Roblox’s Q1 2024 Earnings Call highlighted significant growth and operational efficiency. Daily Active Users (DAUs) reached over 77 million, marking a 17% year-over-year increase, with significant growth in Japan and India at 50% and 58% respectively. Total revenue was $801 million, surpassing expectations and bookings grew 19.4% to $923.8 million. The company also saw a substantial increase in free cash flowThe cash flow statement provides a detailed overview of the cash inflows and outflows of a company over a specified period of time. It includes cash received from operations, inves... More, which was up 133% from the previous year, amounting to $191 million. Despite these gains, the net loss was reported at $272 million, consistent with the previous year but lower than projected losses. The company emphasized improvements in infrastructure, trust and safety, and AI integration, which have driven cost reductions and efficiency gains. There were challenges with new technology rollouts impacting growth, particularly on lower-end Android devices, which the company is addressing. Looking forward, Roblox plans to continue investing in its platform’s economic system, content discovery, and live operations while maintaining conservative hiring growth.

Insights

- Roblox’s strategic focus on key international markets like Japan and India is paying off with high growth rates.

- Despite technological upgrades, challenges remain, particularly in optimizing performance across all device types.

- The increase in free cash flow highlights effective cost management and operational efficiency.

- Future growth strategies include enhancing user and creator experiences through improved discovery mechanisms and live events.

The Essence (80/20)

Core Topics for Comprehensive Understanding:

- User Growth and Engagement: Roblox continues to expand its user base, particularly among users over 13, with enhanced engagement metrics like hours spent on the platform.

- Revenue and Bookings: The company not only met but exceeded revenue expectations and saw healthy bookings growth.

- Operational Efficiency: Through strategic investments in AI and infrastructure, Roblox has improved its cost structures and operational workflows.

- Market Expansion: Focus on burgeoning markets and demographic segments, particularly in Asia, is a key growth driver.

The Action Plan

Practical Applications Based on the Essence:

- Optimize New Technology Deployments: Focus on ensuring that new features like Dynamic heads and layered clothing are optimized for all device types, especially low-end models.

- Enhance Discovery and User Engagement: Continue to refine the platform’s content discovery algorithms and live event offerings to increase user engagement and time spent.

- Expand and Support Creator Economy: Further develop tools and economic systems that support user-generated content, providing creators with better monetization opportunities and encouraging diverse content creation.

- Maintain Cost Efficiency: Continue leveraging AI and other technologies to streamline operations and reduce costs, particularly in areas like trust and safety.

Blind Spot

The potential oversight in Roblox’s strategy may lie in its focus on technological advancements and market expansion possibly at the expense of addressing the core user experience issues across diverse hardware platforms, particularly as new features are rolled out.

