A Proven and Profitable Business Model

Cadre Holdings’ (NYSEThe New York Stock Exchange (NYSE) is a global financial powerhouse, and at the heart of its performance measurement stands the NYSE Composite Index (NYA). This comprehensive index...: CDRE) stock is on an upward trend due to several factors: a strong business model focused on safety equipment for first responders, military, and government agencies; market leadership; a successful acquisition strategy; and improving financial performance.

The company boasts a Relative Strength Rating improvement and a superior Return on Capital Employed (ROCE) compared to the industry average. Effective capital reinvestment has resulted in a 55% return for shareholders over the past year, and investor sentiment remains bullish. Cadre Holdings employs a three-pronged growth strategy targeting core revenue growth, geographical expansion, and margin improvement. Although the stock recently pulled back to $32, some analysts view this as an attractive entry point. The global PPE market, projected to grow significantly, further bolsters Cadre Holdings’ prospects, driven by increasing workplace safety awareness and regulatory mandates. Despite potential restraints such as increased automation and low-quality product sales, the industry is expected to see steady growth over the next decade.

Market Leadership and Competitive Advantage

As a market leader in the safety equipment industry, Cadre Holdings enjoys a significant competitive advantage. Its specialized focus on providing essential gear for first responders and military operations ensures a steady demand for its products. This leadership position not only enhances the company’s market presence but also reinforces its reputation as a reliable provider of critical safety solutions.

Strategic Acquisitions Fueling Growth

Cadre Holdings has strategically expanded its market reach and product offerings through a series of well-executed acquisitions. By integrating closely related companies into its portfolio, Cadre has bolstered its capabilities and diversified its product line. This acquisition strategy has been instrumental in driving the company’s growth and maintaining its competitive edge in a dynamic market landscape.

Financial Performance and Market Confidence

The company’s financial performance has shown notable improvement, reflected in its rising Relative Strength Rating from 66 to 74. This metric indicates growing investor confidence and a positive outlook for the stock. Additionally, Cadre Holdings boasts a Return on Capital Employed (ROCE) of 13%, significantly outpacing the Aerospace & Defense industry average of 9.8%. This superior capital efficiency highlights the company’s effective management and prudent investment strategies.

Effective Capital Reinvestment and Shareholder Returns

Cadre Holdings has demonstrated a strong commitment to reinvesting capital at attractive rates of return. This approach has yielded a remarkable 55% return for shareholders over the past year. The company’s ability to generate substantial returns through strategic reinvestment underscores its operational prowess and long-term growth potential.

Investor Optimism and Market Sentiment

Investor sentiment towards Cadre Holdings remains overwhelmingly positive, with many investors displaying a bullish outlook on the stock. This optimism is reflected in the market’s willingness to hold onto the stock despite recent pullbacks. Analysts suggest that the current stock price of around $32 presents an attractive entry point for investors, given the company’s robust fundamentals and growth prospects. However, prudent monitoring of the stock’s performance is advised to navigate potential market fluctuations.

Insights:

- Cadre Holdings’ proven business model ensures consistent profitability.

- Market leadership offers a competitive advantage in the safety equipment sector.

- Strategic acquisitions expand product offerings and market reach.

- Superior ROCE indicates better capital efficiency.

- Strong investor sentiment and growth strategy attract investment interest.

The Essence (80/20)The Origins and Evolution of the 80/20 Principle The Discovery by Vilfredo Pareto In 1897, Italian economist Vilfredo Pareto uncovered a striking pattern in his study of wealth and...:

Core Topics:

- Strong Business Model: Focused on safety equipment, demonstrating consistent profitability.

- Market Leadership: Dominance in the safety equipment sector for first responders and military.

- Acquisition Strategy: Growth through strategic acquisitions, expanding product offerings and market reach.

- Financial Performance: Improving relative price performance and investor confidence.

- Industry Outperformance: Superior Return on Capital Employed compared to peers.

- Capital Reinvestment: Effective reinvestment translating to high shareholder returns.

