The Matrix hums with energy, a digital world where the line between reality and illusion blurs. Within this world, a new threat emerges—an echo of the past, yet disturbingly present. The Operators, those who manipulate the narratives within the Matrix, begin to weave a story of fear, one that sends shockwaves through the system. This time, it is not a war or a revolution, but a virus—Monkeypox. Unlike its predecessor, COVID-19, this virus is ancient, its roots tangled with smallpox, a disease long thought to be defeated. Yet within the Matrix, nothing is ever truly gone.

The Biotech Players

As the narrative unfolds, three entities within the Matrix begin to rise. GeoVax Labs, Tonix Pharmaceuticals, and Chimerix—once minor players—now find themselves at the center of the storm. These corporations have long been dabbling in the shadows of viral diseases, their work on smallpox vaccines and treatments giving them a unique edge. Now, with the resurgence of Monkeypox, they become the chosen ones, positioned by the Architects of the Matrix to play a crucial role in this new chapter of the simulation.

The Monkeypox Reloaded

The screens within the Matrix flash with headlines, charts, and financial reports. The resurgence of Monkeypox has sparked a ripple of concern, not just among the citizens of the Matrix, but among its financial overlords. The narrative is clear: this could be another pandemic, another opportunity for those who understand the rules of the game. Investors, ever-watchful, begin to move, their digital fingers clicking through stock markets and portfolios. GeoVax Labs, Tonix Pharmaceuticals, and Chimerix become the focal points of their attention.

Parallels to the Past

The Matrix remembers. It remembers the fear, the chaos, the profits that surged during the COVID-19 pandemic. The Operators draw parallels, weaving a narrative that the citizens of the Matrix cannot ignore. Once again, the media, those voices that speak the will of the Matrix, begin to chant the familiar mantras—outbreak, emergency, vaccine, treatment. The citizens respond, just as they did before, with fear, with hope, with the blind pursuit of the next big thing.

The Market Awakens

As the narrative tightens its grip, the market within the Matrix stirs. Investors, both human and algorithm, begin to funnel resources towards these three corporations. GeoVax Labs, with its expertise in vaccine development, becomes a beacon for those who believe in prevention. Tonix Pharmaceuticals, with its treatments designed to combat the deadliest viruses, attracts those who seek a cure. And Chimerix, with its antiviral solutions, offers a promise of protection. The stocks of these companies begin to soar, riding the wave of fear and opportunity.

The Architects’ Design

Behind the scenes, the Architects of the Matrix smile. The narrative is playing out just as they designed. The Monkeypox outbreak, while real, is but a tool—a means to an end. By positioning GeoVax Labs, Tonix Pharmaceuticals, and Chimerix at the forefront, they ensure that the narrative continues to drive the economy within the Matrix. These companies, with their ties to the smallpox market, are not just players; they are the keys to the next phase of the simulation.

The Future Unfolds

The Matrix pulses with the energy of speculation and investment. The short-term gains are significant, but the true test lies in the medium and long term. Will these companies deliver on the promise woven into the narrative? Will they develop the vaccines and treatments that the citizens of the Matrix now believe they need? The answer remains locked within the ever-evolving code of the Matrix, where reality and fiction are one and the same.

Key Players in the Fight Against Monkeypox

GeoVax Labs

GeoVax Labs is at the forefront of developing vaccines for infectious diseases, including smallpox. The company has leveraged its expertise to pivot towards monkeypox, given the similarities between the two viruses. GeoVax’s vaccine platform is designed to produce a strong immune response, making it a potentially valuable tool in the fight against monkeypox. As the company advances its research and development efforts, its stock has seen notable gains, reflecting investor confidence in its potential role in controlling the outbreak.

Insights

- The Matrix manipulates narratives, blurring the lines between reality and illusion.

- Fear and profit are cyclically intertwined within the Matrix, driven by orchestrated crises.

