showed an average lead time of 81 days in detecting cancer progression over traditional imaging methods.

Analyst Upgrades and Financial Performance

Analyst sentiment has also been favorable. Needham & Company LLC raised their price target for Personalis from $2.30 to $3.50 and reiterated a “buy” rating. Such positive analyst coverage often enhances investor sentiment and can lead to an increase in stock price.

Moreover, Personalis reported better-than-expected financial results for the first quarter of 2024, surpassing both earnings per shareEarnings per share (EPS) is a fundamental financial metric that provides valuable insights into a company's profitability. This widely used indicator helps investors and analysts g... (EPS) and revenue estimates. This strong financial performance reassures investors about the company’s future prospects, contributing to the stock’s rise.

Global Cancer Diagnostics Market Forecast

The global cancer diagnostics market is projected to experience significant growth over the coming years. In 2023, the market size was estimated at approximately USD 107.45 billion and is expected to grow at a compound annual growth rateThe world of finance is replete with complex concepts, but one that stands as a cornerstone for investors seeking to gauge returns is the Compound Annual Growth Rate (CAGR). Often ... (CAGR) of 6.16% from 2024 to 2030, reaching around USD 162.31 billion by 2030. Another projection suggests the market could reach USD 204.8 billion by 2032, growing at a CAGR of 6.6% during the forecast period.

Key drivers for this growth include the rising prevalence of cancer, technological advancements in diagnostic procedures, and increased initiatives by both private and public organizations to develop novel imaging solutions and precision medicine. Additionally, the demand for early detection and accurate diagnosis to improve disease management and reduce mortality rates is also propelling market growth. However, the high cost of advanced diagnostic technologies and limited access to healthcare services in developing regions may pose challenges to market expansion. Despite these challenges, strategic collaborations, advancements in molecular diagnostics, and the integration of AI into diagnostic tools present significant growth opportunities for the market.

Insights

- The cross-licensing agreement strengthens Personalis’ market position in MRD testing.

- The NeXT Personal test shows promising results for early cancer detection and immunotherapy monitoring.

- Financial and analyst support indicates strong investor confidence in Personalis’ future growth.

- The global cancer diagnostics market is on a growth trajectory, benefiting companies like Personalis.

The Essence (80/20)

Core Topics for Understanding:

- Cross-Licensing Agreement: Key to expanding MRD testing capabilities and patient access.

- NeXT Personal Test: Revolutionary in detecting early cancer recurrence and monitoring immunotherapy response.

- Financial Moves: Capital raise and strong financial performance boost growth potential.

- Market Growth: The expanding global cancer diagnostics market provides a fertile ground for innovation and revenue growth.

The Action Plan – What Personalis Should Do Next

- Leverage Cross-Licensing: Utilize the agreement with Myriad Genetics to expand MRD testing services and market reach.

- Promote NeXT Personal: Highlight the test’s exceptional detection capabilities to oncologists and healthcare providers.

- Utilize Raised Capital: Invest any proceeds from public offerings into R&D and expanding market presence.

- Engage with Investors: Maintain transparency and continue to deliver strong financial results to sustain investor confidence.

Blind Spot

Potential Overlooked Detail: The high cost of advanced diagnostic technologies may limit market penetration in developing regions, potentially slowing global growth despite technological advancements and market opportunities.

Regulatory Challenges: Navigating the complex and stringent regulatory environment for new diagnostic tests can be time-consuming and costly, potentially delaying market entry and adoption.

Market Competition: The rapid advancements in the cancer diagnostics field mean increased competition from other biotech companies, which could impact Personalis’ market share and pricing strategies.

