Is there such a thing as options trading for dummies? I don’t think so but in this lesson, I hope to make some options trading strategies a little easier for you to understand.

Options Trading Tutorial

There are two categories of options: call and puts.

Calls are like a long position in stocks. A call is a bet that the market will go higher. You make money if the market goes up.

Puts are like a short position in a stock. A put is a bet that the market will go lower. You make money if the market goes down.

Time Decay Strategies For Options Trading

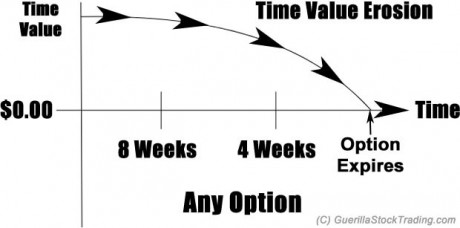

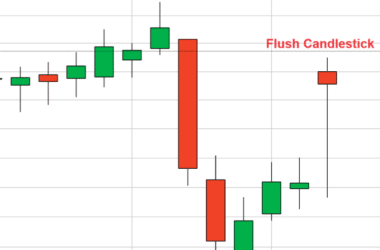

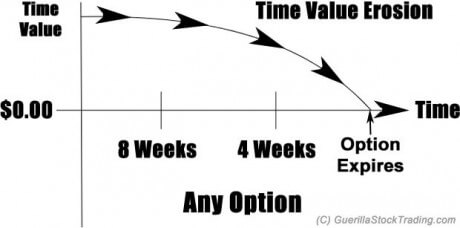

In regular stock trading you go long or short a stock. In options trading, you still go long or short a stock but you have to bet the amount of time the market will take to move in that direction. The amount of time to an option expiring is measured by “theta”. A negative theta means that an option will lose value due to time decay (the closer to the option expiration date). A positive theta means the option will make money due to time decay.

There are four possible option positions:

| Option Type | Theta |

| Long Call Option | Negative |

| Short Call Option | Positive |

| Long Put Option | Negative |

| Short Put Option | Positive |

Theta is the measure of how much an option would decrease per day from time decay. Long call options and long put options always have negative time decay while short call options and short put options always have positive time decay. The higher the theta is (between -1 and 0 for long options and 0 and 1 for short options), the more value will come out of the option each day as option expiration approaches.

Options Trading Strategies

There are a few options trading strategies that work by exploiting time decay and theta. I learned this strategy years ago from an options trading strategies pdf which, back in the 90s, that was the only way to learn the black art of options trading strategies. This options trading strategy is called the Iron Condor. It is one of the best options trading strategies for beginners.

The Iron Condor is actually two stock options trading strategies rolled into one: a call spread, and a put spread.

A credit spread is when you sell a closer “in the money” option (more expensive) and buy a further out of money option (cheaper) on the same underlying stock with the same expiration date.

Let’s use the stock of Google as an example with a December expiration.

Google is trading at $1,011.

The $970 put is at $18.

The $920 put is at $6.79.

Google is trading at $1,011 and we feel bullish on Google. We could sell a $970 put and buy a $920 put. The premium in the $970 put is going to be higher than the $920 put because it is closer to where the market is currently trading. We could collect the $18 premium from the $970 put and pay out the $6.79 premium of the $920 put at a net credit on the trade of $11.21. Our profit is the amount we collected between the 970/920 put spread, $18 – $6.79 = $11.21. We’re risking the difference between the two strike prices, ($970 – $920 = $50 x $0.4958/point = $24.79 and since we already collected a premium of $11.21, our risk is reduced to $13.58 ($24.79 – $11.21 = $13.58).

Options Trading Strategies – Iron Condor

In this options trading tutorial, you will learn about the Iron Condor. An Iron Condor is simply a combination or two credit spreads: a call spread, and a put spread. The Iron Condor is one of several options trading strategies you can use when you think the market will go sideways. It is a bet where you think the market will NOT go.

Once again, let’s take a look at an example using Google’s stock.