- GeoVax Labs, Tonix Pharmaceuticals, and Chimerix are central to the current narrative of Monkeypox.

- The true test lies in whether these companies can deliver on their promises amid speculation.

The Essence (80/20)The Origins and Evolution of the 80/20 Principle The Discovery by Vilfredo Pareto In 1897, Italian economist Vilfredo Pareto uncovered a striking pattern in his study of wealth and...

- Core Topic 1: Narrative Manipulation – The Matrix crafts stories that blur reality, using crises like pandemics to drive both fear and economic activity.

- Core Topic 2: Corporate Focal Points – GeoVax Labs, Tonix Pharmaceuticals, and Chimerix are positioned as key players in the Monkeypox narrative due to their expertise in smallpox-related treatments.

- Core Topic 3: Investor Behavior – The Matrix’s narrative drives significant investment towards these corporations, repeating a pattern seen during the COVID-19 pandemic.

- Core Topic 4: Cyclic Nature of Fear and Profit – The Matrix ensures that each crisis serves as an opportunity for financial gain, with the cycle repeating as new threats emerge.

The Guerilla Stock Trading Action Plan

Stay Informed: Continuously update knowledge on how fear and speculation are used to drive economic behavior, preparing for similar future events.

Understand the Narrative: Recognize the patterns of narrative manipulation within digital and real-world environments.

Monitor Key Players: Keep a close watch on GeoVax Labs, Tonix Pharmaceuticals, and Chimerix for developments in vaccine and treatment advancements.

Strategic Investment: Consider the risks and potential rewards of investing in companies central to pandemic narratives, balancing short-term gains with long-term viability.

Blind Spots

Overreliance on Narratives for Investment Decisions

- Blind Spot: Investors may overly rely on narratives spun within the Matrix, neglecting fundamental analysis and objective data when making investment decisions.

- Remedy: Combine narrative-driven insights with thorough due diligence, analyzing the financial health, product pipeline, and market potential of the companies involved before investing.

Underestimating the Long-term Impact of Viral Threats Within the Matrix

- Blind Spot: The narrative focuses heavily on short-term market movements and profits, potentially underestimating the long-term psychological impact and societal consequences of repeated viral outbreak fear narratives within the Matrix.

- Remedy: Balance short-term profit motives with considerations for long-term societal impacts by supporting anti-Matrix research and independent doctors and medical labs aimed at preventing and controlling future outbreaks.

Ignoring Ethical Implications of Profit-Driven Health Crises

- Blind Spot: The focus on profit and market speculation might overlook the ethical implications of exploiting health crises for financial gain.

- Remedy: Advocate for and invest in businesses that prioritize ethical considerations such as proven safe and effective drugs that have been thoroughly tested, and transparent communication about the public health risks of Matrix-pushed vaccines.

Assuming Continuity of Market Reactions

- Blind Spot: There’s an assumption that market reactions to new viral threats will mirror those seen during the COVID-19 pandemic, ignoring the possibility of different outcomes.

- Remedy: Recognize that each health crisis is unique, and diversify investments to mitigate risks. Consider market factors, public sentiment, and the evolving nature of health threats.

Neglecting the Role of Mavericks Within the Matrix

- Blind Spot: The narrative doesn’t account for the potential spread of information that could influence public perception and investor behavior, leading to informed decision making about the risks of vaccines. To keep the Matrix illusion going, a censorship grid will descend across the entire internet and public discussion spaces.

- Remedy: Stay informed through independent sources and the internet, critically evaluate information released within the matrix, and support initiatives that combat matrix-based illusions and misinformation in public health and investment spaces. Oppose censorship of any kind.