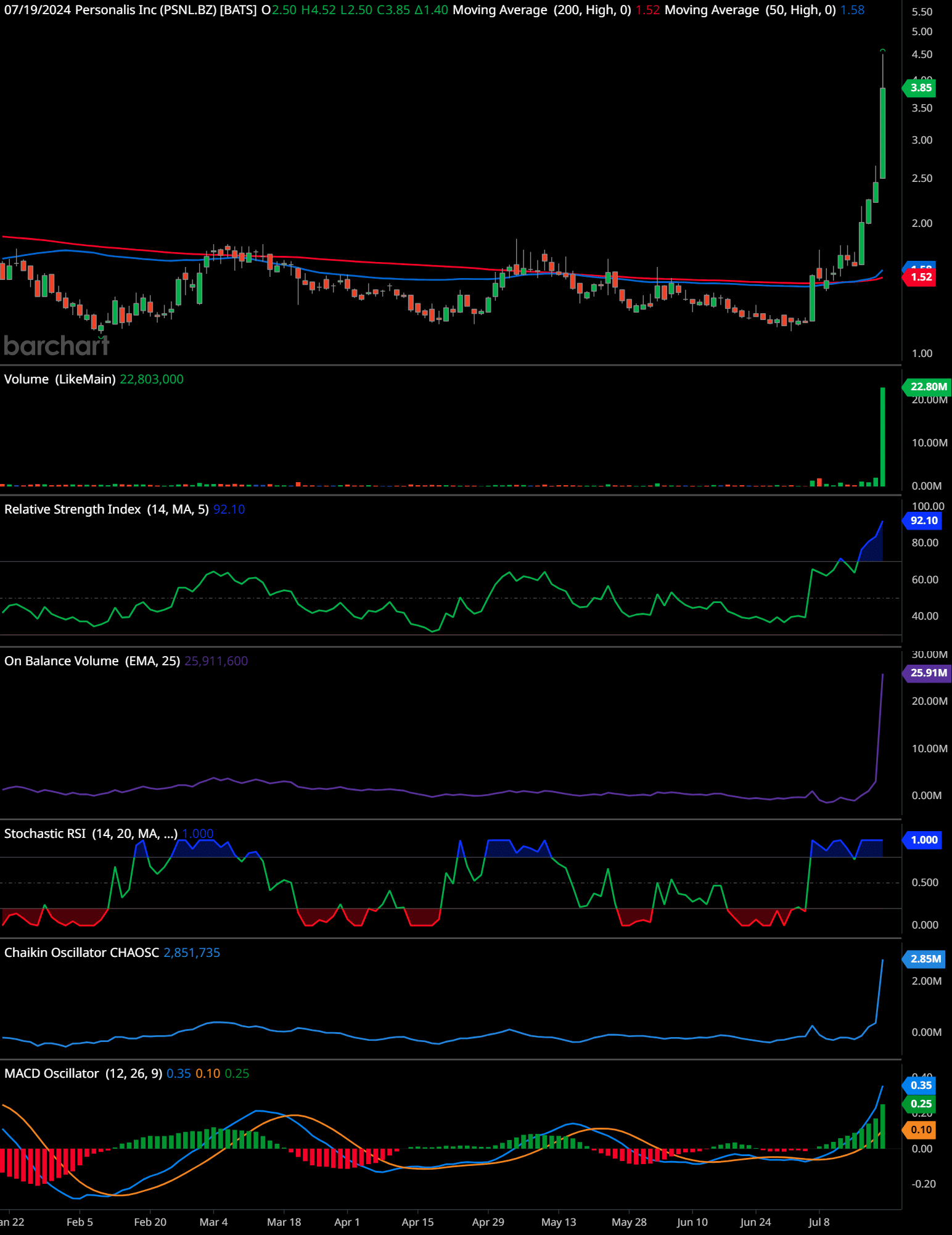

PSNL Technical Analysis

Analyzing the chart for Personal Inc (PSNL) on 07/19/2024, the following observations and trends are noted:

Trend Identification and Analysis:

The stock shows a significant upward trend starting from early July, as evidenced by a sharp price increase and the candlesticks moving well above both the 50-day and 200-day moving averages. The current price at 3.85 indicates a strong bullish sentiment, especially with the recent high volume spike of 22.80M.

Support and Resistance Levels:

Key support level: Around 1.50 (200-day moving average).

Key resistance level: 3.85 (current price level).

Indicators:

- Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is at 92.10, which is in the overbought territory, indicating the stock might be overvalued and could be due for a pullback.

- On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV shows a significant rise, indicating strong buying pressure.

- Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: The Stochastic RSI is at 1.000, suggesting an overbought condition, similar to the RSI.

- Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: A sharp increase to 2,851,735 supports the bullish trend with high accumulation.

- MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More Oscillator: The MACD line is above the signal line, with strong bullish momentum as seen from the widening histogram bars.

Time-Frame Signals:

- 3 months: Buy – The strong upward momentum and high volume suggest continued bullish activity in the short term, but watch for potential corrections due to overbought conditions.

- 6 months: Hold – Given the high RSI and Stochastic RSI, there might be some volatility and potential pullbacks. Maintaining a hold position could be wise to see how the stock stabilizes.

- 12 months: Hold – Longer-term performance will depend on the company’s fundamentals and market conditions. Monitoring ongoing performance and any significant news is essential.