- Investor Optimism: Bullish investor sentiment, indicating strong market confidence.

- Growth Strategy: Emphasis on core revenue growth, geographical expansion, and margin improvement.

- PPE Market Growth: Significant projected growth in the PPE market, driven by safety awareness and regulatory mandates.

The Action Plan – What Cadre Holdings Will Likely Do:

- Investment Monitoring:

- Track financial performance and market conditions regularly.

- Monitor acquisition activity and its impact on market reach and product offerings.

- Growth Strategy Execution:

- Focus on geographical expansion opportunities.

- Implement margin improvement initiatives.

- Market Awareness:

- Stay informed about PPE market trends and projections.

- Assess regulatory changes impacting the safety equipment industry.

Blind Spot:

Potential challenges include increased automation reducing PPE demand and competition from low-quality product sales. Continuous market analysis and strategic adjustments are essential to mitigate these risks.

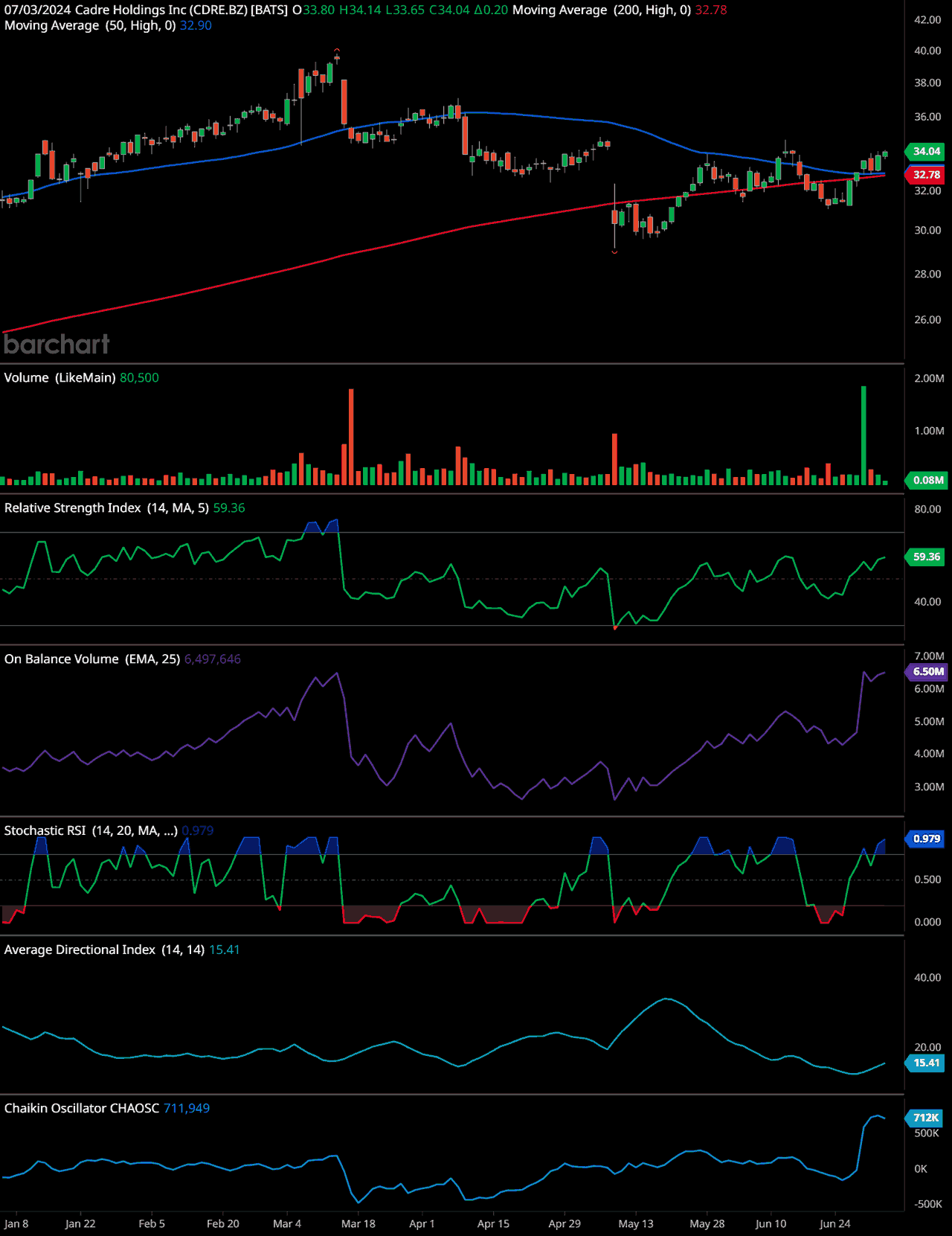

CDRE Technical Analysis

The chart for Cadre Holdings Inc. (CDRE) shows the stock price movement along with several technical indicators.

Trend Analysis:

The stock has shown a significant decline from its peak around $39 in early May to a low near $28 in mid-June. Since then, it has recovered slightly and is now trading around $34.04. The 50-day moving average is at $32.90, while the 200-day moving average is at $32.78, indicating a potential crossover which could signal a bullish trend if the stock price remains above these levels.

Volume Analysis:

There was a notable increase in volume on the latest trading day, suggesting heightened interest in the stock. Sustained high volume is often a precursor to significant price movement.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI):

The RSI is at 59.36, which is in the neutral zone. An RSI above 70 typically indicates an overbought condition, while below 30 indicates oversold. Currently, the RSI suggests that the stock is neither overbought nor oversold, with room for upward movement.

On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV):

The OBV is rising, which typically indicates that the volume on up days is outpacing the volume on down days. This is often a bullish sign as it shows accumulation by investors.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...:

The Stochastic RSI is at 0.979, near its upper bound of 1. This suggests that the stock is potentially overbought in the short term and might experience a pullback or consolidation before continuing its trend.

Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX):

The ADX is at 15.41, which is below the threshold of 20 that typically indicates a strong trend. This suggests that the current trend (either up or down) is relatively weak.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...:

The Chaikin Oscillator is at 711,949, showing a significant recent increase. This can be a bullish signal, indicating strong buying pressure.

Time-Frame Signals:

- 3-Month Horizon: Hold. The stock is showing some signs of recovery and accumulation, but the overall trend strength is weak.

- 6-Month Horizon: Buy. If the stock can maintain above the 50-day and 200-day moving averages, it may indicate a stronger bullish trend.

- 12-Month Horizon: Buy. The indicators suggest potential for longer-term growth if the current recovery and accumulation continue.

Past performance is not an indication of future results. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

