Palantir Technologies (PLTR) stock is rising due to positive analyst coverage, significant institutional investment, AI-driven growth, strong financial performance, expansion in the commercial sector, and overall market momentum. Wedbush analyst Daniel Ives recently highlighted Palantir as a top tech pick, predicting a 15% rise in tech stocks, including Palantir, for the rest of 2024. Cathie Wood’s ARK Invest’s purchase of 199,372 shares valued at $5.16 million signals strong confidence in Palantir. The company’s Artificial Intelligence Platform (AIP) is driving growth, particularly in the private sector, with a 69% increase in U.S. commercial customers year-over-year. Financially, Palantir reported a 21% revenue increase to $634 million and an operating marginThe operating margin is a critical financial metric that measures a company's ability to generate profit through its core operations. It provides valuable insights into a company's... expansion from 24% to 36% in Q1 2024. Analysts view Palantir’s ventures in data management and analytics in the commercial sector as promising. The stock trades above its 50-day moving average of $22.82, nearing its 52-week high of $27.50, showing strong market momentum.

Positive Analyst Coverage

One of the pivotal factors contributing to Palantir’s stock surge is the positive analyst sentiment. Daniel Ives, a prominent analyst at Wedbush, recently highlighted Palantir as one of his top tech picks for the rest of 2024. Ives’s endorsement stems from his expectation that tech stocks, including Palantir, will see an additional 15% rise in value, building on the gains already observed in the first half of the year. This positive outlook from a respected voice in the financial community has undoubtedly fueled investor optimism and confidence in Palantir’s future performance.

Institutional Investment by ARK Invest

Another significant driver of Palantir’s stock momentum is the recent investment by Cathie Wood’s ARK Invest. The firm acquired 199,372 shares of Palantir, valued at approximately $5.16 million. This substantial purchase is a strong vote of confidence in Palantir’s growth trajectory and strategic direction. Cathie Wood, known for her forward-thinking investment strategies, has a track record of backing innovative companies poised for substantial growth. Her firm’s investment in Palantir signals to the market that Palantir is a valuable player in the tech space, further boosting investor sentiment.

AI-Driven Growth

Palantir has been a significant beneficiary of the ongoing AI revolution. The company’s Artificial Intelligence Platform (AIP) has emerged as a crucial growth driver, especially within the private sector. During the first quarter, Palantir saw its U.S. commercial customer count skyrocket by 69% year over year. This impressive growth highlights the increasing demand for Palantir’s AI-driven solutions and their efficacy in addressing complex data analytics and management needs. The AIP’s robust capabilities have positioned Palantir as a leader in leveraging AI to drive business transformation, making it an attractive proposition for investors.

Strong Financial Performance

Palantir’s financial performance in the first quarter of 2024 has been robust, further underpinning the positive sentiment around its stock. The company reported a 21% year-over-year increase in revenue, reaching $634 million. This substantial revenue growth was complemented by an expansion in the operating margin, which increased from 24% to 36% compared to the same period in 2023. These financial metrics reflect Palantir’s efficient operational management and its ability to scale its revenue streams effectively, providing a solid foundation for future growth.

Expansion in the Commercial Sector

Analysts are particularly optimistic about Palantir’s ventures into the commercial sector. The company’s efforts in developing and deploying data management and analytics platforms tailored for commercial use have shown promising results. This expansion into the commercial domain is seen as a strategic move that diversifies Palantir’s revenue base beyond its traditional government contracts, opening up new avenues for growth and market penetration.

Market Performance and Momentum

Palantir’s stock performance in the market further illustrates its strong momentum. Shares are trading above the 50-day moving average of $22.82 and are approaching the 52-week high of $27.50. This upward trend indicates strong investor confidence and a positive market outlook for Palantir’s stock, driven by the various factors mentioned above.

Insights:

- Positive analyst coverage boosts investor confidence and stock performance.

- Institutional investments indicate strong future prospects for the company.

- AI-driven solutions are a major growth driver for Palantir.

- Strong financial metrics enhance market perception and stock value.

The Essence (80/20)The Origins and Evolution of the 80/20 Principle The Discovery by Vilfredo Pareto In 1897, Italian economist Vilfredo Pareto uncovered a striking pattern in his study of wealth and...:

- Core Topics: Analyst endorsements, institutional investment, AI-driven growth, financial performance, commercial sector expansion, market momentum.

- Details: Analyst Daniel Ives’ positive outlook, ARK Invest’s share purchase, growth of Palantir’s AI platform, revenue and margin improvements, commercial ventures, stock trading patterns.

