Have you ever wondered what the best way for a beginner to start trading is? You are probably not going to find the answers in a stock trading for beginners pdf or in the many stock trading for beginners books available because what strategy you should be using in the market is fluid and changes every couple of months.

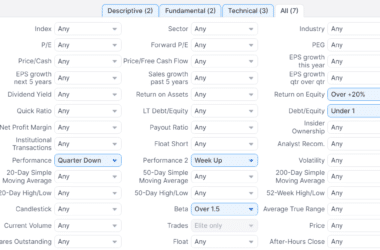

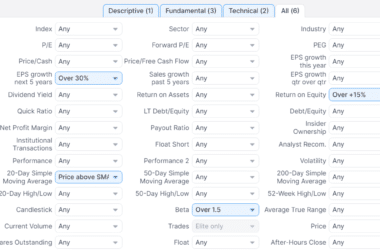

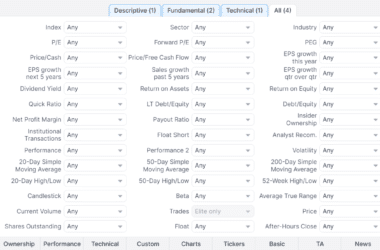

Effective online stock trading for beginners begins with what is a good stock screener to use, and how to set the parameters inside the stock screener to find stocks that are likely going to move higher in the current market environment.

What you are about to see and hear is nothing less than the best online stock trading for beginners education you can get. I wish I would have found this information some 20 years ago when I first began trading.

Before you hear the information below, if you are wondering what is the best online broker you should go with for your stock trading, in my opinion it is etrade. I did a etrade beginners lesson here.

Frequently Asked Questions about Stock Trading for Beginners

What does an oversold stock market mean?

An oversold stock market means one or more of the major indices (Dow, Nasdaq, S&P 500, Russell 2000, etc.) have sold off so as to make the RSI at or below 30.

What does an oversold stock mean?

An oversold stock is a stock that has dropped so that the RSI is at or below 30. The lower the RSI, the more oversold the stock is.

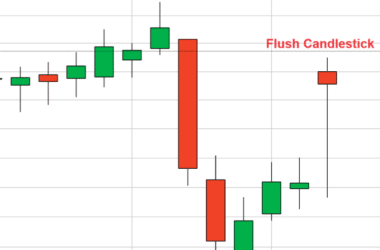

Trading an oversold stock is about establishing the support area. Having an oversold stock hit a support level where there is a history of the stock bouncing off that level, and then waiting for a candle over candle bounce is how to trade an oversold stock pattern.

What is relative strength indexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... in technical analysis?

The relative strength index or RSI is used by traders to determine when a stock is overbought or oversold.

The RSI compares the magnitude of recent swing move ups to recent swing move downs in an attempt to determine if a stock is overbought or oversold. It is calculated using the following formula:

RSI = 100 – 100/(1 + RS*)

*Where RS = Average of x days’ up closes / Average of x days’ down closes.

The RSI indicator is a type of oscillator indicator which means it works best in a trading market and not a trending market. In a trending market, the RSI can become useless as it gyrates for long periods of time at an either overbought or oversold level.

What are short sellers?

Short sellers are traders who are short a stock. Shorting a stock means to bet that the stock will go lower. A short seller borrows shares from his broker and sells them with the contractual obligation to buy the shares back (buy to cover) at a later date. The idea is to buy the shares back for less than you sold them short so you can pocket the difference. Short selling involves borrowing thus you need to have a margin account in order to short stocks.

The initial short sale that opens a trade pushes the stock price down. The buy to cover order to exit the trade pushes the stock price up.

Short sellers often push a stock down to an oversold level where the RSI falls below 30.

Wall Street Survivor published the excellent video below called Understanding Short Selling.

What are the best RSI settings?

The best RSI setting used by most traders is the default setting of 14. This means that the indicator will go back 14 periods based on the chart being used (14 days on a daily chart, 14 hours on an hourly chart and so forth) and make its calculation based on that.

Again, since most traders use the default setting for the RSI which is 14, that setting will usually produce the most reliable overbought and oversold signals.

The RSI gives a buy signal when it has been below 30 and then closes above 30. The sell signal is provided from the RSI when it has been above 70 and then closes below 70.

I did not follow a break above 70 and then a break back below 70 as the signal in these charts. The two charts above are just so that you can see how you have fewer, but more accurate, overbought or oversold levels the more you increase the RSI.

Some professional swing traders swear that the best RSI settings use a 2 day period using 90 as the overbought level, and 10 as the oversold level. Divergences are then used to predict market turns.

Notice the divergences between the RSI and price. These divergences take place because momentum often drops right before a market turn.

There’s no reason you can’t use a 14 period RSI to determine if the market is overbought or oversold in the larger trend, then use the 2 period RSI divergence method to better time your exact entry or exit.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.