Stock market investing strategies are great as long as they work. Learn one simple investing strategy that you can do with Google Finance in about 30 seconds that works really well in any market.

Does This Work With Other Stock Market Strategies?

Out of all the stock trading strategies you will find over the Internet, this is one of the few strategies you can use with the other methods you are currently using.

When your stock investing strategy is to buy oversold stocks, you must be careful not to “try and catch all falling knife”. How can you possibly do that? The answer is the catalystA stock catalyst is an engine that will drive your stock either up or down. A catalyst could be news of a new contract, SEC filings, earnings and revenue beats, merger and acquisit... More.

If you are just buying a stock because it’s oversold or because it has a high shares short as a percentage of float value, you’re probably going to get killed. You must understand the importance of finding and establishing the catalyst.

Stock Market Strategies For Beginners

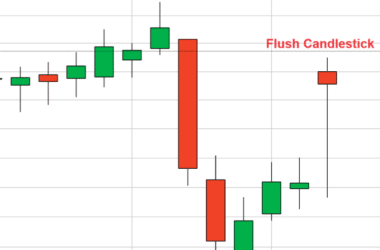

Here is how this stock market strategy works.

Step 1: Go to Google Finance.

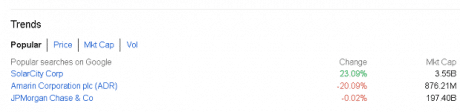

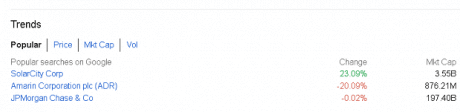

Step 2: Scroll down to the section called “Trends” and click the “Popular” sub-tab if it’s not already selected.

Step 3: Make sure the market cap column shows the stock with a market cap of less than 1 billion. The reason is that stocks with a market cap under 1 billion can make big moves and thus are perfect for swing trading.

The best stock market strategies usually overlook the power of Google Finance Trends. Think about what a trending stock listed here means. There is a reason that Google’s vast intelligence network is picking up this stock as popular. It means there are a lot of people searching on the company. You will find some of the best “story stocks” or stocks with catalysts, by using this stock market strategy.

Frequently Asked Questions about Stock Market Investing Strategies: Finding The Catalyst

What are trending stocks?

Trending stocks are stocks that form a series of higher lows and higher highs, or lower lows and lower highs. Big buyers cause a stock to trend.

Stocks don’t move unless there are big buyers present. One way to know that people will be buying a stock is to measure the “footprint” it has on the Internet. This is why Google Finance Trends and the “Popular” screen work. Why is everybody talking about the company? Answer that and you’ll know the “story” behind the stock.

What liquidity ratio is best?

The two best liquidity ratios that stock traders use are the “quick ratio” and the “current ratio”.

The current ratioIn the complex world of finance, where numbers and ratios hold the key to understanding a company's financial health, the current ratio emerges as a vital metric. This ratio, often... is the most popular liquidity ratio. The current ratio is calculated by dividing current assets by current liabilities. The idea is to determine whether a company’s assets (cash, cash equivalents, securities, receivables, and inventory) can pay off its liabilities (notes payable, debt, payables, accrued expenses, taxes, etc.). A higher current ratio means the company has enough assets to pay off its debt.

The quick ratio (also called the acid-test) measures the most liquid current assets there are to cover current liabilities. The quick ratio excludes assets that are more difficult to convert into cash like inventory. A higher quick ratio means a more liquid current position.

Do not confuse liquidity from an accounting perspective, with liquidity from a traders perspective. Traders are referring to the average daily volume in a stock and how easy it is to trade in and out of that stock.

Gordon Hensley posted the excellent video below on financial ratios.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.