The Guerilla Stock Trading Action Plan:

- Monitor Analyst Coverage: Track updates from key analysts like Daniel Ives for investment guidance.

- Watch Institutional Movements: Follow significant investments from entities like ARK Invest.

- Leverage AI Innovations: Explore opportunities within Palantir’s AI Platform for business integration.

- Assess Financial Health: Regularly review Palantir’s financial reports for sustained growth and profitability.

- Explore Commercial Solutions: Investigate Palantir’s commercial data management and analytics services for potential applications.

Blind Spots:

- Over-reliance on positive analysts: Institutional signals may overlook potential market volatility or internal company challenges.

- Regulatory Risks: Potential regulatory changes affecting AI technology and data privacy could impact Palantir’s operations and market positioning.

- Market Dependence: Heavy reliance on AI-driven growth might make the company vulnerable if advancements in AI technology slow down or face significant competition.

PLTR Technical Analysis

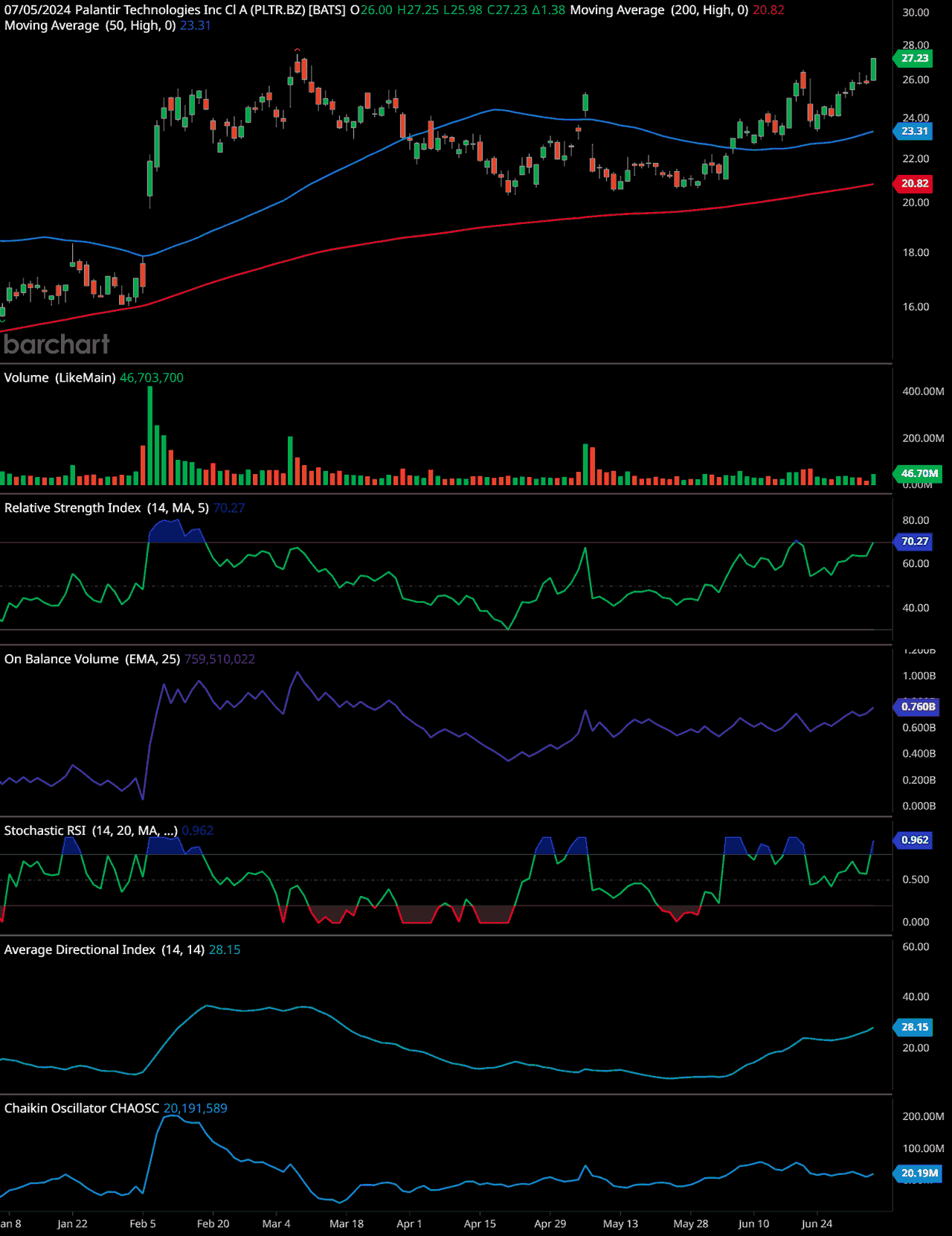

The chart for Palantir Technologies Inc (PLTR) shows the following analysis:

- Trend Analysis: The stock is currently in an upward trend, as indicated by the rising 50-day moving average (blue line) which is above the 200-day moving average (red line). The price is trading above both moving averages, reinforcing the bullish trend.