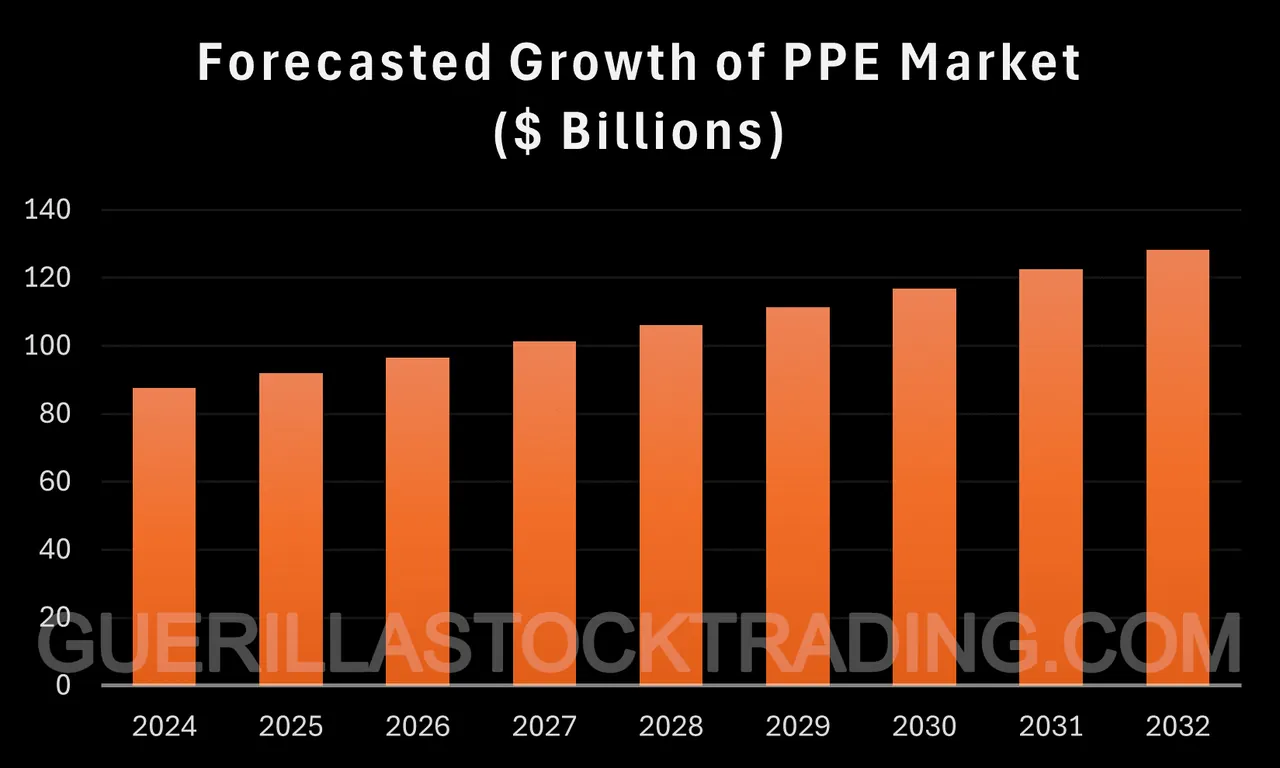

The Booming Personal Protective Equipment (PPE) Market

Projected Market Growth

The global Personal Protective Equipment (PPE) market is poised for significant growth in the coming years. Forecasts indicate that the market will expand from $87.69 billion in 2024 to $128 billion by 2032, exhibiting a compound annual growth rateThe world of finance is replete with complex concepts, but one that stands as a cornerstone for investors seeking to gauge returns is the Compound Annual Growth Rate (CAGR). Often ... (CAGR) of 4.9% during this period. In the United States, the PPE market is expected to grow at a CAGR of 6.7% from 2022 to 2030, reaching $32.5 billion by 2030. Additionally, another source projects the global PPE market to grow at a CAGR of 7.2% from 2024 to 2030.

Key Drivers of Market Growth

Several factors are driving the anticipated growth of the PPE market:

- Increasing Awareness about Workplace Safety: Growing awareness of the importance of workplace safety and the critical role of PPE in protecting workers is fueling demand.

- Stringent Safety Regulations: Regulatory mandates from bodies like the Occupational Safety and Health Administration (OSHA) are compelling industries to adhere to safety standards, thereby boosting PPE sales.

- Industry Expansion: Sectors such as healthcare, construction, manufacturing, and oil & gas are expanding, leading to increased demand for safety equipment.

- Technological Advancements: Innovations in PPE, including the development of smart PPE, are enhancing product functionality and appeal.

Potential Market Restraints

Despite the positive outlook, the PPE market faces potential challenges:

- Increased Automation: The rise of automation in end-use industries may reduce the workforce requiring PPE, potentially dampening demand.

- Low-Quality Products: The influx of inexpensive, low-quality PPE products could undercut the market and impact overall growth.

Outlook for the Safety Equipment Industry

Overall, the safety equipment industry, particularly the PPE segment, is set for steady growth over the next 5-10 years. Driven by regulatory requirements, heightened workplace safety awareness, and the expansion of key end-use industries, the market presents promising opportunities for companies like Cadre Holdings. By leveraging its market leadership, strategic growth initiatives, and robust financial performance, Cadre is well-positioned to capitalize on these trends and sustain its upward trajectory.