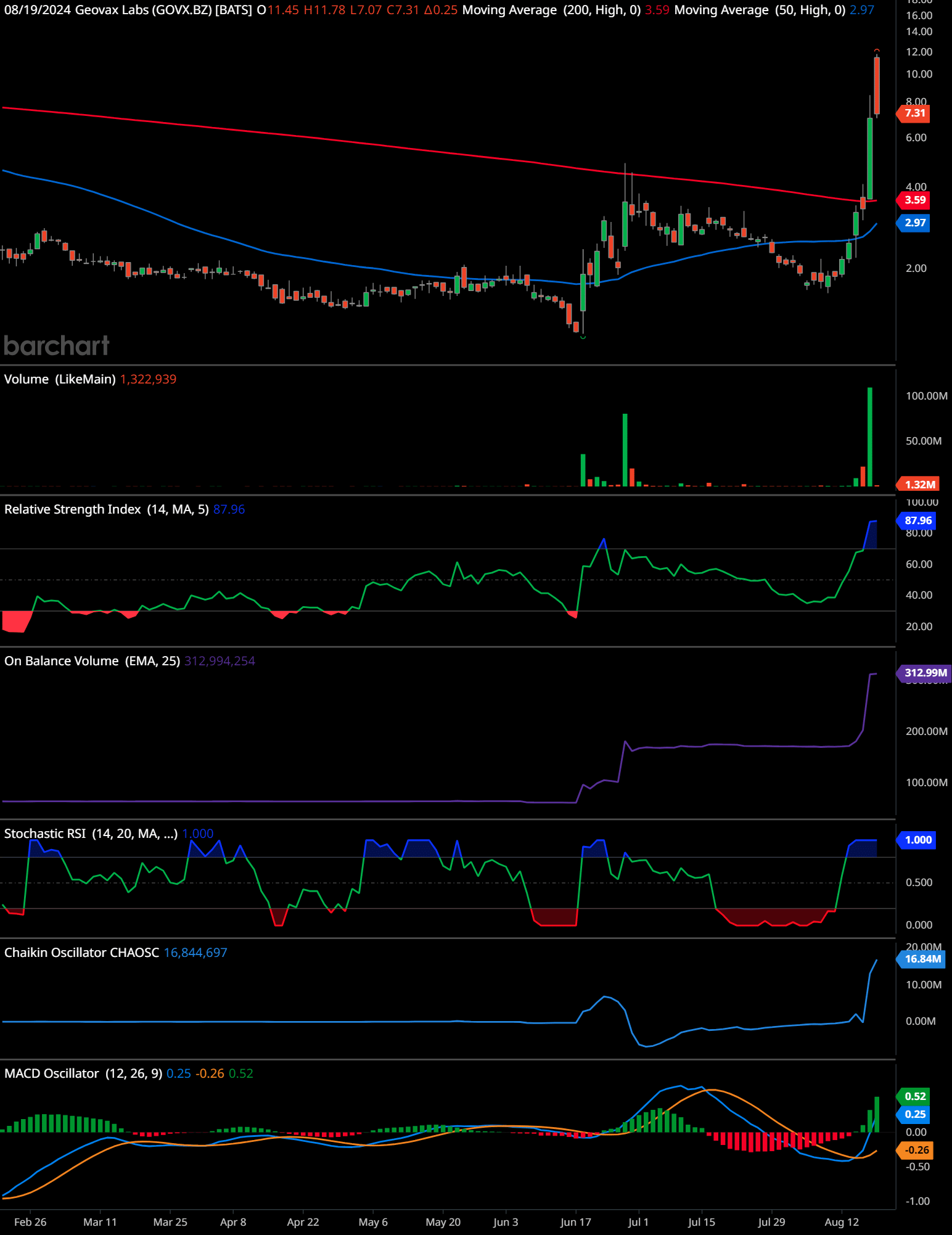

GOVX Technical Analysis

The chart for GeoVax Labs (GOVX) in the daily time frame shows significant bullish momentum recently, following a period of consolidation. Key elements to consider:

Price Action and Moving Averages: The price has broken out sharply above both the 50-day and 200-day moving averages. The 50-day moving average is rising, signaling a bullish trend, while the 200-day remains flat but could turn upward if the momentum continues. The breakout above the 200-day moving average is particularly significant as it often signals a shift from a long-term downtrend to an uptrend.

