Dark pool trading is the monitoring of private exchanges that are not accessible to the average investor and then making guesses about what the large block orders coming off the dark pools mean in terms of buying or selling. Due to our limited vision of this secret world of trading, dark pool trading is as much an art as it is science.

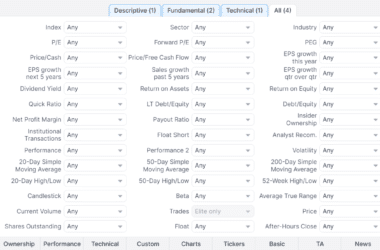

How To Scan For Dark Pool Prints

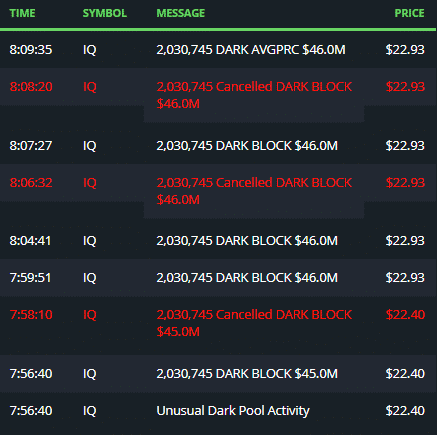

The best way to scan for dark pool prints is to use a tool that not only lists dark pool trades, but also shows “ships passing in the night” cancellations. If you can’t see dark pool trade cancellations then you’ll form the completely wrong opinion about what is happening over the dark pool.

You also want a tool that shows you a chart right next to the dark pool trade so you can easily see the price action on the chart. This is important when determining if a dark pool order was a buy or sell order. If the price of a stock moves up after the dark pool print, then the dark pool order was likely a buy. Conversely, if the stock of a security sells off after a large dark pool order, the dark pool print was likely a sell order. You need a chart displayed right next to the dark pool prints that you can quickly determine how the stock moved after the dark pool order.

You also want a tool that displays options flow on the same screen as the dark pool trades because options flow will also help you determine if a dark pool print was a buy or sell order. What happens is that large institutions often front-run their own dark pool orders with large option sweeps and block orders. If smart money that trades options are buying huge call sweeps on the same day that an unusually large dark pool print hits, and the price of the stock goes up, the dark pool order is probably a buy order.

Finally, you need a tool that displays news catalysts on the same screen with dark pool prints and options flow. If a bullish news catalystA stock catalyst is an engine that will drive your stock either up or down. A catalyst could be news of a new contract, SEC filings, earnings and revenue beats, merger and acquisit... More hits, and then you see unusual dark pool activity and the stock rises, and you see lots of bullish options sweeps, there’s a good chance the dark pool print was a buy order. You need the news to display quickly on the same screen so that it cuts down your research time.

The best tool on the market that allows you to scan for dark pool prints, shows options flow, and displays news catalysts from multiple sources is BlackBox.