The current price of Google is $1011. Let’s say you think that Google will likely trade within a channel between $960 and $1100 over the next 30 to 60 days. Google’s options are currently trading at the following prices:

1100 call = $7.60

1150 call = $2.62

960 put = $13.61

910 put = $5.65

In order to take advantage of a sideways market we would use an Iron Condor by selling the 1100/1150 call spread and the 960/910 put spread.

We would place an order to sell the 1100 call and purchase the 1150 call. We would collect $4.98 premium on our call spread ($7.60 – $2.62 = $4.98). We would also sell the 960 put and purchase the 910 put. We would collect another $7.96 premium on our put spread ($13.61 – $5.65 = $7.96). This defines our profit potential as $12.94 (total premiums from call spread + put spread, $4.98 + $7.96 = $12.94).

Iron Condor – Maximum profit potential = Call Spread Premium + Put Spread Premium

We also need to calculate the maximum risk potential. Our risk is the difference between our spread strike prices minus the amount we collected. Since we have both a put and call spread, our risk is limited to only one side. It is impossible for the price of Google to expire above our call spread and below our put spread simultaneously, thus our risk is $19.26 (960 – 910 = 50 x $0.3852/point = $19.26 or 1100 – 1150 = 50 x $0.2044/point = $10.22). Note: We use the greater difference between strike prices. Now we need to minus out the premiums we have already collected. We have collected a total of $12.94 for our put and call spreads upfront, so we can deduct this from our risk total. Thus or risk is reduced to $6.32 ($19.26 – $12.94 = $6.32).

Iron Condor – Defined Risk = Greater Difference between Strike Prices – Premium Collected

Let’s analyze this Iron Condor options strategy and how it relates to the price of Google’s stock. Let’s say we bought 1 options contract (1 contract controls 100 shares), with 60 days until expiration. We slapped down an Iron Condor on Google at $1011 and and got instantly paid $1,294 ($12.94 x 100).

Let’s say Google’s stock closes at $1070 after 60 days. If Google’s stock continues to go up, we will lose money on our puts and they will expire worthless in 60 days. We don’t have to hold them for the entire 60 days until they expire worthless but let’s imagine a worse case scenario. So after 60 days, we lost our entire money on the $910 put which is $565 ($5.65 x 100).

However, the $1,150 call soared in value and went from $2.62 to $4.80 making you $218 if you were to sell that option before expiration. Even if you let it expire worthless, you would still make $729 ($1,294 – $565 = $729).

Let’s say Google’s stock closes all the way down to $970 after 60 days. We will lose money on our calls and they will expire worthless in 60 days. However, the $910 put soared in value and went from $5.65 to $8.20 making you $255 if you were able to sell it before it expired. But even if you didn’t sell it and everything expired, and we lost our entire money on the 1150 call which is $262. We would still make $1032 ($1,294 – $262 = $1032).

If Google’s stock goes sideways for the next 60 days so that it closes at $1011, then you get to keep the full $1,294.

When options trading strategies are used correctly like this, they actually lower your risk. You can define your risk to a very small sum, while having almost unlimited profit potential.

Frequently Asked Questions about Options Trading

What is an options trading account?

An options trading account is an account that allows you to trade options. Many online brokerage firms require additional Options Account Agreement forms to be filled out where you sign that you understand the risks associated with options trading.

What are option trading hours?

Options only trade during regular market hours. You cannot place orders for options for the pre-market or after-hours trading.

Options on stocks trade from 9:30 a.m. to 4 p.m. ET.

The close of trading for options on ETFs coincides with the closing of the underlying security.

Last Trading Day: Trading in options on ETFs will ordinarily cease at the close on the business day (usually a Friday) preceding the option expiration date.

What is triple witching?

Triple witching or Triple Witching Hour or Freaky Friday, is the last hour of the stock market trading session (3:00-4:00 P.M., New York Time) on the third Friday of every March, June, September, and December. On these days three kinds of securities expire: stock market index futures, stock market index options, and stock options.