Past performance is not an indication of future results. This article should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

The combination of strategic agreements, groundbreaking test data, successful public offerings, positive analyst upgrades, and strong financial performance has propelled Personalis, Inc. to new heights. The company’s recent achievements underscore its commitment to advancing cancer diagnostics and treatment, positioning it for continued success in the evolving oncology market. As Personalis continues to innovate and expand its capabilities, it is poised to make significant contributions to the healthcare industry and deliver value to its shareholders.

Personalis FAQs

- 1. What recent event caused a significant rise in Personalis (PSNL) stock price?

- Personalis, Inc. experienced a significant rise in its stock price due to several factors, including an agreement with Myriad Genetics, the announcement of NeXT Personal test data, analyst upgrades, and better-than-expected financial performance.

- 2. What is the agreement between Myriad Genetics and Personalis about?

- Myriad Genetics and Personalis entered into an agreement to cross-license patent estates covering tumor-informed approaches to detect minimal residual disease (MRD). This agreement solidifies each company’s freedom to operate in the MRD market and broadens patient access to MRD testing benefits.

- 3. How does the Myriad Genetics and Personalis agreement benefit patients?

- The agreement is expected to help drive broader MRD testing adoption and reimbursement, advancing patient access to MRD testing and improving clinical decision-making for oncology patients.

- 4. What is the NeXT Personal test?

- The NeXT Personal test is an ultra-sensitive liquid biopsy test designed to detect the earliest traces of cancer recurrence and monitor a patient’s response to therapy by detecting circulating tumor DNA (ctDNA).

- 5. What were the key findings presented at the ASCO regarding NeXT Personal?

- The data presented at ASCO demonstrated that NeXT Personal had exceptional detection rates and performance for early-stage breast cancer and immunotherapy monitoring. It also showed that changes in ctDNA levels detected by NeXT Personal are highly predictive of therapy response and clinical outcomes for late-stage cancer patients receiving immunotherapy.

- 6. How did analyst upgrades affect Personalis’ stock price?

- Needham & Company LLC raised their price target for Personalis from $2.30 to $3.50 and reiterated a “buy” rating. Such positive analyst coverage often boosts investor sentiment, leading to an increase in stock price.

- 7. What financial performance did Personalis report for the first quarter of 2024?

- Personalis reported better-than-expected financial results for the first quarter of 2024, beating both EPS and revenue estimates. This strong financial performance reassured investors about the company’s prospects, leading to a rise in stock value.

- 8. What is the projected growth of the global cancer diagnostics market?

- The global cancer diagnostics market is projected to grow at a compound annual growth rate (CAGR) of 6.16% from 2024 to 2030, reaching around USD 162.31 billion by 2030. Another projection suggests the market could reach USD 204.8 billion by 2032, growing at a CAGR of 6.6% during the forecast period.

- 9. What are the key drivers for the growth of the global cancer diagnostics market?

- Key drivers include the rising prevalence of cancer, technological advancements in diagnostic procedures, and increased initiatives by private and public organizations to develop novel imaging solutions and precision medicine. The demand for early detection and accurate diagnosis to improve disease management and reduce mortality rates is also propelling market growth.

- 10. What challenges could the cancer diagnostics market face?

- The high cost of advanced diagnostic technologies and limited access to healthcare services in developing regions may pose challenges to the market’s expansion.

- 11. What opportunities exist in the cancer diagnostics market despite the challenges?

- Strategic collaborations, advancements in molecular diagnostics, and the integration of AI into diagnostic tools present significant growth opportunities for the cancer diagnostics market.

- 12. How does the Myriad Genetics’ Precise MRD test fit into their oncology solutions?

- Myriad Genetics’ Precise MRD test is a tumor-informed, genome-scale MRD test that is part of Precise Oncology Solutions, which is their expanding portfolio of comprehensive molecular diagnostic tools for oncology detection and treatment.

- 13. What is the importance of NeXT Personal’s use for immunotherapy monitoring?

- NeXT Personal’s use for immunotherapy monitoring is important because it can predict therapy response and clinical outcomes. For example, a significant decrease in ctDNA levels from baseline to the third cycle of immunotherapy was associated with a more than twofold increase in overall survival for late-stage cancer patients.

- 14. What role does AI play in the future of cancer diagnostics?

- AI integration into diagnostic tools is expected to enhance the accuracy and efficiency of cancer diagnostics, providing significant growth opportunities for the market.

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

- Nvidia just poured $160 million into Applied Digital Stock… and it skyrocketed 76% in a day! 🚀 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.