Palantir Technologies, a leading player in the data analytics and software industry, has seen its stock price rise significantly since August 5, 2024. This growth can be attributed to several key factors, including robust financial results for the second quarter of 2024, raised full-year guidance, and favorable market conditions.

Strong Q2 2024 Earnings Drive Investor Confidence

Palantir’s recent stock performance can be traced back to its impressive second-quarter earnings report for 2024, released on August 5. The company delivered strong financial results, with a 27% year-over-year revenue increase to $678 million, surpassing management’s guidance. This revenue growth underscores Palantir’s ability to capture and expand market share, driven by its expertise in handling complex data environments across both commercial and government sectors.

Notably, Palantir’s adjusted income from operations soared to $254 million, well above the initial estimates. This remarkable achievement indicates improved operational efficiency and effective cost management strategies. The company’s earnings per shareEarnings per share (EPS) is a fundamental financial metric that provides valuable insights into a company's profitability. This widely used indicator helps investors and analysts g... (EPS) experienced substantial growth, with a 500% year-over-year increase and an 80% rise in adjusted EPS. These results signal Palantir’s successful transition from a high-growth startup phase to a more mature, profitable enterprise.

Raised Full-Year Guidance Reflects Optimism

Building on its strong quarterly performance, Palantir has raised its full-year revenue and adjusted income from operations guidance. This revised outlook reflects management’s confidence in the company’s continued growth and profitability. The decision to increase the guidance highlights Palantir’s strategic positioning in the market and its ability to leverage its technological advantages to drive future expansion.

For investors, this upward revision is a clear signal of Palantir’s momentum and potential for sustained success. Companies that demonstrate consistent revenue growth and exceed market expectations often attract greater investor interest, leading to higher stock valuations. Palantir’s ability to deliver strong results while also projecting an optimistic future has been a critical factor in the stock’s upward trajectory.

Growth Across Commercial and Government Segments

A significant driver of Palantir’s recent success is its growth in both the commercial and government segments. The company’s U.S. commercial revenue grew by 55% year-over-year, while government revenue increased by 23%. Palantir’s strategic focus on high-quality, long-term engagements has been pivotal in achieving this growth. By catering to complex data environments, the company has managed to secure lucrative contracts and expand its footprint across various sectors.

The growth in commercial revenue reflects Palantir’s increasing relevance in the private sector, where companies are increasingly reliant on data analytics for decision-making and operational efficiency. Meanwhile, the sustained growth in government revenue demonstrates the company’s strength in securing and maintaining critical government contracts, which tend to be long-term and high-value.

Favorable Market Conditions Boost Stock Valuation

Palantir’s stock performance has also been supported by broader market conditions. Economic indicators such as the U.S. Producer Price Index (PPI) have suggested easing inflation, which could potentially lead to interest rate cuts by the Federal Reserve. Lower interest rates generally create a more favorable environment for equities, as they reduce the cost of borrowing and increase the attractiveness of stocks relative to other asset classes.

For Palantir, a technology-driven company with a focus on innovation, lower interest rates can translate into higher valuations. This is because the future cash flows of high-growth companies are often more sensitive to changes in interest rates. The combination of Palantir’s strong financial performance, optimistic future guidance, and supportive market conditions has created a positive feedback loop, driving its stock price upward since August 5, 2024.

Why Palantir Is Important for Investors

Palantir’s significance in the investment landscape stems from its unique positioning in the data analytics and software industry. As a company that provides critical data solutions to both commercial and government clients, Palantir has carved out a niche in a market that is becoming increasingly data-driven. Its ability to secure long-term, high-value contracts and its consistent financial growth make it an attractive option for investors looking for exposure to the technology sector.

Moreover, Palantir’s focus on both commercial and government segments provides a diversified revenue base, reducing its vulnerability to sector-specific downturns. This diversified strategy, combined with its strong financial performance and positive market outlook, positions Palantir as a compelling investment for those looking to benefit from the growth of data analytics and technology-driven innovation.