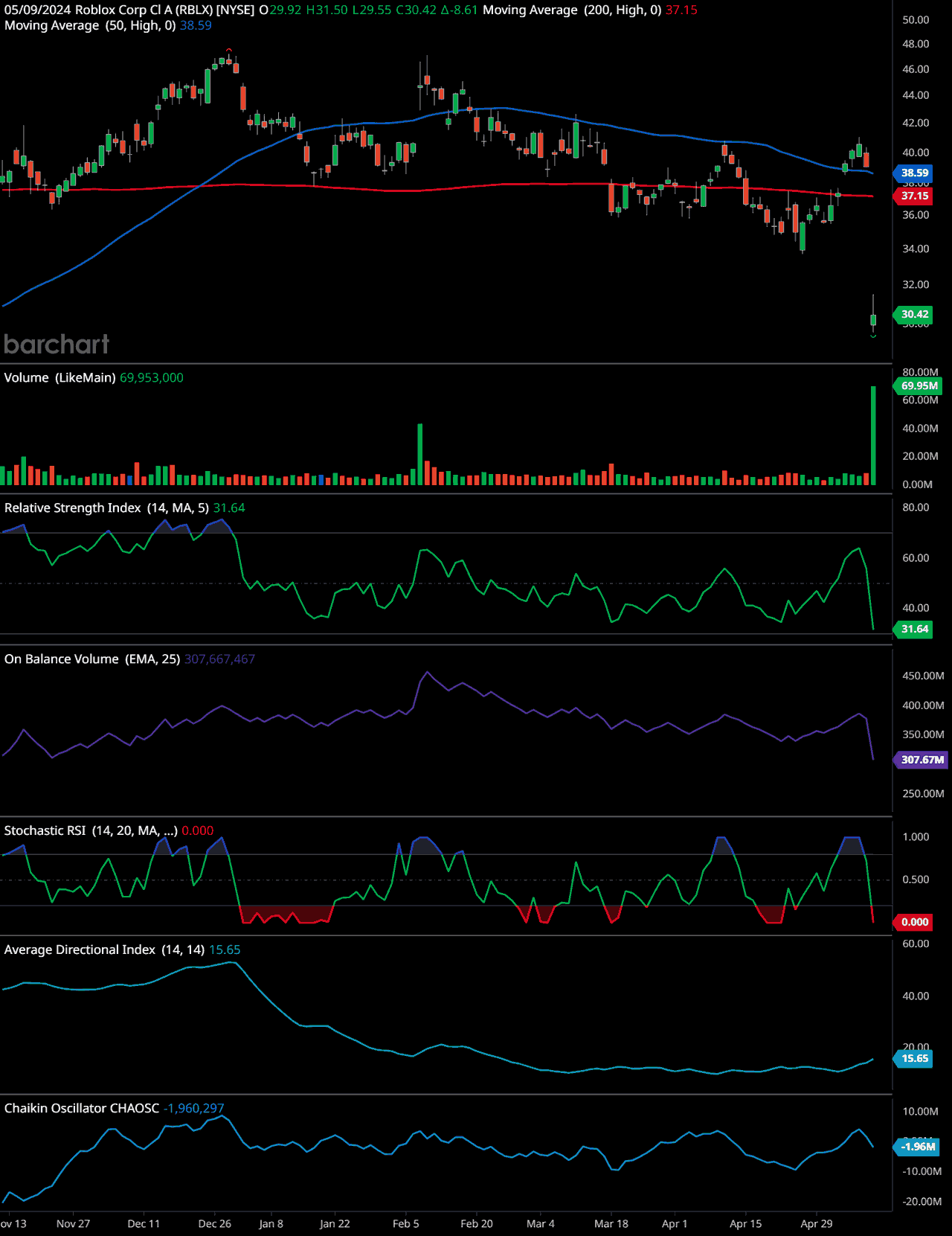

Roblox (RBLX) Technical Analysis

- Price and Moving Averages: The stock closed at $30.42, showing a notable decrease from the previous session. It’s currently positioned below the 50-day moving average (blue line) and below the 200-day moving average (red line), indicating a potential short-term bullish momentum but overall bearish trend in the longer term.

- Volume: There was a significant spike in trading volume, marked at approximately 69.95 million shares, which is substantially higher than the previous trading sessions. This increase in volume, coupled with the price collapse, suggests strong selling interest.

- Relative Strength IndexIn the world of technical analysis, the Relative Strength Index (RSI) stands as a cornerstone tool for traders seeking insights into market momentum. Developed by J. Welles Wilder ... (RSI): The RSI is at 31.64, which places it in bearish territory.

- On Balance VolumeThe On Balance Volume indicator (OBV) is a technical analysis tool used to measure the flow of money into and out of a security over a specified period of time. It is a cumulative ... (OBV): The OBV line shows a sharp decrease. This typically confirms the ongoing bearish trend supported by volume.

- Stochastic RSIIn the realm of technical analysis, the Stochastic RSI (StochRSI) emerges as a powerful tool for traders seeking to navigate market dynamics with precision. Developed by Tushar S. ...: Currently at 0.000, indicating that the stock was recently in an oversold condition but might be reversing as it’s at the lower bound of the typical range. This could be a buying signal if followed by an upward crossover.

- Average Directional IndexThe Average Directional Index (ADX) stands as a cornerstone indicator in the toolkit of technical traders, offering insights into the strength of market trends. Developed by Welles... (ADX): With a value of 15.65, the ADX suggests that the current trend strength is weak. It indicates that the market is mostly range-bound or the trend is not yet well-established.

- Chaikin OscillatorNamed after its creator Marc Chaikin, the Chaikin Oscillator stands as a formidable tool in the arsenal of technical analysts. This oscillator is designed to measure the accumulati...: The oscillator is showing a value of -1,960,297, which is quite negative. This might suggest that there’s still some downward pressure or distribution happening despite the recent bullish price action.

Overall, there’s bearish signals in Roblox’s stock and with the significant volume increase on the sell off, suggests the stock could go lower and that the overall market sentiment must be monitored closely for sustained momentum.

Frequently Asked Questions: Roblox Q1 2024 Earnings

What were the highlights of Roblox’s Q1 2024 Earnings Call?

Roblox’s Q1 2024 Earnings Call highlighted significant growth with Daily Active Users increasing by 17% year-over-year, reaching over 77 million. The company reported total revenue of $801 million and bookings of $923.8 million, indicating strong financial performance.

How has Roblox’s market performance been in international regions?

Roblox has experienced significant growth in international markets, particularly in Japan and India, with growth rates of 50% and 58% respectively. These markets have contributed substantially to the overall increase in user engagement and revenue.

What technological challenges did Roblox face in Q1 2024?

Roblox faced challenges with new technology rollouts, particularly impacting performance on lower-end Android devices. The company is actively addressing these issues to enhance user experience across all device types.

What are Roblox’s future investment focuses?

Going forward, Roblox plans to continue investing in its platform’s economic system, content discovery, and live operations. These areas are key to sustaining growth and improving both user and creator experiences on the platform.

What improvements has Roblox made in operational efficiency?

Roblox has made significant improvements in infrastructure, trust and safety, and AI integration, which have driven cost reductions and efficiency gains. These enhancements have resulted in a substantial increase in free cash flow, up 133% from the previous year.

Book Recommendations

- “Hooked: How to Build Habit-Forming Products” by Nir Eyal – Offers insights into creating engaging products that keep users returning, relevant for understanding user engagement.

- “Crossing the Chasm” by Geoffrey A. Moore – Useful for strategies on marketing technology products amidst rapid growth and technological change.

- “AI Superpowers: China, Silicon Valley, and the New World Order” by Kai-Fu Lee – Provides perspective on the global AI landscape, beneficial for Roblox’s AI integration strategies.

- Hoth Therapeutics breakthrough! 🧬✨ Why one patient sent Hoth Therapeutics stock forecast soaring by 81% in a single day! - September 8, 2024

- BloomZ Stock Price Just Exploded! Here’s the scoop on their latest alliance and why investors are excited 💥 - September 8, 2024

- The 10-year Treasury rate chart shows a surprising twist… Did hedge funds miscalculate with their record shorts? 🤔 - September 8, 2024

💥 GET OUR LATEST CONTENT IN YOUR RSS FEED READER

We are entirely supported by readers like you. Thank you.🧡

This content is provided for informational purposes only and does not constitute financial, investment, tax or legal advice or a recommendation to buy any security or other financial asset. The content is general in nature and does not reflect any individual’s unique personal circumstances. The above content might not be suitable for your particular circumstances. Before making any financial decisions, you should strongly consider seeking advice from your own financial or investment advisor.