The opening range breakout strategy is one of the more popular day trading strategies. In this lesson you will learn how the opening range breakout strategy works in order to better decide if it is a day trading strategy you want to try.

Opening Range Breakout Strategy

The opening range breakout strategy defines a high and low price level for a certain period of time, from the opening bell. The basic idea is that the direction you trade a stock is determined by where the stock is trading relative to its opening range.

There are different variations on the time that is set from the opening bell. The most popular opening range breakout time frames that day traders use are: 15 minute, 30 minute, and 1 hour. Keep in mind that you need to be disciplined and stick with one strategy for one trade.

Market open is a discovery time where the market is digesting the orders that were entered the previous day after market close, overnight futures, and any news that came out after market close on the previous day.

The premise behind the opening range breakout strategy is that after this discovery period is done, the bias for the day can be determined fairly quickly, by comparing it to the high and low points in the opening range.

Opening Range Breakout Strategy Rules

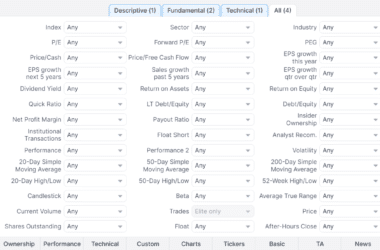

You must determine what period of time from the open is the most effective in the market you are trading. Look at 15 minutes, 30 minutes, and 1 hour from market open and see which time span is most effective in predicting market action for the remainder of the day. You do this manually or you can do this automatically with a opening range breakout backtest.

The OR high (opening range high) and OR low (opening range low) often represent important prices levels in determining the market’s direction for the remainder of the day. This will let you filter out different types of trading setups and focus in on specific trading setups.

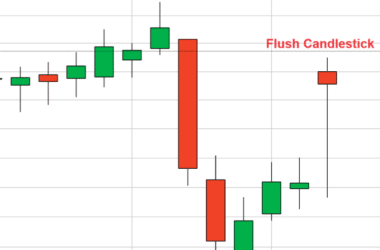

If the price breaks above the OR high, day traders have a bullish bias. Look for bullish trading setups like breakout trades or moves down to support that you can go long. Look for bullish candlestick patterns.

If the price breaks below the OR low, day traders have a bearish bias. Look for bearish trading setups like breakdowns or moves up to resistance that you can short. Look for bearish candlestick patterns.

Opening Range Breakout Trade

There are three positions you can initiate with the opening range breakout strategy:

| Opening Range Breakout Strategies | Description |

|---|---|

| Initial Breakout of OR Low or OR High | This is a very risky approach but it comes with the most reward if you get it right. |

| Pullback After Breakout | This allows you to confirm the break of the OR low or OR high. You lose some of the profits versus the Initial Breakout strategy above but you gain accuracy. |

| Fading | This is where you take a position against the current price move. For example on a OR high break, you wait until you get some reversal signals then you go short and cover once you get bullish candlestick patterns. |

Below are chart examples of each opening range breakout strategy.

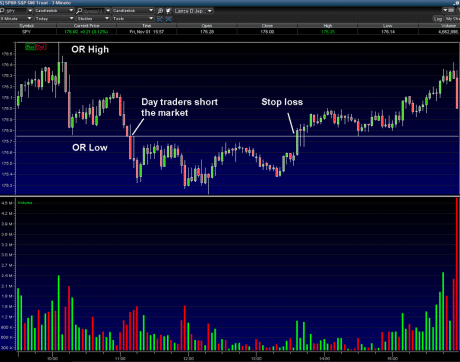

Opening Range Breakout – Initial Breakout of OR Low or OR High Using 1 Hour

After establishing the OR low and OR high in the first 1 hour of trading, notice the OR low was broke. The huge volume surge shows that a lot of day traders were using 1 hour on the opening range breakout to short the market. The short is covered two 3 minute candlesticks later or 6 minutes after entry when lower shadows started appearing on the 3 minute candlesticks. The stop loss is set at the OR low.

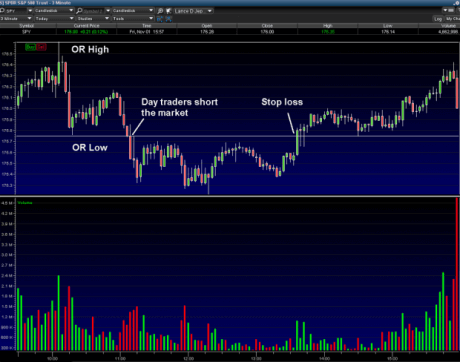

Opening Range Breakout – Pullback After Breakout Using 30 Minutes

After establishing the OR low and OR high levels 30 minutes from market open, notice the OR high was broke. In this opening range breakout strategy we wait for a pullback to take an entry. Notice that we lose the OR high break entry but when the market forms a higher low on the pullback, we gain confidence that the market has higher to go that day.

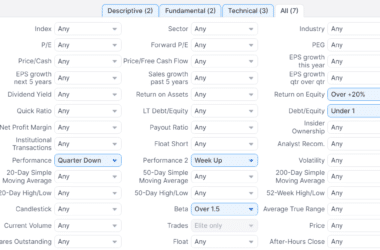

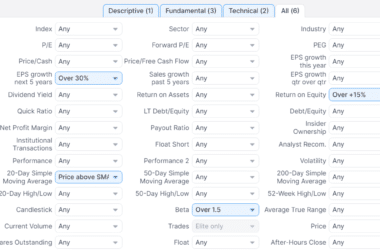

Opening Range Breakout – Fade Using 15 Minutes

After establishing the OR low and OR high levels 15 minutes from the market open, notice the OR high was broke. The S&P 500 is weak on this day so we want to use a fade strategy. The faster the market moves up, the more spiky it looks and we gain confidence that a fade strategy is what we want to do. We patiently wait until we see a long upper shadow form on the candlestick then we fade or short the market. We cover as soon as we see a candle over candle form as the market begins to turn back up.

Frequently Asked Opening Range Breakout Questions

What is an opening range breakout?

An opening range breakout is when a stock breaks above or below the time period you set to establish the low and the high opening range.

Somesh De Swardt posted the two videos below on the opening range breakout:

Accendotraders posted the video below called How to Trade the Opening Range Breakout.

What time frame should I use for the opening range breakout?

The most popular time frames day traders use to establish the opening range is 15 minutes, 30 minutes, and 1 hour.

Which time frame you use depends on the market or stock you are trading. Chart the stock for the last 2 weeks and see which time frame (15 minutes, 30 minutes, 1 hour) would have allowed you to get in the trade the earliest, with the least headfakes.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.