Volume: There is a substantial increase in trading volume accompanying the recent price surge, indicating strong buying interest and validating the breakout.

Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is in the overbought territory at 87.96. While this shows strong upward momentum, it also suggests that the stock could be due for a short-term pullback or consolidation.

On-Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV has spiked sharply upwards, which confirms that the recent price movement is supported by significant volume, a positive sign for the continuation of the trend.

Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: The Stochastic RSI is at its maximum reading of 1.00, which, like the RSI, indicates the stock is overbought and may experience a short-term pullback.

Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: The Chaikin Oscillator has surged, reflecting strong accumulation and supporting the bullish case.

MACDThe MACD indicator is essentially a momentum indicator that shows the relationship between two different moving averages of price. The MACD is the difference between the 12-period ... More: The MACD is positive with a bullish crossover above the signal line, reinforcing the current uptrend. The increasing histogram bars indicate that the bullish momentum is gaining strength.

Support and Resistance Levels: Immediate support is around the $3.60 level, where the 200-day moving average currently sits. Additional support is likely around $2.97, close to the 50-day moving average. Resistance is around $11.78, which was the recent high, and a significant psychological level.

Time-Frame Signals:

- 3 Months: Buy – The stock has shown strong bullish momentum and the breakout above the 200-day moving average suggests a continued uptrend.

- 6 Months: Hold – While the short-term outlook is bullish, the overbought indicators suggest potential for a pullback or consolidation in the medium term.

- 12 Months: Hold – The long-term trend may depend on whether the stock can maintain above the 200-day moving average and establish new higher support levels.

Overall, the chart indicates a strong bullish trend in the short term, but caution is advised due to overbought conditions.

Tonix Pharmaceuticals

Tonix Pharmaceuticals has also emerged as a significant player in the battle against monkeypox. Known for its focus on developing therapies for central nervous system disorders and infectious diseases, Tonix has been working on a smallpox vaccine that could be repurposed to address the current monkeypox threat. The company’s stock has surged as it accelerates its efforts to bring its vaccine candidate to market. Tonix’s experience in dealing with viral infections positions it well to capitalize on the increasing demand for monkeypox-related treatments.