Dark Pool Trading Strategies

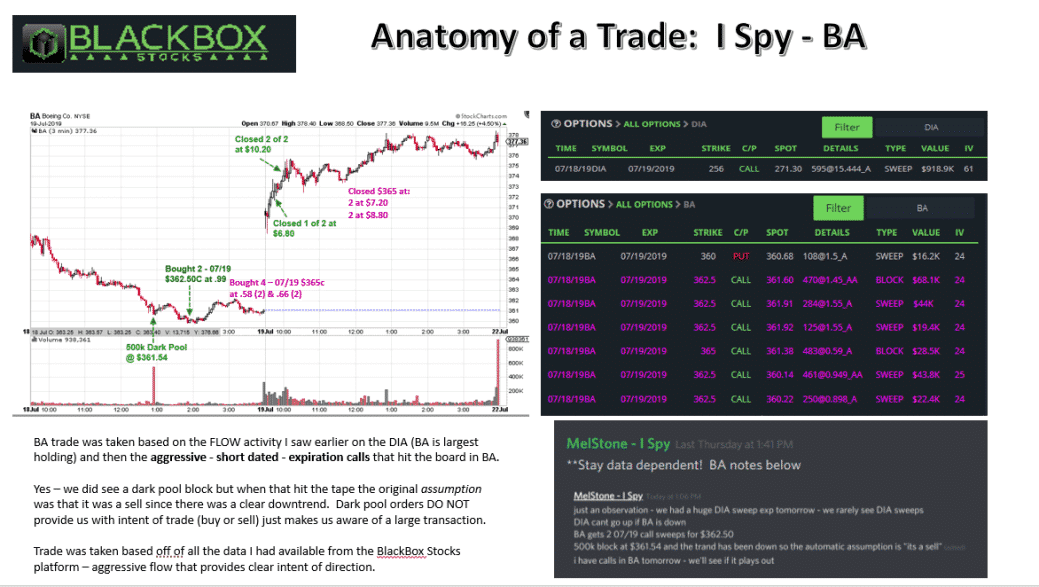

Mel Stone joined the BlackBox team to help provide insight into dark pool data. She focuses on following the money trail and finds that researching dark pool activity, options flow, insider buying, and institutional filings provides clues into positions big money players are taking. She prefers swing and position trading. You can find Mel’s research in the dark pool trading room on BlackBox Stocks.

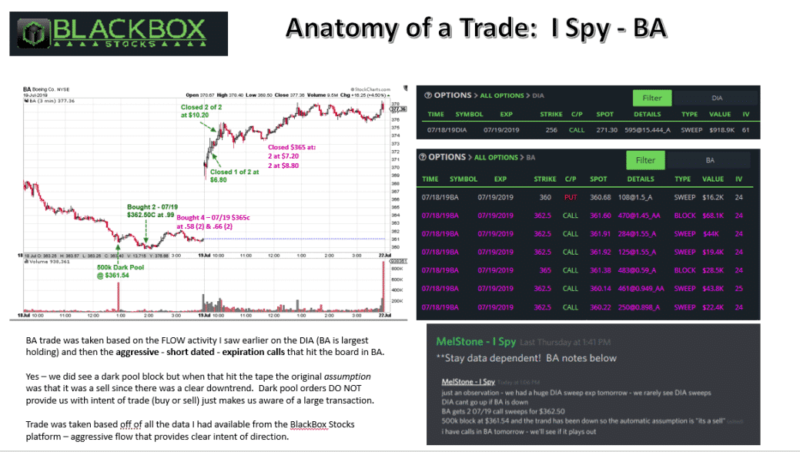

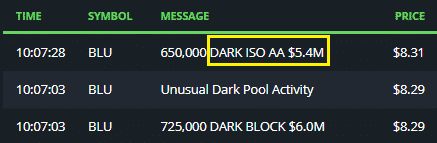

Mel recently hit a winning trade in BA and posted how she did it using flow activity. Mel said, “I saw earlier on the DIA (BA is largest holding) aggressive, short dated, expiration calls that hit the board in BA.

Yes, we did see a dark pool block but when that hit the tape the original assumption was that it was a sell since there was a clear downtrend. Dark pool orders DO NOT provide us with intent of trade (buy or sell), they just make us aware of a large transaction.

Trade was taken based off of all the data I had available from the BlackBox Stocks platform, aggressive flow that provides clear intent of direction.

Below is an image of the flow Mel was watching as well as how the trade worked out.

Dark Pool Data Analysis Tips

Dark pools are an ominous sounding term for private exchanges or markets for securities trading. However, unlike stock exchanges, dark pools are not accessible by the investing public. Dark pools are also sometimes called “dark pools of liquidity”.

Dark pools were invented to facilitate block trading by institutional investors who did not wish to impact the markets with their large orders and obtain adverse prices for their trades.

Dark pool data does NOT provide us with INTENT, we do not know if the large block trade or sweep was a buy or sell. We only know that a large transaction occurred off the normal exchange. Dark pool transactions are done off the exchange and we only get to see the transaction when it hits the tape.

Use options flow analysis to assist with determining intent of dark pool data. Intent should be clear and aggressive for optimal set-ups.