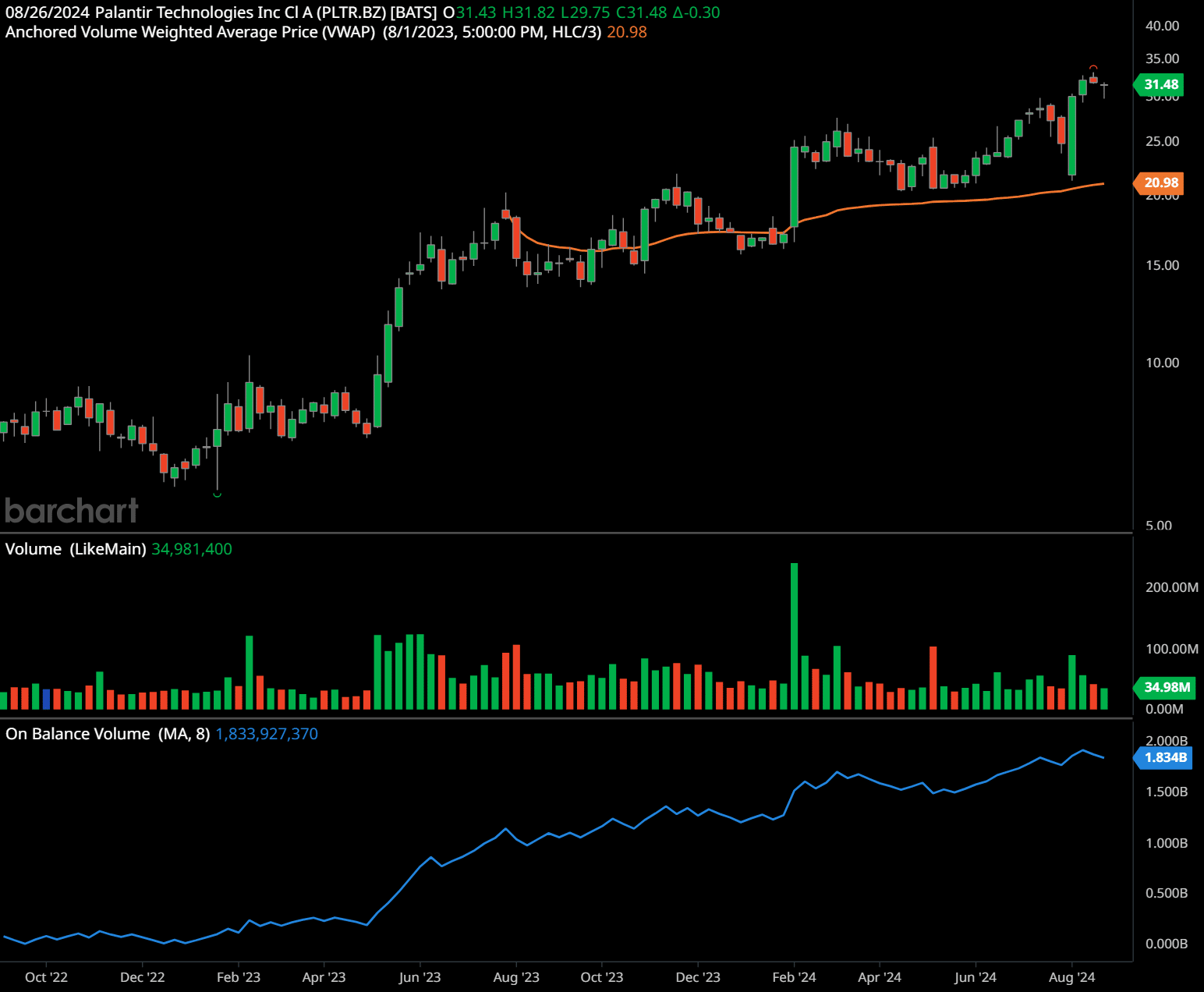

Palantir Technologies (PLTR) Technical Analysis (daily)

Time-Frame Signals:

3-Month Signal: Buy

The chart shows an overall uptrend in the short term. The price of Palantir Technologies Inc. (PLTR) has moved above the 50-day moving average (MA), currently at 28.79, which is a bullish signal. Additionally, the stock has recently bounced back strongly from the 200-day MA at 23.36, another bullish indicator. The RSIIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... is at 60.43, showing bullish momentum without being overbought. The MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More line is above the signal line, with positive histogram bars indicating further upward momentum. Given these bullish signals, a buy recommendation is suitable for a 3-month horizon.

6-Month Signal: Hold

The longer-term trend shows mixed signals. While the price is currently above both the 50-day and 200-day moving averages, indicating a potential sustained upward trend, the recent decline from the peak near 34 could suggest a period of consolidation or minor correction. The On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV) has been trending upward, showing accumulation, but the Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ... at 0.713 suggests the stock might be near overbought levels. The Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati... remains positive, but the momentum appears to be flattening. A hold recommendation is appropriate for a 6-month horizon, waiting for clearer directional cues.