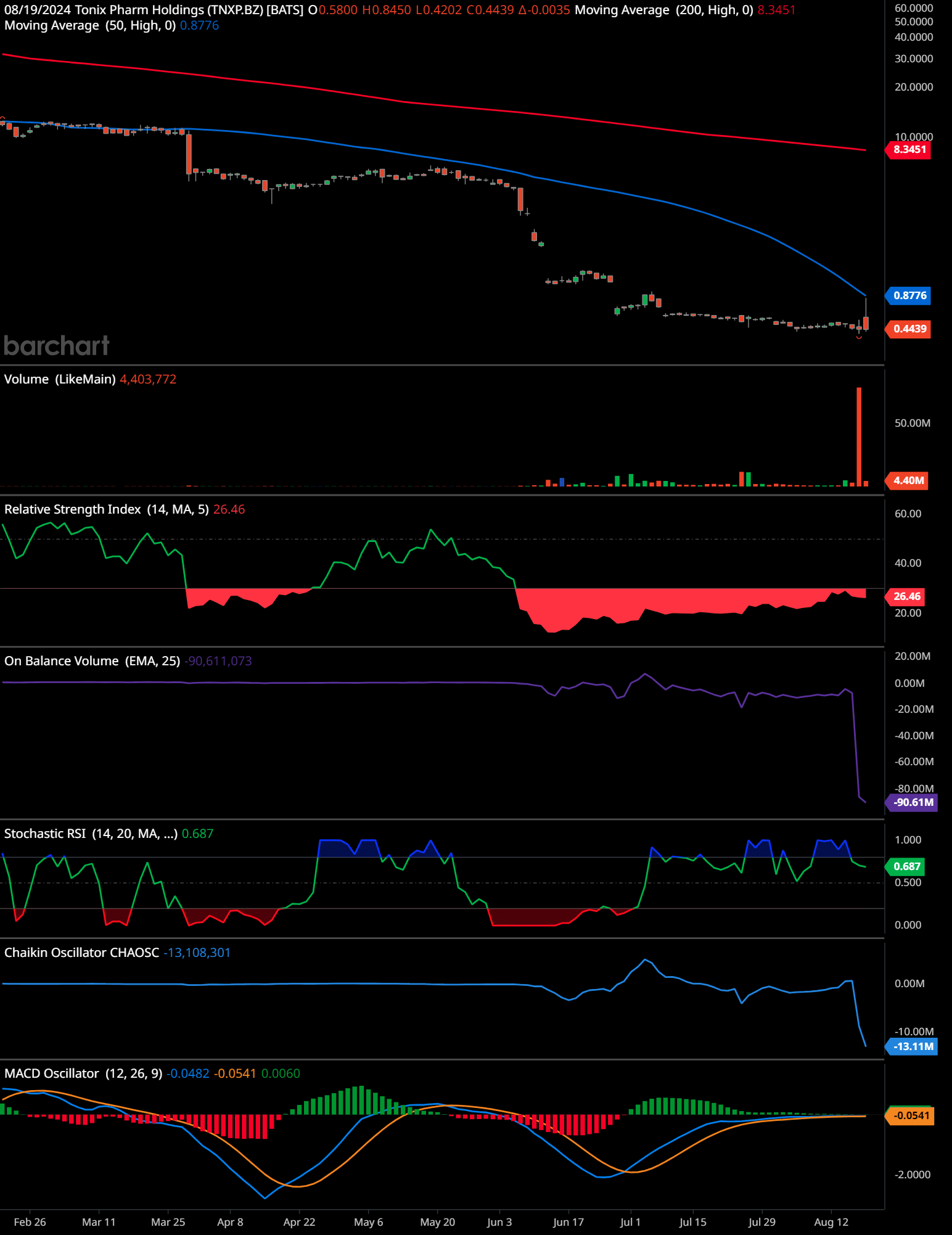

TNXP Technical Analysis

The chart for Tonix Pharmaceuticals Holdings (TNXP) in the daily time frame shows a clear downtrend with recent signs of extreme weakness.

Price Action and Moving Averages: The stock is trading well below both the 50-day and 200-day moving averages, which are both sloping downward. This indicates a strong and persistent bearish trend. The recent price action shows a significant drop followed by a minor bounce, but the stock remains under heavy selling pressure.

Volume: There is a notable spike in volume during the most recent trading sessions, which suggests that the latest price movements are being driven by a large amount of trading activity. However, given the price decline, this volume increase likely indicates panic selling rather than accumulation.

Relative Strength Index (RSI): The RSI is at 26.46, which is in the oversold territory. This suggests the stock is heavily oversold, and while this could lead to a short-term bounce, it is not necessarily a sign of a reversal in the longer term.

On-Balance Volume (OBV): The OBV has sharply declined, reflecting a significant outflow of money from the stock, which is consistent with the ongoing downtrend.

Stochastic RSI: The Stochastic RSI is at 0.687, relatively low but not fully oversold. This indicates that there might still be some downward pressure left before the stock potentially reaches a more stable level.

Chaikin Oscillator: The Chaikin Oscillator is negative, at -13.11 million, indicating distribution and reinforcing the bearish outlook.

MACD: The MACD is below the signal line, though it shows a slight narrowing. The histogram is slightly negative, indicating that the bearish momentum might be slowing, but no bullish crossover has occurred yet.

Support and Resistance Levels: Immediate support is around $0.42, which is close to the recent low. If this level fails to hold, the stock could continue to fall with no clear support level in sight. Resistance is at $0.88, where the 50-day moving average lies. A break above this level would be necessary to consider a potential reversal.