Always make sure that the dark pool print is relative in terms of volume. For example, if Facebook average volume is 17.42 million and we see a 100,000 dark pool print, just ignore it. However, if OLLI has an average volume of 970K and we see a 300,000 share dark print, that’s important because if represents a whopping 1/3 of daily trading volume in just one block.

When looking at dark pool data, look for unusual events. What makes it unusual? A stock repeatedly shows up on the dark pool list. Also, compare dark pool block size to the average daily volume for the stock. If it represents 1/4th the average daily volume or more, it’s an unusual print.

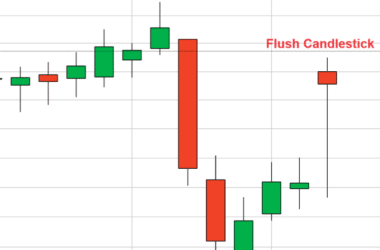

The hardest part about integrating dark pool data into your trading strategy is trying to stay neutral and not create a bias within your mind. Remember, dark pool block orders do NOT give us INTENT. Often times an institutional trader is building a large position for a client and that can take time. We will see repeat orders coming off the dark pool for a single stock but its price doesn’t really seem to do anything and stays somewhat range bound. When you see dark pool prints like this, watch the options order flow. If options sweeps come in that are aggressive and directional, that’s when you make your move to either buy or sell the stock.

Charting Dark Pool Data Levels

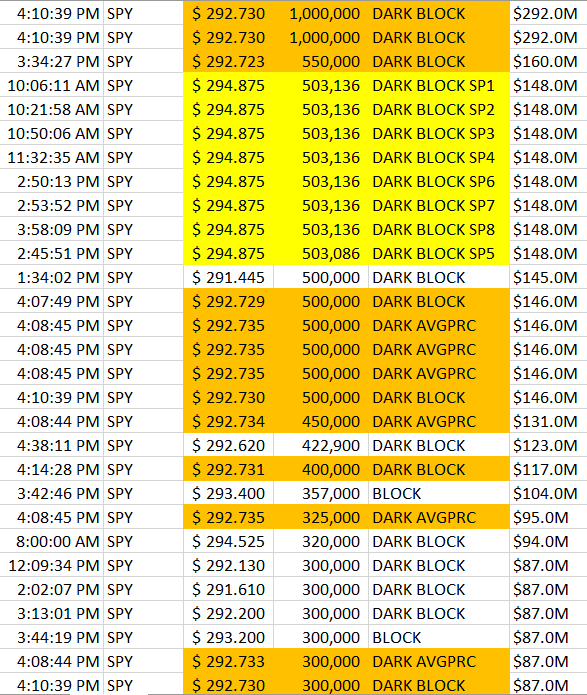

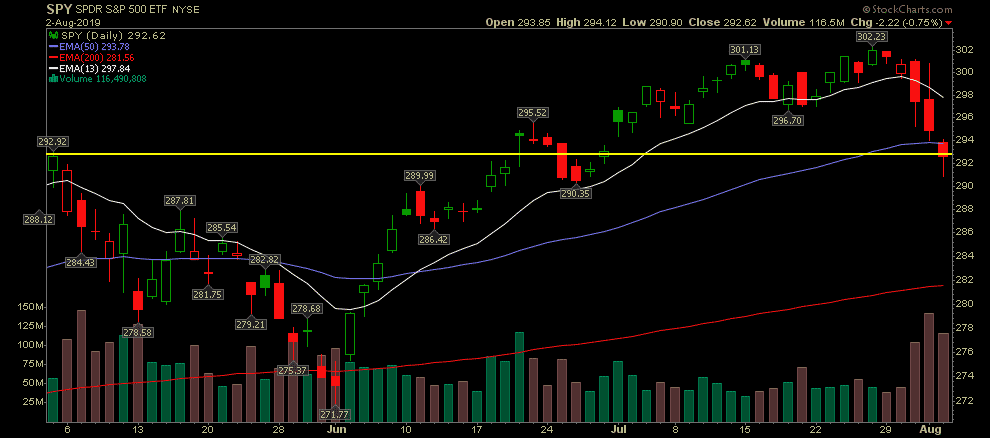

You can use Excel or any spreadsheet software to do this. Record the dark pool orders for the ticker you are tracking. In this example, I’m looking at the orders coming off the dark pool for SPY.