12-Month Signal: Hold

Over the long term, the stock’s performance indicates a generally positive trajectory, but it is currently in a phase of consolidation after a significant uptrend. The MACD’s continued positive crossover supports a bullish long-term view, but with some caution due to potential corrections. The RSI’s position near 60 indicates neither overbought nor oversold conditions. The key support at the 200-day moving average of 23.36 and resistance at 34 suggests potential for a longer-term move upwards, but patience is advised. Thus, a hold recommendation remains appropriate for the 12-month horizon until a clearer trend emerges.

Support and Resistance Levels:

The key support levels are 28.79 (50-day moving average) and 23.36 (200-day moving average). These levels will likely provide strong support if the price retraces. The resistance level is around 34, where the price recently peaked and encountered selling pressure. A break above this resistance would indicate further bullish potential.

Future Trend Analysis:

The overall trend for Palantir Technologies Inc. (PLTR) in the daily time frame is bullish in the short term, with potential for further gains. The bounce from the 200-day moving average and the crossing above the 50-day moving average are encouraging signs. However, caution is advised due to the recent price peak and potential consolidation around the resistance level of 34. If the price manages to break and hold above this resistance, a continuation of the uptrend is likely. Conversely, failure to break this resistance may lead to a consolidation or a minor pullback to test support levels.

Palantir Technologies (PLTR) Technical Analysis (weekly)

Time-Frame Signals:

1-Year Signal: Buy

The weekly chart for Palantir Technologies Inc. (PLTR) shows a clear uptrend over the past year. The price is consistently trading above the Anchored VWAP from August 1, 2023, currently at 20.98, indicating strong buying interest around this level. The stock has recently broken above a key resistance level near 30, which now serves as support. Volume levels have generally increased during upward price movements, reinforcing the bullish trend. The On-Balance Volume (OBV) indicator also shows a steady upward trend, suggesting that accumulation is occurring. Given these strong bullish signals, a buy recommendation is appropriate for a 1-year horizon.

2-Year Signal: Hold

The 2-year time frame reveals a more balanced perspective. While the overall trend is bullish, the stock is approaching a major resistance level around 35. This resistance level represents a critical point where the stock has previously encountered selling pressure. The steady rise in OBV suggests sustained accumulation, but the slight flattening near current levels indicates that buying momentum could be slowing. The Anchored VWAP at 20.98 is well below the current price, providing a solid support base, but caution is warranted as the stock tests resistance. Therefore, a hold recommendation is suitable for a 2-year horizon, waiting to see if the stock can break above resistance or if a correction might occur.

3-Year Signal: Hold

Over a 3-year period, the stock has shown significant growth, moving from below 10 to over 30. The bullish trend is intact, but there are signs of potential consolidation. The price has risen steeply over the last year, and while the OBV shows a continued uptrend, the recent flattening suggests the potential for a period of sideways movement or a slight pullback before the next significant move. The support level at the Anchored VWAP of 20.98 is a strong base for the long term, but the stock needs to break above the resistance at 35 to confirm a continued long-term uptrend. Therefore, a hold recommendation is appropriate for the 3-year horizon until clearer signals emerge.

Support and Resistance Levels:

Key support level is at 20.98, where the Anchored VWAP is located. This level has shown strong buying interest and serves as a solid support line. Resistance is at 35, a significant level where the stock has encountered selling pressure in the past. A break above this resistance level could lead to further bullish momentum.

Future Trend Analysis:

The weekly chart indicates a strong bullish trend over the past year with consistent higher highs and higher lows. The upward momentum is supported by increasing volume on up days and a rising OBV, suggesting accumulation by investors. However, the stock is near a resistance level of 35, which could pose a challenge in the near term. If the stock successfully breaks above this resistance, it could indicate further upside potential. Conversely, a failure to break above this level may result in a consolidation phase or a minor pullback.

Past performance is not an indication of future results. This analysis should not be considered as investment advice. Always conduct your own research and consider consulting with a financial advisor before making any investment decisions. 🧡

Looking Ahead

Palantir Technologies’ rising stock price since August 5, 2024, is a result of its strong Q2 2024 earnings, raised full-year guidance, growth across key segments, and favorable market conditions. For investors, Palantir represents a dynamic and growing player in the data analytics space, with a proven track record of delivering results and a clear pathway for future growth.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.