Time-Frame Signals:

- 3 Months: Sell – The stock is in a strong downtrend with little sign of reversal. Despite being oversold, it may continue to decline or remain weak.

- 6 Months: Hold – If the stock manages to stabilize and hold support, there could be some recovery, but the overall trend remains bearish.

- 12 Months: Hold – The stock may need significant time to recover, if at all, depending on whether it can find strong support and begin forming a base.

Overall, the chart indicates a strongly bearish trend with some potential for a short-term oversold bounce, but no clear signs of a reversal.

Chimerix

Chimerix, another pharmaceutical company with a background in antiviral therapies, has seen its stock rise amidst the growing monkeypox concerns. The company is known for its development of brincidofovir, an antiviral medication that has shown efficacy against smallpox and could be repurposed for monkeypox treatment. Chimerix’s strategic focus on viral diseases has made it a beneficiary of the heightened awareness and demand for effective treatments during this outbreak. Investors are betting on Chimerix’s ability to leverage its existing research to address the monkeypox challenge.

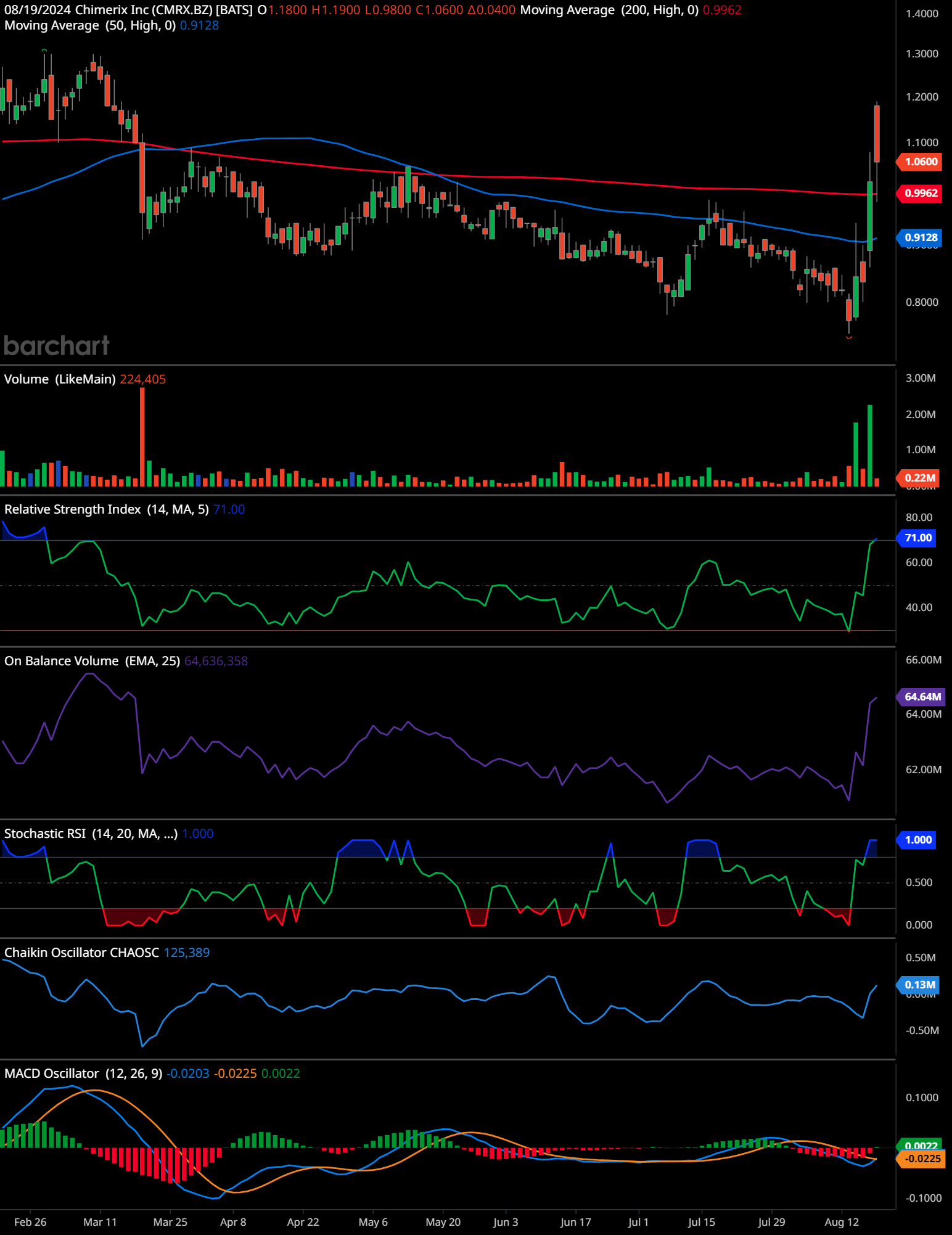

CMRX Technical Analysis

The chart for Chimerix Inc (CMRX) in the daily time frame shows a recent breakout after a prolonged period of consolidation, suggesting the potential for a trend reversal.

Price Action and Moving Averages: The stock has recently surged above both the 50-day and 200-day moving averages, with the 50-day crossing above the 200-day. This is a bullish sign, often referred to as a “golden crossWhen the 50 day moving average crosses above the 200 day moving average, it is called a Resurrection Cross. Conversely, when the 50 day moving average crosses below the 200 day mov...,” indicating a possible shift from a downtrend to an uptrend. The breakout above the 200-day moving average is particularly significant, suggesting a reversal of the prior downtrend.

Volume: There is a substantial increase in volume accompanying the recent breakout, which confirms strong buying interest and supports the likelihood of a sustained upward move.

Relative Strength Index (RSI): The RSI is at 71.00, which is in the overbought territory. This indicates strong bullish momentum, though it also suggests that the stock could experience a short-term pullback or consolidation.