Sort the dark pool orders by the block size. In the data above, notice all the activity around the $292.73 level on SPY. At the $292.73 level, heavy dark pool volume occurred, over 6.8 million shares with just the orange highlighted above. We now draw a horizontal line at the $292.73 level.

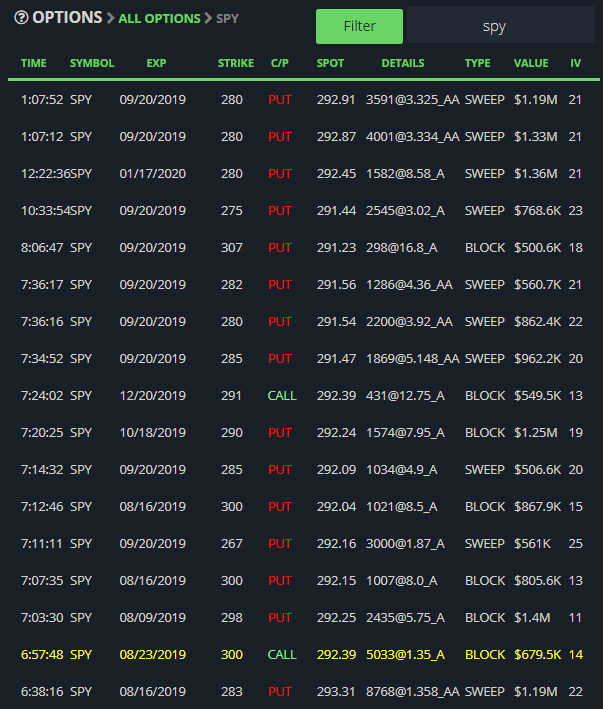

Now, let’s bring up the options flow data on SPY and look for direction bias around the $292.73 level.

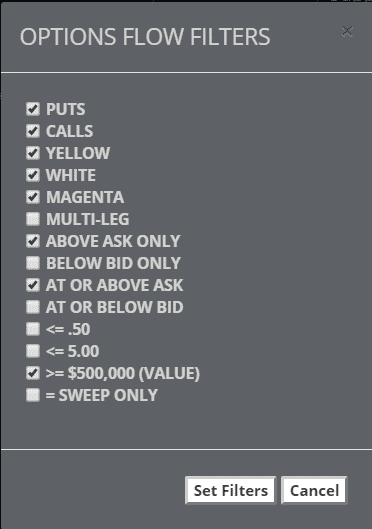

I want to see the options that were equal to or greater than $500,000 in value so that I see what the large players are doing. To do that I’ll set the Options Flow Filter:

Here are the results.

Not a single SPY CALL contract valued at over $500,000 traded above $292.73 the entire day. However, we had a few PUT contracts trade above the $292.73 level. Also, the entire day was dominated by PUT contracts.