- Volume Analysis: The volume shows spikes on certain days, indicating periods of higher trading activity. The latest volume bar indicates a significant buying interest.

- Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is at 70.27, which is near the overbought threshold of 70. This suggests that the stock might be overbought and could be due for a pullback or consolidation.

- On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV is trending upwards, suggesting that the stock is being accumulated as higher volume is associated with upward price movements.

- Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: The Stochastic RSI is at 0.962, indicating that the stock is in the overbought territory. This could signal a potential reversal or a period of consolidation.

- Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX): The ADX is at 28.15, which indicates a moderately strong trend. A reading above 25 typically signals that a trend is strong enough to continue.

- Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: The Chaikin Oscillator is positive at 20,191,589, suggesting buying pressure and confirming the bullish trend.

Time-Frame Signals:

- 3-month horizon: Hold – The stock is currently in an upward trend but is nearing overbought conditions. Monitoring for a potential pullback is advised.

- 6-month horizon: Buy – Given the bullish indicators, the stock is likely to continue its upward trend after any short-term corrections.

- 12-month horizon: Buy – The long-term trend remains positive with strong accumulation signals.

Please note that past performance is not an indication of future results. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. ❤️

Looking Ahead

Palantir Technologies is experiencing a significant upswing in 2024, driven by positive analyst coverage, strategic institutional investments, AI-driven growth, robust financial performance, and expansion in the commercial sector. These factors have collectively contributed to Palantir’s strong market presence and stock performance, positioning the company for continued growth and success in the tech landscape. As Palantir continues to innovate and expand its offerings, it remains a compelling investment opportunity for those looking to capitalize on the tech industry’s growth potential.

Frequently Asked Questions about Palantir Technologies (PLTR) Stock

FAQs

- 1. Why is Palantir Technologies (PLTR) stock moving higher?

- Several factors are contributing to the rise in Palantir Technologies (PLTR) stock, including positive analyst coverage, increased institutional investment, AI-driven growth, strong financial performance, commercial sector expansion, and overall market performance.

- 2. What did Wedbush analyst Daniel Ives say about Palantir?

- Wedbush analyst Daniel Ives named Palantir as one of his top tech picks for the remainder of 2024, expecting tech stocks, including Palantir, to rise another 15% on top of gains from the first half of the year.

- 3. How has institutional investment influenced Palantir’s stock?

- Cathie Wood’s ARK Invest purchased 199,372 shares of Palantir valued at approximately $5.16 million, signaling confidence in the company’s prospects and positively influencing the stock.

- 4. How is AI impacting Palantir’s growth?

- Palantir has benefited significantly from the ongoing AI revolution. The company’s Artificial Intelligence Platform (AIP) has become a new growth driver, particularly in the private sector.

- 5. What is the growth in Palantir’s U.S. commercial customer count?

- During the first quarter, Palantir’s U.S. commercial customer count surged by 69% year over year, indicating strong growth in this segment.

- 6. What were Palantir’s financial results in the first quarter of 2024?

- In the first quarter of 2024, Palantir reported a 21% year-over-year revenue increase to $634 million. The company’s operating margin also expanded from 24% to 36% compared to the same period in 2023.

- 7. How is Palantir expanding in the commercial sector?

- Palantir’s ventures into data management and analytics platforms in the commercial arena are seen as promising by analysts, contributing to the company’s growth.

- 8. How is Palantir’s stock performing in the market?

- Palantir shares are trading above the stock’s 50-day moving average of $22.82 and approaching its 52-week high of $27.50, indicating strong momentum in the market.

- 9. What is the significance of Palantir’s operating margin expansion?

- Palantir’s operating margin expanded from 24% to 36% in the first quarter of 2024 compared to the same period in 2023, reflecting improved operational efficiency and profitability.

- 10. What are analysts saying about Palantir’s prospects in the data management and analytics sectors?

- Analysts view Palantir’s expansion into data management and analytics platforms in the commercial sector as promising, contributing to the overall positive outlook for the company’s stock.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.