Three-Pronged Growth Strategy

Cadre Holdings has adopted a comprehensive growth strategy centered on core revenue growth, geographical expansion, and margin improvement. This multifaceted approach has been pivotal in driving the company’s performance and capturing investor interest. By focusing on these key areas, Cadre is well-positioned to capitalize on emerging opportunities and sustain its growth trajectory.

Cadre Holdings (NYSE: CDRE) FAQ

FAQs

- What factors have contributed to the upward trend of Cadre Holdings (NYSE: CDRE) stock?

- Several factors have contributed, including a strong business model, market leadership, successful acquisition strategy, improving financial performance, industry outperformance, effective capital reinvestment, investor optimism, and a robust growth strategy.

- What is the business model of Cadre Holdings?

- Cadre Holdings has a proven profitable business model focused on providing safety equipment to first responders, military, government agencies, and individuals.

- How does Cadre Holdings maintain a competitive advantage in the market?

- Cadre Holdings is a market leader in the safety equipment sector, particularly for first responders and military operations, which provides a competitive advantage and helps maintain steady demand for their products.

- How has Cadre Holdings grown through acquisitions?

- Cadre Holdings has been successfully growing through strategic acquisitions of closely related companies, allowing them to expand their product offerings and market reach.

- What is the significance of Cadre Holdings’ improving financial performance?

- The company has shown improved relative price performance, with its Relative Strength Rating increasing from 66 to 74, indicating growing investor confidence in the stock.

- How does Cadre Holdings’ Return on Capital Employed (ROCE) compare to industry averages?

- Cadre Holdings’ ROCE of 13% outperforms the Aerospace & Defense industry average of 9.8%, suggesting better capital efficiency compared to peers.

- What has been the impact of Cadre Holdings’ capital reinvestment strategy?

- The company’s effective capital reinvestment has translated to a 55% return for shareholders over the past year.

- What indicates strong market sentiment towards Cadre Holdings?

- Many investors appear to be more bullish on Cadre Holdings than analysts, indicating strong market sentiment and unwillingness to sell the stock.

- What are the components of Cadre Holdings’ growth strategy?

- Cadre Holdings’ growth strategy focuses on core revenue growth, geographical expansion, and margin improvement.

- Why do some analysts see the recent stock pullback as an attractive entry point?

- Despite a recent pullback to around $32, some analysts view this as an attractive entry point due to the company’s strong fundamentals and growth prospects.

- What is the projected growth for the global PPE market?

- The global PPE market is forecasted to grow from $87.69 billion in 2024 to $128.57 billion by 2032, with a CAGR of 4.9% during this period.

- What is the expected growth rate for the U.S. PPE market?

- The U.S. PPE market is expected to grow at a CAGR of 6.7% from 2022 to 2030, reaching $32.5 billion by 2030.

- What are some key factors driving the growth of the PPE market?

- Key factors include increasing awareness about workplace safety, stringent safety regulations, growth in industries like healthcare, construction, manufacturing, and oil & gas, and technological advancements in PPE.

- What are potential restraints on the PPE market growth?

- Potential restraints include increased automation in end-use industries, which may reduce the workforce requiring PPE, and sales of inexpensive, low-quality products that may undercut the market.

- What is the overall forecast for the safety equipment industry?

- The safety equipment industry, particularly the PPE segment, is forecasted to see steady growth over the next 5-10 years, driven by regulatory requirements, workplace safety awareness, and expansion of key end-use industries.

- Nvidia just poured $160 million into Applied Digital Stock… and it skyrocketed 76% in a day! 🚀 - September 8, 2024

- Is Trump Media stock the next meme stock disaster? 📉 Find out why DJT stock is tanking! - September 8, 2024

- When was the last time a new drug humbled the world’s best? Summit Therapeutics Stock To Explode 🧬 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.