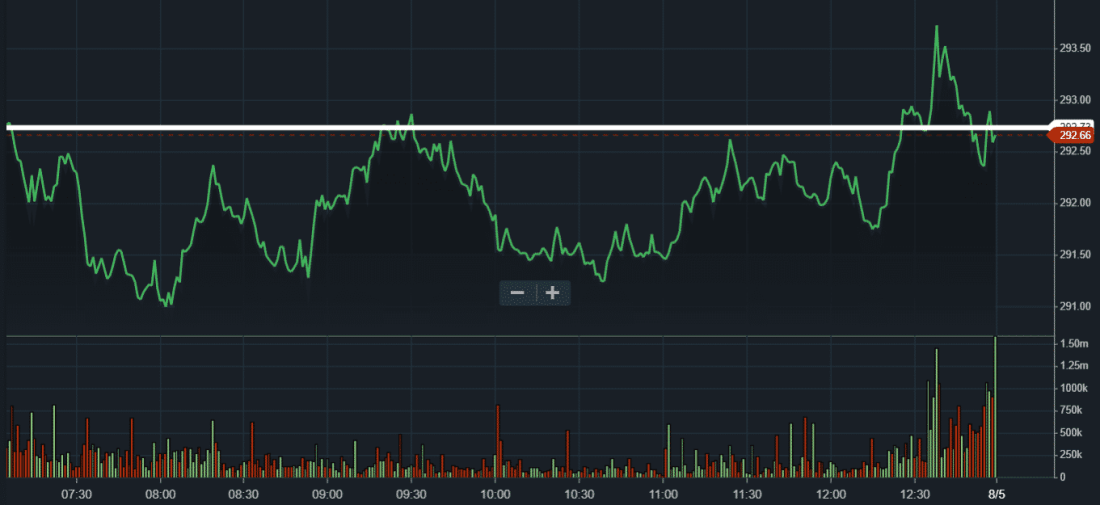

Finally, we pull up a 1 minute chart for the day and plot a horizontal line at $292.73 and see if we can visually see a pattern at that level.

Notice that each time SPY got up to the $292.73 level (white line), it pulled back from that level. At the end of the day, we got a break above that level but in the last 30 minutes of trading, the market sold off and ended up closing below $292.73.

Combining both options flow data and visual chart data in the 1 minute time frame, we can reason that most of the dark pool orders we saw were likely sell orders.

Dark Pool Prints

We are often asked about the dark pool abbreviations that show on the dark pool charts we publish on GuerillaStockTrading.

Below are what the most common abbreviations mean.

Dark Block – General ADF (Alternative Display Facility) reported trade

Dark ISO – ADF reported trade with ISO (Intermarket Sweep Order) designation. Intermarket sweep orders (ISO) is a type of stock market order that sweep several different market centers and scoop up as many shares as possible from them all. For example, if a trader is trying to buy 1000 shares of X, and there are 100 shares of X being offered at $1 at one exchange and 2000 at $1.10 at another exchange, with an ISO order, a trader can buy the 100 shares at $1 and the remaining 900 at $1.10 on the other exchange without having to place another order.

On ISO orders, AA stands for Above Ask, while BB stand for Below Bid.

Dark AvgPrc – ADF reported trade where multiple orders are filled and reported as one.

Unusual Very Large Block – Block trades over 4M shares that meet minimum dollar value will be labeled Very Large, or a calculated combination of shares and dollar amount.

Unusual Dark Block Activity – our system monitors average Dark Pool volume by stock, and if a particular stock has an unusually large amount of DP volume, we will alert.

SP1,SP* – On the DIA, IWM, SPY, and QQQ we alert when Dark Blocks meet criteria that suggest the trades occurred overnight but are just being reported. We label these with SP and a number that counts the number throughout the day.

Dark Pool Prints

Make sure you have the ability to track cancelled dark pool prints. You could get the completely wrong impression of prints coming off the dark pool if you can’t see cancelled prints. This BB tool we recommend does show cancelled dark pool block orders.

When dark pool prints are cancelled, here is what is happening. Orders in dark pools are like giant ice-bergs in the ocean. For a trade to take place, a resting bid, or buyer, has to be present when a seller initiates a sale. Sometimes both sides are not present at the same time so orders are cancelled and replaced, these orders are referred to as “ships passing in the night”.

Another way to think of dark pool trades is that they are executed in the dark (without published bid and asking prices). When a trader speaks of a “cross” or “crossing a block”, it means to match and execute a block trade or “crossing a board lot”. Once an order has been crossed it is referred to as a “fill”. The “contra” is the opposite side of the trade needed to make the “cross” complete. Not all orders cross, especially on dark pools where it can be difficult to detect contra and the orders can miss each other. These missed orders are referred to as “ships passing in the night.”

Sometimes traders will “shotgun” or “spray” an order which means to send in multiple orders into multiple venues/dark pools in hopes of finding contra to make a cross. Sweeping is when traders take an order and try to cross it against the book (i.e. walking the book) or against contra in multiple markets (i.e. sweeping the market), to try and cross as much of the block order as possible.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.