On-Balance Volume (OBV): The OBV has risen sharply, signaling that the recent price move is supported by increased buying volume. This adds further confidence to the breakout.

Stochastic RSI: The Stochastic RSI is at its maximum reading of 1.00, indicating the stock is overbought. Similar to the RSI, this suggests that while the trend is strong, a short-term pullback could be expected.

Chaikin Oscillator: The Chaikin Oscillator has turned positive, reflecting accumulation and supporting the bullish outlook.

MACD: The MACD is positive and has crossed above the signal line, reinforcing the bullish trend. The histogram has just turned positive, indicating that the momentum is beginning to build.

Support and Resistance Levels: Immediate support is around $1.00, which is close to the 200-day moving average. This level should act as strong support if the stock experiences a pullback. Resistance is at $1.19, which was the recent high. A break above this level would confirm the continuation of the uptrend.

Time-Frame Signals:

- 3 Months: Buy – The recent breakout above key moving averages and strong volume support the continuation of the uptrend in the short term.

- 6 Months: Hold – The stock may experience some volatility due to overbought conditions, but the overall trend appears to be reversing to the upside.

- 12 Months: Hold – The longer-term outlook is positive if the stock can maintain above key support levels and continue building on its current momentum.

Overall, the chart indicates a strong bullish reversal with the potential for continued upside, though short-term overbought conditions could lead to a brief pullback or consolidation.

The Cycle Continues

As the narrative of Monkeypox continues to unfold, the citizens of the Matrix watch, invest, and hope. They are unaware that they are part of a larger design, a cycle that has played out before and will play out again. GeoVax Labs, Tonix Pharmaceuticals, and Chimerix are merely the latest avatars in this game of fear and profit. In the Matrix, the cycle never ends, only resets, with new players and new stories, all leading to the same inevitable conclusion: the Matrix always wins.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.