The simultaneous expiration of these three kinds of securities often increases the trading volume of options, futures and the underlying stocks.

On those same days in March, June, September, and December, Single-stock futures also expire, so that the final hour on those days is sometimes referred to as the Quadruple Witching Hour.

What are option trading strategies?

The most popular options trading strategies are: naked calls/puts, covered calls, married puts, bull call spreads, bear put spreads, protective collar, long straddle, long strangle, butterfly spread, iron condor, and an iron butterfly.

Naked Calls/Puts

Naked calls are just buying the call option without owning the underlying stock.

Covered Calls

Covered calls or a buy-write strategy is when an options trader buys a stock and then writes (sells) a call option against that stock. Option traders use covered calls when they have a short-term position in a stock and fear it will go sideways or down. Selling a covered call against their stock generates income by way of the call premium that can lower the cost basis of the stock held.

Investopedia posted the excellent educational video below called Call Option Basics.

Married Puts

A married put is when an options trader buys a stock, then simultaneously purchases a put option for an equal number of shares. Option traders who use this strategy are bullish on the stock they hold but want to protect themselves against possible short-term losses.

Charles Hughes posted the awesome video below called Maximum Risk 5.9% with Unlimited Upside.

Bull Call Spreads

A bull call spread is when an options trader buys call options at a certain strike price and then sells the same number of calls at a higher strike price. Both call options will have the same expiration and will be for the same underlying stock. Options traders use this strategy when they are bullish and expect a small rise in the price of the underlying stock.

Daniels Trading posted the excellent video below called Bull Call Spreads – A Cheaper Way to Be Long Options.

Bear Put Spreads

A bear put spread is when an options trader buys put options at a certain strike price and then sells the same number of puts at a lower strike price. Both put options will have the same expiration and will be for the same underlying stock. Options traders use this strategy when they are bearish and expect the underlying stock price to drop.

Option Alpha posted the fantastic video below called Bear Put Spread Option Strategy.

Protective Collar

A protective collar is when an options trader buys an out-of-the-money put option and writes an out-of-the-money call option at the same time, for the same underlying stock. Option traders use this strategy after a long position in a stock has had large gains. This allows options traders to lock in profit without selling their shares.

FNArenaEducation posted the video below called Options and Equity Strategy Collars – Covered calls and protective puts.

Long Straddle

A long straddle is when an options trader buys both a put and a call option with the same strike price, on the same stock, with the same expiration date. Options traders use this strategy when they are convinced that a stock will have a big move, but are unsure which direction the move will be in. This allows options traders to maintain the possibility of unlimited gains, while the loss is limited to the cost of both options contracts.

Option Alpha posted the video below called Long Straddle Option Strategy.

Long Strangle

A long strangle is when an options trader buys a put and call option with the same expiration, on the same stock, but with different strike prices. The put strike price will usually be below the strike price of the call option, and both options will be out-of-the-money. Options traders use this strategy when they think a stock will have a big move, but are unsure which direction the move will be in. Losses are limited to the costs of both options.

Option Alpha posted another awesome video below called Long Strangle Option Strategy.

Butterfly Spread

A butterfly spread is when an options trader combines both a bull spread with a bear spread, and uses three different strike prices.

Investopedia posted the excellent video below called Investopedia Video: Butterfly Spread.

Iron Condor

An iron condor is when an options trader enters a long and short position in two different strangle strategies. In the article above I talk more about the iron condor.

ZacksInvestmentNews posted the excellent educational video below called How to Profit with an Iron Condor Option Strategy.

Iron Butterfly

An iron butterfly is when an options trader combines either a long or short straddle with the purchase (or sale) of a strangle at the same time. Options traders use the iron butterfly to limit losses within a specific price range, depending on the strike prices of the options purchased.

ZacksInvestmentNews posted another excellent educational video on the Iron Butterfly below.

Tradestation posted the fantastic video below from a lecture John Carter did called My Five Favorite Options Trading Strategies – John Carter.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.